How is BOZR calculated?

BOZR = (BOZRAPEX*0.88)+0.77 Improvement of BOZR proposed by APEX software CL fitting.

What is back optic zone diameter?

Diameter of the optic zone (front or back) of a contact lens measured to the surrounding junction. It is commonly specified in millimetres. Specifically, there are the back optic zone diameter (BOZD), formerly called back central optic diameter (BCOD), and the front optic zone diameter (FOZD).

What does BOZR stand for?

BOZRAcronymDefinitionBOZRBack Optic Zone Radius (optometry)

How would you describe RGP fit?

Lens movement is one of the key characteristics of an ideal RGP fit. The lens should move around 1 to 1.5mm with each blink. The movement should be smooth and unobstructed in the a vertical plane, indicating a near alignment fit. Lens movement occurs either as a response to the eyelid force or by upper lid attachment.

What is optic zone in contact lens?

Generally, the relationship between optic zone diameter and the power of the contact lens is an inverse one: as the dioptric power of the contact lens increases, the overall diameter of the optic zone decreases. This is generally done in an attempt to control the contact lens thickness.

What is the back optic zone radius of a contact lens?

Radius of curvature of the back optic zone of a contact lens. (It was formerly called the back central optic radius (BCOR or BC) or posterior central curve radius (PCCR).) If the optic zone is surrounded by a peripheral zone there will be a radius of curvature of a back peripheral zone (BPR).

What does BOZR mean on contact lens prescription?

Base Curve» BC (or BOZR) = Base Curve (a number between 8.0 and 10.0). This is the inside curve of your contact lens (e.g.,8.0, 8.1, 8.2, etc.). Many contact lenses come in only one base curve, many others in only two base curves, some come in multiple base curves so care must be taken when ordering.

What does BOZR mean on contact lenses?

BACK OPTIC ZONE RADIUSBACK OPTIC ZONE RADIUS (BOZR): Radius of curvature of the central, optic zone of a hard contact lens; previously known as back central optic radius (BCOR). BACK PERIPHERAL RADIUS (BPR): Radius of curvature of a peripheral curve of a contact lens.

What does add do on contact lenses?

Addition (ADD): If you suffer from presbyopia it affects your near vision, the Addition figure determines what level of correction you need to be able to see clearly at a close distance. This is a number between 0.50 and 3.00, some contact lens brands refer to this as a high, medium or low.

How can I make my RGP lenses more comfortable?

Slowly bring the RGP lens toward your eye and gently place it on the cornea of your eye, while looking straight ahead. Blink multiple times to ensure the lens stays in its correct location, this also allows tears to flow under the lens adding a cushion of comfort.

How long does it take to make RGP lenses?

It is a good idea to have a spare set of lenses on hand because a new set can take 10-14 days to be made.

How do you calculate RGP base curve?

Base curve = 0.95 * 34.82 D = 33.07 D and then round up or down to the nearest whole diopter to arrive at the following final base curve to use for a contact lens over-refraction: Base curve = 33.00 D (actual measured base curve is 32.95 D)

How do you fit gas permeable contact lenses?

3:1314:50Fitting GP Lenses Part 1 - Mark Andre - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe base curve radius. The peripheral curves the lens thickness again a very important part of ofMoreThe base curve radius. The peripheral curves the lens thickness again a very important part of of rigid contact lens in terms of how it fits and the mass of the lens.

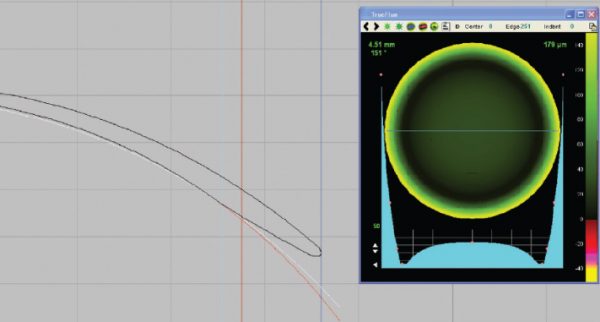

What is EDGE clearance RGP?

Edge clearance refers to the gap between the front surface of the cornea and the back surface of the peripheral curves, and it is edge clearance that is observable with fluorescein.

How do RGP bifocals work?

