Definition of the annual deficit According to theinternetfaqs.com, the annual deficit is a term used in the balance sheet and profit and loss account of corporations. It results from the excess of expenses over income within a financial year.

Full Answer

What does it mean when there is a deficit?

A deficit occurs when the money going out exceeds the money coming in. Since the federal government spent $6.55 trillion and collected $3.42 trillion in 2020, the government ran a deficit for the year. What is the deficit and how does that compare to the national debt?

What is the budget deficit by year?

She also served as an editor for a weekly print publication. Her stint as a legal assistant at a law firm equipped her to track down legal, policy and financial information. The U.S. budget deficit by year is how much more the federal government spends than it receives in revenue annually.

What is the difference between fiscal deficit and current account deficit?

A current account deficit occurs when the total value of goods and services a country imports exceeds the total value of goods and services it exports. A fiscal deficit is a shortfall in a government's income compared with its spending. A government that has a fiscal deficit is spending beyond its means.

What is primary deficit and revenue deficit?

Primary deficit is the fiscal deficit for the current year minus interest payments on previous borrowings. Revenue deficit describes the shortfall of total revenue receipts compared with total revenue expenditures for a government.

What are annual deficits?

A deficit occurs when the government spends more money than it collects. The federal government has run deficits for the last 20 years.

How do you calculate annual deficit?

The formula for calculating fiscal deficit is as follows:Fiscal deficit = Total expenditures – Total receipts excluding borrowings.Revenue deficit = Total revenue expenditure – Total revenue receipts.Primary deficit = Fiscal deficit – Interest payments.

What is the meaning of budget deficit?

Definition: Budgetary deficit is the difference between all receipts and expenses in both revenue and capital account of the government. Description: Budgetary deficit is the sum of revenue account deficit and capital account deficit.

What is difference between debt and deficit?

Debt is an amount of money owed, A deficit refers to negative net money taken in over the course of some period. Both the national debt and budget deficit are watched by investors and economists. Debt is not necessarily an indicator of a weak economy.

What are different types of deficits?

Types of Deficits in IndiaBudget deficit: Total expenditure as reduced by total receipts.Revenue deficit: Revenue expenditure as reduced by revenue receipts.Fiscal Deficit: Total expenditure as reduced by total receipts except borrowings.Primary Deficit: Fiscal deficit as reduced by interest payments.More items...•

What is deficit and surplus?

Surplus: the amount by which your income is greater than your spending. Deficit: the amount by which your spending is greater than your income.

What is budget deficit with example?

A budget deficit occurs when a government spends more in a given year than it collects in revenues, such as taxes. As a simple example, if a government takes in $10 billion in revenue in a particular year, and its expenditures for the same year are $12 billion, it is running a deficit of $2 billion.

What causes budget deficit?

The two main causes of a budget deficit are excessive government spending and low levels of taxation that don't cover expenditure. Tax cuts can cause declines in revenue can result in a budget deficit, or, a massive fiscal stimulus can increase government spending over and above the income it receives.

Is a budget deficit bad?

An increase in the fiscal deficit, in theory, can boost a sluggish economy by giving more money to people who can then buy and invest more. Long-term deficits, however, can be detrimental for economic growth and stability. The U.S. has run deficits consistently over the past decade.

What country has the largest deficit?

Many nations around the world have trade deficits, including the United Kingdom, Mexico, Brazil, and the United States. The United States has the largest trade deficit in the world. In 2018, the trade deficit of this nation was $621 billion.

How do governments pay back debt?

The government borrows money by selling bonds. A bond is a promise to make payments to whoever holds it on certain dates. There is a large payment on the final date - in effect, the repayment. Interest is also paid to whoever owns the bond in the meantime.

Which nation has the largest debt?

As of December 2020, the nation with the highest debt-to-GDP ratio is Venezuela, and by a considerable margin. The South American country has what may be the world's largest reserves of oil, but the state-owned oil company is said to be poorly managed, and Venezuela's GDP has plummeted in recent years.

How do you calculate deficit in Excel?

Use formulas for the following:Total Income = sum of all income items for the month; ... Total Expenses = sum of all expense items for the month; ... Surplus or Deficit = Total Income - Total Expenses for the month; ... The "Total" column is the sum of all the amounts of the respective row for January through May;

How is fiscal deficit calculated with example?

