Full Answer

What deductions are not allowed for AMT?

Line 2a: Standard deduction or deductible taxes from Schedule A: In calculating the AMT, you cannot take itemized deductions for state and local income tax, real estate taxes and personal property taxes, even though these are deductible on your regular return.

What can trigger Amt?

What triggers the AMT for tax years 2018 to 2025? These are some of the most likely situations: Having a high household income. If your household income is over the phase-out thresholds ($1,047,200 for married filing jointly and $523,600 for everyone else), and you have a significant amount of itemized deductions, the AMT could still affect you.

Is there still an Alternative Minimum Tax?

The alternative minimum tax, or AMT, is a different, yet parallel, method to calculate a taxpayer's bill. It applies to people whose income exceeds a certain level and is intended to close the loopholes that allow them to reduce or eliminate their tax payments. It's adjusted each year for inflation.

Does AMT still exist?

Does the AMT still exist? Unfortunately, it still exists under the new Tax Cuts and Jobs Act (TCJA). However, the AMT rules are now more taxpayer-friendly, and other TCJA changes reduce the odds that you will owe the AMT for 2018-2025.

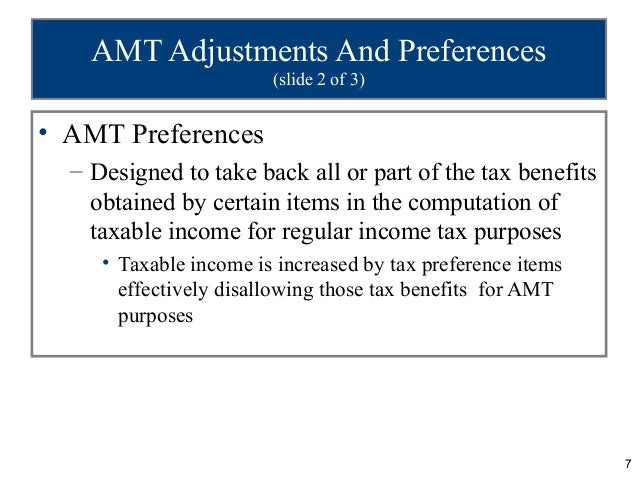

What is an adjustment for AMT?

The AMT starts with regular taxable income and applies its own system of “adjustments” and “preferences.” These are calculations that add more income to or remove deductions from regular taxable income to arrive at alternative minimum taxable income (AMTI).

Is AMT adjustment positive or negative?

Adjustments. AMT tax is generally calculated by first calculating AMTI. There are 2 types of changes that modify AMTI: adjustments and tax preferences. Adjustments can be either positive or negative – positive adjustments are added to AMTI and negative adjustments are subtracted from it.

What does AMT stand for?

alternative minimum taxUnder the tax law, certain tax benefits can significantly reduce a taxpayer's regular tax amount. The alternative minimum tax (AMT) applies to taxpayers with high economic income by setting a limit on those benefits. It helps to ensure that those taxpayers pay at least a minimum amount of tax.

What triggers AMT tax?

The Alternative Minimum Tax (AMT) is triggered when taxpayers have more income than an exemption amount and they make use of many common itemized deductions. You must calculate your tax twice if your income is greater than the AMT exemption.

Do I need to make an AMT adjustment?

To figure out whether you owe any additional tax under the Alternative Minimum Tax system, you need to fill out Form 6251. If the tax calculated on Form 6251 is higher than that calculated on your regular tax return, you have to pay the difference as AMT in addition to the regularly calculated income tax.

How is AMT adjustment calculated?

AMT Adjustments Explained. Per Code Sec. 56, in calculating alternative minimum taxable income (AMTI), a taxpayer must add or subtract amounts from regular taxable income due to the different treatment of certain tax items for AMT. These additions and subtractions are called AMT adjustments.

How does an AMT work?

AMTs operate like an automatic while providing the affordability and fuel-saving benefits of a manual transmission. With this type of transmission, the driver can manually shift gears or opt for automatic shifting. Either way, he or she does not need to use the clutch, which is operated by a hydraulic system.

Who Must File AMT form?

Key Takeaways It effectively adds back certain tax breaks you might have claimed on your Form 1040 tax return. Only people with taxable incomes that exceed certain income levels, and taxpayers who claimed some uncommon tax deductions, are required to complete this form and pay the AMT.

At what income does AMT start?

Having a high household income. If your household income is over the phase-out thresholds ($1,079,800 for married filing jointly and $539,900 for everyone else), and you have a significant amount of itemized deductions, the AMT could still affect you.

How can I avoid paying AMT?

