What does owner Equity mean?

Owner's equity represents investments made by owners. On the balance sheet, the assets of a company equal its liabilities plus equity. Therefore, equity equals assets minus liabilities.

Is equity in my company the same as ownership?

Yes, equity relates to ownership but not necessarily control. To clarify, if you start a company as the sole founder, you’ll own all of the issued shares and will therefore own 100% of the company. If you sell it, you get 100% of the sale price. Let’s say you created the company with 100,000 shares in the first place.

What is owner Equity on balance sheet?

Owner's equity is the amount that belongs to the owners of the business as shown on the capital side of the balance sheet and the examples include common stock and preferred stock, retained earnings. accumulated profits, general reserves and other reserves, etc.

Does owners equity appear in balance sheet?

The balance sheet represents the financial position of the company. Therefore, the assets held by the business would be balanced by the corresponding liabilities and the owner’s equity. The owner’s equity represents the amount of the capital given by the owners to start the business and the business is liable to return them and therefore they form a important component of the balance sheet.

Is capital Another term for owner's equity?

Capital or Equity The fund invested by the owner in the business or the net amount claimable by the owner from the business is known as the Capital or Owner's Equity or Net Worth.

What is another name for equity in accounting?

stockholders' equityYou may hear of equity being referred to as “stockholders' equity” (for corporations) or “owner's equity” (for sole proprietorships). Equity can be calculated as: Equity = Assets - Liabilities. The word “equity” can also be used to refer to personal finances.

What is owner's equity in simple words?

In simple terms, owner's equity is defined as the amount of money invested by the owner in the business minus any money taken out by the owner of the business.

What type of account is owner's equity?

There are several types of equity accounts that combine to make up total shareholders' equity. These accounts include common stock, preferred stock, contributed surplus, additional paid-in capital, retained earnings, other comprehensive earnings, and treasury stock.

What is another term for equity quizlet?

owners' equity. Another term for stockholders' equity. The owners' claim in the assets of the entity. Sometimes called net assets; the difference between assets and liabilities. paid-in capital.

Is owner's equity an asset?

Assets are the total of your cash, the items that you have purchased, and any money that your customers owe you. Liabilities are the total amount of money that you owe to creditors. Owner's equity, net worth, or capital is the total value of assets that you own minus your total liabilities.

What is owner's equity quizlet?

Owners' equity is the total assets of an entity, minus its total liabilities.

How do you find owner's equity in accounting?

The formula for owner's equity is: Owner's Equity = Assets – Liabilities.

What is an equity in accounting?

The equity meaning in accounting refers to a company's book value, which is the difference between liabilities and assets on the balance sheet. This is also called the owner's equity, as it's the value that an owner of a business has left over after liabilities are deducted.

Is equity the same as capital?

Equity represents the total amount of money a business owner or shareholder would receive if they liquidated all their assets and paid off the company's debt. Capital refers only to a company's financial assets that are available to spend.

What is other equity in balance sheet?

Other Equity Securities means any Capital Stock, other than the Common Stock, Convertible Securities or Options.

Is net assets the same as equity?

Definition: Net assets are more commonly referred to as equity. This is the amount of retained earnings that are left in the business. In other words, the retained earnings or profits made by the company are not distributed to the owners. The profits are left in the business to help it grow.

What is the most accurate synonym for owner's equity?

In my opinion, the most common and accurate synonym for owner's equity is: net asset value.

Is a stockholder the same as a shareholder?

Shareholders and stockholders are the same thing and refer to the individual owners of shares (small amounts) of a company.

Is equity and capital a synonym?

As you will see in the comments at the bottom of the page, many people believe that equity and capital are synonyms. Actually, that's not true.

What is owner equity?

What is owner’s equity? Owner’s equity is essential ly the owner’s rights to the assets of the business. It’s what’s left over for the owner after you’ve subtracted all the liabilities from the assets.

How is owner's equity calculated?

Owner’s equity is calculated by adding up all of the business assets and deducting all of its liabilities.

What is a statement of owner’s equity?

Some financial statements include a statement of owner’s equity. This financial statement provides details about the changes to the owner’s capital account over a certain period, such as:

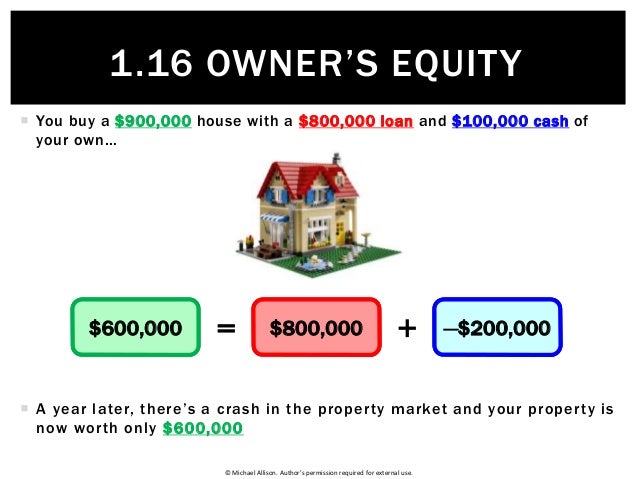

Why is owner's equity negative?

Owner’s equity can be negative if the business’s liabilities are greater than its assets. In this case, the owner may need to invest additional money to cover the shortfall. When a company has negative owner’s equity and the owner takes draws from the company, those draws may be taxable as capital gains on the owner’s tax return.

What is equity in a business?

Money invested by the owner of the business. Plus profits of the business since its inception. Minus money taken out of the business by the owner. Minus money owed to others. If the business is structured as a corporation, equity may also include accounts like: Retained earnings. Common stock. Preferred stock.

What is the difference between assets and liabilities?

Assets – Liabilities = Owner’s Equity. The term “owner’s equity” is typically used for a sole proprietorship. It may also be known as shareholder’s equity or stockholder’s equity if the business is structured as an LLC or a corporation.

What is closing balance?

Decreases to equity from losses or capital distributions. The closing balance of the owner’s capital account. The closing balances on the statement of owner’s equity should match the equity accounts shown on the company’s balance sheet for that accounting period.

What is owner equity?

Owner's equity is one of the three main sections of a sole proprietorship's balance sheet and one of the components of the accounting equation: Assets = Liabilities + Owner's Equity. Owner's equity represents the owner's investment in the business minus the owner's draws or withdrawals from the business plus the net income (or minus the net loss) ...

Why is owner's equity a residual claim?

Owner's equity is viewed as a residual claim on the business assets because liabilities have a higher claim. Owner's equity can also be viewed (along with liabilities) as a source of the business assets.

Is owner's equity fair market value?

Due to the cost principle (and other accounting principles) the amount of owner's equity should not be considered to be the fair market value of the business.