Loan cost amortization (or amortization simply) refers to spreading the cost of a loan over its life. This concept applies to specific loans only and not to every form of debt. Usually, it occurs when companies pay the same monthly amount to the lender.

How to calculate the payments for amortized loans?

- Total monthly payment: The amount you'll pay each month for the duration of the loan. ...

- Total principal paid: The total amount of money you'll borrow to buy the car.

- Total interest paid: The total amount of interest you'll have paid over the life of the loan. ...

How do you calculate compounded interest on a loan?

Part 1 Part 1 of 3: Finding Annual Compound Interest

- Define annual compounding. The interest rate stated on your investment prospectus or loan agreement is an annual rate.

- Calculate interest compounding annually for year one. Assume that you own a $1,000, 6% savings bond issued by the US Treasury.

- Compute interest compounding for later years. ...

- Create an Excel document to compute compound interest. ...

Can I amortize debt financing costs?

For a home mortgage, you can often deduct mortgage points, which are effectively prepaid interest, from your taxes the year you pay them. Debt financing costs can be amortized across the lifespan of a loan in order to develop a reasonable repayment plan for the borrower in question.

Do loan fees have to be amortized?

When you take out a mortgage, the IRS lets you write off your interest, but you will have to amortize your closing costs over the life of the loan. Closing costs like prepaid interest, loan origination fees and even "junk" charges like appraisal fees or documentation fees all get divided over the life of your loan.

How do you calculate Amortised cost?

How To Calculate Amortization Cost BasisAmortized amount = Accrual period interest - (Beginning cost basis x Yield to maturity)Amortized amount = Premium / Total accrual periods.Amortized premium = Qualified stated interested - (Adjusted acquisition price x Yield to maturity)More items...•

What does amortized mean in loans?

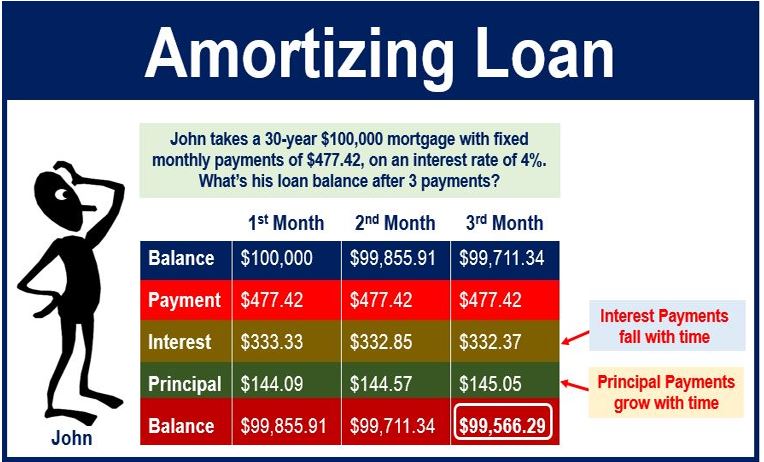

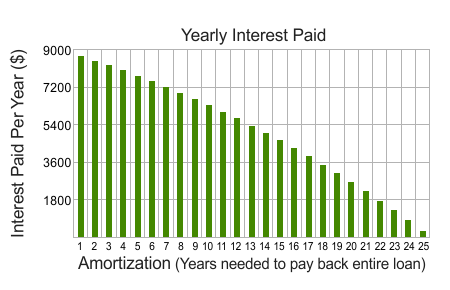

The word amortization simply refers to the amount of principal and interest paid each month over the course of your loan term. Near the beginning of a loan, the vast majority of your payment goes toward interest.

What is an example of an amortized loan?

Examples of typically amortized loans include mortgages, car loans, and student loans.

What is the difference between amortized cost and fair value?

Unlike amortized cost, the fair value of an asset or liability does not consider factors such as depreciation and amortization. Similarly, companies may recalculate the fair value of their assets or liabilities after a reasonable time. They do not rely on the historical cost or value of their items.

What is amortization in simple terms?

What Is Amortization? Amortization is an accounting technique used to periodically lower the book value of a loan or an intangible asset over a set period of time. Concerning a loan, amortization focuses on spreading out loan payments over time. When applied to an asset, amortization is similar to depreciation.

Why do you amortize a loan?

