Drive Other Car coverage is a fairly common endorsement on Commercial Auto insurance policies. Drive Other Car (also known as DOC or CA9910), is a broadened coverage endorsement that gives certain named individuals coverage on vehicles that do not have to be listed on an Auto policy.

What is a drive other car?

When is DOC coverage needed?

What is a DOC endorsement?

Is DOC needed for commercial auto insurance?

Do all businesses need a DOC endorsement?

Do you need DOC coverage for a car?

See 1 more

What is broadened insurance?

Broad Collision – or broad form collision, broadened collision is the level of coverage that waives paying any deductible unless you are AT-fault in a collision. That means if someone hits you, you don't pay! Regular Collision – or basic, standard collision.

What is the difference between broadened collision and standard collision?

Broad Collision – also known as broad form collision or broadened collision. With this option you only pay the deductible when you are AT-fault. If the collision is not your fault you pay nothing. Regular Collision – also known as basic or standard collision.

What is the difference between broad and basic collision?

With broad coverage, your insurance company will generally waive your deductible if you are not at fault in the accident. With basic coverage, you pay your deductible no matter who is at fault. Of course, broad collision is more expensive, and often, considerably more.

How does broad form insurance work?

Broad form insurance is insurance that provides “bare-bones” coverage at a low premium rate. It is typically thought to be extensive coverage because of the name “broad”, but in actuality is very narrow coverage. It can serve to cover the minimum liability insurance required by state laws.

What does a $500 deductible broad form mean?

For example: With $500 deductible broad form collision, if another vehicle rear-ends your vehicle at a stop sign your insurance pays the full cost of repairs. If the situation was reversed and you instead rear-ended the other car you would be responsible for the first $500 of repair costs.

What happens if someone else is driving my car and gets in an accident progressive?

Collision and comprehensive coverage from Progressive also follow the car, so you'll have to file a claim using your policy to get your own vehicle repaired or replaced if someone else gets into an accident while driving it.

What is broad insurance coverage?

Broad form insurance is a type of insurance policy that offers minimal auto liability for one person only. It covers the property damage and bodily injury sustained by another driver when involved in an accident.

What is the difference between Broad and special coverage?

Fortunately, the Broad Form is designed to cover the most common forms of property damage. Special Form coverage is the most inclusive of the three options. The trick with Special Form policies is that they should be read differently from how you would read a Basic or Broad Form policy.

What is the difference between basic broad and special form coverage?

Basic, Broad, and Special form are three common coverage forms when insuring property. Basic form is the most restrictive, while Special offers the greater level of protection.

Is broad form the same as all risk?

Broad form insurance can be described as comprehensive insurance for your home, and named perils insurance for your contents. With broad form insurance, your property is covered against all risks, except those specifically excluded (terrorism, war, etc.).

Does broad form coverage include theft?

What is Broad Form Personal Theft Insurance? Broad form personal theft insurance covers the theft or loss of personal assets. It can be placed on all personal property, and is on an all-risk basis, meaning no matter whether the loss is from vandalism, theft or loss, the same coverage will apply.

Which of the following has the broadest coverage under the insurance policy?

Which of the following has the broadest coverage under the insurance policy? Named Insured--The Named Insured receives the broadest coverage of all persons or organizations protected by a policy.

What is standard collision coverage in Michigan?

Standard Collision Coverage – For standard form coverage, your car insurance pays you 50% or less if you are at fault for causing the accident. However, if you are more than 50% at fault, your insurance company will pay the claim but you will be responsible for paying the deductible.

What is collision coverage type?

Collision insurance is auto coverage that reimburses the insured for damage sustained to their personal automobile, due to the fault of the insured driver. This type of insurance is often added as an extension of a basic automobile policy to protect drivers in the event of damage fro a collision.

What is limited collision in Michigan?

(a) Limited collision coverage, which must pay for collision damage to the insured vehicle without a deductible amount if the operator of the vehicle is not substantially at fault in the accident from which the damage arose.

