There are three types of intercompany eliminations:

- Intercompany debt: eliminates loans made between subsidiaries

- Intercompany revenue and expenses: eliminates sales between subsidiaries

- Intercompany stock ownership: eliminates ownership interest of the parent company in its subsidiaries.

What are inter company eliminations?

Intercompany eliminations. Intercompany eliminations are used to remove from the financial statements of a group of companies any transactions involving dealings between the companies in the group.

What is intercompany elimination in consolidated financial statement?

In the process of preparing Consolidated Financial Statement, intercompany elimination is one among the steps. Intercompany Elimination refers to excluding of / removing of transactions between the companies of same consolidation group from the Consolidated Financial Statements.

What are intercompany eliminations (ice)?

Intercompany eliminations (ICE) are made to remove the profit/loss arising from intercompany transactions. No intercompany receivables, payables, investments, capital, revenue, cost of sales, or profits and losses are recognised in consolidated financial statements until they are realised through a transaction with an unrelated party.

What is an elimination entry in accounting?

Generally, elimination entries are made for removing the effects of intercompany transactions. There are, basically, three types of intercompany eliminations as follows: Elimination of intercompany stock ownership.

Which intercompany transactions should be eliminated?

Intercompany revenue and expenses: The intercompany elimination of the sale of goods or services from one entity to another within the enterprise or group. The related revenues, cost of goods sold, and profits must all be eliminated.

Why do you eliminate intercompany transactions?

The reason for these eliminations is that a company cannot recognize revenue from sales to itself; all sales must be to external entities. These issues most commonly arise when a company is vertically integrated.

What is the purpose of elimination entries?

Elimination entries are used to simplify the consolidated financial statements of affiliated companies. When two or more companies are affiliated, elimination entries are used to avoid redundancy in ownership, inter-company debt, inter-company revenue and inter-company expenses.

What are examples of intercompany transactions?

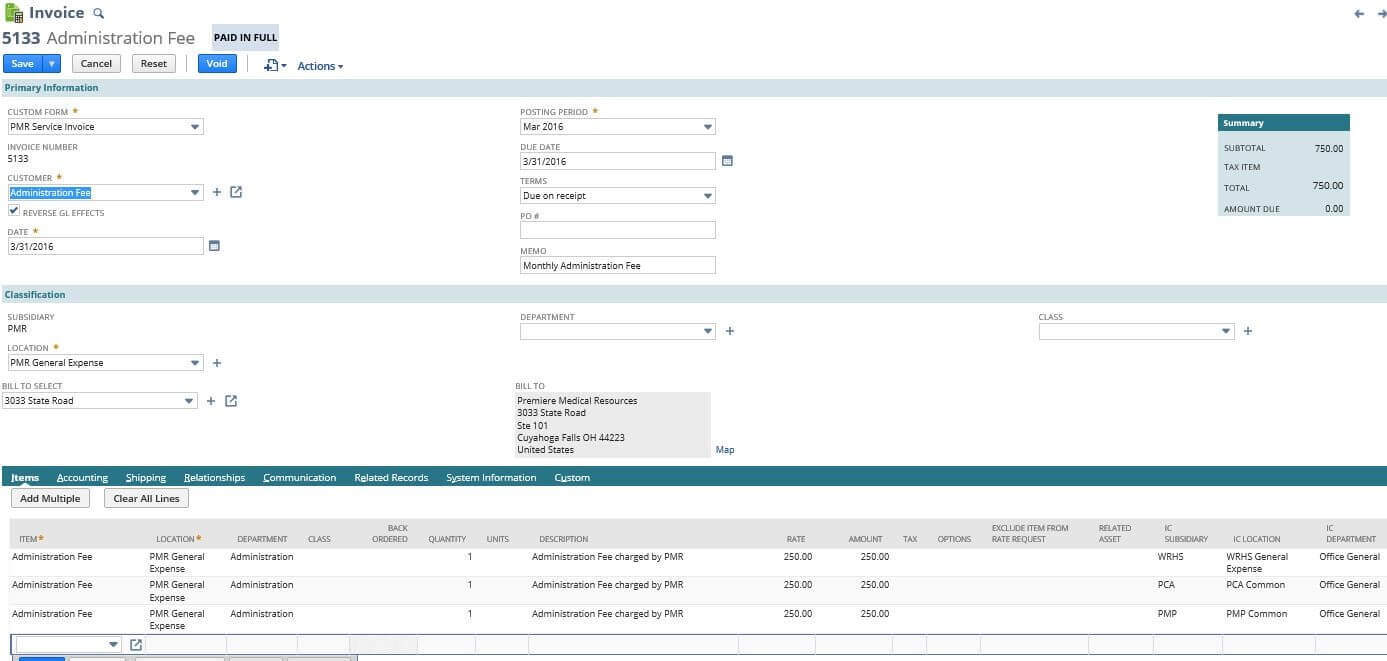

What Are Some Examples of Intercompany Journal Entries?Sales and purchases of services and goods between a parent company and its subsidiaries.Fee sharing.Cost allocations.Royalties.Financing activities, such as loans.Centralized cash management functions.Dividends between subsidiaries and parent company.More items...

