What is a life insurance assignment?

A life insurance assignment is a document that allows you to transfer the ownership rights of your policy to a third party, transferring to that third party all rights of ownership under your policy, including the rights to make decisions regarding coverage, beneficiary and investment options. What does it mean to accept assignment of benefits?

Can I assign my insurance proceeds?

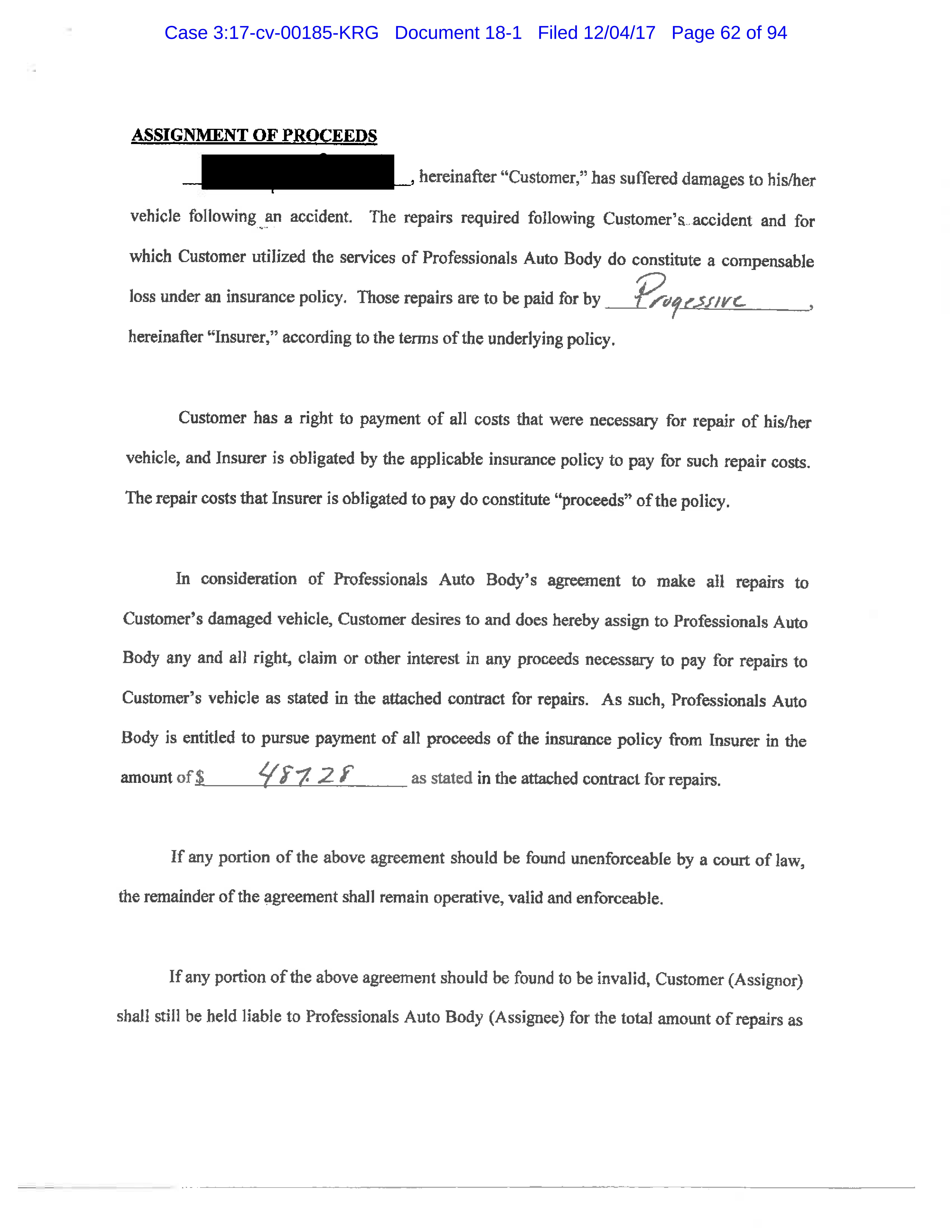

An “assignment” is a transfer of an interest or right to another. Once a right has been “assigned,” the recipient, or transferee, stands in the shoes of the prior owner, or transferor, and obtains the rights the transferor had prior to the assignment. Almost any right can be assigned, including the right to insurance proceeds.

What is an assignment of proceeds?

What Is an Assignment of Proceeds? An assignment of proceeds occurs when a beneficiary transfers all or part of the proceeds from a letter of credit to a third party beneficiary.

