What is an unregulated bridging loan?

Unregulated bridging loans can be used for many of the same reasons as a regulated bridging loan. The only difference is that when a property is bought with an unregulated bridging loan, it can’t be purchased with the buyer intending to live at the property.

What types of Home Loans are unregulated?

Home loans that are unregulated include: Loans used predominantly to invest in commercial property, shares or a business. There may be more flexible lending products available for these loan types, where no form of income verification is required. These are known as no doc loans. Start buying your home. Now!

What is the difference between FCA regulated and unregulated loans?

Essentially, FCA regulated loans carry more protection than unregulated ones, giving consumers an extra level of safety beyond common law or the existing consumer protection laws. They are also subject to supervision and enforcement where appropriate meaning consumers are protected under the Mortgage Code of Business (MCOB) rules.

What is a regulated mortgage contract?

This arrangement is sometimes known as a regulated mortgage contract. Certain loans which are secured by a second charge on a borrower (or partners's) home are also regulated. These are known as consumer credit loans.

What is the difference between a regulated loan and an unregulated loan?

Put simply: a regulated loan is regulated by the Financial Conduct Authority (FCA), whereas an unregulated loan is not. Regulation means that consumers are protected from incorrect advice or miss-selling from lenders or brokers. Unregulated bridging loans don't have this protection.

What is an unregulated lender?

Any loan taken out where the borrower or their family does not live in the property will be unregulated. Lenders of unregulated loans are not bound by the FCA's regulations. This type of loan is popular with property investors seeking short-term financing to purchase or renovate a commercial property.

What is regulated and non regulated?

regulated, the recognition of your qualifications will be determined by the appropriate provincial or territorial regulatory authority; non-regulated, recognition is normally at the discretion of the employer.

What is unregulated bridging?

What is an unregulated bridging loan? A bridging loan is 'unregulated' when the property being used as security is for business or investment purposes which will never be occupied by the borrower or any member of their immediate family.

What is the difference between a regulated and unregulated buy-to-let mortgage?

Regulated buy to let mortgages are assessed in a completely different way from conventional buy to let mortgages. Conventional buy to let is typically assessed on the rental income of the property, rather than the applicant. Regulated buy to let is largely calculated on the income and affordability of the borrower.

Is commercial lending unregulated?

That being said as commercial lending is unregulated any previous action by the Financial Conduct Authority (FCA) against RBS in relation to GRG has been extremely limited despite a highly critical report.

What does non regulated mean?

Definition of nonregulation (Entry 1 of 2) : an absence or lack of regulation : the failure or refusal to regulate the nonregulation of the financial markets. nonregulation. adjective.

What does it mean when something is not regulated?

non-regulated. adjective. used to describe businesses, services, agreements, etc. that do not have to obey official rules: Non-regulated products and services: please note that the Financial Services Authority does not regulate all of the products featured on the website.

What It Means of not regulated?

: not regulated: such as. a : disorderly, chaotic unregulated habits an unregulated mind. b : not controlled by regulation unregulated fishing an unregulated industry.

Are bridge loans regulated?

The FCA does not offer protection for bridging loans used to secure an investment property, buy-to-let investment, or commercial real estate. This means all bridging loans including commercial or residential ones are unregulated.

Are residential mortgages regulated?

Residential mortgages are regulated by Financial Conduct Authority (FCA)

Is Bridge Finance regulated?

Commercial – Currently, all commercial bridging finance is unregulated, meaning the FCA extends no protection or supervision to this area of the industry. If you're securing a loan for an investment property, a commercial building, or for a buy-to-let it will not be regulated.

Is a broker the same as a lender?

What is the difference between a mortgage broker and a mortgage lender? A lender is a financial institution that makes loans directly to you. A broker does not lend money. A broker finds a lender.

What is a lender's policy?

Lender's title insurance protects your lender against problems with the title to your property-such as someone with a legal claim against the home. Lender's title insurance only protects the lender against problems with the title. To protect yourself, you may want to purchase owner's title insurance.

What are the qualifying debt ratios for an FHA loan?

FHA Debt-to-Income Ratio Requirement With the FHA, you're generally required to have a DTI of 43% or less, though it varies based on credit score. To be more specific, your front-end DTI (monthly mortgage payments only) should be 31% or less, and your back-end DTI (all monthly debt payments) should be 43% or less.

How can I dissolve my mortgage?