How do you handle intercompany transactions?

How to Overcome Intercompany Transaction Challenges?Standardise Global Policies. It's best to set global policies and clearly communicate them to each entity's management and leadership. ... Establish Experts. ... Set up a Master Data Management Program. ... Use Third Party Software. ... Define a Cash Management Strategy.

What is the purpose of intercompany transactions?

Why are Inter-Company Transactions important for business today? An inter-company transactions list enables your company to: Track, record and reconcile the transactions between your company and group entities. Understand and assess the types of transactions within your group company and parties involved.

When should intercompany transactions be removed?

An investor should eliminate its intercompany profits or losses related to transactions with an investee until profits or losses are realized through transactions with third parties. For example, assume an investor holds a 25% interest in an investee entity and sells inventory at arm's length to that investee.

What are the four 4 common intercompany transactions that are eliminated when preparing consolidated financial statements?

In the consolidated balance sheet, eliminate intercompany payable and receivable, purchase, cost of sales, and profit/loss arising from transaction.

What journal entries can be eliminated?

Elimination entries are journal entries that eliminate duplicate revenue, expenses, receivables, and payables. These duplications occur as the result of intercompany work where the sending and receiving companies both recognize the same effort.

What is intercompany on a balance sheet?

Companies that have transactions with other companies in the same group, report intercompany balances. The intercompany balances are reported on specific accounts, which are reconciled with each other according to one or more predefined control tables.

What does intercompany mean in accounting?

Intercompany accounting is defined as all financial and commercial transactions carried out and recorded between separate legal entities or subsidiaries that belong to a single parent company, as well as the “elimination” of these flows at the closing of the financial year.

What type of account is intercompany transfer?

Intercompany accounts are general ledger accounts used to record transactions, such as intercompany payments, loans, and funds transfers between subsidiaries. These accounts track the intercompany amounts to be eliminated.

When should intercompany transactions be removed?

An investor should eliminate its intercompany profits or losses related to transactions with an investee until profits or losses are realized through transactions with third parties. For example, assume an investor holds a 25% interest in an investee entity and sells inventory at arm's length to that investee.

Why must the eliminating entries be entered in the consolidation worksheet each time consolidated statements are prepared?

Eliminating entries are used in the consolidation workpaper to adjust the totals of the individual account balances of the separate consolidating companies to reflect the amounts that would appear if all the legally separate companies were actually a single company.

What should be eliminated in consolidation?

In a consolidation model, intercompany eliminations are used to remove from the consolidated financial statements any transactions involving dealings between the entities being consolidated. Common examples of intercompany eliminations include intercompany revenue and expenses, loans, and stock ownership.

Why are intercompany transactions between a parent and its subsidiary eliminated in preparing a consolidated financial statement?

The accounting staff eliminates these transactions because they represent the transfer of assets from one associated entity to another. The reason is clear: A company can't recognize revenue from the sale of items to itself.

Why is intercompany elimination important?

The process of intercompany elimination is helpful in managing eliminations of operations among companies within a single group. Besides, intercompany eliminations encourage and establish controls in multifaceted corporate environments .

What is intercompany accounting?

Intercompany accounting is a crucial process for any company that has at least one subsidiary. It involves removing from the financial books any transactions that occurred between the company’s entities. This intercompany reconciliation greatly reduces the chance of inaccuracies in the company’s financial statements.

Why do you need to adjust intercompany transactions?

Intercompany transactions must be adjusted correctly in consolidated financial statements in order to show their impact on the consolidated entity instead of its impact on the parent or subsidiaries solely. Understanding how intercompany transactions are recorded in each concerning entity’s journal entries and the impact of the transaction on each entity is necessary to determine how to adjust intercompany transactions in the consolidated financial statement.

What is IC reconciliation?

