What Is an Estoppel Letter From a Homeowners Association?

- HOA Outstanding Balances. The types of outstanding balances referenced in an estoppel letter vary and cover all fees that the seller is delinquent in paying.

- Estoppel Letters Affect Title Insurance. ...

- Covering the Lender and the Buyer. ...

What do you need to know about An Estoppel Letter?

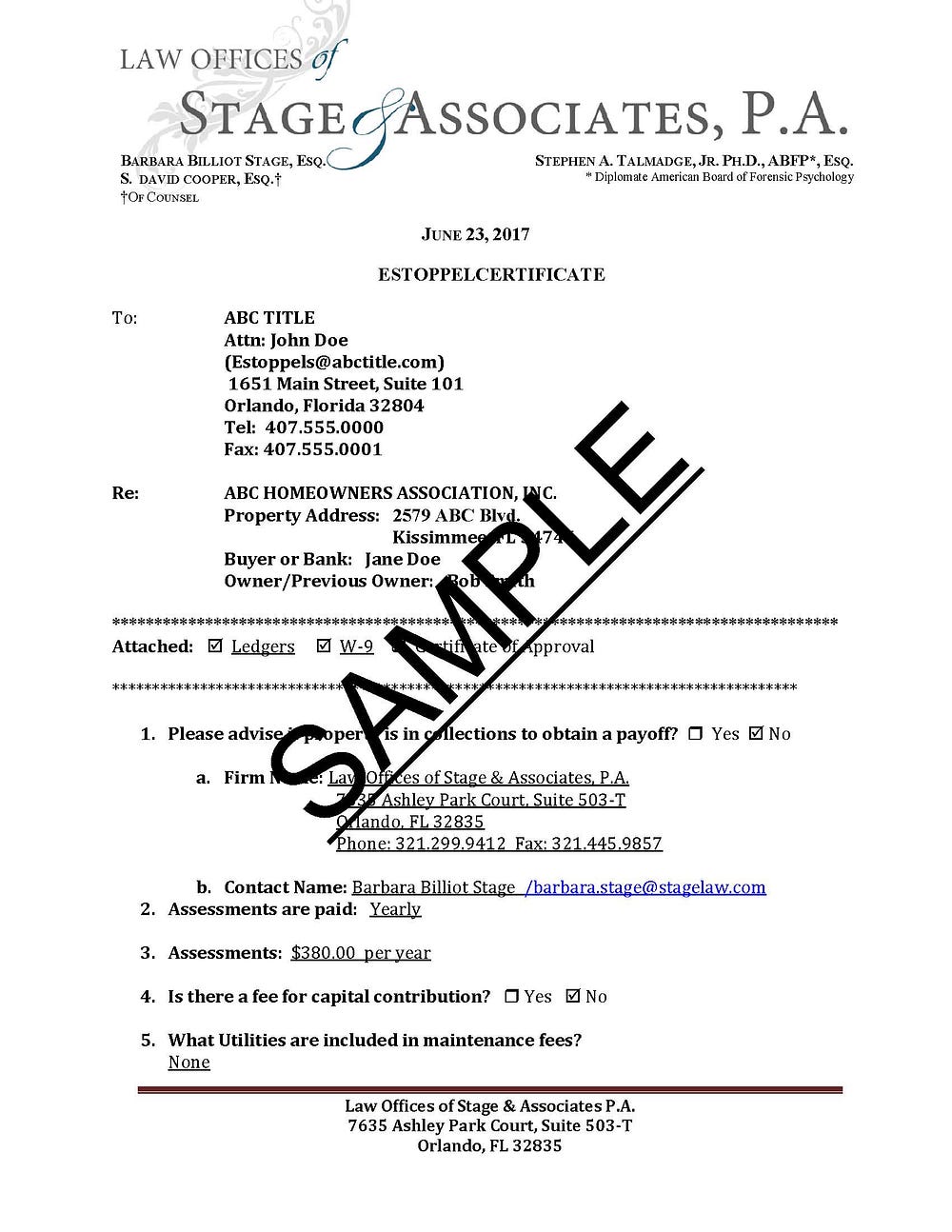

Estoppel letters vary from HOA to HOA but they generally include the HOA name, homeowner name, property address and the total financial obligation the current owner owes to the HOA. The total amount owed might include calculations of monthly fees up to the future closing date of the sale.

