What are the 5 types of annuities?

Types of Annuity: Types of annuities in India includes immediate annuity, variable annuity, Deferred, Fixed and lump-sum annuity. Read to know more. Types of Annuity: Immediate, Deferred, Fixed & Variable Annuities

Is annuity a good retirement plan?

Annuities are a good way to supplement your income during retirement by providing a reliable income stream. Many people buy an annuity after maxing out other tax-advantageous savings accounts, such as a 401(k) or an IRA.

What is an example of ordinary annuity?

Annuity Examples

- The Pension Plan

- Mega Millions Annuity

- Powerball Annuity

- Court Settlement

- Tax-Sheltered Annuity

What is an annuity and how does it work?

Often marketed as a financial product, an annuity is basically a contract between you and an insurance company designed to provide an income that is guaranteed for the rest of your life. You make a payment (or payments) to an insurance company and, in return, they promise to grow that money and send you payments during retirement.

What is an annuity in simple terms?

An annuity is a long-term investment that is issued by an insurance company and is designed to help protect you from the risk of outliving your income. Through annuitization, your purchase payments (what you contribute) are converted into periodic payments that can last for life.

What is the example of simple annuity?

For example, most car loans are ordinary simple annuities where payments are made monthly and interest rates are compounded monthly. As well, car loans do not require the first monthly payment until the end of the first month.

How is annuity used in real life?

Annuities are used mainly to supplement more traditional sources of retirement income such as Social Security and pension plans. Common features include: Tax-deferred growth. You will pay no income taxes on the earnings from your annuity investments until you begin making withdrawals or receiving periodic payments.

Is bills an example of annuity?

Many monthly bills, such as rent, car payments, and cellphone payments, are annuities due because the beneficiary must pay at the beginning of the billing period.

What are the 3 types of annuities?

The three main types of annuities are fixed annuities, fixed indexed annuities and variable annuities, which can be immediate or deferred. The immediate and deferred classifications indicate when you will begin receiving payments.

How do you get an annuity?

0:2916:15How To Calculate The Present Value of an Annuity - YouTubeYouTubeStart of suggested clipEnd of suggested clipTimes 1 minus 1 plus r r being the interest rate raised to the negative n divided by r.MoreTimes 1 minus 1 plus r r being the interest rate raised to the negative n divided by r.

What is another word for annuity?

In this page you can discover 12 synonyms, antonyms, idiomatic expressions, and related words for annuity, like: income, rente, lump-sum, pension, annuitant, endowment, , mortgage, sipp, and tax-free.

What is the purpose of an annuity?

What is an annuity? An annuity is a long-term insurance product that provides guaranteed income. Annuities are a common source of retirement income because they provide a steady stream of payments at regular intervals and because their earnings grow tax-deferred1 until you withdraw funds.

What's the benefit of an annuity?

One of the key benefits of an annuity is that it allows the investor to save money without paying taxes on the interest until a later date. Annuities have no contribution limits, unlike 401(k)s and IRAs. Another significant benefit of annuities is the creation of a predictable income stream to fund retirement.

How much does a 100 000 annuity pay per month?

A $100,000 annuity would pay you approximately $508 each month for the rest of your life if you purchased the annuity at age 60 and began taking payments immediately.

What is the best type of annuity?

The best type of annuity for retirees Annuities come in many forms, but the best type for most retirees is a single premium immediate annuity, also known as an immediate fixed annuity. These annuities offer monthly payments that usually begin shortly after they're purchased with a lump-sum payment.

How do annuities make money?

How Annuities Work. An annuity is a contract between an individual and an insurance company. The investor contributes a sum of money—either all up-front or in payments over time—and the insurer promises to pay them a regular stream of income in return. With an immediate annuity, that income begins almost right away.

What is an annuity?

An annuity is a financial product that allows investors to save for retirement by housing their money with an insurance company or brokerage that will help it grow.

What is an immediate annuity?

Immediate: Also known as a single premium immediate annuity, these annuities allow an annuitant to receive immediate income payments as soon as the premium is paid with a lump-sum amount. Typically used to supplement the annuitant’s retirement account immediately, the purchaser cannot cancel this type of annuity.

How long does an annuity surrender?

Most annuities also have a surrender period, usually in the first five to 10 years of the annuity. The annuitant will incur surrender charges, or fees, if they prematurely withdraw funds or cancel during this period. Early withdrawal is also subject to income tax and a possible 10 percent tax penalty from the Internal Revenue Service (IRS).

How do you fund a deferred income annuity?

Deferred: You can fund a deferred income annuity through regular payments or a lump-sum payment. This type of annuity then grows during the accumulation period. The accumulation is tax-deferred and then either withdrawn or distributed back to the annuitant at an agreed-upon future date. Companies disburse payments for deferred income annuities as either a lump sum or series of payments.