What does assignment of benefits mean?

“Assignment of Benefits” is a legally binding agreement between you and your Insurance Company, asking them to send your reimbursement checks directly to your doctor. When our office accepts an assignment of benefits, this means that we have to wait for up to one month for your insurance reimbursement to arrive. What does policy assigned mean?

What Is an Assignment of Proceeds?

What happens when a financial institution assigns proceeds?

What are the advantages and disadvantages of an assignment of proceeds?

What happens if a beneficiary does not meet the obligations outlined in the letter of credit?

Is Eric a licensed insurance broker?

See 2 more

About this website

What does assignment of insurance proceeds mean?

Assignment of Insurance Proceeds means any assignment by way of security in favour of the Noteholders of receivables arising from the Insurance Policies, which may be entered into as an alternative to the Endorsement of Insurance Policies.

Can insurance proceeds be assigned?

Almost any right can be assigned, including the right to insurance proceeds. When insurance proceeds are assigned to a restoration contractor, the contractor has the right to demand payment directly from the insurance company.

What are the two types of insurance assignments?

There are two types of conventional insurance policy assignments:An absolute assignment is typically intended to transfer all your interests, rights and ownership in the policy to an assignee. ... A collateral assignment is a more limited type of transfer.

What does it mean to have insurance assigned?

Assignment — a transfer of legal rights under, or interest in, an insurance policy to another party. In most instances, the assignment of such rights can only be effected with the written consent of the insurer.

What does it mean to assign a claim?

You can sign an “assignment of claim,” which assigns your rights (as the policyholder) to benefits and proceeds from the loss, to the company or contractors. In the simplest of terms, the assignment of claim allows your contractor to get paid directly from the insurance company.

What does it mean to accept assignment of benefits?

“Assignment of Benefits” is a legally binding agreement between you and your Insurance Company, asking them to send your reimbursement checks directly to your doctor. When our office accepts an assignment of benefits, this means that we have to wait for up to one month for your insurance reimbursement to arrive.

Who pays premium when a policy is assigned?

In the case of an assignment against a loan the assignor can continue to pay the policy premiums and claim the Section 80C tax benefit on them as the policy is on his life and he is the person paying the premiums.

Is assignee the same as beneficiary?

If you die, the life insurance company pays the lender, or assignee, the loan balance. The remainder of your death benefit — if there is one — goes to your beneficiaries.

What is the full meaning of assignment?

Definition of assignment 1 : the act of assigning something the assignment of a task. 2a : a position, post, or office to which one is assigned Her assignment was to the embassy in India. b : a specified task or amount of work assigned or undertaken as if assigned by authority a homework assignment.

What is the difference between assignment of benefits and accept assignment on an insurance claim?

To accept assignment means that the provider agrees to accept what the insurance company allows or approves as payment in full for the claim. Assignment of benefits means the patient and/or insured authorizes the payer to reimburse the provider directly.

How do you revoke an assignment of benefits?

An assignor can revoke an assignment by notifying the assignee of the revocation, by accepting the obligor's performance, or by subsequently assigning the same right to another party. Also, the death or bankruptcy of the assignor will automatically revoke the assignment.

What is an assignment on a life insurance policy?

In its simplest form, a life insurance policy assignment is the transfer of ownership or a portion of a death benefit to another person or entity.

How are insurance proceeds treated in accounting?

Before insurance proceeds are paid out, the claim must be fully evaluated to determine the extent of the payment. Accounting for insurance proceeds is very specific, in the manner in which they need to be credited. In general, insurance proceeds are tax-free, though there are certain exceptions to this rule.

How do you classify insurance proceeds in Quickbooks?

Here's how:Go to the + New icon.Select Bank deposit.On the Bank Deposit page, go to the Add funds to this deposit section to input the entry.Under the Account column, select the Other Income account.On the Class section, choose the class the insurance claim will be linked.Enter the other necessary details.More items...•

How do you record proceeds from an insurance claim?

How To Record Insurance Reimbursement in AccountingDetermine the amount of the proceeds of the damaged property. This is the amount sent to you by the insurance company. ... Locate the entry made to record the cost of the repair. ... Debit insurance proceeds to the Repairs account. ... Record a loss on the insurance settlement.

How are insurance proceeds treated for tax purposes?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

Assignment of Proceeds Sample Clauses: 124 Samples | Law Insider

Assignment of Proceeds. If (a) Buyer does not elect to terminate this Agreement as aforesaid if all or any significant portion of the Property is taken, or (b) a portion of the Property not constituti...

