How do I file an affidavit of voluntary administration?

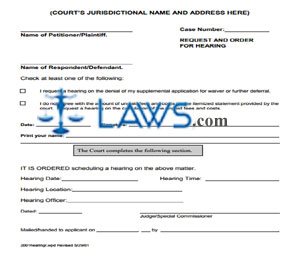

To do this you need to file a form called an "Affidavit of Voluntary Administration," also known as the "small estate affidavit." This free program will help you create the affidavit that you will need to file in Surrogate's Court. [Learn more about Small Estate] File this form in Surrogate's Court.

What is a voluntary administration of an estate?

File a voluntary administration for an estate Voluntary administration is a simplified probate procedure for an estate with minimal assets and no real estate. Find out how to file a voluntary administration for an estate and what forms you'll need.

What is voluntary administration in New York State?

New York Small Estates and Voluntary Administration When a person passes away leaving assets in their own name, their heirs generally have to go through probate or an administration proceeding to transfer those assets.

How do I complete a voluntary administration of a will?

To complete a voluntary administration, you'll need to file: A Cause of Death Affidavit (MPC 475) or Affidavit of Domicile (MPC 485) Some forms may not display properly in your browser. Please download the forms and open them using Acrobat reader. for 1. Fill out the forms for 1. Fill out the forms for 1. Fill out the forms 2. Gather the fees

What is voluntary administration in New York?

When the person who died (the Decedent) had less than $50,000 of personal property then it's considered a small estate, and is called a Voluntary Administration. It does not matter if the Decedent had a Will or not. Personal property is things that belong to a person not including real property.

How long do you have to file probate after death in New York?

Six months: By the sixth month, the executor must ensure creditors are paid, resolve disputes and file Federal Income Tax return forms 1040 and 1041. Nine months: In an ideal case, the court should distribute benefits to heirs, discharge the personal representative and close the estate.

Is probate necessary in NY State?

Is Probate Required in New York? Probate is necessary for estates in New York. It is the process by which those assets are transferred to the heirs. State probate laws provide guidance and requirements for how it is accomplished.

How long does it take to get letters of administration in NY?

The short answer: 2 to 6 months. Typically 3 months. In the best-case scenario, getting your letters testamentary will take just 2 months.

What happens to bank account when someone dies without beneficiary?

If there is no beneficiary, the funds go to the deceased's estate. From there, any remaining funds will be distributed according to instructions in the will. If there is no will, state law typically dictates who receives the funds.

How much does it cost to go through probate in New York?

Many probate attorneys charge by the hour and their fees can be anywhere from $350 - $600/hour. Sometimes, if an estate is small and simple, they may charge a flat fee, generally starting around $3,000 and going up from there.

What happens if you don't probate a will ny?

What Happens If You Never Go to Probate? If Probate is necessary but never established, beneficiaries will not receive their inheritance or assets. The assets of the deceased person will be held by the state and frozen as there are no legal beneficiaries of the assets.

Can you avoid probate in NY?

In New York, you can make a living trust to avoid probate for virtually any asset you own—real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Do you have to pay taxes on inheritance in NY?

While New York doesn't charge an inheritance tax, it does include an estate tax in its laws. The state has set a $6.11 million estate tax exemption, meaning if the decedent's estate exceeds that amount, the estate is required to file a New York estate tax return.

Who is entitled to Letters of Administration?

Where the next-of-kin are of equal ranking and their interest is almost equal, the Court has the power to accept one or more of them subject to suitability. These persons are: Spouse of the Deceased. Children of the Deceased or the surviving issue of a child who died in the lifetime of the Deceased.

Who inherits if no will in New York?

surviving spouseFor a New York resident without a will, a surviving spouse inherits the entire probate estate if there are no children or other descendants. If there are descendants, the surviving spouse gets the first $50,000 and the balance is divided one-half to the spouse and one-half to the decedent's descendants.

Can anyone apply for Letters of Administration?

If there is a valid will, you can apply for letters of administration if: the person who died left all of their estate to you in the will, and. the executors are not named, or cannot or are unwilling to act.

What is the probate process in New York?

If you have made a will, after your death the will is presented to the court in a probate proceeding. Probate is the court process where, after your death, the terms of your will are approved by a judge, and your assets, property and possessions are given out to your beneficiaries after your debts are paid off.

Is probate easy in New York?

New York has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

How long after probate can a house be sold?

You won't be able to sell the home until probate has been granted. Although you may put the property on the market, contracts can't be exchanged – so your buyer will need to be prepared to wait. It usually takes six to eight weeks for probate to come through, although it can take longer in more complex cases.

Why would you need a probate attorney?

A probate attorney can accomplish many things to settle an estate and assist the Executor and beneficiaries, including: Collecting life insurance policy proceeds. Determining and paying inheritance taxes. Figuring out and paying estate and income taxes that may be due.

How much does it cost to file a small estate affidavit?

In general, the person who is the closest distributee to the Decedent files for administration. See When There Is No Will. The filing fee is $1.00.

Who is the administrator of a will?

In a small estate proceeding, the Surrogate's Court appoints a Voluntary Administrator. If there is a Will, the Executor of the Will is appointed the Voluntary Administrator. If there is no Will, then the closest relative is named the Voluntary Administrator. The Surrogate's Court issues a certificate for each asset listed in the papers which the Voluntary Administrator collects and distributes according to the law.

How to make court papers?

The easiest way to make the court papers is to use the Small Estate DIY (Do-It-Yourself) Form program. This program walks you step-by-step to complete the paperwork you need and gives you helpful definitions and legal information. When you finish the program you get the court forms you need and instructions of what to do next.

Who is the administrator of a small estate?