The total income of the government is calculated by including taxes, non-debt capital receipts and other forms of revenue except borrowings. For example, if the GDP of a country is ₹100 lakh crore and the difference between total income and expenditure is ₹10 lakh crore then the fiscal deficit is 10%.

How do you calculate an annual rate?

The formula and calculations are as follows:Effective annual interest rate = (1 + (nominal rate / number of compounding periods)) ^ (number of compounding periods) - 1.For investment A, this would be: 10.47% = (1 + (10% / 12)) ^ 12 - 1.And for investment B, it would be: 10.36% = (1 + (10.1% / 2)) ^ 2 - 1.

How do you calculate surplus and deficit in economics?

0:060:55Goods market: Calculate the budget balance of government - YouTubeYouTubeStart of suggested clipEnd of suggested clipNow the budget deficit or surplus is calculated by taking the tax revenue of government - itsMoreNow the budget deficit or surplus is calculated by taking the tax revenue of government - its spending depending on the answer here you can decide where it's a deficit or a surplus.

How is the budget deficit measured?

The budget deficit should be compared to the country's ability to pay it back. That ability is measured by dividing the deficit by gross domestic product (GDP). The deficit-to-GDP ratio set a record of 27% in 1943 as the country geared up for World War II. 6 The deficit then was only about $55 billion and GDP was only $203 billion, both much lower than current numbers. 7

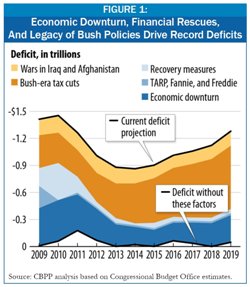

Why is the annual debt higher than the deficit?

The annual debt is higher than the deficit because Congress borrows from retirement funds. Looking at deficits by year shows how events influenced America's need to borrow money.

How can the government reduce the deficit?

The government can reduce the deficit by increasing revenues, decreasing spending, or both. It's a fine line, however. If the government pushes too far on either, its efforts can backfire and have the opposite effect.

How much is the deficit in 2021?

In February 2021, the Congressional Budget Office (CBO) predicted that as a result of the COVID-19 pandemic, the fiscal year (FY) 2021 deficit would be $2.3 trillion. 1 After the American Rescue Plan was passed in March 2021, that deficit was expected to increase to $3.4 trillion. 2 In the federal government's budget for fiscal year 2022, it estimated that the fiscal year 2021 budget deficit would be almost $3.7 trillion. By July 2021, the CBO estimated that the fiscal year 2021 deficit would be $3 trillion. 3 The budget deficit in 2020 was about $3.1 trillion, the largest in U.S. history. 4

Why is the federal deficit and debt a concern?

The federal deficit and debt are a concern for the country because the debt is held by those that have purchased Treasury notes and other securities. A continuous deficit adds to the national debt, increasing the amount owed to security holders. The concern is that the country will not be able to pay.

What is the budget deficit for 2020?

The Congressional Budget Office (CBO) predicted that the COVID-19 pandemic would raise the fiscal year (FY) 2020 deficit to $3.7 trillion. 1 . The CBO predicted the FY 2021 deficit to be $2.1 trillion.

Why is the federal deficit important?

The federal deficit and debt are concerns for the country because the majority of the national debt is held by those who have purchased Treasury notes and other securities. A continuous deficit adds to the national debt, increasing the amount owed to security holders.

What Is a Deficit?

A deficit is synonymous with a shortfall or loss and is the opposite of a surplus. A deficit can occur when a government, company, or person spends more than it receives in a given period, usually a year.

What is a deficit in government?

Budget deficit. A budget deficit occurs when a government spends more in a given year than it collects in revenues, such as taxes. As a simple example, if a government takes in $10 billion in revenue in a particular year, and its expenditures for the same year are $12 billion, it is running a deficit of $2 billion.

Why are fiscal deficits important?

On the other hand, the famous British economist John Maynard Keynes maintained that fiscal deficits allow governments to purchase goods and services that can help stimulate their economy—making deficits a useful tool for bringing nations out of recessions. Proponents of trade deficits say they allow countries to obtain more goods more than they produce—at least for a period of time—and can also spur their domestic industries to become more competitive globally.

What is a trade deficit?

A trade deficit exists when the value of a nation’s imports exceed the value of its exports. For example, if a country imports $3 billion in goods but only exports $2 billion worth, then it has a trade deficit of $1 billion for that year. In effect, more money is leaving the country than is coming in, which can cause a drop in the value ...