Get Assignment Of Proceeds Form - US Legal Forms

USLegal has been awarded the TopTenREVIEWS Gold Award 9 years in a row as the most comprehensive and helpful online legal forms services on the market today. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else".

Letter of Credit Transfer and Assignment of Letter of Credit ... - Lexology

Transfer versus Assignment Effecting Assignment Types of Assignment Common Questions Comment. Article 39 of the Seventh Revision of Uniform Customs and Practice for Documentary Credits (UCP 600 ...

Assignment of Sale Proceeds Definition | Law Insider

Examples of Assignment of Sale Proceeds in a sentence. The Company shall have no obligation to deliver shares of Stock until the tax withholding obligations of the Participating Company have been satisfied by the Participant.7.2 Assignment of Sale Proceeds.. If a speaker persists in improper conduct or remarks, the Chairperson may terminate that individual’s privilege of address.

What Is an Assignment of Proceeds?

An assignment of proceeds occurs when a beneficiary transfers all or part of the proceeds from a letter of credit to a third-party beneficiary. Assigning the proceeds from a letter of credit can be utilized in many types of scenarios, such as to pay suppliers or vendors in a business transaction or to settle other debts.

What happens when a financial institution assigns proceeds?

When an assignment of proceeds takes place, the financial institution is not contracting directly with the third-party beneficiary. It is only acting as an agent in supplying the funds to the third party. The original beneficiary is still responsible for completing any and all requirements under the letter of credit.

What are the advantages and disadvantages of an assignment of proceeds?

The main benefit of an assignment of proceeds is that the original beneficiary has the ability to assign all or just a portion of the letter of credit to the third party. The original beneficiary will retain access to any portion of the proceeds not redirected to the third party.

What happens if a beneficiary does not meet the obligations outlined in the letter of credit?

If the original beneficiary does not meet the obligations outlined in the letter of credit, no assignment will take place. Once approved, the bank or other entity will release the money to the specified third party to be drawn upon at will.

Is Eric a licensed insurance broker?

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Examples of Assignment of Title Insurance Proceeds in a sentence

Administrative Agent shall have received from Borrower and Mortgage Borrower an Assignment of Title Insurance Proceeds regarding the Owner’s Policy acknowledged by the Title Company and Commonwealth Land Title Insurance Company and in form and substance acceptable to Administrative Agent.

Related to Assignment of Title Insurance Proceeds

Excluded Insurance Proceeds means any proceeds of an insurance claim which the Company notifies the Agent are, or are to be, applied:

Which case ruled that assignments of insurance proceeds after a loss are valid despite a policy provision preventing an?

A recent decision, City Center West v. American Modern Home Insurance, 1 reiterated the majority view that assignments of insurance proceeds after a loss are valid despite a policy provision preventing an assignment of the policy:

Is assignment of insurance benefits boring?

Assignment of insurance benefits is a pretty boring aspect of insurance law. But, the topic came in handy for me this evening.

What is assignment of insurance claim?

What is an Assignment of an insurance claim? The assignment of an insurance claim can be seen in a similar light to the assignment of a contractual right or benefit. It is when one confers the financial payment or obligation of the insurer to another making them a beneficiary. It also can be understood as a delegation of ...

What is assignment of a policyholder's interest?

An assignment of an obligation to pay is similar but is from the obligor’s side of a contractual relationship. An employer or other defendant to the claim may be required to pay the plaintiff, but can seek reimbursement from ...

What is assignment of a right?

(1) An assignment of a right is a manifestation of the assignor's intention to transfer it by virtue of which the assignor's right to performance by the obligor is extinguished in whole or in part and the assignee acquires a right to such performance.

What is an anti-assignment clause?

These are clauses found within the contractual language of your policy that forbids an assignment of the conferred benefits or delegation of contractual obligations. However, the inclusion of an “anti-assignment” clause does not necessarily mean it is ...

Why is it important to have an attorney for an assignment?

Administrative regulations and public policy make it difficult to determine the validity of an assignment, so it is important that you become informed to protect your claim . An attorney can help you analyze the contractual language and State law in regard to the assignment of your claim. Many settlements disperse their payments amongst assigned ...

Why are Statutory Caps on Compensation taken into account?

Statutory caps on compensation must also be taken into account because a third-party cannot surpass the allowed limit even if they were assigned as a beneficiary. The contractual obligations and limitations are still valid even though the third-party’s rights were assigned rather than created in the original contract.

Can an anti-assignment clause be disputed?

