What is capital taxable income?

Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or exchanged at a price higher than its basis. Basis is an asset's purchase price, plus commissions and the cost of improvements less depreciation.

How is capital tax calculated?

Capital gain calculation in four stepsDetermine your basis. ... Determine your realized amount. ... Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. ... Review the descriptions in the section below to know which tax rate may apply to your capital gains.

What does taxable capital include?

Taxable capital is defined according to legislation. In general, it is the sum of the carrying values of shareholders' equity, surpluses, debt, and reserves, reduced by investments in shares and debt held in other companies.

What is an example of capital income?

Capital income is income that comes from capital, which is to say, comes from wealth itself, rather than any specific production or direct work. Examples are stock dividends or any sort of capital gains, as well as income an owner gets from a business he owns but not from the work he does there.

How can you avoid capital tax?

9 Ways to Avoid Capital Gains Taxes on StocksInvest for the Long Term. ... Contribute to Your Retirement Accounts. ... Pick Your Cost Basis. ... Lower Your Tax Bracket. ... Harvest Losses to Offset Gains. ... Move to a Tax-Friendly State. ... Donate Stock to Charity. ... Invest in an Opportunity Zone.More items...•

What is capital tax exemption?

Pay less taxes. The Lifetime Capital Gains Exemption (LCGE) allows Canadian incorporated small business owners to claim a deduction when selling shares of a corporation that can effectively eliminate the taxes realized on a sale of their business.

What are items of capital?

long-lived business assets of a firm; these items usually include buildings, plant and equipment.

Is capital subject to tax?

Capital gains taxes are owed on the profits from the sale of most investments if they are held for at least one year. The taxes are reported on a Schedule D form. The capital gains tax rate is 0%, 15%, or 20%, depending on your taxable income for the year. High earners pay more.

What are the 3 types of capital?

When budgeting, businesses of all kinds typically focus on three types of capital: working capital, equity capital, and debt capital.

What are 5 examples of capital?

Here are a few examples of capital:Company cars.Machinery.Patents.Software.Brand names.Bank accounts.Stocks.Bonds.

What are two types of capital income?

In business and economics, the two most common types of capital are financial and human.

What is the capital gains tax rate for 2022?

Capital Gain Tax Rates The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow(er).

What is the capital gains tax rate for 2022 on real estate?

This article has been updated for the 2022 tax year. The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: 10%, 12%, 22%, 24%, 32%, 35% or 37%.

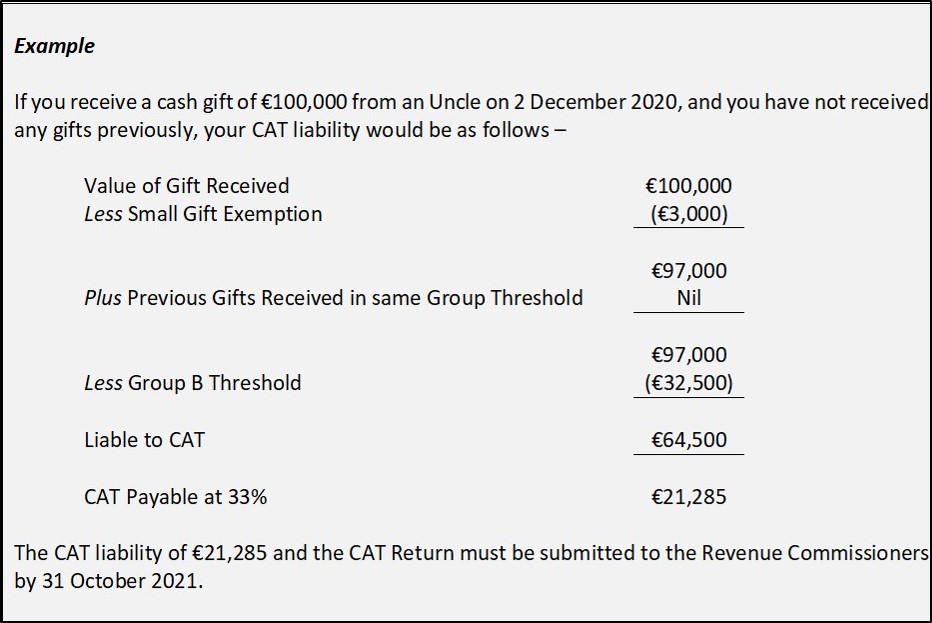

How much is capital gains on $100000?

