An indexed annuity is a financial contract between you and an insurance company. It features characteristics of both fixed and variable annuities. Indexed annuities offer a minimum guaranteed interest rate combined with an interest rate tied to a broad stock market index, such as the S&P 500 or the Dow Jones Industrial Average.

Are variable annuities a good investment?

Variable annuities are a good example of this, as they often are a better deal for the people who sell them than the ones who buy them. ... and buying stocks or bonds in an investment account ...

What are the advantages of a variable annuity?

- They aren’t subject to contribution limits.

- The money in them grows tax deferred.

- Many states protect them from creditors.

- They are exempt from probate.

Are variable annuities bad?

What’s Bad about Variable Annuities? Variable annuities can be expensive. Depending on the insurance company and features selected, the fees and expenses can be upwards of 3%. Variable annuities are not as liquid as other investments. Most variable annuities have surrender penalties for the first four to seven years of the contract.

Does Vanguard sell annuities?

Vanguard isn't an insurance company, but it works with insurance company partners to provide annuities to its customers. For its Vanguard Variable Annuity products, Vanguard works with Transamerica...

How does a variable index annuity work?

Index variable annuities allow you to trade some potential gains from market growth in exchange for a level of protection from down markets. You defer paying taxes on your contract's gain until you receive money from the contract. Tax-deferred interest means the money in your contract can grow faster.

What is the difference between a variable annuity and an indexed annuity?

Variable annuities carry the risk of less growth and the opportunity for more, depending on the underlying investments. Because the interest rate is tied to market performance, indexed annuities expose you to more risk — and greater potential returns — than a fixed annuity.

Is an indexed variable annuity a good investment?

Indexed annuities feature a guaranteed return plus a market-based return. The result is a greater potential upside than a traditional fixed contract, with less risk than a variable annuity. But before jumping into an indexed annuity, investors should read the fine print.

What is the downside of a variable annuity?

Overall cost: A variable annuity's biggest disadvantage is its cost. Variable annuities can charge high fees. These include administrative fees, fees for special features and fund expenses for the mutual funds you invest in. And then there are the sales commissions.

Can you withdraw from an indexed annuity?

You can take your money out of an annuity at any time, but understand that when you do, you will be taking only a portion of the full annuity contract value.

How does a variable annuity work when you retire?

A variable annuity is a tax-deferred retirement vehicle that allows you to choose from a selection of investments, and then pays you a level of income in retirement that is determined by the performance of the investments you choose. Compare that to a fixed annuity, which provides a guaranteed payout.

Can you lose your principal in an indexed annuity?

With this type of annuity, your principal investment is guaranteed, and you can earn interest based on the performance of a market index. This means that you won't lose money if the market goes down, but you also have the potential to earn more than you would with a traditional fixed annuity.

What is better than a variable annuity?

A fixed annuity guarantees an investor a fixed return on their investment. Considered a lower risk product than variable annuities, fixed annuities help investors protect their capital and receive income payments from their retirement savings while avoiding the rollercoaster of the stock market.

Do you pay taxes on index annuity?

In general, gains (or earnings) which are withdrawn from fixed index or multi-year annuities are taxed as ordinary income, not as capital gains. If your annuity is invested with qualified funds, such as monies rolled over from a 401k or IRA, then the full amount withdrawn will be subject to ordinary income tax.

How much does a $50000 annuity pay per month?

approximately $219 each monthA $50,000 annuity would pay you approximately $219 each month for the rest of your life if you purchased the annuity at age 60 and began taking payments immediately.

What is the average return on a variable annuity?

8% to 10% annuallyVariable annuities usually feature many choices, but returns are often similar to popular ETFs and index funds (8% to 10% annually, on average). Your contract fees and investment expense ratios will eat into these returns, though.

What is the safest type of annuity?

Fixed AnnuitiesFixed Annuities (Lowest Risk) Fixed annuities are the least risky annuity product out there. In fact, Fixed annuities are one of the safest investment vehicles in a retirement portfolio. When you sign your contract, you're given a guaranteed rate of return, which remains the same no matter what happens in the market.

Which is better a variable or fixed annuity?

Generally speaking, fixed annuities are less risky than variable annuities. Fixed annuities offer a fixed interest rate. Market volatility or company profits don't affect the interest rate on a contract. For conservative investors who seek stability and safety, a fixed annuity might be a better investment option.

What are the benefits of an indexed annuity?

A fixed indexed annuity is a tax-deferred, long-term savings option that provides principal protection in a down market and opportunity for growth. It gives you more growth potential than a fixed annuity along with less risk and less potential return than a variable annuity.

What is the difference between fixed annuities and indexed annuities?