Do you have to pay for an HOA Estoppel Letter?

The HOAs usually require payment of the fee before an estoppel letter is provided. What Goes Into an HOA Estoppel Letter? Estoppel letters vary from HOA to HOA but they generally include the HOA name, homeowner name, property address and the total financial obligation the current owner owes to the HOA.

When do you need An Estoppel Letter for a refinance?

The request might include the buyer’s name and the closing date. A lender might request an estoppel letter as part of its refinancing process. Rules often require the HOA to provide the estoppel letter within a certain period, such as not more than 10 days after receipt of a written request.

How do estoppel letters affect title insurance?

Estoppel Letters Affect Title Insurance. A homeowner provides the buyer with a warranty deed at the closing, which shows the owner has clear title to the property and the authority to sell it. Title insurance guarantees this deed.

What is an estoppel letter used for?

An estoppel letter is most commonly used when a landlord wants to assure cash flow and prevent a tenant from breaking a promise. This benefits the tenant as well because the tenant is confirming that the landlord won't change any agreed-upon terms.

Who pays the HOA estoppel fee in Florida?

Both the buyer and seller are jointly responsible for the default fees, and payments incurred before a lease transfer is added to a buyer's closing cost. As defined by Florida Statute 720.30851, once a request for an estoppel letter has been made, the HOA must deliver the document to the requested party within 15 days.

How much can an HOA charge for estoppel in Florida?

$250(6) An association or its authorized agent may charge a reasonable fee for the preparation and delivery of an estoppel certificate, which may not exceed $250, if, on the date the certificate is issued, no delinquent amounts are owed to the association for the applicable parcel.

What does estoppel fee mean?

An estoppel fee is a fee charged by the homeowners association to the title company in order for them to determine the status of your account. They will determine if you are current and on-track, if you are behind, or if there are any special assessments that are due by the seller.

How long is an estoppel good for in Florida?

An estoppel certificate that is sent by regular mail has a 35-day effective period.

Is an estoppel letter required in Florida?

An estoppel certificate must also be provided in a uniform-statewide format to ensure that buyers and sellers receive the appropriate information needed to close the real estate transaction. Estoppel certificates are effective for 30-days from the date of delivery, if delivered electronically.

Are estoppel fees tax deductible?

Unfortunately, estoppel or HOA fees cannot be added to the basis of the property, nor are they deductible expenses on a personal property.

