Owners Corporation Certificate The Owners Corporation Certificate, formerly referred to as body corporate is a disclosure of Owners Corporation matters to prospective purchasers. The Owners Corporation certificate forms part of the Section 32.

What is a certificate showing ownership in a company called?

What Document Proves That I Am the Sole Owner of a Company?

- Proof of Business Ownership for Sole Proprietorship. A sole proprietorship is a business owned by one person that is not a separate business entity from the owner.

- Corporation Proof of Business Documents. There are two types of corporations, an S corporation and a C corporation. ...

- Limited Liability Company Ownership Documents. ...

- Things to Consider. ...

What imparts ownership in a corporation?

Weegy: Stock imparts ownership in a corporation. User: Your text suggests that you look for an agent who has been in the insurance business for how long? O A. At least 2 years O B. Less than 1 year O C.

Who represents ownership in a corporation?

- Law firms incorporated as professional corporations

- Partnerships

- Municipal corporations

- Public benefit corporations

- School districts or school district public libraries

- Claims or cause of action brought by an insurer in its own name or in the name of the insured

- A small claims commercial action; or defending small claims non-commercial actions

What is the represented ownership in a corporation?

The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves. I generally consider insider ownership to be a good thing. However, on some ...

Why do we need an owners corporation certificate?

What is owners corporation rules?

How long before a property is sold should you ask for a new certificate?

How long does it take to get a certificate of ownership?

What does an OC certificate tell you?

Do you need an owners corporation certificate to sell a property?

See more

What is an owners corporation in Victoria?

An owners corporation (formerly body corporate) manages the common property of a residential, commercial, retail, industrial or mixed-use property development. You are likely to be a member of an owners corporation if you own a flat, apartment or unit.

How do I register an owner corporation in Victoria?

Any person or company carrying on business as an owners corporation manager for a fee or reward in Victoria must be registered by the Business Licensing Authority (BLA). You can apply for registration using the myCAV 'Start application' button on this page.

Who's responsible A guide to common property Victoria?

Pursuant to Part 2 Division 1 Section 4 of the Owners Corporation Act 2006, the Owners Corporation is responsible for maintenance of common property.

Do you have to have an owners corporation Victoria?

An owners corporation with more than two lots does need to have an Owners Corporation established. However, there is no requirement to have an Owners Corporation Manager appointed and instead it could be self-managed by the owners.

Is an owners corporation a legal entity?

An owners corporation is an artificial legal entity made up of all of the registered owners of all the units in the strata plan.

Can an owners corporation issue fines Victoria?

Monetary penalties under the Owners Corporations Act 2006 can be imposed by: a court, after it finds charges proven. an infringement notice, issued by our officers. For more information, view About infringement notices.

Who is responsible A guide to common property?

The owners corporationThe owners corporation is responsible for the repair and maintenance of common property. This publication provides a list of items found within a building that could generally be considered common property.

Is bathroom waterproofing common property?

A waterproofing membrane in a bathroom that was in place at registration of the strata plan would normally be common property. Under normal circumstances, a waterproofing membrane will last for a minimum of 10 years as this is the usual warranty provided by installers.

Sample owners corporation certificate

Owners Corporation Act 2006 Section 151, Owners Corporations Regulations 2018 Regulation 16. Owners corporation number Address This certificate is issued for lot on plan of subdivision number Postal address Applicant for the certificate Address for delivery of certificate Date that the application was received

Model rules for owners corporations - Consumer Affairs Victoria

The Model rules for an owners corporation (Word, 17KB) (formerly body corporate) are set out in the Owners Corporations Regulations 2018.. If your owners corporation does not make a rule covering any item in the model rules, then the model rule applies. To make its own rules, your owners corporation should use the headings in the model rules (see Schedule 1 of the Regulations) with a clear ...

Owners Corporation Act Victoria – Amendment Act 2021

BREAKING NEWS: Latest Changes for OC Act will come into force on 1 December 2021. In 2019, Victorian Parliament sought to change the Owners Corporations Act 2006 (Vic) (OC Act), with specific amendments that would impact owners corporation arrangements and management rights transactions through the introduction of the Owners Corporations and Other Acts Amendment Bill 2019.

OWNERS CORPORATIONS REGULATIONS 2018 (SR NO 154 OF 2018)

OWNERS CORPORATIONS REGULATIONS 2018 (SR NO 154 OF 2018) TABLE OF PROVISIONS 1.Objective 2.Authorising provision 3.Revocation 4.Commencement 5.Definitions 6.Prescribed owners corporations 7.Prescribed information for maintenance plan 8.Proxy authorisation 9.Membership of committee 10.Professional indemnity insurance 11.Model rules 12.