BlogPay Off The Mortgage.Add Another Co-Signer.Obtain A Release Of Liability.File For Bankruptcy.Sell The Property.Refinance The Loan.Assume The Mortgage.Request A Loan Modification.

What is an unregulated bridging loan?

Unregulated bridging finance is a short-term, property-backed loan which is designed to ‘bridge’ a gap in funding. A loan is unregulated if it is s...

What does unregulated mean?

Unregulated refers to the fact that the loan being taken does not fall under the protection of the Financial Conduct Authority (FCA). This means th...

What can unregulated bridging finance be used for?

We can provide funding for almost any purpose; the most common unregulated bridging loan uses are: Adding value to a property through property refu...

What is your minimum and maximum loan size?

What is your minimum and maximum loan size?

What LTV can you offer?

We fund unregulated bridging loans up to 80% loan to value (LTV), and can even lend up to 100% LTV with additional security.

What is a Regulated Bridging Loan?

Regulated bridging loans are therefore those which fall under the protection of the FCA, i.e. residential ones.

Are Bridging Loans Regulated?

So in the case of bridging, the residential market is currently regulated, and the commercial side currently not.

What is the Difference Between Regulated and Unregulated Loans?

The Financial Conduct Authority FCA is the conduct regulator for some 59,000 financial services firms in the UK, and has the stated goal of:

Can I Get Regulated Development Finance?

Where the borrower wishes to develop a property that is going to be their only dwelling, it is possible to use regulated bridging finance.

What is FCA loan?

protecting consumers. ensuring fair competition. ensuring the integrity of the UK financial system. Essentially, FCA regulated loans carry more protection than unregulated ones, giving consumers an extra level of safety beyond common law or the existing consumer protection laws.

What is a first charge on a bridging loan?

First Charge. In the bridging loan market only consumer loans secured by a first charge on the borrowers (or partners’s) home are regulated. This arrangement is sometimes known as a regulated mortgage contract.

What is the maximum amount of a loan to value?

Regulated loans are generally restricted to a maximum of 70% loan to value (LTV), although higher amounts are available in certain cases.

What is the difference between regulated and unregulated bridging loans?

When completing on a property transaction, finding the right loan for you can be difficult. This is not due to the lack of products available, but the opposite. There are thousands of regulated and unregulated bridging loans on the market, making it hard to narrow down an experienced lender that meets your specific needs.

How do I know which loan I need?

Determining if you need a regulated or unregulated bridging loan will depend on the type of property you wish to purchase.

What is a regulated bridging loan?

A regulated bridging loan relates to securing a loan against a property that is currently, or will be, occupied by the owner or an immediate family member. If other people are looking to live in the property, you will most likely need a buy-to-let loan or mortgage. (You can read more on buy-to-let’s by downloading our buy-to-let guide .)

What is an unregulated bridging loan?

An unregulated bridging loan is a popular source of short-term finance for people looking to complete their property transaction quickly. Their flexibility allows them to be tailor made for borrower’s individual needs and can mitigate a lot of the constraints regulated bridging loans are subject to. Most commonly, unregulated bridging loans cover:

Verdict

Overall, borrowers and brokers need to engage with established lenders who have a strong track record when it comes to deploying bridging loans. If you are a borrower, it can be beneficial to speak with a financial adviser to find out whether regulated or unregulated bridging loans are right for you.

Contact us

Speak to us on the phone, via chat or email about your case, however complex it might be. We have a friendly, dediciated team and one of our underwriters will be happy to help you with your query. We will try our best to say yes to you, instead of finding a reason to say no.

What is a regulated bridging loan?

Broadly, a regulated bridging loan is a loan secured against a property which the borrower currently occupies or intends to . The main difference between this and an unregulated bridging loan is that the transaction is not intended for business purposes.

What are bridging loans?

Common commercial uses of an unregulated bridging loan include: 1 Purchasing land for the purpose of obtaining planning permission before a development 2 Funding works to a property 3 Securing residential, commercial and semi-commercial property quickly 4 Purchasing properties at auction 5 Purchasing and refurbishing a property for resale 6 Securing a property to make improvements ahead of getting a Buy-to-Let mortgage.

Why is bridging finance so popular?

Bridging finance is popular for the flexibility it offers to professional property developers, property investors and homeowners. While it is more commonly used for business purposes, homeowner bridging loans – more commonly referred to as regulated bridging loans – were more than a third of the UK bridging market in 2019.

What is a business assumed to be able to understand and assess?

A business is normally assumed to be able to understand and assess contracts they are signing and commitments they are making, without the need for the same protection afforded consumers.