Where a fixed annuity offers one guaranteed rate, an indexed annuity offers investors the potential to participate in some of the upsides of the stock market. If the markets perform well, you'll make money. If the markets lose money, you'll receive a fixed rate of return or no loss of your original investment instead.

What is the purpose of a variable annuity?

A variable annuity is a contract between you and an insurance company. It serves as an investment account that may grow on a tax-deferred basis and includes certain insurance features, such as the ability to turn your account into a stream of periodic payments.

How does an indexed annuity respond to the stock market?

Indexed annuities are not securities and do not earn interest based on specific investments. Rather, indexed annuity rates fluctuate in relation to...

Can you lose money in an indexed annuity?

Indexed annuities guarantee that you won’t lose money. If the index is positive, then you are credited a certain amount of interest based on your p...

What are the advantages and disadvantages of an indexed annuity?

The advantages of indexed annuities include the potential to earn more interest and the premium protection they offer. The disadvantages include hi...

How does an indexed annuity add balance to a retirement portfolio?

A balanced retirement portfolio requires a mix of assets with varying degrees of risk. Because indexed annuities are inherently balanced — having f...

Are indexed annuities safe?

Indexed annuities are not as safe as fixed annuities, but they are safer than variable annuities. The guaranteed minimum return ensures that an ind...

What is an annuity rider?

An annuity rider is a contract provision that can be purchased with an indexed annuity to mitigate undesired outcomes and enhance specific benefits.

How Does an Indexed Annuity Work?

After you sign an indexed annuity contract, the insurance company invests your money into the market index of your choice. You can select a single index for your funds or spread your dollars across several indexes.

Why is an index annuity good?

An indexed annuity is a good fit for someone like Hallie because these annuities offer a low-risk way to generate predictable income. She’s guaranteed not to lose money, so it’s a lower risk investment than a variable annuity, which would expose her to downturns in the stock market.

What happens after you sign an annuity contract?

After you sign an indexed annuity contract, the insurance company invests your money into the market index of your choice. You can select a single index for your funds or spread your dollars across several indexes.

What percentage of the stock index gain is credited to an annuity?

This is the percentage of the gain in the stock index you will receive on your annuity. For example, if the participation rate is 80 percent and the index gained 10 percent, the annuity would be credited with 80 percent of the 10-percent gain, or 8 percent.

Which annuities offer lower fees?

Indexed an nuities also offer much lower fees than variable annuities with favorable yearly returns.

Which annuities carry more risk?

Indexed annuities carry more risk than fixed annuities, but less risk than variable annuities. Source: Financial Industry Regulatory Authority. Some annuities are variable. Interest rates on variable annuities change according to the performance of an investment portfolio.

When did index annuities take off?

Indexed annuities took off after the tech bubble burst in 2000. But when investors began to grow leery of stock-based investments, companies dropped the word “equity” from the name and began referring to them as fixed index annuities (FIAs) and just index annuities.

Which is better, an index or variable annuity?

If you’re investing for the long-term and can handle waiting out market swings, you could potentially earn more with a variable annuity. An index annuity is better if you want some market exposure without the chance of a big loss, even if it means not earning as much in good years.

Why is an index annuity called a fixed index annuity?

That’s why this product is also called a fixed index annuity—because your losses and gains fall within a fixed limit. These limits are normally set using a combination of the following: Minimum guaranteed return.

How Does an Index Annuity Work?

Like most annuities, index annuities can provide you with a steady stream of income in retirement. Before you start receiving any income, though, you must first agree to and fund a contract. Your contract will spell out how you will fund your annuity—all at once with a lump sum or with steady payments over time—and when you can begin to make withdrawals.

What happens to an annuity if the index goes up?

In other words, if your balance goes up, the annuity company could guarantee that it would not fall below that new adjusted value, even if the index loses money in the future. Return caps.

What index do annuities invest in?

The exact indexes available depend on the annuity company, but common indexes include the S&P 500, the Nasdaq 100, the Russell 2000 and the Euro Stoxx 50. You can put all your money in one index or split it across several.

How much does an index annuity yield?

Accounting for various caps and participation rates, annuity market research company Cannex estimated in 2018 that over seven years an index annuity might yield 3.26% on average annually. That said, rates of returns will greatly vary based on the stipulations of your annuity contract.

How long does an index annuity last?

Besides growing your savings, one of the appeals of an index annuity is the income it can generate for you. Index annuity payments can last over a set number of years or can be guaranteed for your entire life, depending on your contract.

What is index annuity?

An indexed annuity is a type of annuity contract that pays an interest rate based on the performance of a specified market index, such as the S&P 500.

How is the rate of an index annuity calculated?

The rate on an indexed annuity is calculated based on the year-over-year gain in the index or its average monthly gain over a 12-month period.