In a small estate proceeding, the Surrogate's Court appoints a Voluntary Administrator. If there is a will, the Executor of the will is appointed the Voluntary Administrator. If there is no will, then the closest heir is named the Voluntary Administrator.

When should a probate proceeding be filed?

If there's real property and a Will, then a probate proceeding should be filed.

Information Checklist

You will need the following information with you when you use this program:

Start

Note: You will be taken to our partner website called LawHelp Interactive.

About DIY Forms

This program is not e-fileable. Your papers must be printed, then filed at the Court.

What is voluntary administration?

Voluntary administration means that the company has appointed an independent administrator to help resolve its financial difficulties. This article sets out what you should know about voluntary administration and what it might mean for your unpaid debts.

How does voluntary administration help a company?

Voluntary administration can help a company in financial trouble to accommodate the interests of creditors. By ceasing trading, taking stock of the company’s assets and liabilities and bringing together creditors of the company, voluntary administration puts the company in the best position possible to pay its debts.

How long does it take for creditors to vote on an administrator?

Once the administrator has been appointed, all creditors to the company will receive notice of the first meeting. The meeting takes place within 8 days of the appointment of the administrator, and creditors can vote to:

How long do you have to be notified of a creditor meeting?

As a creditor, you should be notified of the meeting at least 5 business days before it is held. At this meeting, the creditors decide on an outcome for the company. The three options are: This is a binding agreement between the company and its creditors, setting out the future of the company.

Can you vote on a claim if you don't have a valid claim?

If the chairperson decides that you do not have a valid claim, you may not be able to vote. This does not necessarily affect your chances of receiving payment of your debt, but it does affect your ability to influence the outcome of creditor’s meetings.

How to be a voluntary administrator?

To be appointed a voluntary administrator, the petitioner must file an "Affidavit in Relation to Settlement of Estate Under Article 13, SCPA" along with a death certificate in the Surrogate’s Court of county in which the decedent lived.

What should be included in an affidavit?

The affidavit should list the specific assets with corresponding values which need to be administered . If the values are unknown, the court will allow the voluntary administrator permission to obtain that information and submit an amended affidavit at a later date with the accurate information.

What happens when a person leaves assets in their own name?

When a person passes away leaving assets in their own name, their heirs generally have to go through probate or an administration proceeding to transfer those assets. Sometimes, however, the value of the assets is so small that it is not cost effective to bring these proceedings. In those cases, New York allows the heirs to bring a “small estate” or “voluntary administration” proceeding, regardless of whether the decedent left a will or not.

How does an estate administrator collect assets?

After the court processes and approves the affidavit, they issue a certificate for each asset listed in the affidavit, which the voluntary administrator can use to collect the assets. The court also instructs the voluntary administrator to open an estate account into which the assets can be deposited and used to pay bills and expenses. An EIN number must be obtained from the IRS for the estate account. Funeral and legal bills incurred by the estate are first bills which are paid. After 7 months, and the payment or settlement of all debts of the estate, the remaining assets are distributed to the distributees as per EPTL 4-1.1.

What state has limited letters of administration?

Limited Letters of Administration in New York State

Can a small estate be opened to administer personal property?

Under Article 13 of the SCPA, small estate petitions can only be opened to administer personal property such as bank accounts. Consequently, if the decedent owned real property in his own name, a small estate will not allow his heirs to take control of the property, and a full administration or probate must be brought.

Can a small estate be administered?

Under Article 13 of the SCPA, small estate petitions can only be opened to administer personalproperty such as bank accounts. Consequently, if the decedent owned realproperty in his own name, a small estate will not allow his heirs to take control of the property, and a full administration or probate must be brought. It is important to note that jointly owned property, for example a marital home with a spouse, passes by operation of law and does not need to go through administration. Likewise, assets which the decedent owned in joint accounts or with beneficiary designations for others pass outside of the Surrogate Court and do not require court intervention.

What is voluntary administration?

Voluntary administration is an insolvency procedure involving the appointment of an external administrator, known as a voluntary administrator. It is usually initiated by the company’s directors or by a secured creditor. Voluntary administration is a process for a business in financial strife and helps determine the best course of option for the future of the business. It aims to help a business by addressing financial issues with respect to creditors.

Why is voluntary administration important?

One of the major advantages of voluntary administration is it allows directors to avoid insolvent trading. Company directors, as mentioned above, have a duty to prevent their company from trading while insolvent.

What is the difference between voluntary administration and liquidation?

There are distinct differences between voluntary administration and liquidation. In liquidation, you’re already in the wind-up stages. In voluntary administration, however, your business could be turned around (in rare cases), enter a deed of company arrangement, or entered into liquidation. Voluntary administration, therefore, is a potential step before liquidation, but entering voluntary administration by no means suggests a business will be liquidated.

What are the disadvantages of voluntary administration?

Possible disadvantages of voluntary administration include costs, loss of control for directors, and loss of control to the administrator, who is obligated to act in the creditors’ best interests.

What are the challenges involved with taking a business through voluntary administration?

As with any insolvency proceeding, voluntary administration means you’ll be publicising your company’s having financial struggles to parties such as customers, suppliers, and lenders . The uncertainty associated with voluntary administration can also make it a challenging process. If you’re a company director, giving up power and control to an external administrator can be unsettling as you have no say in how the company proceeds.

What is the role of the directors during a voluntary administration?

This can mean relinquishing control, helping the voluntary administrator as much as they can with access to information, and preparing for possible outcomes.

How are employees affected by a business going through voluntary administration?

As an employee, you’ll want to know about your claims to proceed if the company is liquidated. As a company director, you’ll probably want to keep your employees informed about their rights , especially in regards to their pay, throughout the process.