Aggregate Excess of Loss The reinsurer indemnifies an insurance company (the reinsured) for an aggregate (or cumulative) amount of losses in excess of a specified aggregate amount. Can be written excess of a dollar amount (e.g., $500,000 in the aggregate excess of $500,000 in the aggregate) or excess of a percentage (loss ratio) amount (e.g., 50 loss ratio points excess of 75 loss ratio points).

What is the difference between aggregate stop loss and excess of loss?

In aggregate stop-loss reinsurance, losses over a specific amount are covered solely by the reinsurer and not by the ceding company. Excess of loss reinsurance is a type of reinsurance in which the reinsurer indemnifies the ceding company for losses that exceed a specified limit.

What is aggregate excess of loss reinsurance?

Aggregate Excess of Loss Reinsurance — a form of reinsurance that stipulates participation by the reinsurer when aggregate excess losses for the primary insurer exceed a certain stated retention level.

What is an example of aggregate loss?

Example of Aggregate Loss Insurance An employer purchases a workers’ compensation policy with aggregate excess coverage. The maximum amount that the company is responsible for is $500,000, with anything over this limit considered the responsibility of the insurer. The company has never experienced losses of $500,000 before.

What is an aggregate excess policy?

An aggregate excess insurance policy limits the amount that a policyholder has to pay out over a specific time period. It is designed to protect policyholders that experience an unusually high level of claims that are considered unexpected.

What Is Aggregate Excess Insurance?

What is excess loss limit?

What is the maximum amount of workers compensation coverage?

What college did Julia Kagan graduate from?

Do companies self-insure?

Who is Julia Kagan?

Who is David Kindness?

See 4 more

About this website

What is aggregate excess?

What Is Aggregate Excess Insurance? Aggregate excess insurance limits the amount that a policyholder has to pay out over a specific time period. Also called stop-loss insurance, it is designed to protect policyholders who experience an unusually high level of claims that are considered unexpected.

What does the word aggregate mean in insurance?

A general aggregate for insurance is the maximum amount of money an insurer will pay out for claims during the policy period.

What is an aggregate loss ratio?

The loss ratio is just the aggregate claims paid, divided by the aggregate premiums collected. This works because the premiums and claims are confined to a short period, usually one year or less.

How is excess of loss calculated?

The Burning Cost /Experience Method: This method is one of the simplest and most used methods used to price Excess of Loss contracts. It relies on the use of past information in its pricing model. The Reinsurer uses the losses/experience of the insured to determine the rate chargeable for the treaty.

What are the 3 examples of aggregate?

The categories of aggregates include gravel, sand, recycled concrete, slag, topsoil, ballast, Type 1 MOT, and geosynthetic aggregates (synthetic products commonly used in civil engineering projects used to stabilise terrain).

What is an example of an aggregate?

An aggregate is a collection of people who happen to be at the same place at the same time but who have no other connection to one another. Example: The people gathered in a restaurant on a particular evening are an example of an aggregate, not a group.

How is loss aggregation done?

The ideal value of aggregate loss is calculated using the number of body dimensions used to segregate the population. Thus, the ideal value is calculated using Equation 1.8. n = number of key dimensions used to divide the population into homogeneous groups.

How do you calculate aggregate stop-loss?

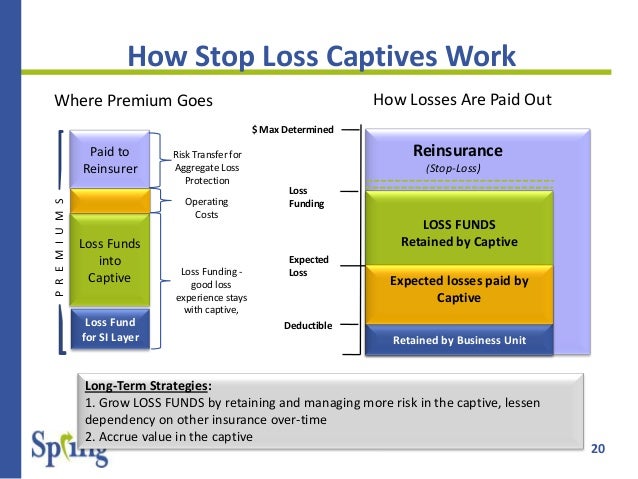

An example of deriving the Aggregate Stop-Loss coverage is as follows: First, the employer and stop-loss carrier establish the average expected monthly claims, for this example $300 PEPM. This figure is then multiplied by a percentage usually ranging between 110%-150%, for this example 150%.

