Key Takeaways

- An operating lease is a contract that permits the use of an asset without transferring the ownership rights of said asset.

- GAAP rules govern accounting for operating leases.

- A new FASB rule, effective Dec. 15, 2018, requires that all leases 12 months and longer must be recognized on the balance sheet.

What is the difference between an operating and finance lease?

• Major difference between a finance lease and operating lease lies in the ownership of the asset. Whereas risk and rewards are with the lessee in case of finance lease, they lie with the lessor in case of an operating lease. • Another difference is the manner in which the lease gets reported in financial statements.

What is an example of an operating lease?

operating leases and service contracts that may have contained leases were expensed in ... For example, a company enters into a contract to advertise on a billboard. ... lease: real-world examples Railcars: A company enters into an arrangement to transport goods using a fleet of railcars. The transportation

What do you need to know about accounting for leases?

- The lease transfers ownership of the underlying asset to the lessee by the end of the lease term.

- The lease grants the lessee an option (that the lessee is reasonably certain to exercise) to purchase the underlying asset.

- The lease term is for the major part of the remaining economic life of the underlying asset. ...

Are operating leases off balance sheet?

The effect of operating lease on the balance sheet is given below: Effect on the income statement: Lease payments will be expensed in the P/L statement. Lease payments are deducted from cash flow from operations. Operating leases do not affect the lessee’s liabilities and hence, are off-balance-sheet items

Is an operating lease an asset?

Operating leases are shown as an asset on the balance sheet, valued as the present value of the lease payments (not the market value of the asset) The lease liability is shown on the balance sheet (similarly, the present value of the lease payments)

What is operating lease example?

An operating lease is a type of lease that allows one party, called as lessee; to use the asset owned by another, the party called as lessor, in return for the rental payments for a particular period that is less than the assets economic rights and without transferring any rights in ownership at the end of the lease ...

Is operating lease considered a fixed asset?

The lessor records the asset under an operating lease as a fixed asset on its books, and depreciates the asset over its useful life.

What makes an operating lease?

Operating leases are defined as a contract that permits the use of a certain asset without transferring the ownership right of that asset for any less than a major part of the asset's life. That is, unless the lessee pays the lessor virtually all of the asset's fair value.

How do you record an operating lease?

Begin with the reported operating income (EBIT). Then, add the current year's operating lease expense and subtract the depreciation on the leased asset to arrive at adjusted operating income. Finally, to adjust debt, take the reported value of debt (book value of debt) and add the debt value of the leases.

How do you calculate operating lease?

How to Calculate an Operating LeaseAgree on inception and termination dates with the lessor.Discuss the regular payment amount with the lessor. ... Choose the duration of the lease. ... Use the calculator to find the total amount of the lease by multiplyng the monthly lease payments by the term of the lease in months.More items...•

Where do operating leases go on the balance sheet?

Operating leases have been treated as off balance sheet transactions; which means, they were not recorded on the balance sheet. However the payment obligation of the lease contract is a liability to your organization and isn't shown as something you owe on your balance sheet.

Can you depreciate an operating lease?

The depreciation expense of an operating lease is calculated as the difference between the monthly straight-line lease expense and the monthly interest expense on the lease liability, in accordance with Accounting Standards Codification Topic 842 (ASC 842), which is the standard in Generally Accepted Accounting ...

What are the disadvantages of operating leases?

Disadvantages of operating leasesCommitted to payment and equipment for length of lease.Payments build no equity (in most cases)Market price at lease end.Longer-term leases may be more expensive than purchase.Cannot depreciate asset.

What are the types of operating lease?

The two most common types of leases are operating leases and financing leases (also called capital leases). In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor.

What are the types of operating lease?

The two most common types of leases are operating leases and financing leases (also called capital leases). In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor.

Is a car lease an operating lease?

Operating Lease The vehicles are the property of the leasing agent or lessor who in turn accrues the tax benefits involved. This is favorable to the business because the leased vehicles are treated as an operating expense and do not figure on the balance sheet.

What is the difference between operating lease and financial lease?

Operating Vs Finance leases (What's the difference): Title: In a finance lease agreement, ownership of the property is transferred to the lessee at the end of the lease term. But, in an operating lease agreement, the ownership of the property is retained during and after the lease term by the lessor.

What is an operating lease vs capital lease?