Lens Designs RGP multifocal lenses are available in two general categories: alternating and simultaneous. Alternating lenses work by presenting distance optics in straight-ahead gaze and near optics in downgaze when the lens translates or moves upward.

What is with the rule astigmatism example?

“With-the-rule” astigmatism occurs when the vertical meridian of the cornea is steepest. Consider a football shape lying on its side, and the vertical meridian of the football is the steepest curve. For these cases, spectacle lenses are fabricated with a minus cylinder placed in the horizontal axis.

How are bonds priced?

Bonds are priced in the secondary market based on their face value, or par. Bonds that are priced above par—higher than face value—are said to trade at a premium, while bonds that are priced below their face value—below par—trade at a discount. Like any other asset, bond prices depend on supply and demand.

How Do Bond Ratings Work?

All bonds carry the risk of default. If a corporate or government bond issuer declares bankruptcy, that means they will likely default on their bond obligations, making it difficult for investors to get their principal back.

Understanding I Bonds

I bonds are safe investments issued by the U.S. Treasury to protect your money from losing value due to inflation. Interest rates on I bonds are adjusted regularly to keep pace with rising prices.

What Are the Benefits of I Bonds?

The chief benefit of I bonds is that they protect the purchasing power of your cash from inflation. When prices rise across the economy, they erode how much the same amount of dollars can buy, but safe investments like I bonds can help you maintain the value of the cash component of your asset allocation.

How to Calculate Series I Bonds Interest Rate

I bonds use what’s called a composite interest rate that consists of two parts:

EE Bonds vs. I Bonds

The U.S. Treasury currently offers two types of savings bonds, series I bonds and series EE bonds. Whether you might prefer one over the other depends upon both the current interest rates and where you believe interest rates and inflation will trend in the future.

How To Buy I Bonds

You can buy I bonds electronically online at the TreasuryDirect website. You can also purchase up to $5,000 per year of paper I bonds with the proceeds from your tax return. There is no secondary market for trading I bonds, meaning you cannot resell them; you must cash them out directly with the U.S. government.

How I Bonds Fit into a Low-Risk Investing Strategy

I bonds are an excellent choice for conservative investors seeking a guaranteed investment to protect their cash from inflation. Although illiquid for one year, after that period you can cash them at any time.

What is a junk bond?from blackrock.com

When investing in bond funds, keep in mind: Junk bonds are a type of high-yield corporate bond that are rated below investment grade .

What is bond fund?from corporatefinanceinstitute.com

Bond funds are mutual funds that typically invest in a variety of bonds, such as corporate, municipal, Treasury, or junk bonds. Bond funds usually pay higher interest rates than bank accounts, money market accounts or certificates of deposit. For a low investment minimum ranging from a few hundred to a few thousand dollars, ...

How does a bond fund work?from corporatefinanceinstitute.com

Through a bond fund, they can have their money actively managed by a portfolio manager who possesses the technical knowledge of the industry. 3. Monthly dividends. Most individual bonds pay interest semi-annually, while bond funds pay interest monthly.

How to get debt bonds in Fortuna?from warframe.fandom.com

As it is known, you can obtain Debt-Bonds by purchasing Ticker’s Case# or from Bounty rewards. Ticker’s inventory not only took quite some time to refresh, but the inventory itself did not offer a diverse source at any given time. Considering the cost at which Debt-Bonds are required to Rank up in Solaris United, we have made the following changes to bring a more balanced rotation for Ticker:

What is a Treasury bond?from fool.com

A Treasury bond is debt issued by the U.S. government to raise money. Technically speaking, every kind of debt issued by the federal government is a bond, but the U.S. Treasury defines the Treasury bond as the 30-year note. Generally considered the safest investment in the world, U.S. Treasury securities of all lengths provide a nearly guaranteed source of income and hold their value in just about every economic environment.

What is corporate bond?from fool.com

A corporate bond is a debt instrument issued by a business to raise money. Unlike a stock offering, with which investors buy a stake in the company itself, a bond is a loan with a fixed term and an interest yield that investors will earn. When it matures, or reaches the end of the term, the company repays the bond holder.

Who regulates the bond market?from blackrock.com

The Financial Industry Regulatory Authority (FINRA) regulates the bond market. FINRA posts transaction prices as the data becomes available. The data may lag the market, however, making it difficult to know what constitutes a fair price at the time you wish to invest.