IC reconciliation is when two branches of a parent company reconcile figures as a result of engaging in a transaction. One child company is the seller to the other child company is the purchaser. Thus, in order to ensure that the correct figures appear on financial statements, the figures need to be reconciled.

When a parent company either directly or indirectly controls a majority interest of a subsidiary, must a consolidated?

When a parent company either directly or indirectly controls a majority interest of a subsidiary, consolidated financial statements must be presented. Consolidated financial statements present the results of operations, statement of cash flows, and financial position of the combined entity.

Is it a nightmare to invest in subsidiary companies?

Simply stated, the joys of creating subsidiary companies and/or investing in related entities may become nightmares unless strategic planning is made to solve the complexities of such relationships.

Can you track financials and create reports for an unlimited number of related companies within your organization?

You can track financials and create reports for an unlimited number of related companies within your organization. Related companies can share charts of accounts, calendars, and currencies, as well as non-financial data. Intercompany accounting is a crucial process for any company that has at least one subsidiary.

What are intercompany eliminations?

Intercompany elimination is the process that a parent company goes through in order to remove transactions between subsidiary companies in a group. Parent companies complete intercompany eliminations when they’re preparing consolidated financial statements.

What is intercompany stock ownership?

Intercompany stock ownership: eliminates ownership interest of the parent company in its subsidiaries.

What is intercompany elimination?

Intercompany elimination refers to the process for removal of transactions between companies included in a group in the preparation of consolidated accounts. The process of intercompany elimination is helpful in managing eliminations of operations among companies within a single group. Besides, intercompany eliminations encourage and establish controls in multifaceted corporate environments. However, the process involves a lot of reporting and paperwork for intercompany relationships can be quite complicated.

What is the elimination of intercompany revenue and expenses?

These intercompany revenues and expenses are eliminated as they are merely transfers of assets from one associated company to another. Moreover, it also does not have any effect on consolidated net assets. Some good examples of intercompany revenue and sales elimination can be indicated by sales to associated companies, interest expense or revenue on loans to or from associated companies, cost of goods sold as an outcome of sales to associated companies, and similar more.

What is elimination entry?

Generally, elimination entries are made for removing the effects of intercompany transactions. There are, basically, three types of intercompany eliminations as follows: This type of intercompany elimination transaction eliminates the assets as well as the stockholders’ equity accounts for the ownership of subsidiaries by the parent company.

