How to establish a compliance program?

Create program oversight. Determine who will oversee, monitor, and enforce the compliance program and serve as your go-to company “watchdog” with questions and concerns. Provide staff training and education. Employees at every level need to understand your compliance program expectations and standards to be able to comply with them.

What are examples of compliance programs?

Tips to Follow When Making a Compliance Strategic Plan

- Know the purpose on why you are developing the document. ...

- Seek help from compliance practitioners and professionals so you can have an idea about the potential of your compliance strategic plan. ...

- Make sure that you will review and evaluate the entire document. ...

How to develop an AML?

- Age: The risk of developing AML increases with age.

- Sex: Males are more likely than females to develop AML.

- Exposure to dangerous chemicals: Long-term exposure to high levels of certain chemicals, such as benzene, is linked to a greater risk of AML.

What is BSA and AML compliance?

The BSA / AML / OFAC Compliance Officer is responsible for developing, implementing and administering all aspects of the Bank Secrecy Act Compliance Program, and for assuring that the bank is in compliance with the Bank Secrecy Act, USA Patriot Act, OFAC, and all other applicable laws.

What is the purpose of an AML program?

The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation.

What is an AML compliance program required to have?

What Should an AML Compliance Program Do? In practice, an AML compliance program should ensure that an institution is able to detect suspicious activities associated with money laundering, including tax evasion, fraud, and terrorist financing, and report them to the appropriate authorities.

What are the four key elements of an AML program?

The written BSA/AML compliance program must include the following four pillars:Internal controls;The designation of a BSA/AML officer;A BSA/AML training program; and.Independent testing to test programs.

What are the 5 requirements of a compliance program?

Seven Elements of an Effective Compliance ProgramImplementing written policies and procedures. ... Designating a compliance officer and compliance committee. ... Conducting effective training and education. ... Developing effective lines of communication. ... Conducting internal monitoring and auditing.More items...

Who needs an AML program?

What is an AML Compliance Program required to have? The Bank Secrecy Act, among other things, requires financial institutions, including broker-dealers, to develop and implement AML compliance programs. Members are also governed by the anti-money laundering rule in FINRA Rule 3310.

What are the 4 stages of money laundering?

This process involves stages of money laundering: Placement, Layering, and Integration.

What are the five pillars of AML?

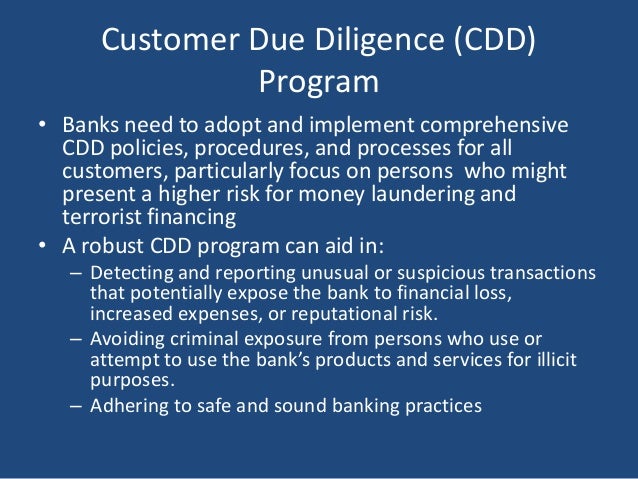

What are the 5 Pillars of AML Compliance that One Should Consider?Implementation of Effective Internal Controls. ... Designation of a Compliance (AML) Officer. ... Appropriate Periodic TrainingForEmployees. ... Independent Testing of the Program. ... Customer Due Diligence.

What are the 3 stages of money laundering?

Although money laundering is a diverse and often complex process, it generally involves three stages: placement, layering, and/or integration. Money laundering is defined as the criminal practice of making funds from illegal activity appear legitimate.

What is KYC and AML process?

Broadly speaking, AML refers to all efforts involved in preventing money laundering, such as stopping criminals from becoming customers and monitoring transactions for suspicious activity. KYC refers to customer identification and screening, and ensuring you understand their risk to your business.

What are the 7 elements of compliance?

Seven Elements of an Effective Compliance ProgramImplementing Policies, Procedures, and Standards of Conduct. ... Designating a Compliance Officer and Compliance Committee. ... Training and Education. ... Effective Communication. ... Monitoring and Auditing. ... Disciplinary Guidelines. ... Detecting Offenses and Corrective Action.

How do I make an AML program?

The FFIEC Manual clearly laid out the four key pillars of an AML program: Designation of a BSA Compliance Officer; Development of Internal Policies, Procedures, and Controls; Ongoing, Relevant Training of Employees; and Independent Testing and Review.

What are the 4 components of the compliance framework?

Compliance Management Framework – 4 Necessary ElementsCompliance program. For a business to comply with all the rules and regulations set, there must be a compliance program to follow. ... Commitment from the Board of Directors. ... Consumer Complaint Program.

What is AML?

AML stands for Anti-Money Laundering, and is a set of measures for combating the laundering of money and other financial crimes.