How to Reduce the AMT. A good strategy for minimizing your AMT liability is to keep your adjusted gross income (AGI) as low as possible. Some options: Participate in a 401(k), 403(b), SARSEP, 457(b) plan, or SIMPLE IRA by making the maximum allowable salary deferral contributions.

What is the AMT exemption amount in 2021?

AMT Exemption for 2021 $114,600 for married individuals filing jointly and surviving spouses, $73,600 for single individuals and heads of households, $57,300 for married individuals filing separately, and. $25,700 for estates and trusts.

How much is the AMT exemption?

Alternative Minimum Tax (AMT) Updated for 2022 “The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 and begins to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption begins to phase out at $1,079,800).” States With Individual Alternative Minimum Tax (AMT):

Are AMT preferences always positive?

AMT adjustments can be positive or negative, whereas AMT preferences are always positive. Since most tax preferences are merely timing differences, they eventually will reverse and net to zero.

What is AMT adjusted basis of like kind property?

The AMT basis is generally the same amount as regular basis, unless you are subject to AMT tax. The cost basis of a house includes your cost, value of improvements, sales expenses, etc. A business vehicle's cost basis would be your cost, less depreciation taken.

Can you differentiate an AMT preference from an AMT adjustment?

These items are referred to as “tax preferences” or “adjustments.” Adjustments differ from preferences only in that adjustments involve a substitution of a special AMT treatment of an item for the regular tax treatment (for example, no deduction is allowed for personal and dependency exemptions), while a preference ...

What is the AMT threshold for 2022?

AMT exemption amounts for 2022SingleMarried, filing jointlyExemption amount$75,900$118,100Income at which exemption begins to phase out$539,900$1,079,800The AMT exemption amount for certain individuals under 24 equals their earned income plus $8,200.

What is AMT exemption?

AMT is designed to prevent taxpayers from escaping their fair share of tax liability through tax breaks. However, the structure was not indexed to inflation or tax cuts. This can cause bracket creep, a condition in which upper-middle-income taxpayers are subject to this tax instead of just the wealthy taxpayers for whom AMT was invented. In 2015, however, Congress passed a law indexing the AMT exemption amount to inflation.

What Is Alternative Minimum Tax (AMT)?

An alternative minimum tax (AMT) places a floor on the percentage of taxes that a filer must pay to the government, no matter how many deductions or credits the filer may claim.

How to determine if you owe AMT?

To determine if they owe AMT, individuals can use tax software that automatically does the calculation, or they can fill out IRS Form 6251. This form takes medical expenses, home mortgage interest, and several other miscellaneous deductions into account to help tax filers determine if their deductions are beyond an overall limit set by the IRS.

What is TMT in tax?

This yields the tentative minimum tax (TMT). If the TMT is higher than the taxpayer's regular tax liability for the year, they pay the regular tax and the amount by which the TMT exceeds the regular tax. In other words, the taxpayer pays the full TMT.

How much is the phase out tax for 2020?

For tax year 2020, the phase-out begins at $518,400 for individuals and $1,036,800 for couples filing jointly. 2 For tax year 2021, it begins to phase out at $523,600, or $1,047,200 for couples filing jointly. 4 .

Do I have to pay AMT if I have a 6251?

Taxpayers have to complete Form 6251 to see whether they might owe AMT. First, they get to subtract the exemption amount. If their AMT is less than the exemption, they do not have to pay AMT. It's important to note, though, that taxpayers with AMTI over a certain threshold do not qualify for the AMT exemption.

AMT (Alternative Minimum Tax)

In the United States, the AMT (alternative minimum tax) has been in effect since 1982. The AMT is a supplement to the regular income tax system and ensures that taxpayers who have significant deductions are not completely shielded from paying taxes.

Factors to consider before calculating AMT

Now that we understand AMT (alternative minimum tax), it is time to learn about the factors that influence its calculation. Following are some of the important factors to consider before calculating AMT.

How to calculate AMT (Alternative Minimum Tax?

Well, we have addressed some of the relevant issues, and it is time to learn alternative minimum tax calculations. The fundamental steps and procedures for calculating the tax liability under AMT (alternative minimum tax) are given below.

AMT (Alternative Minimum Tax) reporting requirements

The reporting requirement for AMT can be completed by providing proof of income along with the supporting documents; the taxpayer is required to report their income properly. In addition, taxpayers must disclose how much of the AMT (alternative minimum tax) has been paid in the previous years.

Get help from Eqvista for your AMT (alternative minimum tax)

AMT is an important tax system that is considered in terms of filing your taxes. The AMT is completely different from the regular income tax. It is important to understand this difference and consider the implications of filing your taxes under the AMT to avoid penalties. Eqvista is here to help make the AM T filing process smooth and simple.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!