For example, in both 2018 and 2022, long-term capital gains of $100,000 had a tax rate of 9.3% but the total income maxed out for this rate at $268,749 in 2018 and increased to $312,686 in 2022.

Are capital gains taxed as income?

Short-term capital gains are taxed as if they are ordinary income, but long-term capital gains are taxed at lower rates.

Are dividends capital gains?

Most ordinary dividends are taxed as ordinary income, but some qualified dividends that meet certain IRS requirements are taxed at lower capital ga...

Do you have to pay capital gains taxes on cryptocurrency?

Yes. The IRS considers cryptocurrency property, making it subject to the same capital gains taxes as stocks, bonds or other capital assets.

What Is a Capital Gains Tax?

You pay a capital gains tax on the profits of an investment that is held for more than one year. (If it's held for less time, the profit is taxed as ordinary income, and that's usually a higher rate.) You don't owe any tax on your investment's profit until you sell it.

How Can I Legally Reduce My Capital Gains Taxes?

There are a number of perfectly legal ways to minimize your capital gains taxes:

How to minimize capital gains tax?

There are a number of perfectly legal ways to minimize your capital gains taxes: 1 Hang onto your investment for more than one year. Otherwise, the profit is not treated as a capital gain, it's treated as regular income, meaning you'll probably pay more. 2 Also, keep in mind that your investment losses can be deducted from your investment profits, at a rate of up to $3,000 a year. Some investors use that fact to good effect. For example, they'll sell a loser at the end of the year in order to have losses to offset their gains. 3 If you're saving for retirement, consider a Roth IRA or a Roth 401 (k). You won't owe capital gains taxes on the profits after retiring. 4 Keep track of any qualifying expenses that you incur in making or maintaining your investment. They can increase the cost basis of the investment and thereby reduce its taxable profit.

What is the short term capital gains tax?

Short-term capital gains tax applies to assets held for a year or less, and are taxed as ordinary income. 1. President Biden is reportedly proposing to raise taxes on long-term capital gains for individuals earning $1 million or more to 39.6%.

What is the tax rate on collectibles?

Collectibles. Gains on collectibles, including art, antiques, jewelry, precious metals, and stamp collections, are taxed at a 28% rate, regardless of your income. So if you're in a lower bracket than 28%, you'll be levied at this higher tax rate. If you're in a tax bracket with a higher rate, your capital gains taxes will be limited to ...

How much capital gains can be reduced?

In other words, your tax is due on the net capital gain. There is a $3,000 maximum per year on reported losses, but leftover losses can be carried forward to the following tax years. 1

How to sort short term gains and losses?

First, sort short-term gains and losses in a separate pile from long-term gains and losses. All short-term gains must be reconciled to yield a total short-term gain. Then the short-term losses are totaled. Finally, long-term gains and losses are tallied. 9

What Is Capital Gains Tax?

A capital gains tax is a tax you pay on the profit made from selling an investment.

Capital Gains Tax Rates for 2021

The capital gains tax on most net gains is no more than 15 percent for most people. If your taxable income is less than $80,000, some or all of your net gain may even be taxed at zero percent.

How to Reduce Your Capital Gains Tax Bill

There are several ways to legally reduce your capital gains tax bill, and much of the strategy has to do with timing.

Why are capital gains taxed?

Because capital gains are taxed only upon realization, an individual who owns a security that has increased in value may be reluctant to sell it. The seller knows that when sold, tax is levied on the positive difference of the price at which the security was bought and the price at which the security was sold. If the seller chooses not to sell, the tax is postponed to later date. The present discounted value of the tax liabilities is reduced by the postponement of the tax. Therefore, the seller has an incentive to hold the securities longer. And this distortion caused by the capital gains tax is called locked-in effect according to the referenced book in this paragraph's heading. Other researches might call this effect lock-in effect. Those terms are interchangeable.

How much is capital gains taxed in Austria?