Owners Corporations Regulations 2018

The Victorian Government acknowledges Aboriginal and Torres Strait Islander people as the Traditional Custodians of the land and acknowledges and pays respect to their Elders, past and present.

When should a certificate be obtained for a property?

The Vendor: A certificate should be obtained as soon as the property is listed for sale. The Purchaser: The purchaser should independently check all the information by obtaining a new certificate. Changes to fees, special levies, rules and maintenance do occur, particularly after the Annual General Meeting.

How long does it take to update a certificate?

Time Period: All information in the certificate is current at the time of preparation. Prior to settlement an update is recommended. Updates within the 60 day period are free of charge. After the 60 day period new certificate fees will apply.

Who prepares the vendor statement?

Who prepares the Vendors Statement? A solicitor or conveyancer prepares the Vendors Statement. They arrange for documentation from all the various authorities (Council, Gas, Water, Electricity, Roads, Owners Corporation Managers, etc.), which make up the Vendors Statement.

What is an owners corporation?

Definition of an owners corporation. An owners corporation (formerly body corporate) manages the common property of a residential, commercial, retail, industrial or mixed-use property development. You are likely to be a member of an owners corporation if you own a flat, apartment or unit. Your ‘body corporate’ became an owners corporation on 31 ...

What are the responsibilities of an owners corporation?

An owners corporation must: manage and administer the common property. repair and maintain the common property, fixtures and services. take out and maintain required insurance. raise fees from the lot owners to meet financial obligations.

What happens if you own property affected by an owners corporation?

If you own property affected by an owners corporation then you become a member of that owners corporation automatically. As a member, you have legal and financial responsibilities to the owners corporation.

How many levels are there in an owners corporation?

Four levels of an owners corporation. The owners corporation operates at four levels: The owners corporation, consisting of all the lot owners. The committee, consisting of elected lot owners or lot owners’ proxies. A delegate of the owners corporation.

What is the decision making process in an owners corporation?

Decision-making in owners corporations. Your owners corporation makes a decision or resolution when its members vote at a meeting or by ballot. Votes are based on lots or lot entitlements, not by the number of individuals living in or owning a lot. This means:

When did the body corporate become an owners corporation?

Your ‘body corporate’ became an owners corporation on 31 December 2007, when the Owners Corporations Act 2006 came into force. This law sets out the duties and powers of owners corporations.

Who is responsible for the common property?

The owners corporation is responsible for the common property - the Owners Corporations Act 2006 states that the owners corporation must, among other things, manage, administer, repair and maintain the common property. The plan of subdivision shows the parcels of land that can be sold separately.

