What Are Assets, Liabilities, and Equity?

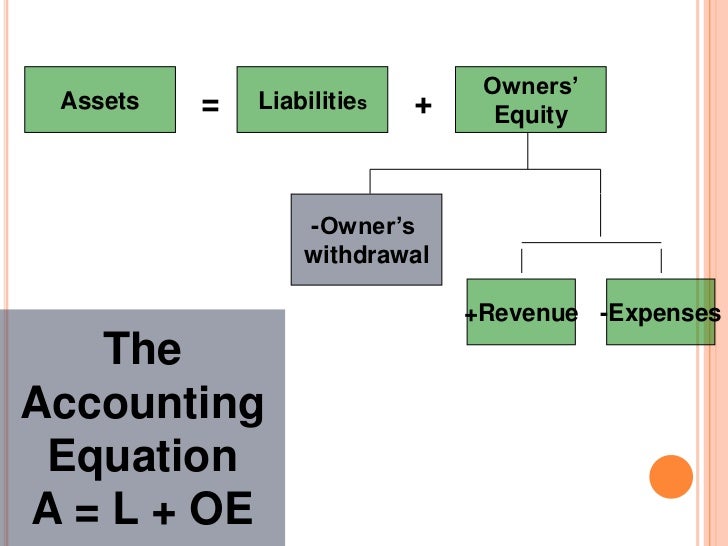

- The Accounting Equation. It’s a big name for a simple-looking formula (Seriously, doesn’t “the accounting equation” just sound important?).

- Assets. Assets mean anything that a company possesses. ...

- Liabilities. Liabilities mean everything that the company owes to other people. ...

- Equity. ...

- The Accounting Equation & Bookkeeping. ...

When liabilities are greater than assets?

What happens when the current liabilities are greater than the current assets? It means the business is counting on profits or new investment to pay its bills over the next year. That’s consider imprudent in a normal business, but is common in start-ups and fast-growing businesses.

Is shareholder equity an asset or liability?

The total of a firm's liabilities and stockholder equity must always be equal to its assets. Although a stockholder's equity has similarities to a liability, it is not considered to be a liability itself.

What is an asset vs liability?

- Accrued expenses

- Taxes

- Accounts payable

- Principal and interest payable

- Short-term loans

- Unearned revenue such as money paid before a service is rendered

What are different types of liabilities?

- Deferred tax liabilities

- Mortgage payable

- Bonds payable

- Capital leases

- Long-term notes payable

What are examples of assets liabilities and equity?

Parts of the balance sheet equationAssets are any items of value that your business owns. Your bank account, company vehicles, office equipment, and owned property are all examples of assets. ... Liabilities are debts (aka payables) that you owe to others. ... Equity shows your ownership in the business.

What is assets liabilities and Owner's equity?

Assets are the total of your cash, the items that you have purchased, and any money that your customers owe you. Liabilities are the total amount of money that you owe to creditors. Owner's equity, net worth, or capital is the total value of assets that you own minus your total liabilities.

What is the difference between asset and liability?

Assets are the items your company owns that can provide future economic benefit. Liabilities are what you owe other parties. In short, assets put money in your pocket, and liabilities take money out!

What are the 3 golden rules of accounting?

Real Account. ... Personal Account. ... Nominal Account. ... Rule 1: Debit What Comes In, Credit What Goes Out. ... Rule 2: Debit the Receiver, Credit the Giver. ... Rule 3: Debit All Expenses and Losses, Credit all Incomes and Gains. ... Using the Golden Rules of Accounting.

What are examples of equity?

Equity is the ownership of any asset after any liabilities associated with the asset are cleared. For example, if you own a car worth $25,000, but you owe $10,000 on that vehicle, the car represents $15,000 equity. It is the value or interest of the most junior class of investors in assets.

What are 3 types of assets?

Assets are generally classified in three ways:Convertibility: Classifying assets based on how easy it is to convert them into cash.Physical Existence: Classifying assets based on their physical existence (in other words, tangible vs. ... Usage: Classifying assets based on their business operation usage/purpose.

