A New York Affidavit of Heirship is used to establish ownership of a Decedent’s property when the Decedent failed to execute a will or failed to divide all of his or her property through his or her Last Will and Testament. When someone in New York dies without a will, legal issues usually arise as to who has title over the property.

Can a surviving spouse file an affidavit of heirship in NY?

Adobe PDF In New York state, a surviving spouse may file an affidavit of heirship to collect up to $50,000 of the loved one’s estate. However, the affidavit must be filed with the state’s probate court so that a judge may distribute some of the private property, such as bank accounts and trusts, among other heirs, including children and creditors.

What is an affidavit of heirship?

The affidavit of heirship is an affidavit executed by a disinterested person, which should include a family tree unless the distributee is the spouse or only child of the decedent.

What are the inheritance laws in New York State?

The estate may not exceed $50,000 in value. Affidavit of Heirship: Unlike other states, New York requires that the affidavit of heirship be filed in probate court, and a probate judge will still distribute the property evenly among successors such as a surviving spouse and children.

Can you file an affidavit of heirship without probate?

In some states, it may be possible to use affidavits of heirship for the transfer of real estate without going through the probate process. The affidavit of heirship would be filed in the deeds records office in the county where the real property is.

What is an affidavit of heirship?

When do you use an affidavit of heirship? An affidavit of heirship can be used when someone dies without a will, and the estate consists mostly of real property titled in the deceased's name. It is an affidavit used to identify the heirs to real property when the deceased died without a will (that is, intestate).

How do you prove you are an heir?

If you are named as an heir, you may have to prove to the estate trustee that you are the person named. This can be done by showing the estate trustee identification or providing an affidavit.

What is an heir file?

An Affidavit of Heirship is a legal document used in some states to establish the legal heirs of a person who dies without a will.

Do all heirs have to agree to sell property in Texas?

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

What makes someone an heir?

An heir is a person who is legally entitled to collect an inheritance when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants, or other close relatives of the decedent.

Who becomes next of kin when someone dies?

It is normally expected that a relative, spouse or partner will receive the death certificate and register a person's death, so if your next of kin is a relative, spouse or partner it might be natural for them to do this.

Who are the legal heirs of a deceased person?

The parents, spouse and children are the immediate legal heirs of the deceased person. When a deceased person does not have immediate legal heirs, then the deceased's grandchildren will be the legal heirs.

Can property be transferred without probate?

Probate is not required to deal with the property but may be needed if the deceased's estate warrants it. Much will depend on what the deceased owned and what the beneficiaries intend to do with the property.

What happens to bank account when someone dies without a will?

What happens to a bank account when someone dies without a will? If someone dies without a will, the bank account still passes to the named beneficiary for the account.

Can siblings force the sale of inherited property?

No. All of the inheritors of the house will need to agree before a sale goes ahead. One of the biggest questions around inheriting property with a sibling is if a sale can be forced. The short answer is no; if more than one person has inherited shares, then any sale must have all shareholder's consent.

Can a house be sold before probate is complete?

Technically the answer to 'can you sell a house before probate' is yes, yes you can. Although you will need probate to exchange and complete, nothing is stopping you from listing your house on the market and accepting any offers, if you get them, before being given the Grant of Probate.

How long is a will valid after death?

You should store the original will until after the death of the client, or until you are able to return the original to the client. Some firms keep wills indefinitely, while others have a policy of holding the original will for fifty years from the date of its creation.

Who are considered legal heirs?

Legal heirs can be categorized in two segments—Class I and Class II heirs. For instance, according to the Hindu succession law, if a Hindu man leaves behind property without a Will, it is primarily passed on to Class I heirs (the widow, children and mother) in equal share.

How do I find my heirs in Georgia?

If no spouse, children, descendants of children, or parents survived the decedent, the brothers and sisters of the decedent and the descendants of any deceased brother or sister who predeceased the decedent will be the heirs. If none of the above were living at decedent's death, then the grandparents will be the heirs.

Who is considered an heir in Illinois?

An heir is the person who legally stands to inherit assets in the absence of direction from the decedent. Whereas a legatee is someone the decedent has directed shall receive assets. So if a decedent had a will leaving money to a nephew, the nephew is a legatee.

How much does it cost to file an affidavit of heirship in Texas?

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

What is an affidavit of heirship?

An affidavit of heirship is used to prove someone is entitled to the assets of a deceased person when no will is left. An affidavit can be defined as a statement of fact or declaration of fact. Typically, this type of document is used in certain states to prove an heir is legally entitled to the asset, so the courts can transfer ownership of the deceased’s property.

Can an Attorney or Law Firm Help Me File an Affidavit of heirship?

Yes, not only can a lawyer help you file, but they can also help ensure you understand the full process, what all is needed, and what to expect as you go through the transfer of ownership.