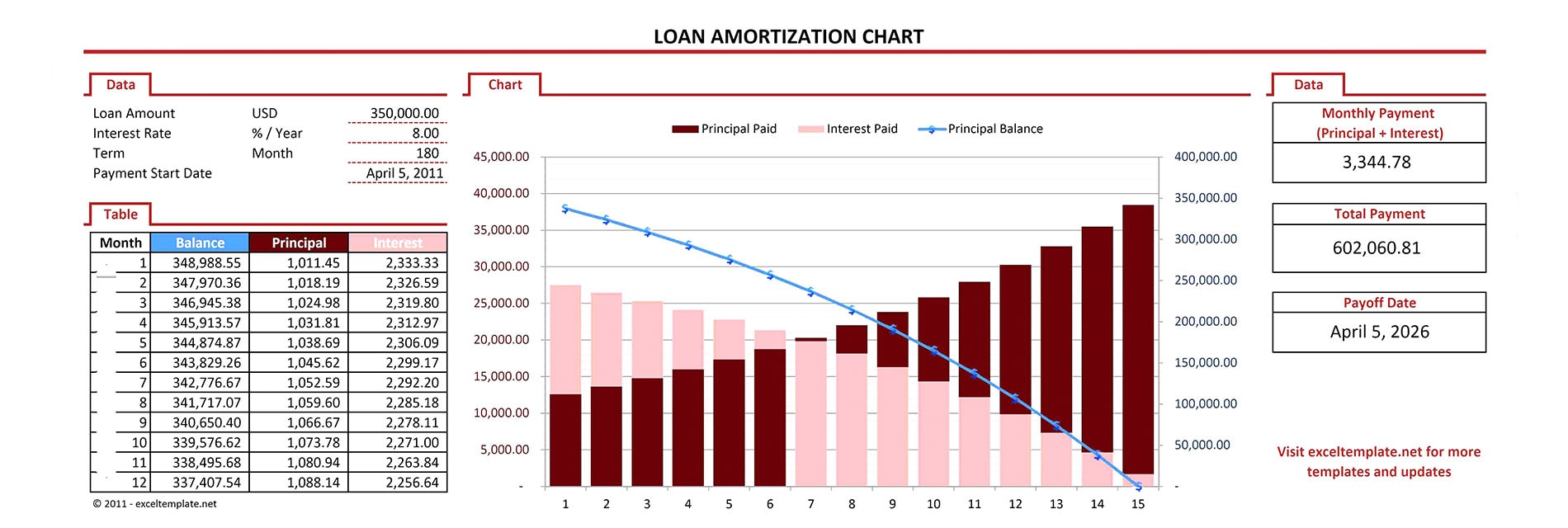

This loan amortization schedule lets borrowers see how much interest and principal they will pay as part of each monthly payment—as well as the outstanding balance after each payment. A loan amortization table can also help borrowers: Calculate how much total interest they can save by making additional payments.

What does a 10 year loan amortized over 30 years mean?

The interest rate is fixed for the first 120 payments (10 years). After 10 years, the interest rate will be adjusted to our current 30-year fixed rate, not to exceed 3% above the introductory rate, but not less than the initial interest rate.

What are the four types of amortization?

Amortization Schedules: 5 Common Types of AmortizationFull amortization with a fixed rate. ... Full amortization with a variable rate. ... Full amortization with deferred interest. ... Partial amortization with a balloon payment. ... Negative amortization.

What is another term for amortization?

payment. nounfee; installment of fee. acquittal. advance. alimony.

What is Amortised cost with example?

The principles of amortised cost accounting require that interest must be recorded on the amount outstanding. This is relatively straight forward for many instruments. For example, on a $10m 5% loan, with $10m repayable at the end of a three-year term, interest would simply be recorded as $500,000 a year.

Does amortized cost include accrued interest?

Because the amortized cost basis of a financial asset would include the accrued interest on that financial asset, the measurement of an allowance for credit losses on the amortized cost basis of that asset will include an allowance for the applicable accrued interest of the financial asset.

What is the amortized cost basis?

Amortized cost basis: The amortized cost basis is the amount at which a financing receivable or investment is originated or acquired, adjusted for applicable accrued interest, accretion, or amortization of premium, discount, and net deferred fees or costs, collection of cash, writeoffs, foreign exchange, and fair value ...

Is amortization good or bad?

Is amortization good or bad? At its core, loan amortization helps you budget for large debts like mortgages or car loans. It's also a useful tool to demonstrate how borrowing works.

Can you pay off an amortized loan early?

Paying off an amortizing loan early can save you from having to pay future interest. However, some lenders include an early payoff penalty in the loan contract since an early payoff will cause the lender to lose out on interest. Should I Pay It Off Early? It can be beneficial to pay off amortizing loans early.

What happens to monthly payments when loans are amortized?

Loan amortization is the reduction of debt by regular payments of principal and interest over a period of time. For example, if you make a monthly mortgage payment, a portion of that payment covers interest and a portion pays down your principal.

What is another name for a fully amortized loan?

a fixed-payment loan. A fully amortized loan is a loan whose interest is calculated on a fixed interest rate during the repayment period. The installment payments for the principal and the interest are also fixed. Thus, fully amortized loans can also be referred to as fixed-payment loans.

What is amortization in accounting?

As part of an accounting procedure, amortization is the process of lowering the book value of an asset or loan over a finite period of time. During the amortization of a loan, payments are spread out over a period of time. This concept is similar to depreciation and amortization that reduces book value with time and usage.

What is amortization used for?

Amortization is used to allocate the cost of the loan over the life of the loan. The loan cost may fall in interest expense, the redemption premium, and applicable fees on the loans.

What happens to the net liability at the end of a loan?

At the end of the loan age, the loan balance reduces to zero as all liability has been repaid.

What is pre-agreed interest?

It refers to the amount of money you owe the lender at a specific period of time. A pre-agreed rate of interest is applied to this amount to calculate the interest charge for the year. If the interest remains unpaid in accounting books, it’s also reported as a liability in the financial statement.

How long are amortized loans repaid?

In general, amortized loans are repaid over several months, with a fixed amount paid per month. The principal owed can be further reduced by paying more, so there is always the option to pay more.

What is revolving debt?

Revolving debts are most commonly associated with credit cards. These debts are revolving and are based on a credit limit. To keep borrowing, you don’t need to reach your credit limit yet. Furthermore, the cardholders have no set payments or fixed loan amounts, so they are different from those who take out amortized loans.

How long is the amortization period for a balloon loan?

An amortization period of several years is usually the norm for balloon loans, and the entire principal balance is only amortized to a certain extent.