Is cash an asset?

Common examples of personal assets include: Cash and cash equivalents, certificates of deposit, checking, and savings accounts, money market accounts, physical cash, Treasury bills.

Is a car a liability or asset?

The vehicle itself is an asset, since it's a tangible thing that helps you get from point A to point B and has some amount of value on the market if you need to sell it. However, the car loan that you took out to get that car is a liability.

What is equity in accounting?

The first part, equity is what you currently have before liabilities are taken away. Next, liabilities are subtracted (the same as expenses and taxes is subtracted in an income or profit equation) and you’re left with the net result, your total assets.

Is a balance sheet always balanced?

If your accounting is accurate, as you should hope it is, your balance sheet will always balanced. That means if you compare assets with the sum of your liabilities and equity, the two should always equal one another.

What is the equation for assets and liabilities?

Assets = Liabilities + Equity. To understand the accounting equation, it’s important to remember what the goal of a balance sheet is. The balance sheet, unlike the income statement or other financial reports, is a snapshot of your business in a specific moment. While the income statement shows how well your company did or didn’t do over a period ...

What does "assets" mean in a balance sheet?

Assets mean anything that a company possesses. This doesn’t necessarily mean that the company owns those things, simply that they have them in their possession. A balance sheet is often shown in two columns, and you’ll find assets listed in order of liquidity in the left column.

What does equity show?

Equity shows the assets that the company owns outright. If you were to sell all your assets and pay off your liabilities, the owner’s equity would be what’s left. It shows retained earnings and, if the company is publicly traded, common stock information. It’s the exact opposite of liabilities because it shows you what is yours to keep as a company.

What are the components of a balance sheet?

Assets, liability, and equity are the three components of a balance sheet. In order for the balance sheet to be considered “balanced”, assets must equal liabilities plus equity. These three categories allow business owners and investors to evaluate the overall health of the business, as well as its liquidity, or how easily its assets can be turned ...

What are current assets?

As a rule of thumb, any assets that could be turned into cash within a year are considered current assets. Toward the bottom of the asset list are Property, Plant, and Equipment. These are the company’s assets that would be difficult to liquidate quickly. You may have several delivery vehicles in your possession, for example.

Why are assets subdivided into categories?

The reason assets are subdivided into categories based on how easily they can be liquidated is to show anyone interested in your books ( read: lenders or investors) how able you are to pay off debts and liabilities.

Is cash considered current assets?

As a rule of thumb, any assets that could be turned into cash within a year are considered current assets .

What are the parts of equity?

Equity is made up of three parts: contributions, or money you’ve invested in the business; distributions, or money you or any other business owner has taken out of the company; and retained earnings, or the cumulative profit the company has made since its founding.

What are short term liabilities?

Other examples of short-term liabilities include: 1 Cash 2 Payroll 3 Credit lines 4 Dividends payable (dividends that a company’s board of directors has determined is payable to its shareholders) 5 Customer deposits (cash the company has received from a customer before the company delivers the purchased good or service) 6 Short-term debt (a loan with a term of one year or less)

What is a balance sheet?

A balance sheet is a financial snapshot of your company during a certain period of time. It takes into account your company’s assets, liabilities and equity and tells you what the business owes and what it owns. And a balance sheet can tell a very different story from day to day.

What are the assets that are considered current?

Investments. Trademarks. Current — or short-term — assets include cash, plus inventory and accounts receivable that you expect to turn into cash in one year or less. Fixed assets are physical assets that have an expected life of more than a year, such as buildings, vehicles, machinery , computer equipment and tools.

What is the equation for a balance sheet?

In fact, the equation for a balance sheet is: Assets – Liabilities = Equity. The balance sheet is a powerful partner to another common document business owners use: the profit and loss statement.

What is equity in business?

Equity is also referred to as net worth or capital and shareholders equity.

How to calculate equity?

