What is Asset-Based Valuation?

- Asset-Based Valuation Explained. Asset-based valuation model derives the value of a company by determining the fair market value of its assets.

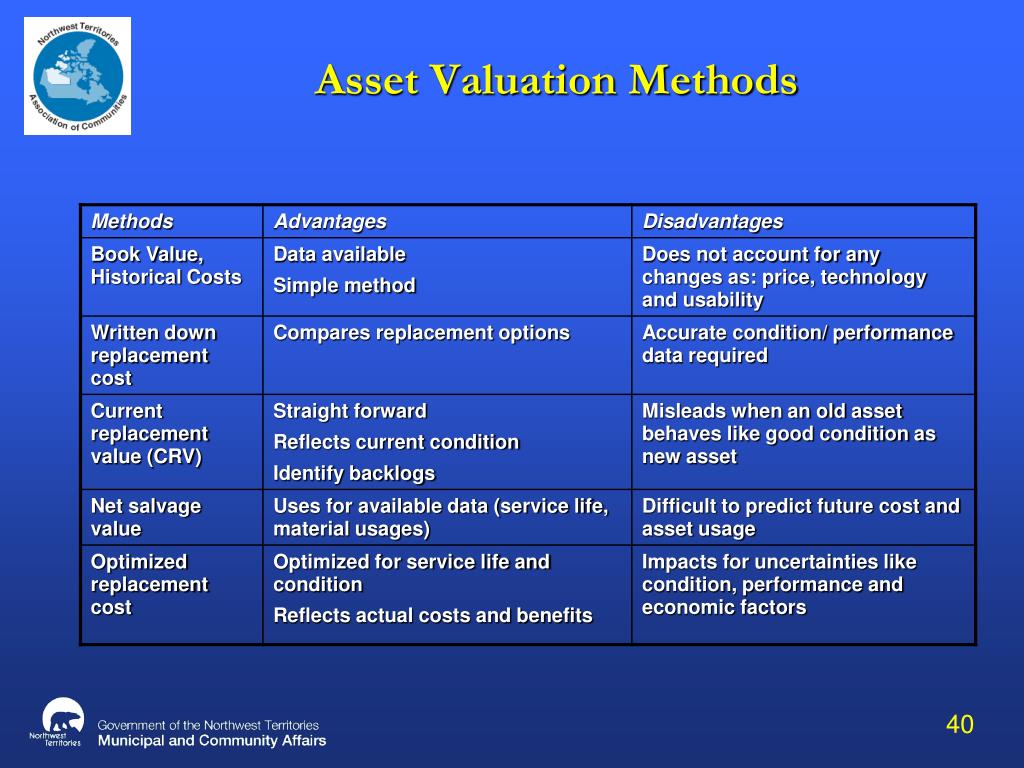

- Asset-Based Valuation Methods. ...

- Examples. ...

- Pros and Cons. ...

- Frequently Asked Questions (FAQs) What are the three methods of valuation? ...

- Recommended Articles. ...

What are the methods of asset valuation?

Methods of Asset Valuation. Valuing fixed assets can be done using various methods, which include the following: 1. Cost Method. The cost method is the easiest way of asset valuation. It is done by basing the value on the historical price for which the asset was bought. 2. Market Value Method.

How to determine value of asset?

To compute the net tangible assets of a company:

- The company needs to look at its balance sheet and identify tangible and intangible assets.

- From the total assets, deduct the total value of the intangible assets.

- From what is left, deduct the total value of the liabilities. What is left are the net tangible assets or net asset value.

How to calculate asset market value?

- Get the balancesheet

- Reduce all liabilities except shareholders funds from Assets

- Shares holders fund means equity +free reserves +any Gen reserve

- What you are left with is called networth

- Divide the same by no of shares

- Here you are that's the book value per share.

What is asset valuation in accounting?

Asset valuation is a procedure in which the value of an asset is determined. This is done in order to confirm that the value is reported accurately and appropriately on balance sheets. If assets are not valued properly, it can create a skewed value in accounting documents which can in turn lead to failure on an accounting audit , problems with ...

Why is asset-based valuation important?

In the event that two companies are merging, or if a company is to be taken over, asset valuation is important because it helps both parties determine the true value of the business.

What is the asset-based approach?

In the simplest terms, an asset-based approach focuses on strengths. It views diversity in thought, culture, and traits as positive assets. Teachers and students alike are valued for what they bring to the classroom rather than being characterized by what they may need to work on or lack.

What is meant by asset-based?

Asset-based finance is a specialized method of providing companies with working capital and term loans that use accounts receivable, inventory, machinery, equipment, or real estate as collateral. It is essentially any loan to a company that is secured by one of the company's assets.