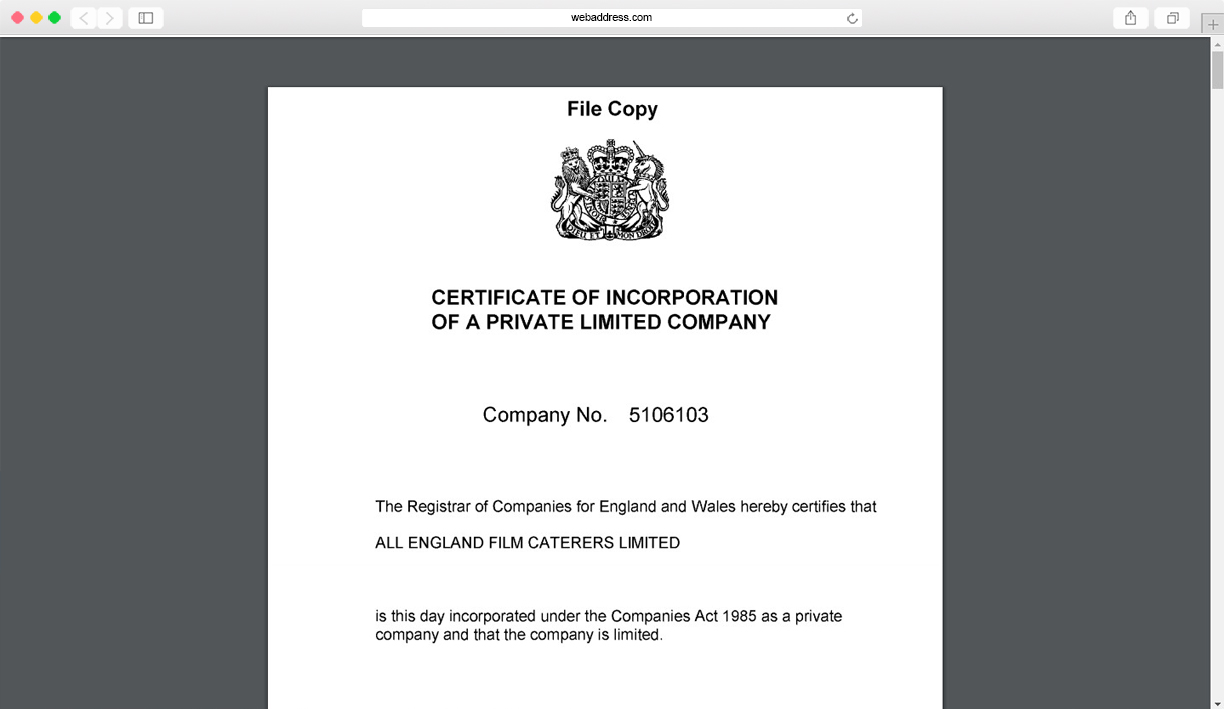

What is a certificate of incorporation?

Entrepreneurs who want to operate their company as a corporation—a legal entity that is separate from and that provides personal liability protection for its owners—must file a certificate of incorporation form. They must have their certificate of incorporation approved by the state (usually the Secretary of State Office) before they can conduct ...

What information is required on a certificate of incorporation?

The information requested on the certificate of incorporation form may vary slightly from one state to the next. I’ve listed some of the details you might be expected to share below: 1 Type of corporation being registered. Some examples include:#N#Business stock#N#Business nonstock#N#Business-statutory close#N#Management#N#Professional#N#Insurance#N#Nonprofit#N#Benefit#N#Cooperative 2 Name of the corporation – The name must include a corporate ending such as “Corporation,” “Incorporated,” “Company” (or an abbreviation of them such as “Inc.,” “Corp.,” or “Co.,” etc.) 3 Address of the corporation’s office within the state of registration 4 Name of the corporation’s registered agent and location 5 Whether the corporation is organized on a stock basis; if so, the aggregate number of authorized shares 6 Name and address of each incorporator 7 Name and address of each member of the initial board of directors 8 Future effective date requested (if any) 9 Purpose of the business 10 Whether the corporation is a cooperative. 11 Whether the corporation is being formed as a benefit organization. If so, what that public benefit is. 12 Additional provisions

What is the process of filing a certificate of incorporation?

Filing certificate of incorporation paperwork is just one of many steps involved in starting a corporation. Make sure you have a firm understanding of everything you need to pay attention to by researching the requirements in your state and asking legal and financial professionals for insight.

What are the most valuable resources for business owners?

Attorneys are among the most valuable resources business owners can have. By sharing expertise about the legal advantages and disadvantages of business entity types, lawyers can help entrepreneurs decide which legal structure (LLC, corporation, etc.) will benefit them most.

What are some examples of business incorporation?

Some examples include: Open a corporate bank account. Apply for business licenses and permits. Hire employees.

When is the best time to file a certificate of incorporation?

So a good time to file certificate of incorporation paperwork is generally after business owners have decided that they want to operate their company as a corporation, after they have conducted a corporate name and trademark searches to make sure that the name they want to use is available, and after they have secured a registered agent.

What is franchise tax?

State franchise tax – For the privilege of doing business as a corporation in the state. Business licenses and permits – Depending on the type of business and where it’s located. Attorney’s fees – For legal guidance and handling legal documents.

What is required of an owner corporation?

any leases and licences entered into by the owners corporation. An owners corporation is required to keep records under the Owners Corporations Act 2006 and other laws, such as Commonwealth taxation laws and the Building Act 1993.

What do owners corporations collect?

An owner corporations must collect and keep: the full name and address of each lot owner. a consolidated copy of the owners corporation’s rules. minutes of meetings. copies of resolutions . records of the results of ballots . proxies. voting papers or ballots. correspondence.

How long does it take to get an owner's certificate?

Owners corporation certificate. An owners corporation must issue an owners corporation certificate to any person within 10 business days of receiving a written request and the relevant fee payment. There are maximum fees that can be charged for this service, and for meeting urgent requests within a set number of days.

What is required to keep records?

Records from the developer. An owners corporation (formerly body corporate) is required by law to keep certain records. By law, the property developer or initial owner must give an owners corporation: a copy of the plan of subdivision and planning documents. copies of any building contract and building plans.

What is an owners corporation?

An owners corporation (formerly body corporate) manages the common property of a residential, commercial, retail, industrial or mixed-use property development. Owners of flats, apartments or units are usually members of an owners corporation. Land Use Victoria registers plans of subdivision which create or alter owners corporations, ...

What is a consolidated copy of the rules in place?

When lodging rules with Land Use Victoria, a ‘consolidated copy' of the rules must be supplied. This means a current copy of all rules in place, as only one set of rules will be recorded against an owners corporation.

What is a certificate of incorporation?