What is limited collision coverage in MA?

Limited Collision: As opposed to standard collision — which pays for your damages regardless of fault — limited collision only pays out if you are found to be less than 50% at fault.

Drive other car coverage, broadened coverage, extended ... - reddit

Hi all, We are considering increasing from 100/300/250 to 250/500/250 for our auto insurance liability limits and are wondering if this is overkill.

Broad Form Drive Other Car Coverage - IRMI.com

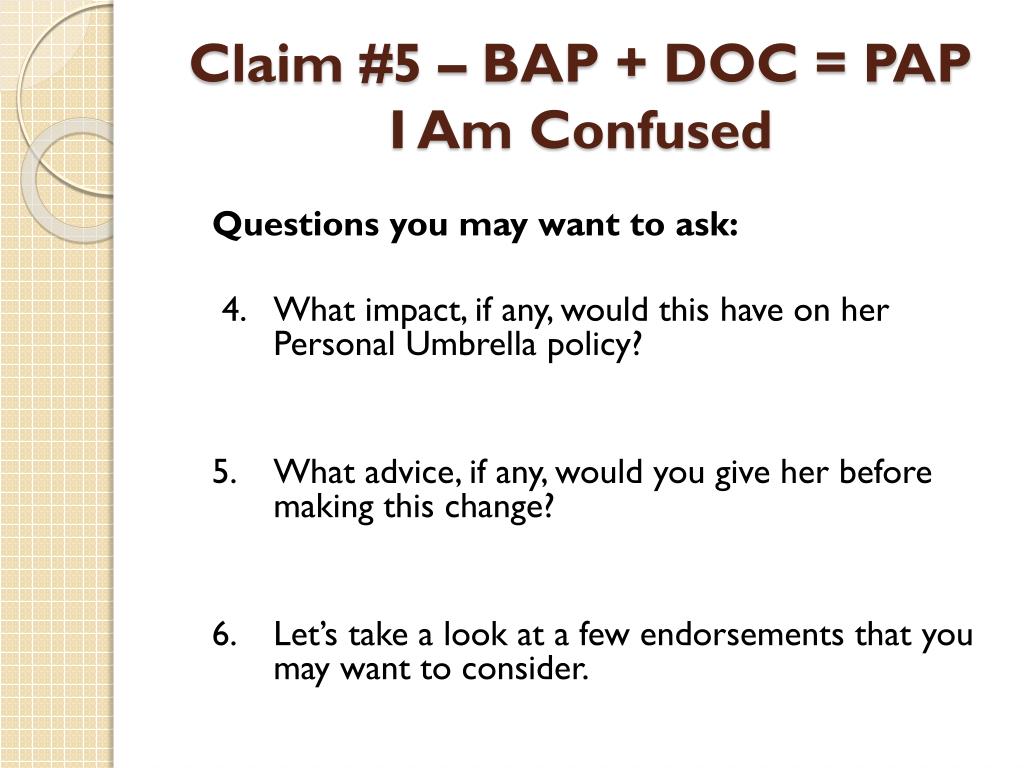

Broad Form Drive Other Car Coverage — automobile coverage available under a commercial auto (e.g., business auto, auto dealers, motor carrier) policy for employees, executives, or any other person who is supplied a company-owned vehicle but who does not own a personal vehicle and thus does not have a personal auto policy (PAP).

What is "Drive Other Car" Coverage? - Clark-Mortenson Insurance

Drive other car coverage provides liability, medical payments, uninsured/under-insured motorist, and physical damage coverage for the personal use of a non-owned automobile by the individual wished to protect. If an individual, for example a company officer, does not have their own personal auto policy and drives a corporate car, you would want to add this coverage to protect them from ...

Drive Other Car Insurance | Progressive Commercial

Drive Other Car insurance can provide protection for the executive of a Partnership or Corporation or their spouse when driving a non-owned car, such as a vehicle that is rented or borrowed.