What is settlement in annuity?

A settlement typically includes a one-time lump sum of cash, followed by regular payments. An annuity distributes these payments.

What is equity index annuity?

An equity-indexed annuity is a type of fixed annuity that earns interest based on a portion of an equities index, typically the S&P 500. An …

What is inflation protected annuity?

An inflation-protected annuity is a type of annuity that has been designed to provide inflation protection. This means it will increase in value as inflation …

How many times does Mega Millions pay an annuity?

The annuity payout from Mega Millions is paid one time immediately and then twenty-nine annual payments, each five percent larger than the previous.

What is pension plan?

A pension plan is a type of retirement plan for which an employer contributes to a worker’s pool of account funds. The fund is invested on the worker’s behalf and produces earnings when the worker retires.

What happens to pension plans when they retire?

When pension plan owners retire, they can either take the plan’s value in a lump sum or payments for the rest of the owner’s life. The payments are in the form of an annuity.

What are the different types of annuities?

Fixed annuities pay out a guaranteed amount. This type of annuity comes in two different styles—fixed immediate annuities, which pay a fixed rate right now, and fixed deferred annuities, which pay you later . The downside of this predictability is a relatively modest annual return, generally slightly higher than a certificate of deposit (CD) from a bank.

What is an annuity contract?

An annuity is a contract between you and an insurance company in which you make a lump-sum payment or series of payments and, in return, receive regular disbursements, beginning either immediately or at some point in the future.

What is variable annuity?

Variable annuities provide an opportunity for a potentially higher return, accompanied by greater risk. In this case, you pick from a menu of mutual funds that go into your personal "sub-account.". Here, your payments in retirement are based on the performance of investments in your sub-account.

How long can you receive an annuity?

You can choose to receive payments for a specific period of time, such as 25 years, or for the rest of your life. Of course, securing a lifetime of payments can lower the amount of each check, but it helps ensure that you don't outlive your assets, which is one of the main selling points of annuities.

When can you withdraw an annuity without penalty?

Funds accrue on a tax-deferred basis and—like 401 (k) contributions—can only be withdrawn without penalty after age 59½. 1

Is an annuity income taxed?

The income you receive from an annuity is taxed at regular income tax rates, not long-term capital gains rates, which are usually lower.

Can you annuitize lump sum?

Many aspects of an annuity can be tailored to the specific needs of the buyer. In addition to choosing between a lump-sum payment or a series of payments to the insurer, you can choose when you want to annuitize your contributions—that is, start receiving payments.

What is annuity in financial terms?

Define Annuities: Annuity means a regular payment stream of equal amounts over a stated period.

What Does Annuity Mean?

What is the definition of annuity? Most investment and loans are set up as annuities to keep the terms simple. Let’s take a look at both of these examples.

What determines the interest rate and the time value of money needed to recoup their principle?

The bank determines the interest rate and the time value of money needed to recoup their principle and generate the adequate return on the loan.

Is a loan considered an annuity?

Loans are also set up as annuities. Sometimes people don’t think of them as annuities because they are not receiving the payments. Remember annuities are just agreements with equal payments and time intervals. When a business signs a loan with a bank, it agrees to make a payment each month for specific amount.

What is an annuity?

Annuities Explained. An annuity is a contract between you and an insurance company in which you purchase a stream of payments to yourself over time. There are a number of annuity types, allowing you to find which one fits your needs and comfort level.

What is annuity insurance?

Annuities are insurance products that provide a reliable, steady stream of payments to support your financial needs for the rest of your life or for a pre-determined number of years.

What is the difference between annuities and 401(k)?

Here are some of those differences: Availability. 401 (k) plans are available only to individuals whose employers offer them. Annuities are not employer-sponsored and can be purchased by anyone. Contribution limits.

How does a fixed annuity work?

Fixed annuities work by providing periodic payments in the amounts specified in the contract. If your contract says the payout rate is 5 percent on a $100,000 annuity, for example, then you will receive $5,000 worth of payments every year covered by the contract.

What is variable annuity?

Variable annuities have payout rates that vary, depending on the performance of an investment portfolio. The amount you receive in payments depends on how much money the portfolio gains or loses. This is riskier, but also has the potential of paying you more. Expand.

Why do people roll their 401(k) into annuities?

Some people chose to roll all or part of their 401 (k) savings into annuities as a means of providing a stream of income to fund retirement.

Why invest in an annuity?

Investing in a fixed annuity, as opposed to the stock market, protects your money from the overall economic threats that can diminish your nest egg in the short term, said Wenliang Hou, senior research advisor at the Center for Retirement Research at Boston College.

What is an annuity?

An annuity is an agreement with an insurance company in which you make a lump sum payment (one-time big payment) or series of payments and, in return, receive a regular fixed income, beginning either immediately or after some predefined time in the future.