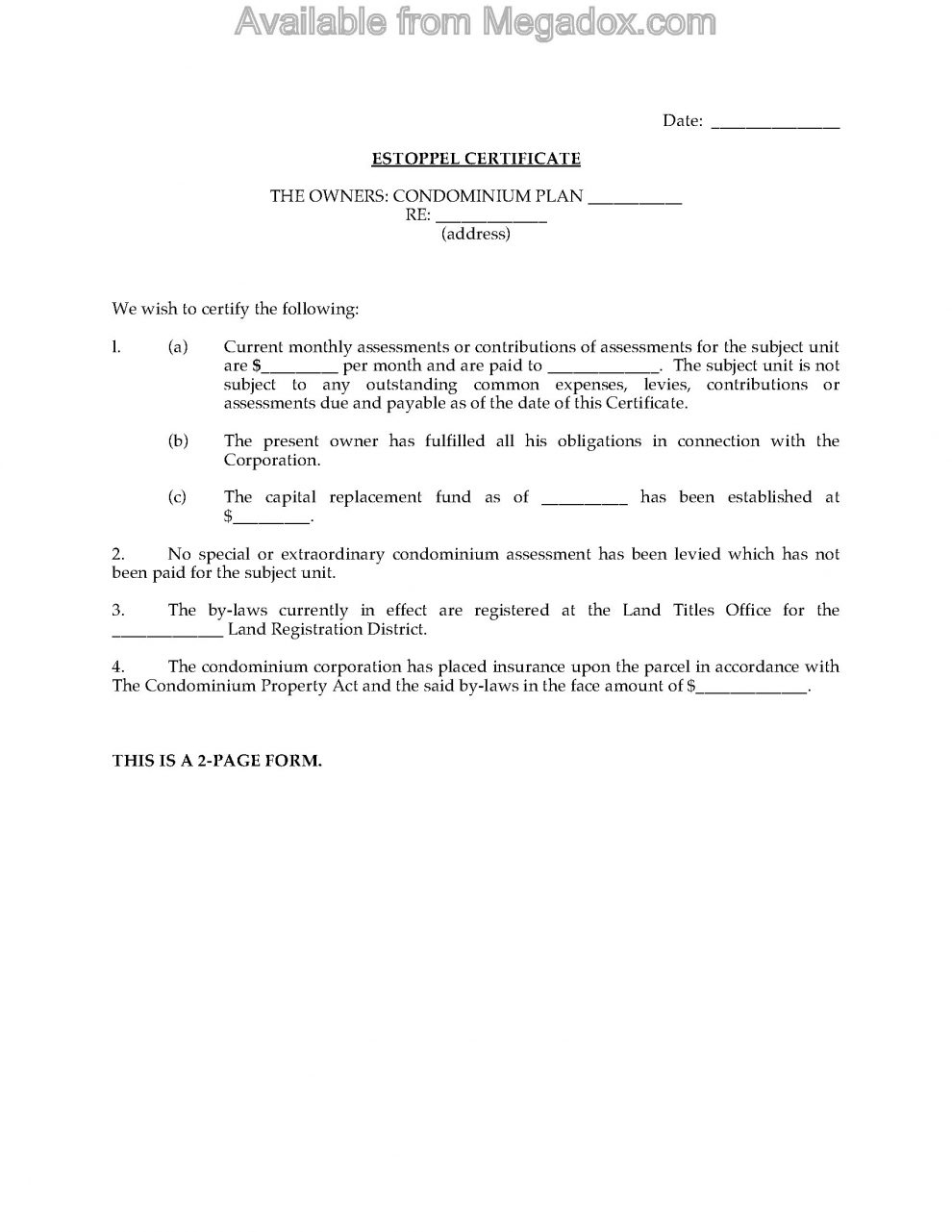

What is an estoppel certificate for a condo?

A condo status certificate, also known as an estoppel certificate, certifies that certain things are true about a condominium you intend to buy. The last thing you want to do is buy into a condo building that's on shaky legal or financial grounds.

Who pays HOA transfer fees in Florida?

In general, the seller will pay the transfer fees. However, there is no official rule that states who's responsible 100% of the time.

What does estoppel mean in simple terms?

Definition of estoppel : a legal bar to alleging or denying a fact because of one's own previous actions or words to the contrary.

What does estoppel mean in real estate terms?

What Is an Estoppel Certificate? A tenant estoppel certificate is a binding document that clarifies the current status and terms of the lease agreement between a landlord and a tenant for a prospective purchaser of property. Another name for a tenant estoppel certificate is a tenant estoppel letter.

What does estoppel mean in insurance?

Estoppel — a legal doctrine restraining a party from contradicting its own previous actions if those actions have been reasonably relied on by another party.

What are the three kinds of estoppel?

The most common types of estoppel are: Estoppel by representation. Promissory estoppel (also known as equitable forbearance) Proprietary estoppel.

What is an estoppel letter?

An estoppel letter is a legally binding document that certifies the accuracy of certain facts as of a specified date.

How long does it take to get an estoppel letter?

Those preparing estoppel letters typically have 15 days to provide it, but the exact amount of time varies from state to state.

What does a HOA certificate do?

The HOA certificate will help the lender determine whether the HOA is fiscally sound.

What happens if a property has an HOA?

If a property has an HOA, the title company must first make sure there are no outstanding balances.

Can a HOA add debt to an estoppel letter?

In addition, once an HOA estoppel letter has been issued, the HOA cannot add newly discovered debts to the estoppel letter.

Do you need an estoppel letter before buying a condo?

Before buying into an HOA or condo, you must obtain an HOA estoppel letter from the association.

Do you need more information on an estoppel letter for a buyer's mortgage?

A buyer’s mortgage lender may require more information on the HOA than what an estoppel letter provides.

What is included in an estoppel letter?