These clauses may be disputed in Court, but it is important to be aware as a policyholder of the contractual language in your policy to not be caught off guard if an “anti-assignment” clause is included. If present it may void a claim to an insurer’s compensation, so it is important to be aware of these clauses.

What is an assignment in insurance?

Use professional pre-bu ilt templates to fill in and sign documents online faster . Get access to thousands of forms.

What is absolute assignment?

Absolute Assignment - Absolute assignment means the complete assignment of the ownership, benefits, liabilities under the life insurance policy from assignor to assignee without any terms and conditions.

What is assignment of insurance?

An “assignment” is a transfer of an interest or right to another. Once a right has been “assigned,” the recipient, or transferee, stands in the shoes of the prior owner, or transferor, and obtains the rights the transferor had prior to the assignment. Almost any right can be assigned, including the right to insurance proceeds. When insurance proceeds are assigned to a restoration contractor, the contractor has the right to demand payment directly from the insurance company. Just as an insured property owner would have the right to file a lawsuit against an insurance company to enforce an insurance policy, if the insurance company refuses to pay a contractor who has obtained an insurance assignment, the contractor has the right to sue the insurance company to receive payment.

What are the benefits of insurance assignments?

The benefits of insurance assignments are substantial. Assignments of insurance proceeds allow restoration contractors to control project funding. Professionals who obtain insurance assignments avoid the potential for the misappropriation of insurance proceeds and the possibility of performing work for “judgment-proof” property owners. Although property owners continue to be liable in accordance with the terms of their restoration-services contracts, assignments of insurance proceeds open the door to recovery directly from the insurance company.

What is an anti-assignment clause?

Anti-assignment clauses generally state that insured property owners may not assign or in any way transfer any rights or benefits of their insurance policies to third parties without prior written consent. Insurance companies commonly rely upon these provisions to argue that insurance assignments to restoration professionals are ineffective. Under Ohio law, assignments of insurance executed after a covered loss are valid notwithstanding an anti-assignment clause in an insurance policy. This means that even though the policy may have an anti-assignment clause, it is ineffective to prevent an insured from assigning the benefits of the policy to a restoration professional. The law in other states, however, may differ.

What Is an Assignment of Proceeds?

An assignment of proceeds occurs when a beneficiary transfers all or part of the proceeds from a letter of credit to a third-party beneficiary. Assigning the proceeds from a letter of credit can be utilized in many types of scenarios, such as to pay suppliers or vendors in a business transaction or to settle other debts.

What happens when a financial institution assigns proceeds?

When an assignment of proceeds takes place, the financial institution is not contracting directly with the third-party beneficiary. It is only acting as an agent in supplying the funds to the third party. The original beneficiary is still responsible for completing any and all requirements under the letter of credit.

What are the advantages and disadvantages of an assignment of proceeds?

The main benefit of an assignment of proceeds is that the original beneficiary has the ability to assign all or just a portion of the letter of credit to the third party. The original beneficiary will retain access to any portion of the proceeds not redirected to the third party.

What happens if a beneficiary does not meet the obligations outlined in the letter of credit?

If the original beneficiary does not meet the obligations outlined in the letter of credit, no assignment will take place. Once approved, the bank or other entity will release the money to the specified third party to be drawn upon at will.

Is Eric a licensed insurance broker?

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

What Is An Assignment of Proceeds?

- An assignment of proceeds occurs when a beneficiary transfers all or part of the proceeds from a letter of credit to a third-party beneficiary. Assigning the proceeds from a letter of credit can be utilized in many types of scenarios, such as to pay suppliers or vendors in a business transaction or to settle other debts.

Understanding An Assignment of Proceeds

- A letter of creditis a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. The original beneficiary, the named party who is entitled to receive the proceeds from …

Advantages and Disadvantages of An Assignment of Proceeds

- The main benefit of an assignment of proceeds is that the original beneficiary has the ability to assign all or just a portion of the letter of credit to the third party. The original beneficiary will retain access to any portion of the proceeds not redirected to the third party. This allows both entities to make use of the same letter of credit when necessary. This benefit must be weighed …

Example of An Assignment of Proceeds

- Assume XYZ Customer, in Brazil, is purchasing widgets from ABC Manufacturer, in the United States. In order to sign off on the deal, ABC Manufacturer requires that XYZ Customer obtains a letter of credit from a bank to mitigate the risk that XYZ may not pay ABC for the widgets once ABC has shipped them out of the country. At this point, ABC Manufacturer is able to request tha…