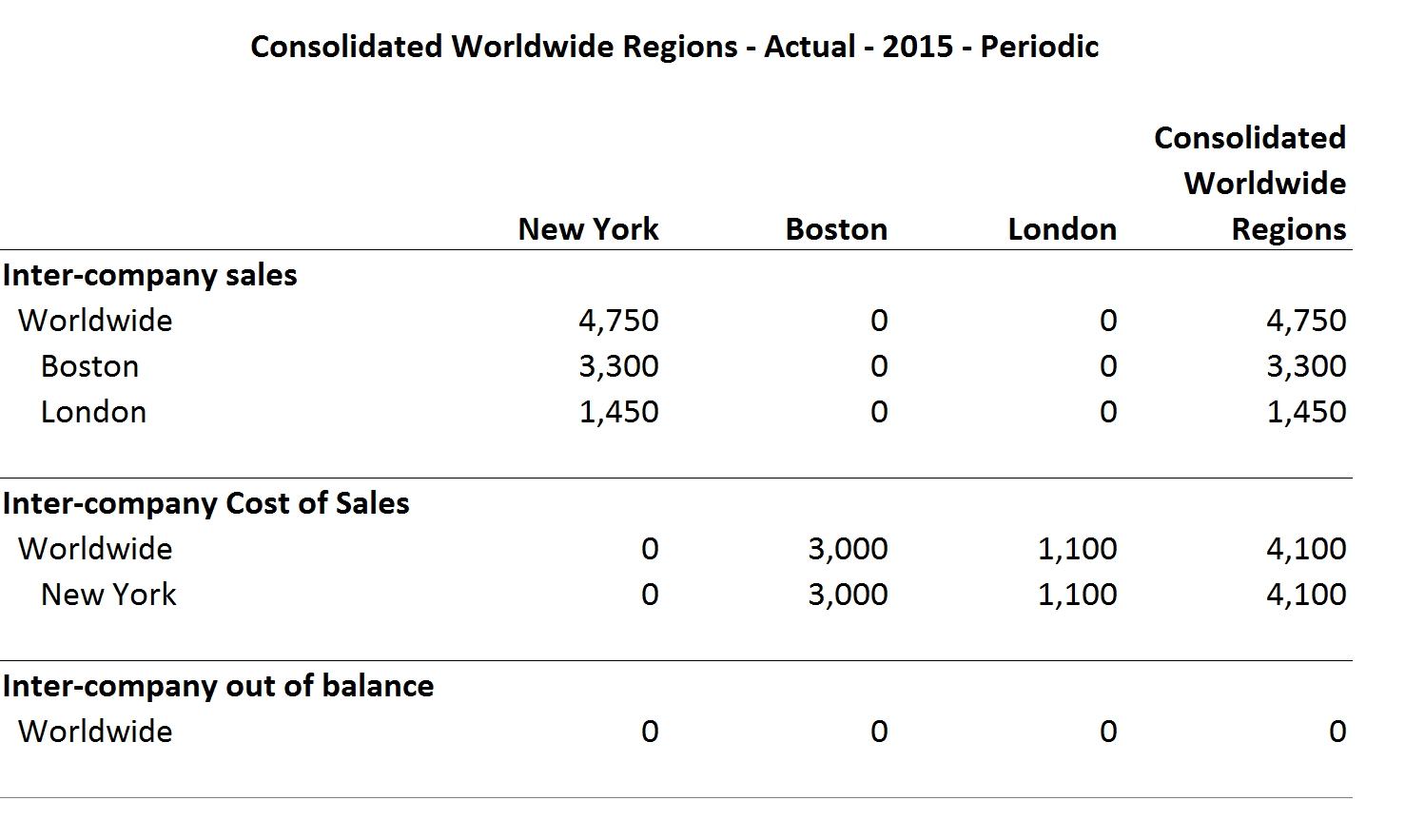

What is the net effect of eliminations?

The net effect of the eliminations must be zero (that is, debits must equal credits), but the data is reclassified in order to net out at the parent entity. If the source data from both entities involved in the transaction is proportionalized at 100%, then the full proportionalized amount must be eliminated.

How many times are intercompany transactions recorded?

The intercompany transaction amounts are initially recorded twice. Each of the two parties (companies) involved in the transaction records their view of the transaction. The transaction is recorded separately by each entity, with the other entity as the "Intercompany partner".

What is eliminated amount?

The amounts to be eliminated are the amounts controlled "in common" by the parent entity at which common ownership is represented in the organization hierarchy . The net effect of the eliminations must be zero (that is, debits must equal credits), but the data is reclassified in order to net out at the parent entity. If the source data from both entities involved in the transaction is proportionalized at 100%, then the full proportionalized amount must be eliminated. If the amount proportionalized by either entity is less than 100%, then only the lowest proportional amount is eliminated because only the lowest proportionalized amount is controlled in common. Therefore an eliminated amount cannot exceed the proportionalized amount under any circumstances. If the Consolidation % for either of the companies involved is 0% then no elimination is processed.

What is lower of entity or partner consolidation?

c. The "lower of entity or partner consolidation %" is applied to the sum of the entity cumulative %, aggregated across all siblings of the entity and the sum of the partner cumulative %, aggregated across all siblings of the entity. In a multi-level hierarchy, both the entity and the partner could exist in more than one branch of the hierarchy and could therefore aggregate to the common ancestor through multiple children of the common ancestor.

Why do you eliminate data that is a result of transactions between two entities?

Data that are a result of transactions between two entities (that is, Intercompany transactions), both being consolidated into a common parent entity, must be eliminated in order to present the parent entity consolidated results as a single economic unit.

What is a sibling entity in a multi level structure?

In a multi-level structure, the sibling entities of each Holding company are those companies directly owned by the Holding company. If those directly owned companies themselves own other companies, then the sibling of the owning Holding company is the consolidated parent of the owned Holding company.

What determines the manner in which information from the in-scope companies is aggregated and eliminated to produce the consolidated?

The nature of the relationship between the related parties will determine the manner in which information from the in-scope companies is aggregated and eliminated to produce the consolidated results. Different accounting standards will require some different aggregation methods, but most standards follow similar general principles.

Intercompany Eliminations Definition

Intercompany elimination is a method used by the parent company to prepare a consolidated financial statement. It is used to remove the effect of not materialized transactions of the company as a whole.

Overview of Intercompany Eliminations

During the reporting of consolidated financial statements of group-entities are considered a single unit, intercompany transactions are needed to eliminate for the correct presentation of consolidated financial statements of the company as a whole.

What is intercompany elimination?

Intercompany Elimination refers to excluding of / removing of transactions between the companies of same consolidation group from the Consolidated Financial Statements. The reason for doing so is to reflect the financials that would appear as if all the legally separate companies were a single company.

