What are examples of cash disbursements?

in detail. Examples include repayments to creditors, payments of rents and salaries, cash refunds for the return of goods, and so on. In contrast, all the receipts of cash are recorded in the cash receipt journal. All entries in the cash disbursement journal have a credit to cash, as all the cash receipt journal entries have a debit to cash.

What is concentration banking in cash management?

Definition: The Concentration Banking is the arrangement used by the firms, wherein the funds from all the regional banks in different locations gets concentrated or collected into the single bank account.

What is a cash disbursement in accounting?

What is a Disbursement?

- Understanding Disbursements. Disbursements represent the delivery of money from a fund or account to another. ...

- Cash Disbursement Journal. The cash disbursement journal is also known as the cash payment journal. ...

- Examples of Disbursements. Here are some examples of disbursements and their entries for better understanding. ...

- Related Readings. ...

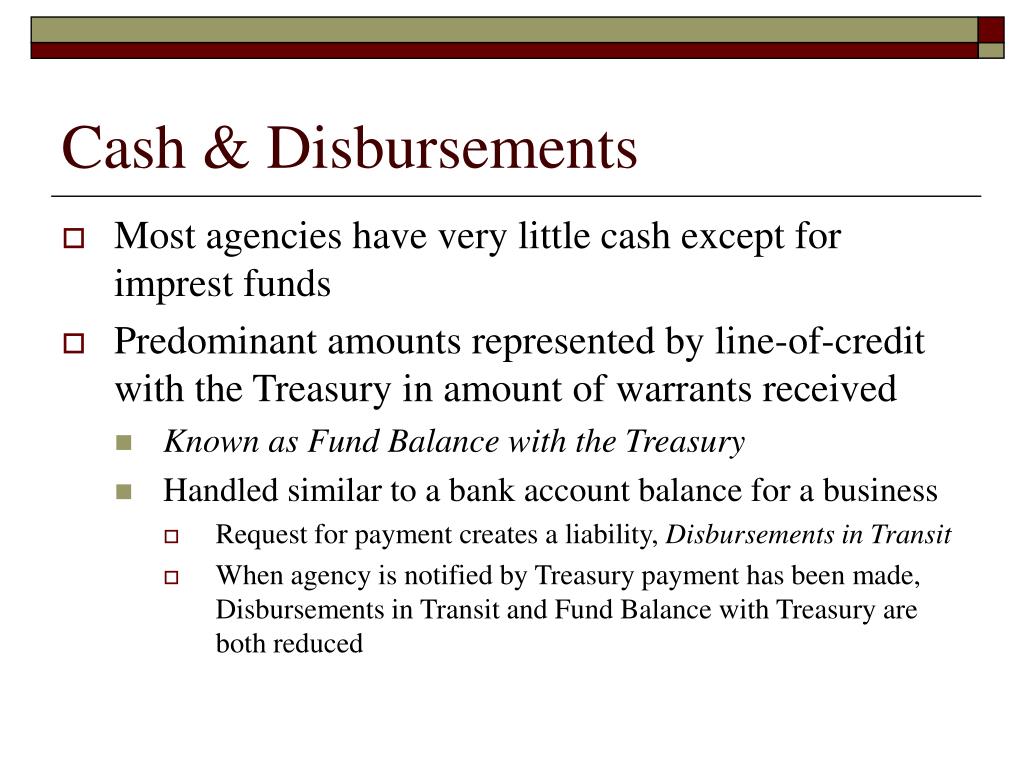

What is controlled disbursement?

Controlled disbursement is a type of cash management service that is only available to companies. The name comes from its function: it allows a bank's corporate clients to see their expenditures, or disbursements, on a daily basis, which is a controlled period of time.