A capital lease (or finance lease) is treated like an asset on a company's balance sheet, while an operating lease is an expense that remains off the balance sheet. Think of a capital lease as more like owning a piece of property, and think of an operating lease as more like renting a property.

What is operating lease accounting?

The term “ Operating Lease Accounting” refers to the accounting methodology used for leasing agreement where the lessor retains the ownership of the leased asset, while the lessee utilizes the asset for an agreed period of time , which is known as the lease term. When the lease payments. Lease Payments Lease payments are the payments where ...

What is annual lease rental expense?

Annual lease rental expense = Average of lease rental for Year 1 and Year 2

What is a lessee in a lease?

Lessee A Lessee, also called a Tenant, is an individual (or entity) who rents the land or property (generally immovable) from a lessor (property owner) under a legal lease agreement. read more. after the expiry of the lease term.

How to calculate depreciation on a lease?

Depreciation on the leased asset = Debt value of lease payments / No. of years

What is lease addendum?

Simply put, it refers to an addendum to the actual lease agreement when the latter is about to expire. read more. term. Further, as per the lease agreement, the lessee also can’t purchase the asset at a lower price after the expiry of the lease term. The equipment has a useful life of 4 years.

What is interest paid on leased asset?

Interest paid on leased asset = Lease payment in the current year – Depreciation on the leased asset

How long is a lease term?

The term of the lease is equal to 2 years, which is less than 75% of the total useful life of the equipment

What is an operating lease?

An operating lease is an agreement to use and operate an asset without the transfer of ownership. Common assets. Tangible Assets Tangible assets are assets with a physical form and that hold value. Examples include property, plant, and equipment.

What is capitalizing an operating lease?

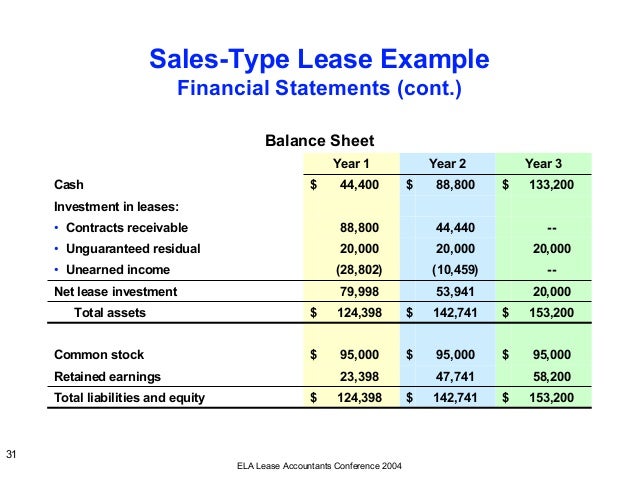

By capitalizing an operating lease, a financial analyst is essentially treating the lease as debt. Both the lease and the asset acquired under the lease will appear on the balance sheet. The firm must adjust depreciation expenses to account for the asset and interest expenses to account for the debt.

How to calculate imputed interest on lease?

To calculate the imputed interest on the operating lease, multiply the debt value of the lease by the cost of debt.

How to adjust interest expense on lease?

To adjust interest expenses, we begin with a simplifying assumption: operating lease expense is equal to the sum of imputed interest expense and depreciation. With this assumption, we can use our newly calculated depreciation value to find imputed interest expense on an operating lease. Take the difference between the current year operating lease expense and our calculated depreciation value to find the imputed interest on the lease.

How to calculate adjusted operating income?

First, we need to adjust operating income. Begin with the reported operating income (EBIT). Then, add the current year’s operating lease expense and subtract the depreciation on the leased asset to arrive at adjusted operating income.

What is a bargain purchase option in a lease?

The lease contains a bargain purchase option for the lessee to buy the equipment below market value at the end of the lease

What is the lease term?

The lease term is greater than or equal to 75% of the asset’s estimated useful life. The present value of the lease payments is greater than or equal to 90% of the fair value of the asset. Ownership of the asset may be transferred to the lessee at the end of the lease.

What is accounting for an operating lease?

The accounting for an operating lease assumes that the lessor owns the leased asset, and the lessee has obtained the use of the underlying asset only for a fixed period of time. Based on this ownership and usage pattern, we describe the accounting treatment of an operating lease by the lessee and lessor.

What is variable lease payment?

Any variable lease payments that are not included in the lease liability. Any impairment of the right-of-use asset. At any point in the life of an operating lease, the remaining cost of the lease is considered to be the total lease payments, plus all initial direct costs associated with the lease, minus the lease cost already recognized in previous ...