Drive Other Car Insurance | DOC Auto Insurance - The Hartford

Sometimes this DOC auto coverage is called CA 99 10, and it usually covers your business’ executive officers and their spouses if they drive vehicles that aren’t on your commercial auto insurance policy. For example, a DOC endorsement would help cover your company’s president while they’re driving an automobile, like a rental car or corporate van, for their job.

What happens if you have no insurance on a car you borrowed from someone else?

If the vehicle owner has no insurance or insufficient limits, the employee may face a large out-of-pocket loss. Businesses can protect their workers from such events by adding drive other car coverage to their commercial ...

How much does a UIM endorsement cost?

The average cost varies by location and the individual policy, but could cost anywhere from a few hundred dollars to more than $1,000 per year.

What is a DOC policy?

Drive other car (DOC) coverage can be included in a commercial auto policy via a policy endorsement. A DOC endorsement covers the individual listed in the endorsement schedule as an insured. If that person's spouse resides in the same household, the spouse is also an insured. The individual and the spouse are insureds while driving any auto the named insured (employer) doesn't own, hire, or borrow. They aren't covered while driving vehicles they own or that are used in an auto-related business, such as a parking garage or auto repair shop.

Do you have to have liability insurance for a company vehicle?

An individual who's been furnished with a company vehicle should have adequate liability coverage under their employer's commercial auto policy if they never drive any other vehicles. But the worker could still face an unexpected loss if they use a car owned by someone other than the employer.

Can spouses drive company owned vehicles?

If the employer has barred employees' spouses from driving company-owned vehicles, they are not part of the DOC coverage. They may be covered for driving vehicles owned by a neighbor or friend under that car owner’s policy, just not the company car.

Can an employee drive a vehicle?

When an employee drives a vehicle provided by their employer, they qualify as an insured person under the employer's commercial auto liability insurance. While the liability section of the standard business auto policy doesn't address employees specifically, it does apply to anyone using a covered auto that the named insured (employer) owns, hires, ...

Can you drive someone else's car without insurance?

Workers who are insured to drive company cars but don’t have their own insurance could face large out-of-pocket costs if they were to cause an accident while driving someone else’s car. Businesses of any size can protect their workers by adding drive other car coverage to their commercial auto policies.

What is broadened personal injury protection?

Broadened personal injury protection, also known as named individuals broadened personal injury protection, is an additional level of personal injury protection. It protects those, other than the insured, who may from time to time drive the insured automobile, such as employees or family members. Advertisement.

What is a broadened PIP?

What Is Broadened PIP Coverage? Broadened PIP coverage protects individuals other than the insured. Auto insurance is a patchwork of laws across the United States, and exact insurance requirements vary among the states.

What is PIP insurance?

PIP. Personal injury protection is a form of insurance that covers the insured, no matter who is at fault in the accident. It is a common requirement in states with "no-fault" auto insurance systems.

What is the difference between broad form collision and standard collision?

The main difference between broad form collision and standard collision is the deductible . As stated below, with broad form collision insurance coverage the deductible is waived if the operator or driver of the insured vehicle was “not substantially at fault” in causing the accident which resulted in damage to the insured vehicle.

When must a deductible be paid on a broad form collision policy?

However, the deductible on a broad form collision coverage policy must be paid as a prerequisite to the insurer’s payment of benefits when the covered-vehicle’s operator or driver was “more than 50%” at fault in causing the accident.

What If I Don’t Purchase Collision Insurance Coverage?

Failure to purchase any of these collision policies means that, unless you find an alternative source of payment (such as the Michigan mini tort or the No-Fault Law’s Property Protection Insurance benefits), you will pay for all of the repair costs associated with your accident-related motor vehicle damage.

How Much Is Your Michigan Auto Accident Case Worth?

Michigan Auto Law is the leading and largest law firm in Michigan exclusively handling auto accident cases for more than 50 years . By answering a few simple questions we can help you determine how much your accident case could be worth.