What are the three important elements of asset valuation?

The 3 Elements of Valuation: Assets, Earnings Power and Profitable GrowthThe value of the assets. “We begin with the balance sheet and examine the value of the company's assets at the end of the most recent operating period, as determined by the company's accountants. ... Earnings power value. ... The value of growth. ... Summary.

How do you do an asset based valuation?

In its most basic form, the asset-based value is equivalent to the company's book value or shareholders' equity. The calculation is generated by subtracting liabilities from assets. Often, the value of assets minus liabilities differs from the value reported on the balance sheet due to timing and other factors.

What are the 5 methods of valuation?

There are five main methods used when conducting a property evaluation; the comparison, profits, residual, contractors and that of the investment. A property valuer can use one of more of these methods when calculating the market or rental value of a property.

What are two major methods of asset valuation?

There are two main axes on which to think about asset based business valuation. The first is the asset valuation methodology, and the second is the type of asset you are trying to value. There are many different methodologies, but the most common are the cost approach, the market approach, and the income approach.

What are the two types of valuation What is meant by asset-based valuation?

An asset-based valuation approach determines the fair market value of all assets to determine the current worth of the firm. The method is important because assets are an important factor in the revenue generation process. The common valuation methods are asset accumulation and the excess earning valuation method.

What is NAV used for?

NAV stands for net asset value. In finance, it is used to evaluate the value of a firm or an investment fund by subtracting its liabilities from assets.

What are the four valuation methods?

4 Most Common Business Valuation MethodsDiscounted Cash Flow (DCF) Analysis.Multiples Method.Market Valuation.Comparable Transactions Method.

What is an asset based approach in health?

– Asset-based approaches enable people to share their views and experiences of local services, access to health assets and their personal/collective aspirations. They allow active participation by the community in the planning, delivery and outcomes of services and the generation of community-based solutions.

What is asset based approach in social work?

Asset based approaches recognise and build on a combination of the human, social and physical capital that exists within local communities. They acknowledge and build on what people value most and can help ensure that public services are provided where and how they are needed.

What are asset based approaches to community development?

t Asset-based Community Development (ABCD) is a powerful approach focused on discovering and mobilizing the resources that are already present in a community. The ABCD approach provides a way for citizens to find and mobilize what they have in order to build a stronger community.

What is an assets based community development model?

Asset Based Community Development (ABCD) is a strategy for sustainable community- driven development. Beyond the mobilization of a particular community, ABCD is concerned with how to link micro-assets to the macro-environment.

What is asset valuation?

Asset valuation is the process of determining the fair market value of an asset. Asset valuation often consists of both subjective and objective measurements. Net asset value is the book value of tangible assets, less intangible assets and liabilities. Absolute value models value assets based only on the characteristics of that asset, ...

What is net asset value?

The net asset value – also known as net tangible assets – is the book value of tangible assets on the balance sheet (their historical cost minus the accumulated depreciation) less intangible assets and liabilities – or the money that would be left over if the company was liquidated.

What is absolute value model?

Absolute value models value assets based only on the characteristics of that asset. These models are known as discounted cash flow (DCF) models, and value assets like stocks, bonds and real estate, based on their future cash flows and the opportunity cost of capital. They include:

What is the term for valuing a company's stock before it goes public?

Venture capitalists refer to valuing a company's stock before it goes public as pre-money valuation. By looking at the amounts paid for similar companies in past transactions, investors get an indication of an unlisted company's potential value. This is called precedent transaction analysis .

Is a stock undervalued?

A stock would be considered undervalued if its market value were below book value, which means the stock is trading at a deep discount to book value per share. However, the market value for an asset is likely to differ significantly from book value – or shareholders’ equity – which is based on historical cost.

Can a company overvalue its goodwill?

However, there's no number on the financial statements that tell investors exactly how much a company's brand and intellectual property are worth. Companies can overvalue goodwill in an acquisition as the valuation of intangible assets is subjective and can be difficult to measure.

Why is asset valuation important?

Asset valuation is important for because it provides information on how much your business is worth. It plays an important role in valuation of privately held companies because there are no comparable companies to use for comparison purposes. Otherwise, you can use publicly traded companies as a reference point for comparison.

What are the types of asset-based valuation

The types of asset-based valuation include historical value, replacement value and liquidation value. These three methods look at the asset’s past, present and estimated future value to determine the asset’s worth.

How is historical value chosen?

The historical method or book value method is used for tangible or intangible assets that have a history of being sold. It uses the cost of an asset minus depreciation as its starting point for determining what it is worth.