An estoppel letter should include the current homeowner’s name, property address, and financial obligations (such as monthly dues and upcoming special assessments).

Why is an estoppel letter important?

An estoppel letter can be valuable evidence in verifying the details of the legal agreement between the HOA and the buyer at the time of the sale.

How much does an estoppel letter cost?

The fee for an association or HOA management company to prepare an estoppel letter will vary widely and can cost anywhere from zero to $500. Additionally, payment is usually required up front, rather than at time of closing. By law, those preparing the estoppel letter have 15 days to provide it and may charge an additional rush fee if it’s needed before the deadline.

What does "go to" mean in HOA?

Go to... Go to... Estoppel is a legal concept meaning that someone certifies the accuracy of certain facts as of a specified date. A lender or bank requires an estoppel letter or certificate from the homeowners association prior to closing on a property within the HOA.

How to request estoppel letter from HOA?

An HOA might use a standard request form, either a paper or online form, or require a written request for the letter. Generally, you'll need to provide the the buyer’s name and the closing date of the sale or refinance. Rules often require the HOA to provide the estoppel letter within a certain period, such as not more than 10 days after receipt of a written request. Rules also prescribe the maximum amount the HOA may charge for preparing an estoppel letter. The HOAs usually require payment of the fee before an estoppel letter is provided.

How long does an estoppel letter have to be sent to a HOA?

Rules often require the HOA to provide the estoppel letter within a certain period, such as not more than 10 days after receipt of a written request. Rules also prescribe the maximum amount the HOA may charge for preparing an estoppel letter.

What is an Estoppel Letter?

The HOA estoppel letter certifies how much the current homeowner owes to the HOA in fees and other charges, as of the date specified in the letter. Financial obligations owed to an HOA can include past-due debt, monthly maintenance fees, assessments for repairs or special projects, late fees, fines and interest. The estoppel letter is legally binding. The HOA cannot add newly discovered debts to the estoppel letter after it has been submitted; what you read is what you get. The financial obligation often is included in negotiations to determine closing costs for the sale of a home.

What are the obligations of an HOA?

Financial obligations owed to an HOA can include past-due debt, monthly maintenance fees, assessments for repairs or special projects, late fees, fines and interest. The estoppel letter is legally binding.

Who is responsible for HOA debt?

Sellers and buyers of homes are “jointly and severally” responsible for the financial obligations owed to the HOA, with some exceptions provided for under state laws. For instance, Florida’s HOA statutes limit how far back an HOA may go to pass along unpaid financial obligations to a new homeowner. Your state’s statutes might address the question of financial liability for unpaid debt when an HOA takes ownership of a home because of a lien foreclosure. Your real estate attorney can determine which HOA statutes apply to your situation.

Can HOA add debts to estoppel letter?

The HOA cannot add newly discovered debts to the estoppel letter after it has been submitted; what you read is what you get. The financial obligation often is included in negotiations to determine closing costs for the sale of a home.

What is an estoppel letter from a home association?

What Is an Estoppel Letter From a Homeowners Association? An Estoppel letter from a homeowners association is a document placed into file when a home or condominium is in escrow. The document states the seller’s annual fees for the homeowners association and indicates if the seller has paid in full or has fees due at the time of sale.

What is a title search letter?

The document states the seller’s annual fees for the homeowners association and indicates if the seller has paid in full or has fees due at the time of sale. The title search company usually requests the letter on behalf of the buyer from the homeowners association board.

What is a homeowners association?

A homeowners association may have long-term plans that involve assessments. This may be for new roofing for a condominium association. A private gated community may have an assessment for improving roads, street lighting, snow removal or maintenance of other community property owned by the homeowners association. The HOA may own a community center clubhouse, parks and trail system. The buyer must be made aware of these continuing maintenance and building fees due through an established date.

Can homeowners vote against HOA assessments?

Homeowners can usually vote for or against assessments proposed by the association board . Once the assessed project is approved by the HOA board and homeowners, buyers are obligated to pay the future assessments. The costs are usually added to the monthly homeowner association fees.

Is a HOA letter binding?

The HOA board may also charge a fee for the letter which is placed with other escrow documents. The letter is legally binding and must be accurate.