Why should governments not incur fiscal deficits regularly?

Also, many argue that governments should not incur fiscal deficits regularly because the cost of servicing the debt uses up resources that the government might deploy in more productive ways, such as providing education, housing, or public infrastructure. 1:12.

What are the two major types of deficits incurred by nations?

The two major types of deficits incurred by nations are budget deficits and trade deficits.

Why do governments run deficits?

Governments and businesses sometimes run deficits deliberately, to stimulate an economy during a recession or to foster future growth. The two major types of deficits incurred by nations are budget deficits and trade deficits.

Why is the current fiscal deficit justified?

The government’s current fiscal deficit is justified by the possibility that such actions can help the country recover from the recession in the near future. Fiscal deficit and trade deficit are among the most important kinds of deficit. Others include current account deficit, capital account deficit, primary deficit, and budget deficit.

What are the most important types of government deficits?

Fiscal deficits and trade deficits are among the most important kinds of government deficits.

What is the shortfall of the government?

Fiscal Deficit. Fiscal deficit refers to the shortfall that arises when a government spends more money than what it collects. The amount of the deficit also represents how much the government needs to borrow to pay for its excess expenditure. Governments can borrow money from the citizens of the country by issuing and selling government bonds.

What is the meaning of recession?

Recession Recession is a term used to signify a slowdown in general economic activity. In macroeconomics, recessions are officially recognized after two consecutive quarters of negative GDP growth rates. , even if it means increasing its fiscal ...

Why are deficits considered unsustainable?

It is why experts consider deficits to be highly unsustainable and detrimental to long-term economic stability . However, there are situations when entities willingly incur deficits for some future benefit. A government sometimes spends more money to develop the economy and create jobs during a recession.

How to finance the debt requirements of the government?

Another way to finance the debt requirements of the government is by printing new currency. This is known as deficit financing. As mentioned above, the creation of a fiscal deficit can be justified. However, fiscal deficits pose the following risks:

How does interest affect government expenditure?

Interest payments drive up government expenditure in subsequent periods and increase the deficit in the future. It leads to a phenomenon called the vicious cycle of debt, wherein governments have to take additional loans to pay off past debts.

Determination of The Annual Deficit

- In order to determine the annual deficit, all income and all expenses within a period, usually within a fiscal year, must first be added up. It is determined by subtracting the expenses from the income. The result is negative. If the result were positive, it would be a profit for the year. In orde…

The Annual Deficit in The Income Statement

- The net loss for the year is a loss and can be found last in the income statement . It is the negative business result for a financial year and represents the difference between expenses and income. However, it can be influenced. Earnings can be improved through the sale of assets and the release of hidden reserves . In order to exclude such special effects in the balance sheet ana…

Effects of The Annual Deficit

- Since an annual deficit is a surplus of expenses, it leads to a reduction in equity. In the worst case scenario, this can result in negative equity arise. In contrast to the annual surplus, which in the case of a corporation can be distributed to the partners, an annual deficit cannot be distributed to the partners. He must remain in the company. If profits were achieved in the previous year in th…

What Is A Deficit?

Understanding Deficits

- Whether the situation is personal, corporate, or governmental, running a deficit will reduce any current surplus or add to any existing debt load. For that reason, many people believe that deficits are unsustainable over the long term. On the other hand, the famous British economist John Maynard Keynes maintained that fiscal deficits allow governments to purchase goods and servi…

Other Deficit Terms

- Along with trade and budget deficits, these are some other deficit-related terms you may encounter: 1. Current account deficitis when a country is importing more goods and services than it exports. 2. Cyclical deficitsoccurwhen an economy is not performing well because of a down business cycle. 3. Deficit financingrefers to the methods governments use to finance their budg…

Risks and Benefits of Running A Deficit

- Deficits are not always unintentional or the sign of a government or business that's in financial trouble. Businesses may deliberately run budget deficits to maximize future earnings opportunities—such as retaining employees during slow months to ensure themselves of an adequate workforce in busier times. Also, some governments run deficits to finance large publi…

Today's Federal Budget Deficit in The U.S.

- In September 2020, the Congressional Budget Office (CBO) projected a federal budget deficit of $3.3 trillion for 2020, more than triple the deficit for 2019. The increase, the CBO explained, "is mostly the result of the economic disruption caused by the 2020 coronavirus pandemic and the enactment of legislation in response." 1 The CBO added that a $3.3 trillion budget deficit woul…