Who is an AML officer?

An AML officer is a person, who is responsible for the company’s compliance with the requirements for preventing money laundering.

Key elements of KYC & AML policy

The elements include the detection of suspicious activity, risk assessment, internal practices, AML training and independent audits.

What are AML requirements?

The primary AML requirement is to adopt measures in order to keep money laundering out of a company’s business.

Where can I learn about the AML compliance program?

You can learn about the five critical components of the AML compliance program by reading Sumsub's blog .

What is an AML compliance program?

The aim of an AML compliance program is to detect, respond, and eliminate inherent and residual money laundering, terrorist financing, and fraud-related risks.

What does a business have to do to stay AML compliant?

All Anti-Money Laundering compliance programs are aimed at the revelation of fraud, money laundering, tax evasion, and terrorist financing within a company. These goals can be achieved through the three most important must-dos.

What are the factors that affect AML compliance?

Factors that impact AML compliance 1 The money laundering risks the business is exposed to; 2 Respective local and global laws and punishment for non-compliance; 3 Potentially suspicious activities within the company.

What is the responsibility of a compliance officer?

Everything from compliance program development to its implementation falls under the responsibility of a compliance officer: internal audits management, compliance analysis, and the development of appropriate guidelines, employee training programs, etc.

How often do companies have to do an AML audit?

Section 59 (2) of the New Zealand AML/CFT Act obliges companies to carry out an independent audit every two years or upon a supervisor request.

Who takes over all things compliance?

Businesses must assign an AML compliance officer or a Money Laundering Reporting Officer (MLRO) (for larger organizations) to take over all things compliance.

What is ML and TF risk assessment?

ML and TF risk assessment can help you score and sort customers into threat tiers based on the evaluation of the risk they pose. To develop a scoring model, assume common risk factors (high-risk countries, PEPs, UBOs, due diligence results).

What is an AML Compliance Program?

In short, an AML сompliance program is a set of policies, practices, measures, procedures, and controls related to the prevention and reporting of money laundering and terrorist financing.

What makes an effective AML Compliance Program?

There are some things that can make the AML Compliance Program much more efficient.

What is AML compliance?

Each financial institution in the U.S. is required by law to have an effective anti-money laundering (AML) compliance program. Each program must be commensurate with the risks posed by the location, size, nature and volume of the financial services. For companies such as Money Services Businesses ...

What is anti-money laundering?

An anti-money laundering program is an essential component of a financial institution’s compliance regime. The primary goal of every good program is to protect the organization against money laundering and to ensure that the organization is in full compliance with relevant laws and regulations. For that reason, designing, structuring ...

What is the purpose of FINRA anti-money laundering program?

FINRA says each member shall develop and implement a written anti-money laundering program reasonably designed to achieve and monitor the member’s compliance with the requirements of the Bank Secrecy Act (BSA) and its regulations. Each member’s anti-money laundering program must be approved, in writing, by a member of senior management.

How many elements are required for a compliance program?

There are five required elements of a compliance program – virtually identical to those listed above for FinCEN and FINRA. Each of the following items is considered to be a pillar of an effective anti-money laundering/anti-terrorist financing (AML/ATF) program:

Why is written compliance important?

This is an important component of your overall compliance program as it will guide your decisions and actions.

What is the organization-wide program?

The organization-wide program may be supplemented by policies and procedures for various lines of business or legal entities, according to Canada’s FINTRAC. The agency also states that compliance programs should also include corporate governance and overall management of money laundering and terrorist financing risks.

Who is the compliance officer for a sole proprietorship?

If you are an individual, such as in the case of a sole proprietorship, you can be the compliance officer or choose another individual to help you implement the compliance program. The compliance officer should have the ability to report compliance related issues to, and meet with the board of directors, senior management or owner on a regular basis.

Effective AML compliance programs

According to the Federal Financial Institutions Examination Council’s (FFIEC) Bank Secrecy Act/Anti-Money Laundering examination manual (updated April 2020), a BSA/AML compliance program must include the following elements:

Are all companies expected to maintain an AML program?

In the U.S., while companies not identified by the BSA or the USA PATRIOT Act need not create an AML program to ensure compliance, their activity may still trigger the submission of a SAR by their bank.

What is AML compliance?

AML compliance program is the predefined process of company-specific AML compliance measures. Although AML regulations vary with jurisdictions and industries, a few mandatory aspects of an AML compliance program are present in all.

How technology can be helpful in anti-money laundering (AML) compliance?

The major part of anti-money laundering compliance is an ongoing screening of customers. AML screening solutions powered with artificial intelligence can share this burden of obligatory entities. AML screening software, first of all, verifies the identity of a customer and then screens their name against global watchlists that are updated regularly.

What is money laundering?

Money laundering is the process of illegal movement of money to hide its original source. Black money gained through illicit activities (drug selling, human trafficking, terrorism, etc.) is transferred in a certain pattern to manipulate the authorities and to hide the money trail. Money laundering is also called a whitecollar crime as often high-rank officials and PEPs (Politically Exposed People) are involved in it. The Motive of money laundering is to wash black money in a seamless manner gradually mixing it with white money.