What is limited collision coverage in Michigan?

Under Michigan’s Insurance Code, “Limited collision coverage … shall pay for collision damage to the insured vehicle without a deductible amount when the operator of the vehicle is not substantially at fault in the accident from which the damage arose.” (MCL 500.3037 (1) (a))

What is collision insurance?

Collision insurance is a coverage that will help pay your repair costs for accident-related car or truck damage.

Do you have to pay a deductible on a collision?

The owner of a damaged vehicle which is covered by a limited collision coverage with a deductible policy must pay a deductible before his or her insurance company begins paying for the vehicle damage repairs, even if the operator or driver of the insured vehicle was not at fault in causing the accident.

What is a drive other car?

Drive Other Car coverage is a fairly common endorsement on Commercial Auto insurance policies . Drive Other Car (also known as DOC or CA9910), is a broadened coverage endorsement that gives certain named individuals coverage on vehicles that do not have to be listed on an Auto policy . DOC provides broadened coverage for named individuals when an executive officer is given a company vehicle to use for business purposes. The endorsement also extends non-owned Auto coverage for the individuals listed on the endorsement. These autos can be vehicles the insured does not own on a regular basis or ones that are leased for a short period of time.

When is DOC coverage needed?

Additionally, the need for DOC is necessary when a personal Auto policy is not in place. If there is a personal Auto policy in place and DOC coverage is on a commercial Auto policy, there is essentially double coverage. The coverage comes with additional exposure and an additional premium to the Auto policy.

What is a DOC endorsement?

DOC provides broadened coverage for named individuals when an executive officer is given a company vehicle to use for business purposes. The endorsement also extends non-owned Auto coverage for the individuals listed on the endorsement.

Is DOC needed for commercial auto insurance?

It’s always wise to check if DOC is necessary and if it makes sense to add it to your commercial Auto policy. Personal Auto Policies and Umbrella Policies should also be reviewed or added for more a complete insurance program. Businesses operations may change from year to year and this additional coverage may be needed for proper coverage.

Do all businesses need a DOC endorsement?

Not all businesses need the DOC endorsement. It varies depending on how the company operates, how often certain types of vehicles are used, and how many employees are driving on behalf of the business. Sometimes smaller businesses do not require Drive Other Car coverage.

Do you need DOC coverage for a car?

DOC is necessary if an employee drives an auto that belongs to another person whose insurance may not be maintained or if the limits are inadequate.

The Basics of Drive Other Car Coverage

How It Works

- An individual who's been furnished with a company vehicle should have adequate liability coverage under their employer's commercial auto policy if they never drive any other vehicles. But the worker could still face an unexpected loss if they use a car owned by someone other than the employer. For example, let’s say Cameron is employed by Classic Concepts, a commercial inter…

Drive Other Car Policy Endorsement

- Drive other car (DOC) coverage can be included in a commercial auto policy via a policy endorsement. A DOC endorsement covers the individual listed in the endorsement schedule as an insured. If that person's spouse resides in the same household, the spouse is also an insured. The individual and the spouse are insureds while driving any auto the named insured (employer…

Advantages and Disadvantages

- The DOC endorsement provides backup coverage for employees or company executives who have no personal auto insurance and occasionally drive cars other than the one furnished to them by their employer. Individuals listed in the endorsement and their spouses are insured for liability while driving any auto they rent or borrow from someone else. If the employer has elected medic…

Alternative to Doc

- An alternative to a DOC endorsement is the named nonowner endorsement, which can be added to a personal auto policy. It is designed for individuals who don't own any autos but occasionally rent or borrow vehicles. The individual may cover just themselves, or their family, too. This endorsement includes options for physical damage coverages as well as liability, medical payme…

The Bottom Line

- Workers who are insured to drive company cars but don’t have their own insurance could face large out-of-pocket costs if they were to cause an accident while driving someone else’s car. Businesses of any size can protect their workers by adding drive other car coverage to their commercial auto policies.