How do you calculate an aggregate?

Answer. Take total of all marks ontained in all semesters and divide it by overall total marks of semesters to arrive at aggregate percentage. To arrive at aggregate marks simply in each semester simply add total marks in all semesters and divided by tital semester.

What is aggregate excess of loss reinsurance?

Definition. Aggregate Excess of Loss Reinsurance — a form of reinsurance that stipulates participation by the reinsurer when aggregate excess losses for the primary insurer exceed a certain stated retention level.

How much should my insurance excess be?

As a general guide, standard excesses tend to range from around $200 up to $700, but could be higher or lower depending on your circumstances.

How does excess work on insurance claims?

An excess is a payment you'll need to make if and when you make a claim on your Car Insurance, and your insurer accepts that claim. This amount is confirmed when you take up or renew your policy, and the money goes towards the cost of repairing or replacing your vehicle.

What is the full meaning of aggregate?

: to collect or gather into a mass or whole. The census data were aggregated by gender. : to amount to (a whole sum or total) : total. audiences aggregating several million people. aggregate.

What does it mean to aggregate a claim?

Aggregation between the claims of two or more separate people is permitted when the controversy concerns a common and undivided interest like joint ownership of the same property or the same conduct by the same employer.

What does aggregate mean in legal terms?

[a-grə-gāt] vb -gat·ed. -gat·ing. vt. 1 : to combine or gather into a whole [class members may their individual claims] compare join.

What does an aggregate amount mean?

adjective [ADJECTIVE noun] An aggregate amount or score is made up of several smaller amounts or scores added together.

Occurrence vs. Aggregate Limits

A small construction company may have a general liability policy with an aggregate limit of $2,000,000. This may lead the company owner to believe that if a house his crew is working on is damaged in a fire, his insurance company will cover the damage up to the amount of $2,000,000.

Aggregate Excess Insurance | Insurance Glossary Definition - IRMI

Aggregate Excess Insurance — provides coverage once the total claims for an annual period exceed a predetermined retention amount. The retention can be stated as a flat dollar amount (often calculated as a percentage of expected losses), as a percentage of standard premium, or in terms of a specific loss ratio.

What Does Aggregate Limit Mean in Business Insurance? | TechInsurance

For example, your business insurance policy’s aggregate limit is $5 million. If you filed four claims in one term that cost $1 million each ($4 million total), you would be under your aggregate limit.

Aggregate Excess of Loss (Stop Loss or Loss Ratio)

The reinsurer pays when the ceding company's aggregate net losses exceed a predetermined amount or proportion of premium income. For example, reinsurance covers 90% of losses in excess of a 70% loss ratio.

Understand Insurance Terms: What's an Aggregate Limit? What's a Per ...

Understanding insurance payouts is easier than you think. NEXT explains aggregate limit and per claim limits for your business liability insurance.

What is aggregate outstanding?

Aggregate Outstandings means collective reference to the sum of the Funded Outstandings, Swingline Outstandings and L/C Exposure as of any given date of determination.

What is aggregate revolving loan outstanding?

Aggregate Revolver Outstandings means, at any date of determination: the sum of (a) the unpaid balance of Revolving Loans, (b) the aggregate amount of Pending Revolving Loans , (c) one hundred percent (100%) of the aggregate undrawn face amount of all outstanding Letters of Credit, and (d) the aggregate amount of any unpaid reimbursement obligations in respect of Letters of Credit.

When the aggregate loss balance exceeds the sum of the Class B tranche amount and the Junior tranche answer?

Where the Aggregate Loss Balance exceeds the sum of the Class B Tranche Amount and the Junior Tranche Amount the excess of the Aggregate Loss Balance not so allocated shall be allocated by way of subtraction from the Senior Tranche Amount.

What is aggregate loss severity?

Aggregate Loss Severity Percentage With respect to any Distribution Date, the percentage equivalent of a fraction, the numerator of which is the aggregate amount of Realized Losses incurred on any Mortgage Loans from the Cut-off Date to the last day of the preceding calendar month and the denominator of which is the aggregate principal balance of such Mortgage Loans immediately prior to the liquidation of such Mortgage Loans.