Why was the AMT enacted?

The AMT was enacted in 1969 to keep wealthy taxpayers from using what was viewed as too many tax preferences. In 1969, U.S. Treasury Secretary Joseph Barr testified that in 1966, 155 high-income people paid zero income tax.

How much is the AMT exemption for 2020?

However, exemptions phase out at 25 cents per dollar once AMTI hits $518,400 for single filers and $1,036,800 for married taxpayers filing jointly in 2020.

What is an alternative minimum tax?

What Is the Alternative Minimum Tax (AMT)? The Alternative Minimum Tax (AMT) is a separate tax system that requires some taxpayers to calculate their tax liability twice—first , under ordinary income tax rules, then under the AMT—and pay whichever amount is highest . The AMT has fewer preferences and different exemptions and rates than ...

How Is the AMT Calculated?from irs.gov

The AMT is the excess of the tentative minimum tax over the regular tax. Thus, the AMT is owed only if the tentative minimum tax for the year is greater than the regular tax for that year. The tentative minimum tax is figured separately from the regular tax. In general, compute the tentative minimum tax by:

What is AMT tax?from nerdwallet.com

What is alternative minimum tax (AMT)? The alternative minimum tax ( AMT) is calculated using a different set of rules meant to ensure certain taxpayers pay at least a minimum amount of income tax. AMT calculations limit certain breaks for some taxpayers so their tax bill is higher. AMT rates are 26% or 28%.

What Is Alternative Minimum Tax (AMT)?from investopedia.com

An alternative minimum tax (AMT) places a floor on the percentage of taxes that a filer must pay to the government, no matter how many deductions or credits the filer may claim.

What triggers the alternative minimum tax?from nerdwallet.com

Incomes above the annual AMT exemption amounts typically trigger the alternative minimum tax. AMT payers, who typically have relatively high incomes, essentially calculate their income tax twice — under regular tax rules and under the stricter AMT rules — and then pay the higher amount owed.

What tax breaks do you lose under the AMT?from nerdwallet.com

Taxpayers typically look for deductions, credits and other ways to reduce their taxable income. Under the AMT, you may not be able to take as many of these breaks.

What is AMT exemption?from investopedia.com

AMT is designed to prevent taxpayers from escaping their fair share of tax liability through tax breaks. However, the structure was not indexed to inflation or tax cuts. This can cause bracket creep, a condition in which upper-middle-income taxpayers are subject to this tax instead of just the wealthy taxpayers for whom AMT was invented. In 2015, however, Congress passed a law indexing the AMT exemption amount to inflation.

How to find out if you are subject to AMT?from irs.gov

To find out if you may be subject to the AMT, refer to the Alternative Minimum Tax (AMT) line instructions in the Instructions for Form 1040 and Form 1040-SR. If subject to the AMT, you may be required to complete and attach Form 6251, Alternative Minimum Tax – Individuals. See the Instructions for Form 6251.

What is AMT tax?

What is alternative minimum tax (AMT)? The alternative minimum tax ( AMT) is calculated using a different set of rules meant to ensure certain taxpayers pay at least a minimum amount of income tax. AMT calculations limit certain breaks for some taxpayers so their tax bill is higher. AMT rates are 26% or 28%.

What happens if you subtract AMT?

Subtract the AMT foreign tax credit, if you qualify for it. What’s left is your income tax under the AMT rules. If your income tax under the AMT rules is higher than your income tax under the regular rules, you pay the higher amount. This basically determines who has to pay alternative minimum tax.

What triggers the alternative minimum tax?

Incomes above the annual AMT exemption amounts typically trigger the alternative minimum tax. AMT payers, who typically have relatively high incomes, essentially calculate their income tax twice — under regular tax rules and under the stricter AMT rules — and then pay the higher amount owed.

How do I calculate alternative minimum tax (AMT)?

The alternative minimum tax runs parallel to the standard tax system, but it has a different tax rate structure and eliminates some common tax breaks . This is generally how the calculation works:

What tax breaks do you lose under the AMT?

Taxpayers typically look for deductions, credits and other ways to reduce their taxable income. Under the AMT, you may not be able to take as many of these breaks.

What is the AMT exemption amount?

The AMT exemption amount for certain individuals under 24 equals their earned income plus $7,900. Multiply what’s left by the appropriate AMT tax rates. The AMT has two tax rates: 26% and 28%. (Compare these to the seven federal income tax brackets, ranging from 10% to 37%.)

Does tax software do both sets of calculations?