What is the replacement value method?

The second type of asset-based valuation is called the replacement value. This method uses replacement costs to determine what an asset should cost. It looks at how much it would cost to replace the road, machinery or property that you have and subtracts any depreciation from this amount.

What is liquidation value?

The third method of valuing assets is called the liquidation value. This type of valuation begins by using the historical costs as a starting point and then decreases them based on how much it would cost to sell the asset.

How is liquidation value different from historical value?

The primary difference between historical value and liquidation value is that in using the latter, you are valuing assets in an ongoing business which means you take into account operating costs. The historical value method is only concerned with the past costs, whether or not it would cost more to keep or sell the asset.

What are the benefits of asset-based valuation?

One of the main benefits of using asset-based valuation is that it can help you determine your company’s worth in determining whether or not an investor should purchase your business.

Asset Based Valuation – Approaches

This valuation method requires an accountant or analyst to follow one of the below two approaches:

Asset Based Valuation Methods

This method involves subtracting assets from liabilities to get the value of a business. Therefore, its default value equals the book value of shareholders ’ equity. However, we need the fair market values of the assets and liabilities. So this results in a deviation from the shareholders’ equity value.

Challenges

One major challenge with this valuation method comes up when one needs to adjust net assets. The values on the balance sheet do not show the fair market value because it shows the assets’ value at cost price less depreciation.

Final Words

Asset-Based Valuation is a relatively simple and straightforward method to arrive at a valuation. Analysts prefer this method because one can apply this method even in cases when a firm is suffering from liquidity issues. Also, analysts prefer this method for valuing core niches, such as the real estate industry.

Sanjay Bulaki Borad

Sanjay Borad is the founder & CEO of eFinanceManagement. He is passionate about keeping and making things simple and easy. Running this blog since 2009 and trying to explain "Financial Management Concepts in Layman's Terms".

What is asset based valuation?

An adjusted asset-based valuation seeks to identify the market value of assets in the current environment. Balance sheet valuations use depreciation to decrease the value of assets over time. Thus, the book value of an asset is not necessarily equivalent to the fair market value .

Why is asset based value important?

Furthermore, the asset-based value can also be an important consideration when a company is planning a sale or liquidation . The asset-based approach uses the value of assets to calculate a business entity's valuation.

What is depreciation on a balance sheet?

Balance sheet valuations use depreciation to decrease the value of assets over time. Thus, the book value of an asset is not necessarily equivalent to the fair market value . Other considerations for net asset adjustments may include certain intangibles that are not fully valued on the balance sheet or included on the balance sheet at all.

Why is asset minus liabilities different from balance sheet?

Often, the value of assets minus liabilities differs from the value reported on the balance sheet due to timing and other factors. Asset-based valuations can provide latitude for using market values rather than balance sheet values. Analysts may also include certain intangible assets in asset-based valuations that may or may not be on ...

How to identify a company's value?

There are a few different ways to identify a company’s value. Two of the most common are the equity value and enterprise value. The asset-based approach can also be used in conjunction with these two methods or as a standalone valuation. Both equity value and enterprise value require the use of equity in the calculation.

Do you need equity to calculate enterprise value?

Both equity value and enterprise value require the use of equity in the calculation. If a company does not have equity, analysts may use the asset-based valuation as an alternative. Many stakeholders will also calculate the asset-based value and use it comprehensively in valuation comparisons. The asset-based value may also be required ...

Asset Valuation Approaches

Since the core of an asset-based valuation is determining the underlying value of the assets (subtracted from liabilities) it is important to determine how the assets will be valued in the first place. There are multiple ways to value assets:

Asset-Based Valuation Example

Let’s look at an example Net Book Value calculation using our hypothetical business - Bob’s Tees R Us:

Asset-Based Valuation vs Enterprise Value and Equity Value

As shown above, asset-based valuations can be calculated simply by knowing the assets and liabilities of a company. It does not rely on placing a value on a company’s underlying equity. While this simplicity makes asset-based valuations useful, it may also result in an understatement of the actual market value (or ‘enterprise value’) of a business.

Businesses Worth More Than Asset Value

In nearly every case, a successful company with good cash flows will have an enterprise value that exceeds its asset value.

Businesses Worth Less Than Asset Value

However, it’s not always the case that a company’s enterprise value will exceed its asset value. Recently, we’ve come across several companies for sale with substantial fixed assets – generally in the form of manufacturing equipment.

What is the challenge of asset based valuation?

The adjusted asset-based business valuation aims at identifying the market value of the current environment, and the balance sheet valuations use depreciation to reduce the value of the assets over time. So, the book value of an asset is not specifically equivalent to their fair market value.