Is bridging loan regulated?

Bridging loans can either be regulated or unregulated. In both cases lenders will require security, commonly a 1st or 2nd charge against a property owned by the borrower. It is also necessary to have a clear exit strategy and awareness of the risk that the security will be repossessed if the loan is not repaid.

Can a bridging loan be repossessed?

Something to consider about this type of lending is, as short-term loans, bridging loan interest rates are relatively high. Your home may be repossessed if you do not keep up repayments on your mortgage.

Can a home be repossessed?

Your home (and any other property used as security) may be repossessed if you do not keep up repayments on your mortgage. Bridging loans are short-term, high-rate interest loans and fees apply. A mortgage adviser can recommend the most suitable mortgage for you. Posted by Luke Stevenson.

What is the NCCP Act?

The National Consumer Credit Protection Act 2009, or the NCCP Act, is legislation that’s designed to protect consumers and ensure ethical and professional standards in the finance industry.

What does ‘not unsuitable’ mean?

Your mortgage broker and lender are required by the NCCP act to provide you with a loan that isn’t unsuitable.

Can you give me an indicative interest rate?

Yes, we can give you an indicative interest rate and the details of likely lender fees. We normally give you a range, as we can’t confirm immediately which lenders you’ll qualify for a mortgage with.

What does this mean for low doc loans?

This is at odds with the concept of a low doc loan where you don’t need to provide evidence of your income. To get around this problem, lenders have come up with “alternative verification” methods.

Do no doc loans still exist?

No doc loans don’t require any evidence of your income and, in some cases, don’t require you to sign an income declaration. They don’t meet the requirements of the NCCP Act and as such, are only available from a few select lenders who offer unregulated loans.

Why use us?

We finance properties anywhere in Australia for people anywhere in the world.

What is the age limit for a home loan?

The National Consumer Credit Protection (NCCP) Act requires a lender to make sure that a borrower can repay a loan without significant hardship. It doesn't mention a specific age. We've seen people over the age of 50 obtain a 30-year loan because they were well-off and had income from investments. However, most standard home loans are regulated under the NCCP Act. If you’d like to learn more about the NCCP Act and how it’ll affect your home loan application, please call 1300 889 743 or fill in our free assessment form https://www.homeloanexperts....

What is unregulated property?

Unregulated are useful for corporate entities, properties you aren’t going to live in, or individuals with unique circumstances that don’t fall into other categories.

What are the requirements for a bridging loan?

Regulated residential bridging loan? 1 Regulated Residential Bridging 2 Regulated by the Financial Conduct Authority 3 Secured by first legal charges against property that is currently or will be occupied by their close family 4 Borrower or family need to occupy at least 40% of the property

What was the mortgage market like after the turn of the century?

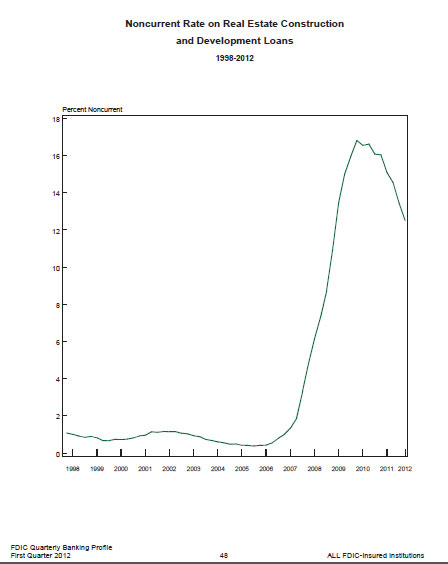

After the turn of the century, low interest rates and demand for investments tied to mortgage loans created a market for mortgage companies to enter. In many parts of the country, these companies and brokers weren't subject to much federal oversight on how they made their loans or to whom they made them. These companies, which usually weren't banks and weren't subject to bank regulation, also could sidestep the requirements of the government-sponsored agencies that bought many of the loans and provided a basic quality check by packaging the loans and selling them on Wall Street as mortgage-backed securities. By the height of the mortgage bubble, Fannie Mae and Freddie Mac were involved in just 37 percent of mortgages, with 84 percent of sub-prime mortgages coming from private lenders.

What is an unregulated mortgage?

An unregulated mortgage is one that avoids the supervision of the federal government and state mortgage regulators. Given the broad reach of the government's regulatory arm, truly unregulated mortgages are relatively few. However, mortgages made by unregulated brokers and originators played a large role in the housing meltdown ...