This equity becomes an asset as it is something that a homeowner can borrow against if need be. You can calculate it by deducting all liabilities from the total value of an asset: (Equity = Assets – Liabilities). In accounting, the company’s total equity value is the sum ...

What is the accounting equation?

The basic accounting equation is fundamental to the double-entry accounting system common in bookkeeping wherein every financial transaction has equal and opposite effects in at least two different accounts .#N#This basic accounting equation “balances” the company’s balance sheet, showing that a company’s total assets are equal to the sum of its liabilities and shareholders’ equity. This formula, also known as the balance sheet equation, shows that what a company owns (assets) is purchased by either what it owes (liabilities) or by what its owners invest (equity).#N#If a company wants to manufacture a car part, they will need to purchase machine X that costs $1000. It borrows $400 from the bank and spends another $600 in order to purchase the machine. Its assets are now worth $1000, which is the sum of its liabilities ($400) and equity ($600).

What does "Tom is an asset to the company" mean?

Ever heard the phrase “Tom is an asset to the company”? The meaning is clear. Tom is a good worker that brings value to the organization. In accounting terms, an asset is any item of value to the company: tangible (property, inventory, equipment) or intangible (patents, trademarks, copyrights, accounts receivable and even reputation).

What is owner equity statement?

A Statement of Owner’s Equity (also known as a Statement of Changes in Owner’s Equity) provides an accounting of how a company’s capital has changed during a specified period due to contributions, withdrawals, net income, or net loss. Net income is equal to income minus expenses.

What are some examples of current assets?

For example: Current assets (assets that can be converted into cash within one year or less) such as cash, outstanding invoices owed to you, and inventory that can be sold. Fixed assets ( things of value that are harder to convert into cash ) such as real estate, heavy machinery, furniture, vehicles, etc.

What are long term liabilities?

Long-term liabilities, on the other hand, include debt such as mortgages or loans used to purchase fixed assets. These are paid off over years instead of months.

What is the accounting equation for assets, liabilities and equity?

The accounting equation for assets, liabilities and equity. Equity, liabilities and assets are all used by accountants to determine the "balance sheet equation," otherwise known as the "accounting formula.". This equation combines a company's equity and liability to determine their total assets, basically reworking the equity formula.

What is the difference between assets and liabilities?

Assets represent a company's resources while liabilities represent a company's obligations. An asset helps business owners and financial professionals find out what the company owns. Liabilities show what a company owes.

What is the right side of a balance sheet?

A balance sheet should be divided into two sections. The right side is used to calculate total assets, while the left side includes liabilities and equity. Separate assets and liabilities into categories.

What are the items that accountants consider when calculating the financial outlook of a company?

These items are called "assets" and "liabilities." It's important to understand these figures because they can help determine the overall financial stability of a company. In this article, we explain the meaning of assets and liabilities, give examples of each and share how companies use these figures on a balance sheet to calculate the total value or equity of a business.

What is equity in accounting?

Equity is the remaining amount after a company deducts their total liabilities from the total assets. It's a way to figure out a company's value once all debts are paid and profit is left over. Depending on the size of the business, equity can be referred to in different ways.

How to determine equity?

Equity is determined by totaling a company's assets and subtracting their total liabilities from that number. The remaining figure represents a company's equity. A quick way to think of equity is assets minus liabilities.

Why use a balance sheet?

Use the balance sheet for analysis. A balance sheet can be used to prepare financial modeling reports that give stakeholders an idea of a company's performance. If the assets far outweigh the liabilities, a company will most likely prove more financially successful in the future.

Why do equity and liabilities equal assets?

A company's assets, or the total of all items the company owns, have been bought with the company's current capital, or equity, and debts, or liabilities. This relationship is known as the accounting equation:

Purpose of the accounting equation

The accounting equation is important to determine the full financial value of a business. Where other financial measurements, like the income sheet, show a company's financial health and earnings, the balance sheet shows the business's financial performance for the entire year.

