What are the uses of the accounts payable ledger?

- Accounts payable ledger provides a quick summary of the account balances payable to the vendors and suppliers of the company.

- Accounts payable ledger greatly helps as control purpose. ...

- The accounts payable ledger can be used to produce an aging report of the payable balances. ...

What are the responsibilities of accounts payable?

Accounts payable ledger contains a list of the company’s vendors with their balances payable. The ending balance of accounts payable is compared with the payable balance in the general ledger to ensure the accuracy of the payable record. Accounts payable management is essential for the successful run of a business.

What is the job description of accounts payable?

Mar 08, 2021 · The accounts payable ledger is an element of a company's general ledger, which tracks all financial transactions within both the accounts payable and accounts receivable ledgers. The biggest difference between the general and accounts payable ledgers is that accounts payable only tracks debts and liabilities while the general ledger tracks all incoming …

What stage of accounting is known as accounts payable?

Dec 28, 2021 · Accounts Payable Ledger, also known as the creditor’s ledger, is the subsidiary ledger which lists down the details of the different suppliers or vendors of the company along with their account balances highlighting the outstanding amount payable by the company.

What type of account is accounts payable?

What is the main purpose of preparing account payable ledger?

The purpose of the accounts payable ledger and its subsidiary accounts is to display a company's debt to each of its creditors, suppliers or vendors in a spreadsheet to more accurately track.Mar 8, 2021

How do you post accounts payable in ledger?

1:3314:56Accounts Payable Subsidiary Ledger - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo accounts payable credit right off the bat that tells me that that is an accounts payable soMoreSo accounts payable credit right off the bat that tells me that that is an accounts payable so therefore I am going to use this journal as I do my subsidiary ledger. Let's look at cash payments.

What is the difference between general ledger and accounts payable?

The main difference between Accounts Payable and General Ledger is that Accounts Payable is the Sub-heading of General Ledger and in contrast, General Ledger is the Master Heading of Accounts Payable covering every transaction in a business.

What is accounts payable example?

Accounts payable include all of the company's short-term debts or obligations. For example, if a restaurant owes money to a food or beverage company, those items are part of the inventory, and thus part of its trade payables.

How do you record accounts payable entry?

When recording an account payable, debit the asset or expense account to which a purchase relates and credit the accounts payable account. When an account payable is paid, debit accounts payable and credit cash.Feb 5, 2022

What is AP reconciliation?

The accounts payable reconciliation process involves comparing balances in two or more sets of financial records, often a general ledger and a subledger, accounts payable aging report, or dashboard that shows outstanding balances to suppliers and vendors.

Is AP a debit or credit balance?

credit balanceAs a liability account, Accounts Payable is expected to have a credit balance. Hence, a credit entry will increase the balance in Accounts Payable and a debit entry will decrease the balance.

Are payables assets or liabilities?

current liabilityAccounts payable is considered a current liability, not an asset, on the balance sheet.

What is the accounts payable ledger?

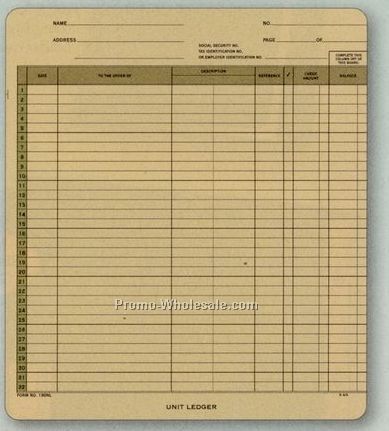

The accounts payable ledger or the accounts payable subsidiary ledger is a financial record account that businesses use to document and track credit transactions with lenders, suppliers, investors and creditors.

What is the purpose of the accounts payable ledger?

The purpose of the accounts payable ledger and its subsidiary accounts is to display a company's debt to each of its creditors, suppliers or vendors in a spreadsheet to more accurately track. The accounts payable ledger shows in a company's general ledger, which is the main financial record of all the sales and purchases an organization makes.

What's the difference between the general ledger and accounts payable?

The accounts payable ledger is an element of a company's general ledger, which tracks all financial transactions within both the accounts payable and accounts receivable ledgers.

What's the difference between the accounts payable and receivable ledgers?

The key difference between a company's accounts payable and accounts receivable is that one ledger is for recording credit, liabilities and expenses companies owe, and the other ledger tracks incoming customer payments and sales transactions.

How do you use the accounts payable ledger?

Since the accounts payable ledger tracks outgoing payments and debt accounts, the transactions you post are the credit purchases your organization makes. Additionally, many accounts payable clerks use financial software to create spreadsheets and track each subsidiary ledger. The following steps outline how to use the accounts payable ledger:

Example

In the following example, assume a manufacturing company that produces and sells after-market auto parts tracks its quarterly accounts payable ledger. In the company's accounting software, the bookkeeper enters the following information:

What is the account payable ledger?

Accounts Payable Ledger, also known as the creditor’s ledger, is the subsidiary ledger which lists down the details of the different suppliers or vendors of the company along with their account balances highlighting the outstanding amount payable by the company.

What is a subsidiary ledger?

Subsidiary Ledger A subsidiary Ledger is a list of individual accounts that bears a similar nature. It refers to an expansion of the conventional general ledger separately used to record all the transactions related to the accounts payable and accounts receivables in a detailed manner. read more

Example of Accounts Payable Ledger

Issues in Matching

- The below are the ways through which the General LedgerGeneral LedgerA general ledger is an accounting record that compiles every financial transaction of a firm to provide accurate entries for financial statements. The double-entry bookkeeping requires the balance sheet to ensure that the sum of its debit side is equal to the credit side total. A general ledger helps to achieve this g…

Advantages of Accounts Payable Ledger

- This ledger can offer a quick snapshot of the current vendor balances.

- It’s useful as a model for internal control and audit purposeAudit PurposeThe primary purpose of an audit is to conduct an independent and unbiased verification of all financial and non-financial m...

- Managers and book-keepers can compare the subsidiary balance with the general ledger bal…

- This ledger can offer a quick snapshot of the current vendor balances.

- It’s useful as a model for internal control and audit purposeAudit PurposeThe primary purpose of an audit is to conduct an independent and unbiased verification of all financial and non-financial m...

- Managers and book-keepers can compare the subsidiary balance with the general ledger balance for the prevention of errors.

- It further helps in the segregation of duties amongst employees. There would be a separate employee recording the transaction and another one checking for potential errors. It will ensure efficienc...

Conclusion

- The existence of Accounts Payable ledger is not mandatory but preferable for keeping the books of accounts clean and organized. Such ledgers help in keeping track of payments receivable and payable for multiple years. It is a critical tool during the audit process as well and can be successfully linked in case of investigating individual entries. Chartered Accountants or individu…

Recommended Articles

- This article has been a guide to Accounts Payable Ledger and its definition. Here we discuss how to prepare accounts payable ledger along with practical examples and explanations. You can learn more about accounting from following articles – 1. Ledger Account | Common Examples 2. Accounts Payable Credit or Debit? 3. Examples of Accounts Payable 4. Accrued Expenses vs Ac…