According to the Cambridge Dictionary, a certificate of incorporation is defined as: An official document that proves that a company has been legally created and officially exists. Whereas according to Investopedia, a certificate of incorporation is defined as:

What information is needed for a deed of incorporation?

Typically, you can expect to provide the following information: The type of corporation you are forming. The name of the corporation. The address of the corporation.

What are the advantages of a corporation?

Operating a business using a corporation as a legal entity can provide many advantages such as: 1 Limited liability protection 2 Ability to raise financing 3 Ability to issue shares to key stakeholders 4 Ability to issue different classes of stock 5 Provides you with additional credibility 6 Can allow you to separate your personal taxes with business income

Is a certificate of incorporation the same as an article of incorporation?

In other jurisdictions, a certificate of incorporation is essentially a “certificate” or a “ confirmation ” issued by the authorities confirming the existence of the corporation whereas articles of incorporation refer to the incorporation documents.

Does an owners corporation have to have a maintenance fund?

If your owners corporation has a maintenance plan, it must also have a maintenance fund. The owners corporation can decide what, if any, portion of the annual fees should be contributed to the fund, how it is paid and when payment is due (usually quarterly).

Can an owners corporation pay direct debit fees?

Your owners corporation can arrange for fees to be paid by direct debit to help you with budgeting and reduce the risk of the owners corporation not being able to meet its financial and legal obligations due to unpaid fees.

Can an owner corporation levy fees?

An owners corporation can also levy fees to recover recurrent expenses from individual lot owners. These fees must be based on lot liability. Example: A lot owner has 10 per cent of the lot liability and has not paid their fees.

Can an owners corporation charge a lot owner?

Note: An owners corporation cannot charge a lot owner any other fees or charges, such as an 'administration fee', for overdue owners corporation fees. Further, an owners corporation manager cannot require a lot owner to pay any fees due to the manager under the contract. A manager's contract of appointment is a contract between ...

Why do we need an owners corporation certificate?

Why do we need one? An owners corporation certificate is required to be attached to the Section 32 statement of the contract of sale. All Owners Corporations in Victoria are required to prepare and supply a certificate within ten business days to anyone who applies in writing and pays the relevant maximum fee for each certificate.

What is owners corporation rules?

The owners corporation rules#N#The Statement of Advice and Information for Prospective Purchasers and Lot Owners#N#All resolutions made at the last annual general meeting, and#N#A statement that more information about prescribed matters is available by inspecting the owners corporation register.

How long before a property is sold should you ask for a new certificate?

Each certificate will incur a separate fee. As vendors certificates are sometimes prepared up to 12 months before the sale of the property, purchasers should ask for a new certificate before settlement. Alternatively, purchasers may make a time to inspect the owners corporation register and records, free of charge.

How long does it take to get a certificate of ownership?

An owners corporation must provide a certificate within 10 business days of receiving the fee and request in writing. If a person asks for the certificate within a shorter time, and the owners corporation agrees to this, the fee cannot exceed the maximum amounts set by the regulations for that service.

What does an OC certificate tell you?

The OC Certificate can tell you a lot about a property. If there are significant issues at an OC you are looking to buy into, they should be reflected in the OC Certificate.

Do you need an owners corporation certificate to sell a property?

If you intend to sell your property, you must include an owners corporation certificate and accompanying documents in the vendor’s statement or section 32. It is very important that the information contained in the owners corporation certificate is accurate. The certificate should be authorised by:

Owners Corporations Certificates – For Sale of Lots in Victoria

- An owners corporation certificate is required to be attached to the Section 32statement of the contract of sale. All Owners Corporations in Victoria are required to prepare and supply a certificate within ten business days to anyone who applies in writing and pays the relevant maximum fee for each certificate. The certificate must outline the curre...

Owners Corporation Certificate Fees

- On 1 October 2014, a new fee structure was introduced, setting out the maximum amount an owners corporation can charge for issuing a certificate. If a lot is affected by more than one owners corporation, a separate certificate may be issued for each and the owners corporation may charge a separate fee. There are discounts for additional certificates, when required as par…

Fees For Copies of Register and Records

- On 1 October 2014, a fee structure was introduced which sets out the maximum amount an owners corporation can charge for providing copies of the register and records. The value of a fee unit is $14.81 for 2020-21. This amount will change at the start of each financial year. For more information, visit Indexation of fees and penalties – Department of Treasury and Finance. From …

Disputes

- We recommend first trying to resolve any disputes about fees and charges through the owners corporation’s internal dispute resolution process. For more information, view our Complaint handling in your owners corporation page. If the matter remains unresolved, a lot owner can apply to the Victorian Civil and Administrative Tribunal (VCAT) for a ruling. If an owners corporation is …