How to use the accounting equation

To use the accounting equation, there are a few steps to follow. Here is how to use this equation in your business's accounting:

Using the accounting equation

Using the accounting equation is easier when you understand what it looks like. Here are two examples of how to use the accounting equation:

What are assets and liabilities on a balance sheet?

Kristen works as a freelance writer for The Balance covering small business topics and terms pertaining to entrepreneurship, business finance, and more.

What Are Assets and Liabilities?

Assets and liabilities may appear side by side on a balance sheet, but they differ when it comes to what they actually represent. There are varying types of assets, just as there are different types of liabilities.

What Is Equity?

Equity is commonly known as shareholder’s equity or owner’s equity. When listed on a balance sheet, though, it may also be referred to as net worth or capital. A shareholder’s equity equals the number of assets minus the number of liabilities. This is essentially the profit that belongs to the owners once all debt is covered.

How Do You Find Net Assets From Liabilities?

The net assets of a business are similar to the meaning of net income. Just as net income refers to the amount after debts are paid, net assets are calculated when you subtract the total assets from the total liabilities. 3 For example, if assets equal $70,000 and liabilities equal to $50,000, then your net assets are $20,000.

How Are Assets and Liabilities Ordered on a Balance Sheet?

On the balance sheet, assets are listed on the left side, while liabilities are listed on the right. A shareholder’s equity is also listed with the liabilities. This layout reflects the formula: Assets = Liabilities + Shareholder’s Equity.

What Are the Differences Between Current Assets and Current Liabilities?

While both current assets and current liabilities refer to transactions within the immediate fiscal period, they differ in the sense that one is incoming, while the other is outgoing. Current assets are the things expected to bring value within the current fiscal period, while current liabilities are the amounts owed in that same period.

What are current liabilities?

Current Liabilities Current liabilities are financial obligations of a business entity that are due and payable within a year. A company shows these on the. Three Financial Statements. Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows.

What are the types of assets?

Types of Assets Common types of assets include current, non-current, physical, intangible, operating, and non-operating. Correctly identifying and. . On the right side, the balance sheet outlines the company’s liabilities.

What is the balance sheet equation?

The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. Image: CFI’s Financial Analysis Course. As such, the balance sheet is divided into two sides (or sections). The left side of the balance sheet outlines all of a company’s assets. Types of Assets Common types of assets include current, non-current, physical, ...

What is leverage ratio?

Leverage Ratios A leverage ratio indicates the level of debt incurred by a business entity against several other accounts in its balance sheet, income statement, or cash flow statement. Excel template.

Why is the balance sheet important?

The balance sheet is a very important financial statement for many reasons. It can be looked at on its own, and in conjunction with other statements like the income statement and cash flow statement to get a full picture of a company’s health.

What is current debt?

Current Debt On a balance sheet, current debt is debts due to be paid within one year (12 months) or less. It is listed as a current liability and part of. Includes non-AP obligations that are due within one year’s time or within one operating cycle for the company (whichever is longest).

Where is cash liquid on a balance sheet?

The most liquid of all assets, cash, appears on the first line of the balance sheet . Cash Equivalents are also lumped under this line item and include assets that have short-term maturities under three months or assets that the company can liquidate on short notice, such as marketable securities.

What is the difference between equity and liabilities?

Liabilities are the financial obligations (debt) that a business owes to anyone besides the owners, such as suppliers, lenders, and tax authorities. In comparison, equity is what’s left in a business for its owners after subtracting all external liabilities from the total assets.

Where are liabilities and equity on the balance sheet?

Although liabilities and equity are both shown on the right side of the balance sheet , there are significant differences between these building blocks of accounting that all beginners must know to differentiate between them.

What are assets of a business?

Assets of a business, such as cash, inventory, machinery, and buildings, are financed by the owner’s equity and liabilities. The total assets in a business are therefore always equal to the sum of liabilities and equity.

Is interest expense a business expense?

Interest expense relating to business liabilities is recorded as an expense in the income statement , but dividend payments issued to owners out of their share of equity is not classified as a business expense.