What is the rate cap on an annuity?

Rate caps typically range from a high of 15% to as low as 4% and are subject to change.

How do you start receiving regular income from an annuity?

As with other types of annuities, the owner can begin receiving regular income by annuitizing the contract and directing the insurer to start the payout phase .

What is the minimum rate of return for an index annuity?

In years when the stock index declines, the insurance company credits the account with a minimum rate of return. A typical minimum rate guarantee is about 2%.

What is the participation rate of an annuity?

The participation rate can be as high as 100%, meaning the account is credited with all of the gain, or as low as 25%. Most indexed annuities offer a participation rate between 80% ...

How does an insurer adjust the value of an account?

Insurers use several different methods to adjust the account's value, such as a year-over-year reset or a point-to-point reset, which incorporates two or more years' worth of returns.

What Is a Variable Annuity?

A variable annuity is a type of annuity contract, the value of which can vary based on the performance of an underlying portfolio of sub accounts. Sub accounts and mutual funds are conceptually identical, but sub accounts don't have ticker symbols that investors can easily type into a fund tracker for research purposes. Among annuities, variable annuities differ from fixed annuities, which provide a specific and guaranteed return.

What is the upside of variable annuities?

The upside was the possibility of higher returns during the accumulation phase and a larger income during the payout phase.

Why are variable annuities riskier than fixed annuities?

Variable annuities are riskier than fixed annuities because the underlying investments may lose value. If you need to withdraw money from the account because of a financial emergency, you may face surrender fees. Any withdrawals you make prior to the age of 59½ may also be subject to a 10% tax penalty. 5 .

What is the accumulation phase of an annuity?

In the case of deferred annuities, this is often referred to as the accumulation phase. The second phase is triggered when the annuity owner asks the insurer to start the flow of income, often referred to as the payout phase. Most annuities will not allow you to withdraw additional funds from the account once the payout phase has begun. 2 .

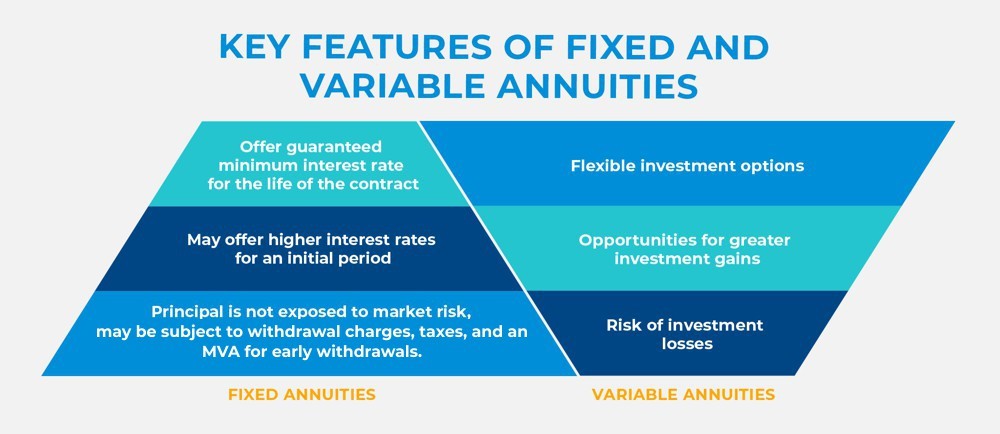

What is the difference between variable and fixed annuities?

Fixed annuities, on the other hand, provide a guaranteed return. Variable annuities offer the possibility of higher returns and greater income than fixed annuities , but there’s also a risk that the account will fall in value.

When did variable annuities start?

Variable annuities were introduced in the 1950s as an alternative to fixed annuities, which offer a guaranteed—but often low—payout during the annuitization phase. (The exception is the fixed income annuity, which has a moderate to high payout that rises as the annuitant ages).

Is an annuity complicated?

Annuities are complicated products, so that may be easier said than done. Bear in mind that between the numerous fees—such as investment management fees, mortality fees, and administrative fees—and charges for any additional riders, a variable annuity’s expenses can quickly add up.

Some Key Distinctions Between Fixed Indexed and Variable Annuities

Here’s a rundown of the primary differences between a fixed index annuity and a variable annuity:

1. Direct Market Investments

Variable annuities let you invest directly in market-based funds. However, fixed index annuities don’t involve a direct investment of any sort.

2. Growth Potential and Market Risk

Variable annuities have more growth opportunity. However, they carry more market risk than fixed indexed annuities.

3. Different Treatment by the Insurance Company

Insurance companies treat fixed index annuities differently from variable annuities.