What is anti-money laundering compliance?

Anti-money laundering compliance is the process of background screening and ongoing monitoring of customers to identify and eliminate any efforts of money laundering. The customer is screened against global watchlists, sanctions, and PEPs lists. AML screening is a part of KYC verification and is mandatory for several industries such as banks, fintech, stock exchanges, real estate, art and precious metals dealers, cryptocurrency, gaming platforms, etc.

Why is AML screening important?

AML/KYC screening of prospects helps prevent such frauds. Otherwise, banks and businesses will be bombarded with chargebacks and other such claims.

What are the three stages of money laundering?

Three layers of money laundering are placement, layering, and integration . Placement is the initial step where black money is placed in banks. In layering several financial transactions are made through the sale and purchase of financial and non-financial assets to manipulate the original place of money. Lastly, illegal money is integrated into white money through legal channels, which shows it either as the profit of a shell company or gain from the sale of assets.

Is AML compliance good for banks?

Going the extra mile to fulfill the anti monitoring obligations is what leads to effective AML compliance in banks, and businesses both. Efficient AML screening is in-evitable especially with changing anti-money laundering trends in 2020. Following an AML compliance checklist for effective anti-money laundering compliance brings long-lasting benefits for your business.

Who is responsible for BSA/AML compliance?

Senior management . Senior management is responsible for communicating and reinforcing the BSA/AML compliance culture established by the board, and implementing and enforcing the board-approved BSA/AML compliance program. If the banking organization has a separate BSA/AML compliance function, senior management of the function should establish, support, and oversee the organization’s BSA/AML compliance program. BSA/AML compliance staff should report to the board, or a committee thereof, on the effectiveness of the BSA/AML compliance program and significant BSA/AML compliance matters.

What is a consolidated BSA/AML program?

A consolidated BSA/AML compliance program typically includes a central point where BSA/AML risks throughout the organization are aggregated. Refer to " Consolidated BSA/AML Compliance Risk Assessment ," page 24. Under a consolidated approach, risk should be assessed both within and across all business lines, legal entities, and jurisdictions of operation. Programs for global organizations should incorporate the AML laws and requirements of the various jurisdictions in which they operate. Internal audit should assess the level of compliance with the consolidated BSA/AML compliance program.

What is BSA risk management?

In such organizations, management of BSA risk is generally the responsibility of a corporate compliance function that supports and oversees the BSA/AML compliance program. Other banking organizations may adopt a structure that is less centralized but still consolidates some or all aspects of BSA/AML compliance.

What is a consolidated approach to BSA?

A consolidated approach should also include the establishment of corporate standards for BSA/AML compliance that reflect the expectations of the organization’s board of directors, with senior management working to ensure that the BSA/AML compliance program implements these corporate standards. Individual lines of business policies would then supplement the corporate standards and address specific risks within the line of business or department.

When evaluating a consolidated BSA/AML compliance program for adequacy, should the examine?

When evaluating a consolidated BSA/AML compliance program for adequacy, the examiner should determine reporting lines and how each affiliate, subsidiary, business line, and jurisdiction fits into the overall compliance structure. This should include an assessment of how clearly roles and responsibilities are communicated across the bank or banking organization. The examiner also should assess how effectively the bank or banking organization monitors BSA/AML compliance throughout the organization, including how well the consolidated and nonconsolidated BSA/AML compliance program captures relevant data from subsidiaries.

Is BSA/AML effective?

Regardless of the management structure or size of the institution, BSA/AML compliance staff located within lines of business is not precluded from close interaction with the management and staff of the various business lines. BSA/AML compliance functions are often most effective when strong working relationships exist between compliance and business line staff.

What are the four pillars of AML?

For many years AML compliance programs were built on the four internationally known pillars: development of internal policies, procedures and controls, designation of a AML (BSA) officer responsible for the program , relevant training of employees and independent testing. In May 2018, a fifth pillar –due diligence – was added after the finalization of the “CDD Rule.”

What are the pillars of compliance?

The pillars are the required foundation of an effective compliance program. Such a program starts with the first pillar: implementation of effective internal controls through the establishment of internal policies and procedures. These controls need to appropriate for the risk profile of the institution and be in written form.

What is the purpose of AML?

The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation. FINRA reviews a firm’s compliance ...

Who approves a program in writing?

The program has to be approved in writing by a senior manager.

What section of the PATRIOT Act is the Special Measures against Specified Banks?

Special Measures against Specified Banks Pursuant to Section 311 of the USA PATRIOT Act

What is a customer due diligence program?

The program must include appropriate risk-based procedures for conducting ongoing customer due diligence, including (i) understanding the nature and purpose of customer relationships for the purpose of developing a customer risk profile; and, (ii) conducting ongoing monitoring to identify and report suspicious transactions and , on a risk basis, to maintain and update customer information, including information regarding the beneficial owners of legal entity customers.

What is CMIR report?

Report of International Transportation of Currency or Monetary Instruments(C MIR)