What is the second kind of asset based valuation method?

This approach is a combination of the income and the asset-based valuation method. In this method, we do not just evaluate the tangible assets and liabilities in the company; The goodwill of the business is also worked out. To be able to determine the goodwill of the company, the earnings of the businesses are treated as input and then a connection is drawn to the income method.

Why is the value of assets minus liabilities different from the value of liabilities?

Most of the time, the value of the assets minus the liabilities can be different from the values that are reported on the balance sheet due to timing and other factors. An asset-based business valuation can offer latitude for using market values instead of the balance sheet values.

What is the first method of calculating the value of a company?

The first method is called the asset accumulation method, that bears a striking similarity to the widely known balance sheet. In this method, all the assets and liabilities of a company are compiled and each one is given a value. And the value of the company here is the difference between the value of its assets and liabilities. Even though this sounds very simple, the devil is in the details.

What are the three main approaches to calculating the value of a business?

Of the many approaches to calculating the value of a business, there are three main types, namely the income-based, asset-based and market-based approach. It is normal if you don’t know the value of your business off the top of your head. While you may have a general idea of what your business is worth, its a good thing to find out, ...

Is the value of a business the same as the selling price?

The value of a business and its selling price are not the same. The reason why many businesses conduct the asset-based valuation is to get what an entity would go for in theory. Nonetheless, in reality the value of the entity varies based on the person doing the valuation.

Breaking Down The Asset-Based valuation Approach

- Cost includes actual machinery and equipment, as well as furniture. However, it’s important to note that cost comprises lost income, especially in cases where a business is listed. Items wear out, and they need to be replaced eventually. Additionally, the valuation process should consider …

Business Value vs. Selling Price

- The selling price of a business and its value are not the same. The reason businesses conduct asset-based valuation is to find out what an entity would go for, theoretically speaking. However, practically speaking, the value of an entity varies, based on the person doing the valuation. So, an overexcited buyer looking to replace losses can choose to pay a substantial sum just to acquire …

Pros and Cons of Asset-Based valuation

- Most companies use the appropriate asset valuation method in cases where they are experiencing issues relating to liquidation. Companies in the investment niche – like financial or real estate investment, where assets are calculated based on income or market approach – can also use asset-based valuation. That said, asset-based valuation is not without its drawbacks. U…

Conclusion

- While there are several methods that can be used to value a business, asset-based valuation is often preferred because of its applicability in instances where a business is suffering from challenges relating to liquidity. The asset-based method is highly favorable for core niches like the real estate sector. However, it comes with its own disadvantages, such as the fact that it’s quite …

Related Readings

- Thank you for reading CFI’s guide to Asset-Based Valuation. To keep learning and advancing your career, the following resources will be helpful: 1. Market Valuation Approach 2. Projecting Balance Sheet Items 3. Types of Assets 4. Valuation Methods

Asset-Based valuation Methods

- This method involves subtracting assets from liabilities to get the value of a business. Therefore, its default value equals the book value of shareholders’ equity. However, we need the fair market values of the assets and liabilities. So this results in a deviation from the shareholders’ equity value. We will discuss below the two most popular Asset-Based Valuation methods:

Pros and Cons of Asset Based valuation

- Below are the prosof this valuation method: 1. This method of valuation can prove extremely useful when a company is facing liquidation issues. 2. One can also use this method to value firms in the investment segment. 3. We can use this method for both equity value and enterprise value, but only if there is no equity involved. 4. Even though this method considers the assets an…

Challenges

- One major challenge with this valuation method comes up when one needs to adjust net assets. The values on the balance sheet do not show the fair market value because it shows the assets’ value at...

- Another issue that many faces are regarding certain intangible assets for whom the balance sheet does not reflect the full value. Or the balance sheet does not show these intangibles at …

- One major challenge with this valuation method comes up when one needs to adjust net assets. The values on the balance sheet do not show the fair market value because it shows the assets’ value at...

- Another issue that many faces are regarding certain intangible assets for whom the balance sheet does not reflect the full value. Or the balance sheet does not show these intangibles at all.

- Moreover, there are certain intangibles (trade secrets) that a company would not want to value. But for the purpose of this valuation, the company would have to value it. Valuing such intangibles c...

- Lastly, a firm may also face challenges when making adjustments to liabilities. Making mark…

Final Words

- Asset-Based Valuation is a relatively simple and straightforward method to arrive at a valuation. Analysts prefer this method because one can apply this method even in cases when a firm is suffering from liquidity issues. Also, analysts prefer this method for valuing core niches, such as the real estate industry. However, to accurately execute this...