What is an affidavit of heirship?

An affidavit of heirship is a document that can be used in some states to transfer ownership of property left by a deceased person to their family. This allows for property to be inherited without a will or a court proceeding.

When do you need to file an affidavit of heirship?

You may need to create and file an affidavit of heirship if a family member has died without a will and you believe you are entitled to inherit any property left behind.

How to file an affidavit of death?

The affidavit form is filed directly with the county where the deceased owned real estate. It must include all the details mentioned above as well as: 1 How long the heir has known the deceased 2 Information about the deceased's children and other heirs, including dates of birth, addresses, and descendants 3 Whether debts of the decedent are yet to be paid 4 List of all of property owned by the deceased at the time of death

What does "heirship" mean in a will?

Heirship simply means you are the legal heir of someone who has died without a will. Heirs are different from beneficiaries. Beneficiaries are the people named in a will who inherit from someone who has died. When there is no will, heirship is created.

What is the heir to a will?

Heirs are the surviving family of a person who dies. This is generally close family such as children, grandchildren, or parents. For someone without close relations, this could include cousins, aunts, and uncles. When a person dies without a will, state intestacy law determines who the heirs are and who will inherit the assets.

How long after death can a will be probated?

There is a will but it has not been probated four years after the death. The affidavit form is filed directly with the county where the deceased owned real estate. It must include all the details mentioned above as well as: How long the heir has known the deceased.

Where do you sign a document to inherit?

Third-party verification that you have a right to inherit (a witness who can verify these facts and who signs the form) You sign the document in front of a notary (if required in your state) and file it with the court or the county (whichever is required by your state). A small filing fee may be required.

How much can creditors collect on affidavit of heirship?