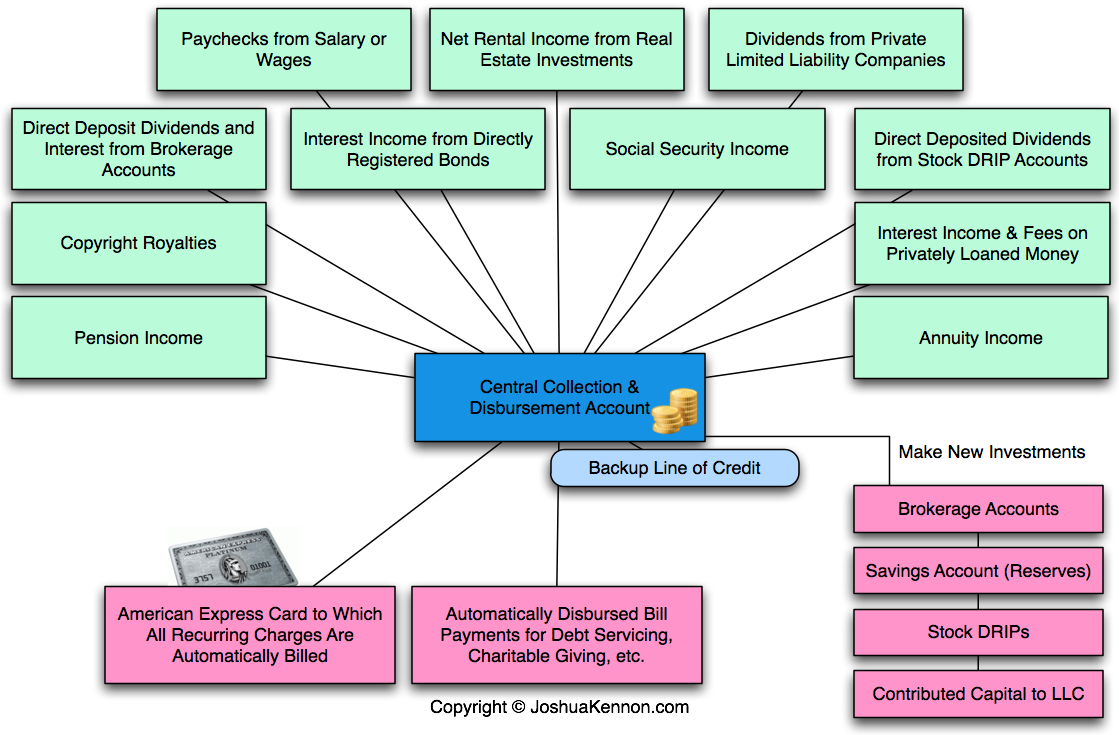

What is Cash Concentration?

Cash concentration is a treasury management method that involves the transfer of all funds from different accounts to a single centralized account.

Why is cash concentration important?

Cash concentration is an important treasury management tool. It helps in centralized cash management for quick pooling and disbursement of funds. It reduces the dependency on short-term financing.

What is the purpose of cash concentration and disbursement?

Cash concentration and disbursement are important treasury management methods. A business may generate cash flow from different sources and keep the cash balances in different accounts. Centralized treasury management will pool the cash funds from different accounts into a single centralized account.

Why is centralized cash balance important?

The business can use the centralized cash balance to fund different investing activities. It helps treasury management to easily disburse funds to sub-accounts when and wherever needed. It is also an important method in modern online banking.

Why use cash concentration method?

Businesses can use the cash concentration method to ease the working capital requirements. Businesses can use the facility to make payments, invoicing, funds collection, and funds pooling. Its main use is to consolidate cash balances from different accounts to a single account.

Why do businesses use cash concentration?

It reduced the dependency on bank loans for short-term financing. Businesses can use the cash concentration method to clear payments in real-time. It can also help in cash disbursement quickly to different accounts as funds are concentrated in ...

Why is centralization important in banking?

It is used among the banking channels as a means of electronic funds transfers. It helps banking channels to clear transactions rapidly without overnight disbursements. Centralization of cash funds helps banks manage electronic funds transfers to and from different accounts.

Examples of Cash Concentration or Disbursement Plus Addendum in a sentence

The consumer or corporation provides the instruction to its financial institution on the correct ACH format to use (e.g., Cash Concentration or Disbursement Plus Addendum (CCD+) or the Corporate Trade Exchange (CTX) and the information to include, and authorizes an ACH credit transaction to the FRB.

Related to Cash Concentration or Disbursement Plus Addendum

Designated Disbursement Account means the account of the Borrower maintained with the Administrative Agent or its Affiliate and designated in writing to the Administrative Agent as the Borrower’s Designated Disbursement Account (or such other account as the Borrower and the Administrative Agent may otherwise agree).