4. Different Fee Schedules

Variable annuities tend to come with more fees than fixed indexed annuities. Like other enterprises, insurance companies are in business to make money (and also to keep their guaranteed promises to you, the contract holder).

One Key Similarity

Keep in mind, most annuities come with surrender charges and some free withdrawal limits that last for the duration of the surrender charge schedule. Fixed index annuities and variable annuities are no exception to this.

What May Be Right for You?

Be sure to weigh the pros and cons of indexed and variable annuities. It’s good to thoroughly understand your options before committing to any annuity purchase. In fact, this is a good rule of thumb for all decisions to commit to any financial strategy or instrument.

What is fixed annuity?

Fixed annuities are financial products that offer guaranteed rates of return for a set period of time after an investor funds an investment account with a lump-sum payment or regular premium payments.

What is the participation rate of an annuity?

The participation rate is the portion of the account that is geared towards the performance of the underlying stocks.

What is an independent insurance agent?

An independent insurance agent can help you find the right financial product that aligns with your long-term investment strategy, weighing the fixed vs. variable annuity pros and cons in an easy-to-understand manner.

What is the advantage of fixed annuities?

The advantage of fixed annuities is that they offer a guaranteed rate of return which makes them a great choice for conservative investors who want to minimize their risk . However, the trade-off is that if the underlying investments of the insurer perform well, the investor doesn’t get to see their money accordingly.

Do variable annuities have guaranteed returns?

Variable annuities, on the other hand, offer a higher growth potential if underlying investments perform well. Most variable annuities don’t have guaranteed rates of return, although some protection can be in place to protect the principal investment.

Do variable annuities have a cap?

And on a side note, many insurers cap the maximum return rates for variable annuities. So, it’s important to fully understand the reality of how variable annuities work.

What is an index annuity?

An indexed annuity is a hybrid annuity type. In other words, they take features from both fixed and variable annuities, with some extra added protections.

How does an index annuity work?

An indexed annuity works like a variable annuity in that you choose investments that track one of several market indices. A market index is a grouping of companies designed to show the overall performance of the market or a segment of it. Some of the more well-known indices are the S&P 500 and the Dow Jones Industrial Average. There are also indices that track specific segments of the market such as tech, healthcare or energy.

How to get help with annuities?

For help with indexed annuities or any other retirement questions, consider working with a financial advisor. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Do index annuities have commissions?

Indexed annuities also often have high sales commissions. This is something to consider when purchasing any product. Fees can sometimes be murkyin the financial planning industry, so make sure you do your homework and know exactly what you are paying and what you’re getting for it before you commit to a indexed annuity or any other product.

Is index annuity better than variable annuity?

Indexed annuities also have some pros over other annuities. For instance, you might be interested in a variable annuity because you have the potential for greater growth than the set income provided from a fixed annuity. With an indexed annuity, you still get that, but with a layer of security provided by the index. Indexed annuities follow the market, so there is a better chance of seeing steady gains than in variable annuities where investments are chosen by a manager, which has greater potential for failure.

Is an annuity good for retirement?

There are many pros to using an indexed annuity as part of our retirement plan. First, there are the pros that come with any annuity– you get a consistent stream of income in your later years, which is helpful for retirement planning. In fact, a recent study shows that using annuitized products often helps retirees feel more comfortable spending their money, as the psychological benefit of seeing money come into your account each month makes spending seem more permissible.

Do indexed annuities intersect with fixed annuities?

But where indexed annuities intersect with fixed annuities are when you consider alternate return potential within them. Most annuity providers provide a “fixed account” alongside the indices that you can also put your money in. These accounts work just like fixed annuities, as they have fixed rates and minimums.

What Is A Variable Annuity?

- An indexed annuity is a type of annuity contract that pays an interest rate based on the performa…

An indexed annuity pays a rate of interest based on a particular market index, such as the S&P 500. - Indexed annuities give buyers an opportunity to benefit when the financial markets perform well…

However, certain provisions in these contracts can limit the potential upside to only a portion of the market's rise.

Understanding Variable Annuities

Variable Annuities vs. Fixed Annuities

Variable Annuity Advantages and Disadvantages

- There are two elements that contribute to the value of a variable annuity: the principal, which is the amount of money you pay into the annuity, and the returns that your annuity’s underlying investments deliver on that principal over the course of time.1 The most popular type of variable annuity is a deferred annuity. Often used for retirement planning purposes, it is meant to provid…

The Bottom Line

- Variable annuities were introduced in the 1950s as an alternative to fixed annuities, which offer a guaranteed—but often low—payout during the annuitization phase. (The exception is the fixed income annuity, which has a moderate to high payout that rises as the annuitant ages). Variable annuities gave buyers a chance to benefit from rising markets by investing in a menu of mutual f…