Can you record profit at the beginning of an operating lease?

Profits cannot be recognized at the beginning of an operating lease, since control of the underlying asset has not been transferred to the lessee. Variable lease payments. If there are any variable lease payments, record them in profit or loss in the same reporting period as the events that triggered the payments. Initial direct costs.

Is lease payment a profit or loss?

Lease payments are recognized in profit or loss over the term of the lease on a straight-line basis, unless another systematic and rational basis more clearly represents the benefit that the lessee is deriving from the underlying asset.

What is an operating lease?

For an operating lease, the company will create an expense instead of a liability, allowing the company to obtain financial funding – often referred to as “off-balance-sheet financing”.

What is a lease in accounting?

A lease is a type of transaction undertaken by a company to have the right to use an asset. In a lease, the company will pay the other party an agreed upon sum of money, not unlike rent, in exchange for the ability to use the asset. in accounting are operating and financing (capital lease) leases. This step-by-step guide covers all the basics ...

What is a moral hazard in a lease?

In a lease, the lessor will transfer all rights to the lessee for a specific period of time, creating a moral hazard issue. Because the lessee who controls the asset is not the owner of the asset, the lessee may not exercise the same amount of care as if it were his/her own asset.

What are the two types of leases?

The two most common types of leases are operating leases and financing leases (also called capital leases). In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor.

What is a lease classification?

Lease classifications. Lease Classifications Lease classifications include operating leases and capital leases. A lease is a type of transaction undertaken by a company to have the right to use an asset. In a lease, the company will pay the other party an agreed upon sum of money, not unlike rent, in exchange for the ability to use the asset.

What is a lease contract?

What is a lease? Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for something, usually money or other assets. The two most common types of leases. Lease Classifications Lease classifications include operating leases and capital leases. A lease is a type of transaction undertaken by ...

Why is leasing more flexible than loan?

Leasing provides a number of benefits that can be used to attract customers: Payment schedules are more flexible than loan contracts. After-tax costs are lower because tax rates are different for the lessor and the lessee. Leasing involves 100% financing of the price of the asset.

What is operating lease accounting?

Operating lease accounting is a methodology of recording, reporting and presenting a leasing transaction whereby an underlying asset is just lent for use ; its ownership rights remain with the person who grants the asset (lessor). Lease transactions need to be recognized in the lessor’s books as operating income. Thus, he/ she can claim depreciation on the leased asset and avail of its relevant tax benefits, whereas the person to whom the asset is leased (lessee) will treat lease payments as an expense which will be charged in P&L A/c.

What is operating lease?

An operating lease is a type of capital asset leasing agreement whereby the lessor agrees to grant a drawl of economic benefits from the use of the underlying asset to the lessee in exchange for periodic lease payments. This approach does not permit capitalization of the underlying asset in the lessee’s books of account. Also, monthly lease payments will be charged off as expenses in the entity’s P&L A/c. While lessor is allowed to capitalize assets in its books of accounts, claim depreciation and related tax benefits. Simultaneously allowing lessor to recognize lease rentals as its income.

What is the present value of periodic lease payments?

The present value of the periodic lease payments must be less than 90% of the asset’s fair market value.

What is contingent rental?

Contingent Rentals: If the lease agreement mentions increasing the rent due to future events like inflation or the property tax incurred, then these must be charged to the expense account on the basis of the accrual.

Is a grant on an operating lease a regular business?

Granting assets on operating lease will be usually considered as a regular business of lessee and accounted accordingly. Lessor will depreciate the asset over its useful life as in normally as like any other fixed asset,

Is an operating lease an off balance sheet asset?

Lessee is not allowed to record assets in its books of accounts as like in the case of a finance lease, and therefore operating lease underlying assets are also known as off-balance sheet assets .

Do lease incentives have to be straight line?

If the lease agreement includes any type of incentives such as free rent or lower rent for several months, the lessee must record incentives straight-line over the lease period. Therefore, most of the lease incentives are recognised over a period of time instead of being written off at the time of occurrence.

What is a lease in accounting?

Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for money or other assets. The two most common types of leases in accounting are operating and financing (capital leases). Advantages, disadvantages, and examples. Prepaid Lease.

Why are operating leases important?