Is a residential mortgage regulated?

However, private mortgages made between a buyer and seller remain largely unregulated. Commercial and investment property mortgages are also subject to relatively little regulation. For instance neither the Real Estate Settlement Procedures Act nor the Truth in Lending Act apply to commercial or rental property mortgages.

Who is Steve Lander?

Steve Lander has been a writer since 1996, with experience in the fields of financial services, real estate and technology. His work has appeared in trade publications such as the "Minnesota Real Estate Journal" and "Minnesota Multi-Housing Association Advocate." Lander holds a Bachelor of Arts in political science from Columbia University.

What did the court find about the pre-contractual and contractual documentation?from gowlingwlg.com

On a proper construction of the pre-contractual and contractual documentation, the court found that the claimant had held out that both regulated and unregulated agreements would all be treated as if they were regulated agreements. The court also held there were no insuperable difficulties in not being able to apply entirely all the "paraphernalia" of a regulated agreement.

What is an unregulated agreement?from specialistautomotivefinance.org.uk

An unregulated agreement gives no additional statutory protections to the customer. They can be signed on or off trade premises and there is no requirement to show an APR. There are also no statutory termination or repossession rights or protections for the customer. An exempt agreement is one which would normally be regulated but falls into one ...

What happens if a lender ends a loan?from citizensadvice.org.uk

If the lender ends the agreement, for example, because you haven’t kept up with the repayments, they may be able to repossess the goods. Usually, the lender will need a court order to do this.

What is an exempt agreement?from specialistautomotivefinance.org.uk

An exempt agreement is one which would normally be regulated but falls into one of the exemptions. The customer will not receive the same level of protection as if the agreement were regulated, but will still have some protection under the unfair relationship provisions in Sections 140A to 140C of the Consumer Credit Act 1974.

What to do if you are not in default?from whatconsumer.co.uk

If you are not yet in default but feel that you will have difficulty meeting the monthly instalments, you are advised to contact the lender (the supplier or the finance company) without delay informing them of the situation. Also seek help from one of the numerous debt advice agencies such as National Debtline who will be able to set up a Debt Management Plan (DMP), negotiate with creditors on your behalf to help you get back on track with your repayments and avoid potential legal proceedings.

What are the different types of credit agreements?from whatconsumer.co.uk

In addition to credit and store cards, personal loans and overdrafts, a credit agreement will govern the following types of contracts: 1 Finance options for the purchase of goods and services (credit sale agreements) 2 Hire purchase agreements 3 Hire agreements 4 Conditional sale agreements

How long does it take for a mortgage lender to send a notice of default?from whatconsumer.co.uk

If you have missed (defaulted on) at least two or more payments (i.e. you are in arrears), the lender will, within 14 days, send you a notice of default which will explain fully your obligations and risks.

What did the court find about the pre-contractual and contractual documentation?

On a proper construction of the pre-contractual and contractual documentation, the court found that the claimant had held out that both regulated and unregulated agreements would all be treated as if they were regulated agreements. The court also held there were no insuperable difficulties in not being able to apply entirely all the "paraphernalia" of a regulated agreement.

What was the court finding in the case of estoppel by convention?

The court also found that there had been a shared assumption between the parties which was capable of giving rise to an estoppel by convention and/or a contractual estoppel, that so far as possible, the defendants would have the protection and rights conferred by the legislation. This also included subsequent amendments (indeed s77A had not been implemented at the date of these agreements) as any other interpretation was illogical when it was known that the legislation would often change.

Is a CCA loan regulated?

The court found that the loan agreements, as well as the wider suite of pre-contractual and contractual documentation, repeatedly referred to the loan being regulated by the CCA and that the borrower would benefit from the rights available under the CCA and associated regulations .

Is CCA regulated or unregulated?

the unregulated agreements had been held out to be regulated agreements and. the provisions of, and remedies under, the CCA, or equivalent protections, were imported, into the unregulated agreements notwithstanding the agreements fell outside the statutory scheme.

When did Northern Rock Building Society enter into unsecured credit?

The claimant's predecessor, Northern Rock Building Society, had, between 1999 and March 2008, entered into a substantial number of unsecured credit agreements as part of a product called the "Together Mortgage".

Is NRAM seeking leave to appeal?

The good news for finance companies is that we understand that NRAM is seeking leave to appeal. If any readers may be affected, do not hesitate to get in touch.