What is a fund loss?

Funding Loss means, with respect to (a) Borrower’s payment or prepayment of principal of a Eurodollar Rate Borrowing or a Money Market Loan on a day other than the last day of the applicable Interest Period; (b) Borrower’s failure to borrow a Eurodollar Rate Borrowing or a Money Market Loan on the date specified by Borrower; (c) Borrower’s failure to make any prepayment of the Loans (other than Base Rate Borrowings) on the date specified by Borrower, or (d) any cessation of a Eurodollar Rate to apply to the Loans or any part thereof pursuant to Section 3.5, in each case whether voluntary or involuntary, any direct loss, expense, penalty, premium or liability incurred by any Lender (including but not limited to any loss or expense incurred by reason of the liquidation or reemployment of deposits or other funds acquired by a Lender to fund or maintain a Loan).

When the aggregate loss balance exceeds the junior tranche amount, the excess of the aggregate loss balance not so allocated?

Where the Aggregate Loss Balance exceeds the Junior Tranche Amount the excess of the Aggregate Loss Balance not so allocated shall be allocated by way of subtraction from the Class B Tranche Amount.

What is aggregate availability?

Aggregate Availability means, with respect to all the Borrowers, at any time, an amount equal to (a) the lesser of (i) the aggregate Commitments of all Lenders and (ii) the Aggregate Borrowing Base minus (b) the aggregate Revolving Exposure of all Lenders.

What Is Excess of Loss Reinsurance?

Excess of loss reinsurance is a type of reinsurance in which the reinsurer indemnifies–or compensates–the ceding company for losses that exceed a specified limit. A reinsurer is a company that provides financial protection to insurance companies; a ceding company is an insurance company that transfers the insurance portfolio to a reinsurer.

What is the excess of loss provision in a reinsurance contract?

For example, a reinsurance contract with an excess of loss provision may indicate that the reinsurer is responsible for 50% of the losses over $500,000. In this case, if aggregate losses amount to $600,000, the reinsurer will be responsible for $50,000 and the ceding company will be responsible for $50,000.

What does it mean when a reinsurer is responsible for a percentage of losses over a certain amount?

This means that the ceding company and the reinsurer will share aggregate losses. For example, a reinsurance contract with an excess ...

What is a treaty reinsurance contract?

Treaty or facultative reinsurance contracts often specify a limit in losses for which the reinsurer will be responsible. This limit is agreed to in the reinsurance contract; it protects the reinsurance company from dealing with unlimited liability. In this way, treaty and facultative reinsurance contracts are similar to a standard insurance ...

Why is excess loss reinsurance important?

By covering itself against excessive losses, an excess of loss reinsurance policy gives the ceding insurer more security for its equity and solvency. It can also provide more stability when unusual or major events occur.

What college did Julia Kagan graduate from?

She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction from Bennington College. Learn about our editorial policies. Julia Kagan. Updated Aug 3, 2020.

Who is Ebony Howard?

Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries.

What Is Aggregate Excess Insurance?

Aggregate excess insurance limits the amount that a policyholder has to pay out over a specific time period. Also called stop-loss insurance, it is designed to protect policyholders who experience an unusually high level of claims that are considered unexpected.

What is excess loss limit?

The excess loss limit, called the loss fund, is set by the insurance company. It may be calculated in a number of ways.

What is the maximum amount of workers compensation coverage?

An employer purchases a workers’ compensation policy with aggregate excess coverage. The maximum amount that the company is responsible for is $500,000, with anything over this limit considered the responsibility of the insurer.

What college did Julia Kagan graduate from?

She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction from Bennington College. Learn about our editorial policies. Julia Kagan. Updated Dec 27, 2020.

Do companies self-insure?

Companies that self-insure are most likely to purchase this type of insurance coverage. The decision to set aside a pool of money to remedy an unexpected loss is based on the company’s estimated losses given its loss experience. However, it's also possible that the company one day experiences losses far higher than it anticipated to occur and is unable to cover the amount or unwilling to make the payout from its working capital .

Who is Julia Kagan?

Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014. The former editor of Consumer Reports, she is an expert in credit and debt, retirement planning, home ownership, employment issues, and insurance. She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction ...

Who is David Kindness?

David Kindness is a Certified Public Accountant (CPA) and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and investing and retirement planning . David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes.