Which bank is best for IRA account?

Overview: Top IRA accounts in April 2022

- Charles Schwab. Charles Schwab does all the core brokerage functions well, and its long-time reputation for investor-friendliness precedes it.

- Wealthfront. ...

- Fidelity Investments. ...

- Vanguard. ...

- Betterment. ...

- Interactive Brokers. ...

- Schwab Intelligent Portfolios. ...

- Merrill Edge. ...

- Fundrise. ...

- E-Trade. ...

Is Merrill Lynch an investment bank?

While today it is focused on its wealth management business, Merrill Lynch & Co. is recognized for its investment banking activities. In June 1971, Merrill Lynch & Co. completed its initial public...

Did Merrill Lynch merge with Bank of America?

“On September 15, 2008, Merrill Lynch & Co., Inc. and Bank of America Corporation announced a strategic business combination in which a subsidiary of Bank of America will merge with and into Merrill Lynch.

How do I contact Merrill Lynch 401k?

How do I contact Merrill Lynch 401k? If you do not receive your User ID, or have any questions, please call the Merrill Lynch Retirement and Benefits Contact Center at 1-866-820-1492 (U.S., Puerto Rico and Canada) or 609-818-8894 (Outside of the U.S., Puerto Rico and Canada).

See more

What is a IRRA investment account?

An individual retirement account (IRA) allows you to save money for retirement in a tax-advantaged way. An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis.

Is an IRRA a Roth?

With a Roth IRA, you contribute after-tax dollars, your money grows tax-free, and you can generally make tax- and penalty-free withdrawals after age 59½. With a Traditional IRA, you contribute pre- or after-tax dollars, your money grows tax-deferred, and withdrawals are taxed as current income after age 59½.

What kind of accounts does Merrill Lynch offer?

Investing & savingsOnline brokerage account: for individual or joint investing or as a custodial account.Bank accounts: for your emergency fund and general savings.

What is a Merrill Lynch RCMA account?

Management Account (RCMA Account) The Retirement Cash Management Account® (RCMA) is an investment-only brokerage account that helps plan sponsors manage and invest retirement plan assets. Only U.S. residents and businesses can apply for a Merrill Edge Self-Directed investing account.

Is pre tax or Roth better?

Pretax contributions may be right for you if: You'd rather save for retirement with a smaller hit to your take-home pay. You pay less in taxes now when you make pretax contributions, while Roth contributions lower your paycheck even more after taxes are paid.

How much will an IRA grow in 10 years?

The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's 500® (S&P 500®) for the 10 years ending December 31st 2016, had an annual compounded rate of return of 6.6%, including reinvestment of dividends.

Are Merrill Lynch fees high?

Commissions range from 0.70% – 15.00% of the principal value of the contracts, plus $3.00 – $9.00 per contract. You also pay an additional transaction fee ranging from $0.15 to up to $1,003 per transaction, determined based on the principal value and number of contracts purchased or sold.

What's the difference between Merrill Edge and Merrill Lynch?

The primary difference is that Merrill Lynch is a conventional brokerage firm that is catered to affluent clients while Merrill Edge is a low-cost discount broker targeted to more retail traders. Moreover, Merrill Lynch can be used by international clients and Merrill Edge is primarily for U.S. clients.

Can I withdraw money from my Merrill Edge account?

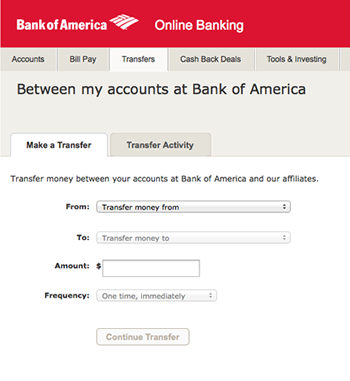

To withdraw money from Merrill Edge, you need to go through the following steps: Log in to your account. Select 'Withdrawal' or 'Withdraw funds' from the appropriate menu. Select the withdrawal method and/or the account to withdraw to (if more than one option is available)

Do you pay taxes on a CMA account?

In general, assets held in a Merrill Cash Management Account ® (CMA account) are taxable, meaning that any interest, dividends or capital gains and/or losses must be declared on the account holder's taxes each year.

How many Merrill Edge accounts can I have?

Joint Brokerage A joint account allows up to four account owners and has all the same benefits of an individual account. If you choose to have Merrill manage the account for you, all owners can receive updates.

What is the difference between a brokerage and cash management account?

Money in a CMA can usually be used to pay bills and make purchases, sometimes with use of a debit card or check writing; money in a brokerage account is strictly for buying, trading and selling stocks, bonds, funds and other securities.

Does a self-directed IRA LLC file a tax return?

Most self-directed IRAs don't need to file a 990-T for their IRA, but you may be required to file for your IRA if your IRA obtained a non-recourse loan to buy a property (UDFI tax), or if your IRA participates in non-passive real estate investments such as: Construction, development, or on-going short-term flips.

Do I need to file a tax return if I contribute to a Roth IRA?

Contributions to a Roth IRA aren't deductible (and you don't report the contributions on your tax return), but qualified distributions or distributions that are a return of contributions aren't subject to tax. To be a Roth IRA, the account or annuity must be designated as a Roth IRA when it's set up.

What type of entity is a self-directed IRA?

A Self-Directed IRA LLC (SDIRA) is a type of individual retirement account that allows retirement investors to use their IRA funds to make alternative asset investments. Self-Directed IRAs are similar to traditional IRAs, but they provide more investment options to IRA holders.

Why did I get a k1 for my IRA?

Federal tax law requires that a Schedule K-1 be sent to every unitholder (individual or business). If your IRA held units of the entity, you will receive a K-1. You will report this information on your return when you take distributions from the IRA.

What can you withdraw from an IRA?

Investors can withdraw funds, called taking a distribution, from their IRA at any time. Distributions from an IRA are considered taxable income. If...

How much can I contribute to my IRA?

IRA contribution limits are set by the IRS and change from time to time. In 2022, the total contributions an investor can make to both traditional...

Can you borrow from an IRA?

In general, you cannot borrow money from an IRA. If an investor wants to access funds in an IRA, a withdrawal may be possible without incurring an...

How are IRAs taxed?

Assets in an IRA are considered tax-advantaged. Funds in an IRA are not subject to taxes while they are held or invested in the account. This means...

Can I roll my 401(k) into an IRA?

Yes. If you have assets in a 401(k) with an employer that you no longer work for, you can roll over these assets. You can also leave the assets in...

What are the advantages of a Roth IRA?

Contributions are subject to regular federal and state income taxes. Earnings are tax-free if withdrawn after age 59 1/2 and your account has been...

Am I eligible for a Roth IRA?

Anyone can open and contribute to a Roth IRA as long as your modified adjusted gross income (your AGI after deductions) does not exceed $144,000 ($...

What are the contribution limits?

If you are under age 50, in 2021 and 2022, you may be able to contribute up to $6,000. Beginning when you become 50 or older, you can make an addit...

What investment choices will I have?

At Merrill, you'll have access to a full range of investment choices. Select from a wide array of stocks, bonds, options, ETFs, well-known mutual f...

Are there any fees associated with a Roth IRA?

Your Merrill Edge Self-Directed Roth IRA has unlimited $0 online stock, ETF and option trades with no trade or balance minimums. Options contract a...

How do I open an IRA?

It takes just minutes to open your account online. Then, you can quickly fund your new Merrill account and start investing with help from a variety...

How can I convert to a Roth IRA?

To convert to a Roth IRA, call us at 888.637.3343 for assistance, and we'll guide you every step of the way. We can help you convert any of these t...

What is an IRA?

An Individual Retirement Account (IRA) is a tax-advantaged account that can help you potentially build wealth for retirement more quickly when compared to a taxable account. There are two common types of IRAs — traditional and Roth.

Is a traditional IRA tax advantaged?

Traditional or Roth IRA? If you’re looking for an opportunity to save for retirement in a tax-advantaged way beyond a 401 (k) plan or other tax-advantaged account, you may benefit from a traditional or Roth IRA.

Is a Roth IRA contribution tax deductible?

With a Roth IRA, contributions are made with after-tax dollars and are not tax-deductible. 2 Distributions from Roth IRAs are free of federal taxes and may be state tax-free as well. 3. Ultimately, your choice depends on things such as your age, current income, distribution goals and tax objectives.

How to contact Merrill Roth IRA?

Call us 24/7 at 888.637.3343. 888.637.3343. Jump down to Features. Jump down to Pricing and fees.

What is the CIO of Merrill?

8 The Chief Investment Office (CIO) develops the investment strategies for Merrill Guided Investing and Merrill Guided Investing with Advisor, including providing its recommendations of ETFs, mutual funds and related asset allocations. Managed Account Advisors LLC (MAA), Merrill's affiliate, is the overlay portfolio manager responsible for implementing the Merrill Guided Investing strategies for client accounts, including facilitating the purchase & sale of ETFs and mutual funds in client accounts and updating account asset allocations when the CIO's recommendations change while also implementing any applicable individual client or firm restriction (s).

How much can I contribute to a Roth IRA?

Anyone can open and contribute to a Roth IRA as long as your modified adjusted gross income (your AGI after deductions) does not exceed $140,000 ( $139,000 in 2020) for single filers and $208,000 ( $206,000 in 2020) for joint filers and your earned income is equal to or greater than your IRA contribution amount for the year.

How much is the transaction fee for ETFs?

3 Other fees may apply. Sales of ETFs are subject to a transaction fee of between $0.01 and $0.03 per $1,000 of principal. There are costs associated with owning ETFs and mutual funds. To learn more about pricing, visit our Pricing page .

How long is a state tax free account open?

Earnings are tax-free if withdrawn after age 59½ and your account has been open for at least five years. This is true for both federal and in most cases state income taxes. Footnote 10

When is the holding period for Roth IRA?

This period begins January 1 of the year of the first contribution to any Roth IRA account.

Can I contribute to a Roth IRA if I have no income?

If you have no earned income but your spouse earns enough income to cover your contribution as well as their own, and their income (AGI) does not exceed the limits above, you can contribute to a Roth IRA account. There's no limit to the number of individual retirement accounts (IRAs) you can own.