Operating leases provide greater flexibility to companies as they can replace/update their equipment more often. No risk of obsolescence, as there is no transfer of ownership. Accounting for an operating lease is simpler. Lease payments are tax-deductible.

What are the advantages of operating leases?

There are many advantages to an operating lease as well: 1 Operating leases provide greater flexibility to companies as they can replace/update their equipment more often 2 No risk of obsolescence, as there is no transfer of ownership 3 Accounting for an operating lease is simpler 4 Lease payments are tax-deductible

What is specialized asset under lease?

The assets under the lease are specialized so that only the lessee is able to utilize them without major changes being made to the assets

What is capital lease?

To be classified as a capital lease under U.S. GAAP, any one of four conditions must be met: A transfer of ownership of the asset at the end of the term. An option to purchase the asset at a discounted price at the end of the term. The term of the lease is greater than or equal to 75% of the useful life of the asset. The present value.

What is prepaid lease?

Prepaid Lease A prepaid lease (or operating lease) is a contract to acquire the use of tangible assets, which include plant, equipment, and real estate. Fixed and Variable Costs. Fixed and Variable Costs Cost is something that can be classified in several ways depending on its nature.

Is lease expense expensed?

Accounting for an operating lease is relatively straightforward. Lease payments are considered operating expenses and are expensed on the income statement. The firm does not own the asset and, therefore, it does not show up on the balance sheet, and the firm does not assess any depreciation.

How Operating Leases Work

- Operating leases are considered a form of off-balance-sheet financing. This means a leased asset and associated liabilities (i.e. future rent payments) are not included on a company's balance sheet. Historically, operating leases have enabled American firms to keep billions of dollars of as…

Operating Lease vs. Capital Lease

- U.S. GAAP accounting treatments for operating and capital leases are different and can have a significant impact on businesses' taxes. An operating lease is treated like renting—lease payments are considered as operating expenses. Assets being leased are not recorded on the company's balance sheet; they are expensed on the income statement. So, they affect both ope…

Special Considerations

- Effective Dec. 15, 2018, the FASBrevised its rules governing lease accounting. Most significantly, the standard now requires that all leases—except short-term leases of less than a year—must be capitalized. Other changes include the following: 1. Amends the bright-line test to help determine whether or not a lessee has the right to control the identified asset. 2. Installs a new definition of …

Operating Lease vs. Capital Lease

- An operating lease is different from a capital lease and must be treated differently for accounting purposes. Under an operating lease, the lessee enjoys no risk of ownership, but cannot deduct depreciation for tax purposes. For a lease to qualify as a capital lease, it must meet any of the following criteria as outlined by GAAP: 1. The lease term ...

Capitalizing An Operating Lease

- If a lease does not meet any of the above criteria, it is considered an operating lease. Assets acquired under operating leases do not need to be reported on the balance sheet. Likewise, operating leases do not need to be reported as a liability on the balance sheet, as they are not treated as debt. The firm does not record any depreciation for assets acquired under operating l…

Full Adjustment Method

- Step 1: Collect input data

Find the operating lease expenses, operating income, reported debt, cost of debt, and reported interest expenses. Cost of debt can be found using the firm’s bond rating. If there is no existing bond rating, a “synthetic” bond rating can be calculated using the firm’s interest coverage ratio. … - Step 2: Calculate the Present Value of Operating Lease Commitments

By capitalizing an operating lease, a financial analyst is essentially treating the lease as debt. Both the lease and the asset acquired under the lease will appear on the balance sheet. The firm must adjust depreciation expenses to account for the asset and interest expenses to account fo…

Approximation Method

- Step 1: Collect input data

Like the full adjustment method, we will need to collect the same input data. - Step 2: Calculate the Present Value of Operating Lease Commitments

The second step for the approximation method is identical to the second step in the full adjustment method as well. We need to calculate the present value of operating lease commitments to arrive at the debt value of the lease.

Impact on valuation

- There are two effects on free cash flow to the firm (FCFF) when we treat operating lease expenses as financing expenses by capitalizing them: 1. FCFF will increase because the imputed interest expense on the capitalized operating leases is added back to the operating income (EBIT). 2. FCFF will decrease if the present value of leases increases (and vice versa) due to th…

Other Resources

- We hope you’ve enjoyed reading this CFI guide to leases. To learn more, see the following free CFI resources. 1. Lease Classifications 2. Lease Accounting 3. Prepaid Lease 4. Projecting Balance Sheet Items