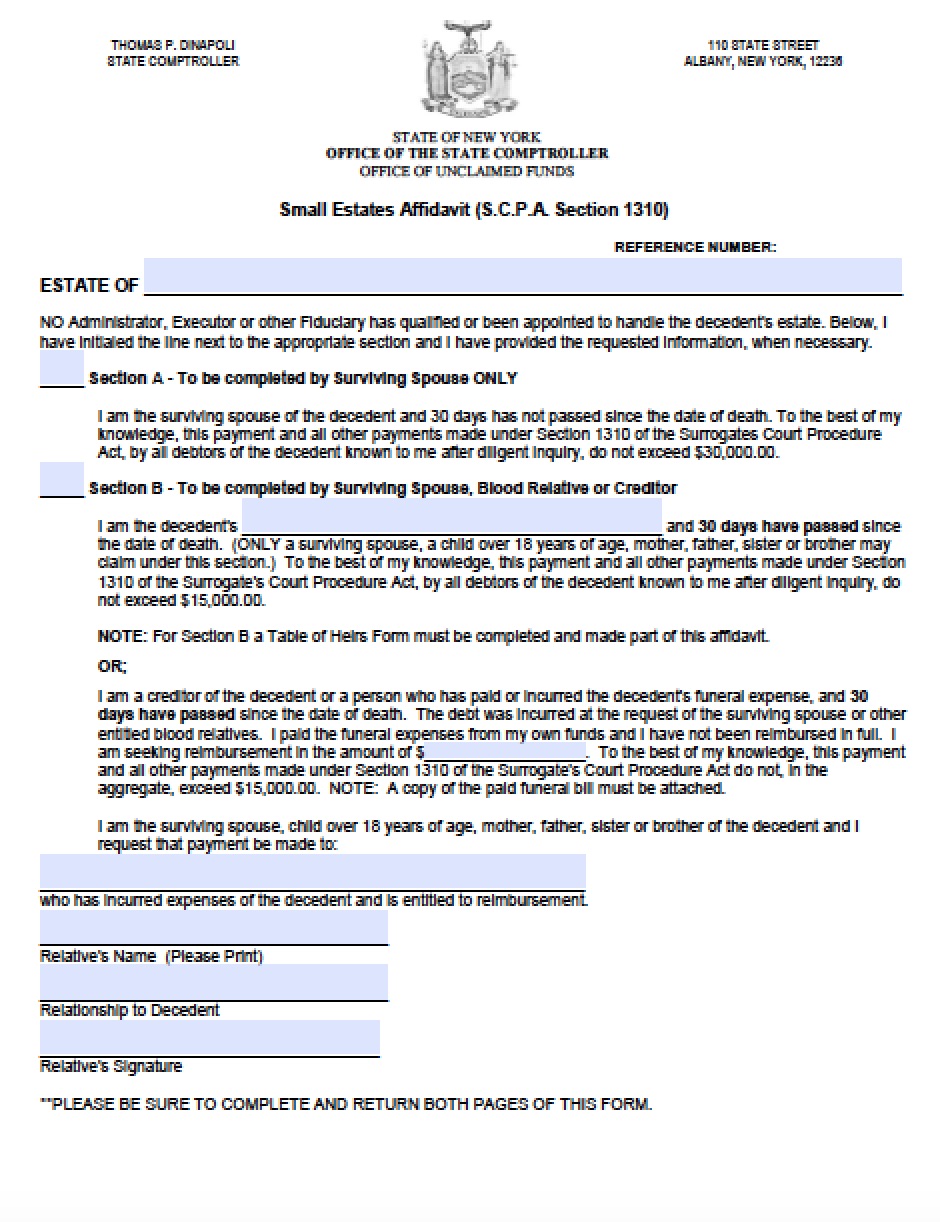

Creditors and certain relatives may collect up to $15,000, based on entitlement. However, if the affidavit of heirship is filed 6 months after the decedent’s passing, then relatives and creditors can only receive up to $5,000. The affidavit of heirship is governed by SCPA 1310. How to Write.

How much can a spouse collect from a loved one's estate in New York?

In New York state, a surviving spouse may file an affidavit of heirship to collect up to $30,000 of the loved one’s estate. However, the affidavit must be filed with the state’s probate court so that a judge may distribute some of the private property, such as bank accounts and trusts, among other heirs, including children and creditors.

Who can sign an affidavit of heirship in New York?

An Affidavit of Heirship must be signed, and one or more disinterested witnesses must complete and/or witness the signature, including a notary public.

Who completes an affidavit of heirship?

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

What is declaration of heirship?

An affidavit of heirship (in some states referred to as a declaration of heirship) is a legal document used to determine the right to inheritance of a deceased individual's assets.

How much does it cost to file an affidavit of heirship?

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

What is an affidavit of descent?

When a person who owns real property dies intestate, and there is no survivor mentioned in the deed, the heirs of the decedent, must file an affidavit of descent to establish their chain of title to the property. This affidavit, is known as an affidavit of descent.

Who signs an affidavit of heirship?

Once the affidavit of heirship is completed, it will need to be signed by the person swearing to the truth of the information contained in the affidavit (known as the “affiant”) in front of a notary public, along with the disinterested witnesses. The Notary Public will verify the identities of the individuals prior to signing of the affidavit. In Texas, often the title company’s attorney prepares the affidavit once the information form is completed by the affiant. This can occur as part of preparation of the property for closing by a title company.

What is an affidavit of heirship in Texas?

Texas Estates Code §101.001 (b). An affidavit of heirship is a legal document recognized by law that identifies the legal heirs of a deceased person. When properly completed, this document should include all relevant ...

What are the complications of an affidavit of heirship?

Factors that could complicate matters include: Possible existence of an unknown child of the deceased person. Lack of communication between heirs.

What happens if a family member dies without a will?

If you or a family member dies without a will, the court will need to step in to determine who are the legal heirs of the estate. The process involves the court hiring an attorney who determines if you had a spouse or any children. If you or a family member don’t have either of …. Continue reading.

What is marriage history?

Marital history. Including a complete list of all marriages (the name of the spouse, date of marriage, and how the marriage ended i.e., divorce or death)

What information do you need to fill out a death certificate?

When filling out the forms needed to have this legal document prepared, you will need to include at least the following information about the deceased person: Last known legal residence. (even if they actually were living somewhere else, such as at a nursing home, or they were in the hospital.) Marital history.

What happens when a loved one passes away without a will?

When a loved one passes away without a will in place, distributing the estate can prove complicated . In many cases, the estate of the deceased person may need to be probated, tasking the court with identifying heirs, ensuring the estate debts are paid, claims are resolved and any remaining estate assets are divided amongst the heirs.

How much can a surviving spouse collect in New York?

New York Affidavit of Heirship. In New York state, a surviving spouse may file an affidavit of heirship to collect up to $30,000 of the loved one’s estate. However, the affidavit must be filed with the state’s probate court so that a judge may distribute some of the private property, such as bank accounts and….

What happens if a loved one dies in New York?

If a loved one dies in New York state without a last will and testament, then successors may file either an affidavit of heirship or a small estate affidavit to claim and distribute the decedent’s estate. In this state, however, successors must file their affidavits with the probate court.

Is a small estate affidavit the same as a small estate affida?

The New York small estate affidavit and the affidavit of heirship are essentially the same document to the state, and are governed by the SCPA 1310 statute. If a loved one owned property or lived in New York, and passed away after 2009, then a surviving spouse may file a…

Does a probate judge have to file an affidavit of heirship in New York?

Affidavit of Heirship: Unlike other states, New York requires that the affidavit of heirship be filed in probate court, and a probate judge will still distribute the property evenly among successors such as a surviving spouse and children. Creditors may also file an affidavit of heirship as long as they have documents proving the decedent owed money.