What is Annuity Formula?

The annuity formula helps in determining the values for annuity payment and annuity due based on the present value of an annuity due, effective interest rate, and several periods. Hence, the formula is based on an ordinary annuity that is calculated based on the present value of an ordinary annuity , effective interest rate, and several periods. The annuity formulas are:

What is the future value of an annuity?

The future value of an annuity, FV = P× ( (1+r) n −1) / r

How to calculate annuity due?

What is the Formula to Calculate Annuity of Ordinary and Due? 1 PVA Due = Present value of an annuity due 2 r = Effective interest rate 3 n = number of periods

Why is an annuity important?

Pension Schemes, Bank Loans, Bond Markets all depend on annuity calculation. It is simple but extremely important to find the present value of Future Cash Flows.

What is an ordinary annuity?

What is Ordinary Annuity? An Ordinary annuity is fixed payment made at the end of equal intervals (Semi-annually, Quarterly or monthly), which is mostly used to calculate the present value of fixed payment paying securities like Bonds, Preferred shares, pension schemes, etc.

Is default risk considered in an ordinary annuity?

It considers that the payment will be fixed throughout the tenure, due to financial distress, the default risk is not considered. Ordinary Annuity always shows the best picture. That is, if all the payments are invested at the exact specified interest rate, then the outcome will match as per the result.

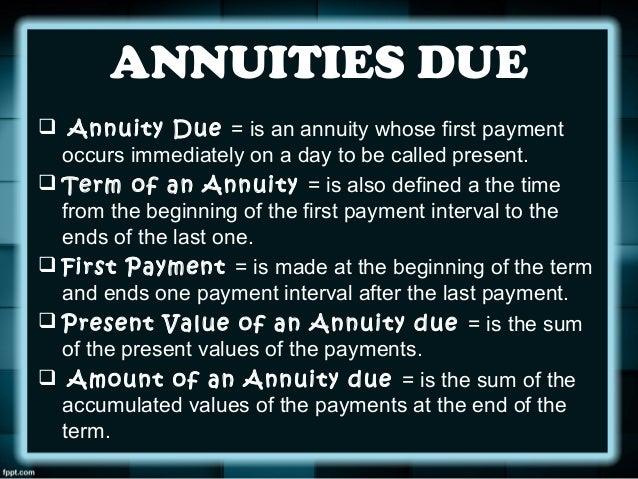

What Is Annuity Due?

An annuity due is an annuity whose payment is due immediately at the beginning of each period. A common example of an annuity due payment is rent, as landlords often require payment upon the start of a new month as opposed to collecting it after the renter has enjoyed the benefits of the apartment for an entire month.

What is an immediate annuity?

An immediate annuity is an account, funded with a lump sum deposit, that generates an immediate stream of income payments. The income can be for a stated amount (e.g., $1,000/month), a stated period (e.g., 10 years), or a lifetime.

How does annuity due work?

How Annuity Due Works. An annuity due requires payments made at the beginning, as opposed to the end, of each annuity period. Annuity due payments received by an individual legally represent an asset. Meanwhile, the individual paying the annuity due has a legal debt liability requiring periodic payments.

What is a whole life annuity?

A whole life annuity due is a financial product sold by insurance companies that require annuity payments at the beginning of each monthly, quarterly, or annual period, as opposed to at the end of the period. This is a type of annuity that will provide the holder with payments during the distribution period for as long as they live. After the annuitant passes on, the insurance company retains any funds remaining.

What happens when an annuity expires?

Once an annuity expires, the contract terminates and no future payments are made. The contractual obligation is fulfilled, with no further duties owed from either party.

What does the present value of an annuity tell us?

The present value of an annuity due tells us the current value of a series of expected annuity payments. In other words, it shows what the future total to be paid is worth now.

What does future value mean in annuities?

The future value of an annuity due shows us the end value of a series of expected payments or the value at a future date.

What Is An Annuity?

Understanding Annuities

- The goal of an annuity is to provide a steady stream of income, typically during retirement. Funds accrue on a tax deferred basis and—like 401(k) contributions—can only be withdrawn without penalty after age 59½.1 Many aspects of an annuity can be tailored to the specific needs of the buyer. In addition to choosing between a lump-sum payment or a series of payments to the insu…

Types of Annuities

- Annuities come in three main varieties: Fixed, variable, and indexed. Each type has its own level of risk and payout potential. For any of these, it is often structured as a deferred annuity.

Tax Treatment of Annuities

- An important feature to consider with any annuity is its tax treatment. While the balance grows on a tax deferred basis, the disbursements you receive are subject to income tax.2 The funds you receive are taxed at your regular income tax rates. By contrast, mutual funds that you hold for over a year are taxed at the long-term capital gains rate, which is generally lower. Additionally, unlike …