Austria taxes capital gains at 25% (on checking account and "Sparbuch" interest) or 27.5% (all other types of capital gains). There is an exception for capital gains from the sale of shares of foreign entities (with opaque taxation) if the participation exceeds 10% and shares are held for over one year (so-called "Schachtelprivileg").

How does capital gains tax help risk taking?

Consider an investor with two investment options – one safe with almost no return and one risky that can cause a big return or a loss with a 50% chance of either result. If the investor decides to split up investments to both alternatives, even if the risky one ends up being a loss, he can through the income tax in combination with full loss deductibility gain most of his lost money back, incentivizing investors to take the risk. ″If the return on safe assets were zero and the government taxed gains and subsidized losses at the same rate, then capital taxation would encourage risk taking; the government would be, in effect, a silent partner.″

Why did the UK introduce CGT?

Channon observes that one of the primary drivers to the introduction of CGT in the UK was the rapid growth in property values post World War II. This led to property developers deliberately leaving office blocks empty so that a rental income could not be established and greater capital gains made. The capital gains tax system was therefore introduced by chancellor James Callaghan in 1965.

What is the capital gains tax rate in Iceland?

From 1 January 2018 the capital gains tax in Iceland is 22%. It was 20% prior to that (for a full year, from 2011 to 2017), which in turn was a result of a progressive raises in the preceding years.

Why is capital gains tax important?

Tax evasion has important implications for the efficiency of taxes, since resources spent on evading the tax could be put to more productive uses.

What was the corporate tax rate in 2010?

Corporate tax in 2010 is 19% . Capital gains from the sale of shares by a company owning 10% or more is entitled to participation exemption under certain terms. For an individual, gain from the sale of a primary private dwelling, held for at least 3 years, is tax exempt.

What is long-term capital gains tax?

Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. The long-term capital gains tax rate is 0%, 15% or 20% depending on your taxable income and filing status. They are generally lower than short-term capital gains tax rates.

What is the capital gains tax rate for 2020?

In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%).

How to rebalance dividends?

Typically, you'd rebalance by selling securities that are doing well and putting that money into those that are underperforming. But using dividends to invest in underperforming assets will allow you avoid selling strong performers — and thus avoid capital gains that would come from that sale. (Learn more about how taxes on dividends work.)

How much does TaxAct save?

TaxAct is a solid budget pick, and NerdWallet users can save 25% on federal and state filing costs.

How long can you hold an asset?

Whenever possible, hold an asset for a year or longer so you can qualify for the long-term capital gains tax rate, since it's significantly lower than the short-term capital gains rate for most assets. Our capital gains tax calculator shows how much that could save.

What is the money you make on the sale of a property called?

The money you make on the sale of any of these items is your capital gain. Money you lose is a capital loss. Our capital gains tax calculator can help you estimate your gains.

How much can you deduct from your taxes if you have capital losses?

The difference between your capital gains and your capital losses is called your “net capital gain.” If your losses exceed your gains, you can deduct the difference on your tax return, up to $3,000 per year ($1,500 for those married filing separately).

What is capital gains tax—and who pays it?

In a nutshell, capital gains tax is a tax levied on possessions and property—including your home—that you sell for a profit.

Do home improvements reduce tax on capital gains?

You can also reduce the amount of capital gains subject to capital gains tax by the cost of home improvements you’ve made. You can add the amount of money you spent on any home improvements—such as replacing the roof, building a deck, replacing the flooring, or finishing a basement—to the initial price of your home to give you the adjusted cost basis. The higher your adjusted cost basis, the lower your capital gain when you sell the home.

What if I have a loss from selling real estate?

If you sell your personal residence for less money than you paid for it , you can’t take a deduction for the capital loss. It’s considered to be a personal loss, and a capital loss from the sale of your residence does not reduce your income subject to tax.

How to avoid capital gains tax?

The best way to avoid a capital gains tax if you’re an investor is by swapping “like-kind” properties with a 1031 exchange . This allows you to sell your property and buy another one without recognizing any potential gain in the tax year of sale.

What is the maximum capital gains tax for 2020?

For single folks, you can benefit from the 0% capital gains rate if you have an income below $40,000 in 2020. Most single people will fall into the 15% capital gains rate, which applies to incomes between $40,001 and $441,500. Single filers with incomes more than $441,500, will get hit with a 20% long-term capital gains rate.