How to achieve intercompany elimination in SAP?

In SAP Group Reporting, Intercompany Elimination is achieved by the reclassification function with following Reclassification Tasks in Consolidation Monitor;

What is elimination entry?

The elimination entry removes IC assets/liabilities from the Cons. Unit/Partner Cons. Unit and transfers the same to a clearing account. Effectively, removing IC Assets and IC Liabilities from the consolidated Financial statement. The clearing account will get nullified with a debit and credit (there will be balance if IC entries are not complete or incorrect).

Is investing elimination part of this blog?

Investments/Equity Elimination is not part of this blog as it is a topic by itself.

What is intercompany elimination?

Intercompany elimination is the process of elimination of / removal of certain transactions between the companies included in the group in the preparation of consolidation financial statements, which include Consolidated Statement of Profit and Loss, Consolidated Balance Sheet and Consolidated Cash Flow Statement, along with relevant notes.

Why is intercompany transaction elimination important?

Being an integral and important step in the consolidation procedure, intercompany transactions eliminations holds importance to both, the Company’s management as well as the Auditors. The Company’s management can benefit from better presentation of individual unit’s performance and can also generate consolidated results after following systematic and controlled accounting procedures and practices. Though identifying intercompany transactions identification may involve difficulty, it can be identified at the source, by implementing robust control system, thus enabling elimination of such transactions smoothly and completely.

Why is it important to clean up consolidated accounts?

It is highly essential in such case to clean up the consolidated accounts to comply with the applicable GAAP and also to honor the substance over form, where one can’t make profits from his own transactions.

What is lateral transaction?

Imagining Parent company at the top, entering into transaction with a subsidiary company will be termed as downstream transaction. Reverse of the same, a transaction initiated from a subsidiary to the parent company will be termed as upstream transaction. While a transaction between two subsidiaries of a parent company will be seen as lateral transaction.

Why is intercompany auditing important?

Since the intercompany transactions, being related parties transactions, involve the possibility that a related party relationship may be a tool for fraud by management, the generally accepted auditing practices provides immense importance to validating the accuracy and fairness of such intra-group transactions. These transactions might also be more of disclosure-oriented than fraud-oriented. However, given the risks involved for an auditor, such intra-group transactions cannot be assumed to be outside the ordinary course of business.

What is elimination of equity ownership in subsidiary companies?

Elimination of Equity Ownership in the subsidiary companies –. Stockholder’s equity account in the subsidiary company is eliminated against the investment in equity shares account of the parent company and assets and liabilities are added line-by-line in the consolidated trial balance. 2.

What is combined in GAAP?

To Combine – The reporting organization gathers the trial balances of all of its units and combines the like items such as assets, liabilities, revenue, expenditure accounts and a consolidated trial balance before adjustments is prepared in the functional currency of the reporting enterprise as per the applicable GAAP.

What is intercompany elimination?

Intercompany eliminations are a key step in the creation of consolidated financial statements. The objective is to ensure the consolidated financial statements present an accurate picture of revenues, expenses, assets, liabilities, and equity – ensuring they aren’t inflated due to transactions occurring between subsidiaries or companies in the group.

What is intercompany debt?

Intercompany debt: The intercompany elimination of any loans made from one entity to another within the enterprise or group since they only result in offsetting notes payable and receivable, and offsetting interest expense and interest income.

What is intercompany revenue and expenses?

Intercompany revenue and expenses: The intercompany elimination of the sale of goods or services from one entity to another within the enterprise or group. The related revenues, cost of goods sold, and profits must all be eliminated.

What is IC dimension?

The IC dimension represents the IC Partners, which as an originating entity can post an entry against (for Intercompany flagged accounts). This is a reserved dimension that’s used by OneStream to track and eliminate intercompany details across the Account dimension and related User Defined dimensions.

What is the power of IC system reports?

The power of these IC system reports is that they ignore security for the intercompany accounts. This feature is helpful in getting users to take ownership of the intercompany matching process, by allowing each intercompany trading partner to see matching balances across entities, and in multiple currencies.

What are some examples of features that simplify the process out of the box?

Some features simplify the process out of the box – for example, the ability to limit the intercompany partner so that they must either enter a partner or not choose themselves.

Does OneStream offset IC?

For each eliminating IC transaction, OneStream will create both sides of the entry that offsets the data value from the IC account and IC partner. That offsetting amount is written to the plug account. If the entries do in fact match, then the debit and credit for each side of the intercompany match would net to zero.