Here’s some welcome news: Most good tax software will do both sets of calculations automatically. As you enter your information, the program will run the numbers in the background according to both the regular tax system (using Form 1040) and AMT rules (using Form 6251).

What is AMT in tax?

The alternative minimum tax (AMT) applies to taxpayers with high economic income by setting a limit on those benefits. It helps to ensure that those taxpayers pay at least a minimum amount of tax.

How Is the AMT Calculated?

The AMT is the excess of the tentative minimum tax over the regular tax. Thus, the AMT is owed only if the tentative minimum tax for the year is greater than the regular tax for that year. The tentative minimum tax is figured separately from the regular tax. In general, compute the tentative minimum tax by:

How to find out if you are subject to AMT?

To find out if you may be subject to the AMT, refer to the Alternative Minimum Tax (AMT) line instructions in the Instructions for Form 1040 and Form 1040-SR. If subject to the AMT, you may be required to complete and attach Form 6251, Alternative Minimum Tax – Individuals. See the Instructions for Form 6251.

What is AMT tax?

The AMT is a parallel tax system that operates in the shadow of the regular tax, expanding the amount of income that is taxed by adding items that are tax-free and disallowing many deductions under the regular tax system .

Why would I have to pay the AMT?

The simplest way to see why you are paying the AMT, or how close you came to paying it, is to look at your Form 6251 from last year.

What is the Alternative Minimum Tax?

The AMT is a parallel tax system that operates in the shadow of the regular tax, expanding the amount of income that is taxed by adding items that are tax-free and disallowing many deductions under the regular tax system .

What are the 2021 AMT exemption amounts?

The AMT exemption is like a standard deduction for calculating the alternative minimum tax.

How can I escape the AMT?

To avoid the AMT, you need to understand how the AMT differs from the regular tax system.

How can I plan ahead for the AMT?

There are some things you can do to plan ahead for the Alternative Minimum Tax:

What is the AMT exemption for 2020?

Thanks to changes made by Congress, each year the AMT exemption amount automatically adjusts with inflation. The AMT exemption is like a standard deduction for calculating the alternative minimum tax. The 2020 exemption amounts are: Single taxpayers: $72,900. Married taxpayers filing jointly: $113,400.

Can a contractor pay AMT?

However, these taxpayers may also be liable for alternative minimum tax (AMT), in which case they may be required to make an adjustment for the percentage-of-completion method that may be overlooked, as well as pay an interest charge under the lookback method upon completion of a long-term contract. This column describes the adjustment and interest charge and when they apply.

Is there an AMT adjustment for work in progress for year 2?

Since Z had no jobs in progress at the end of year 2, there is no AMT adjustment for work in progress for the end of year 2. When the job is completed at the end of year 2, final receivables are collected, and job costs have been paid, the cumulative income for regular income tax and AMT are the same, which is as it should be.

Is there a negative adjustment for AMT in year 2?

Because the $200,000 regular tax profit in year 2 included the $100,000 profit already recognized in year 1 for AMT, there must be a negative adjustment from regular tax for AMT in year 2 for the $100,000; otherwise, Z would have reported $300,000 in cumulative AMTI on a job that only had $200,000 profit.

What Is Alternative Minimum Tax (AMT)?

How The Alternative Minimum Tax (AMT) Works

- The difference between a taxpayer's AMTI and his AMT exemption is taxed using the relevant rate schedule. This yields the tentative minimum tax (TMT). If the TMT is higher than the taxpayer's regular tax liability for the year, they pay the regular tax and the amount by which the TMT exceeds the regular tax. In other words, the taxpayer pays the full TMT.2

Amt Exemption Amounts

- For tax year 2021, the AMT exemption for individual filers is $73,600. For married joint filers, the figure is $114,600. For tax year 2022, the figures are $75,900 for individuals and $118,100 for couples.4 Taxpayers have to complete Form 6251 to see whether they might owe AMT. First, they get to subtract the exemption amount. If their AMT is less than the exemption, they do not have …

Purpose of Amt

- AMT is designed to prevent taxpayers from escaping their fair share of tax liability through tax breaks.6 However, the structure was not indexed to inflation or tax cuts. This can cause bracket creep, a condition in which upper-middle-income taxpayers are subject to this tax instead of just the wealthy taxpayers for whom AMT was invented. In 2012, however, Congress passed a law in…

Calculating Amt

- To determine if they owe AMT, individuals can use tax software that automatically does the calculation, or they can fill out IRS Form 6251. This form takes medical expenses, home mortgage interest, and several other miscellaneous deductions into account to help tax filers determine if their deductions are beyond an overall limit set by the IRS. The form also requests information o…