What is the tax bracket for married couples?

Married couples with incomes of $80,000 or less remain in the 0% bracket, which is great news.

How long do you have to hold a home to sell it?

If you sell the home after you hold it for longer than one year, you have a long-term capital gain. Unlike short-term gains, long-term gains are subject to preferential capital gains tax rates.

What Is the Capital Gains Tax?

- The capital gains tax is the levy on the profit that an investor makes when an investment is sold…

The long-term capital gains tax rates for the 2021 and 2022 tax years are 0%, 15%, or 20% of the profit, depending on the income of the filer. The income brackets are adjusted annually. (See tables below.) - An investor will owe long-term capital gains tax on the profits of any investment owned for at lea…

Capital gains taxes are due only after an investment is sold.

Understanding the Capital Gains Tax

- When stock shares or any other taxable investment assets are sold, the capital gains, or profits, …

Under current U.S. federal tax policy, the capital gains tax rate applies only to profits from the sale of assets held for more than a year, referred to as " long-term capital gains ." The current rates are 0%, 15%, or 20%, depending on the taxpayer's tax bracket for that year. - Most taxpayers pay a higher rate on their income than on any long-term capital gains they may h…

Day traders and others taking advantage of the ease and speed of trading online need to be aware that any profits they make from buying and selling assets held less than a year are not just taxed—they are taxed at a higher rate than assets that are held long-term.

Capital Gains Tax Rates for 2021 and 2022

- The profit on an asset that is sold less than a year after it is purchased is generally treated for ta…

The same generally applies to dividends paid by an asset, which represent profit although they aren't capital gains. In the U.S., dividends are taxed as ordinary income for taxpayers who are in the 15% and higher tax brackets. 3 - A different system applies, however, for long-term capital gains. The tax you pay on assets held …

The rates for tax years 2021 and 2022 are shown in the tables below: 4 1

Calculating Your Capital Gains

- Capital losses can be deducted from capital gains to calculate your taxable gains for the year.

The calculation becomes a little more complex if you've incurred capital gains and capital losses on both short-term and long-term investments. - First, sort short-term gains and losses in a separate pile from long-term gains and losses. All sh…

The short-term gains are netted against the short-term losses to produce a net short-term gain or loss. The same is done with the long-term gains and losses. 10

Capital Gains Tax Strategies

- The capital gains tax effectively reduces the overall return generated by the investment. But ther…

The simplest of strategies is to simply hold assets for more than a year before selling them. That's wise because the tax you will pay on long-term capital gains is generally lower than it would be for short-term gains. 1 - 1. Use Your Capital Losses

Capital losses will offset capital gains and effectively lower capital gains tax for the year. But what if the losses are greater than the gains?

When Do You Owe Capital Gains Taxes?

- You owe the tax on capital gains for the year in which you realize the gain. For example, if you se…

Capital gains taxes are owed on the profits from the sale of most investments if they are held for at least one year. The taxes are reported on a Schedule D form. - The capital gains tax rate is 0%, 15%, or 20%, depending on your taxable income for the year. Hig…

If the investments are held for less than one year, the profits are considered short-term gains and are taxed as ordinary income. For most people, that's a higher rate.

How Can You Avoid Capital Gains Taxes?

- If you want to invest money and make a profit, you will owe capital gains taxes on that profit. Th…

Hang onto your investment for more than one year. Otherwise, the profit is treated as regular income and you'll probably pay more. - Don't forget that your investment losses can be deducted from your investment profits, at a rate …

If your losses are greater than $3,000, you can carry the losses forward and deduct them from your capital gains in future years.

What Is Good About Reducing the Capital Gains Tax Rate?

- Proponents of a low rate on capital gains argue that it is a great incentive to save money and inv…

They also point out that investors are using after-tax income to buy those assets. The money they use to buy stocks or bonds has already been taxed as ordinary income, and adding a capital gains tax is double taxation. 17

What Is Bad About Reducing the Capital Gains Tax Rate?

- Opponents of a low rate on capital gains question the fairness of a lower tax on passive income …

They also argue that a lower capital gains tax primarily benefits the tax sheltering industry. That is, instead of using their money to innovate, businesses park it in low-tax assets. 18