In some businesses, the cash receipts journal is combined with the cash disbursements journal and is referred to as the cash book. The information recorded in the cash receipts journal is used to make postings to the subsidiary ledgers and to relevant accounts in the general ledger.

How to write a cash receipt book?

- For example, the top right of the receipt would look something like: January 20, 2019 004

- You can reset the receipt numbers every day as long as you also write the date on every receipt.

- Most receipt booklets will already have a different receipt number for each receipt.

Where May one purchase a receipt book?

You can purchase a 2 part carbonless receipt book online or at an office supply store or one that has several sheets of reusable carbon paper. These booklets are usually prenumbered and already have the receipt headings in place. Make sure to get booklets with 2 part forms so that you get a copy that you can keep for your records.

Where to buy receipt books?

How to Write a Receipt or Personalized Invoice Book

- Write in the description of the item or service being sold

- Sold By & Received by

- Quantity

- The amount charged - cash, C.O.D., charge, or on account

- Taxes

- Total

How to fill out a receipt book receipt?

There are just five steps to writing a receipt with Invoice Simple:

- Add in your company details (name, address) in From section.

- Fill out client details (name, email, address) in For section.

- Write out line items with description, rate and quantity.

- Finish with the date, invoice number and your personalized brand.

What does cash receipt mean?

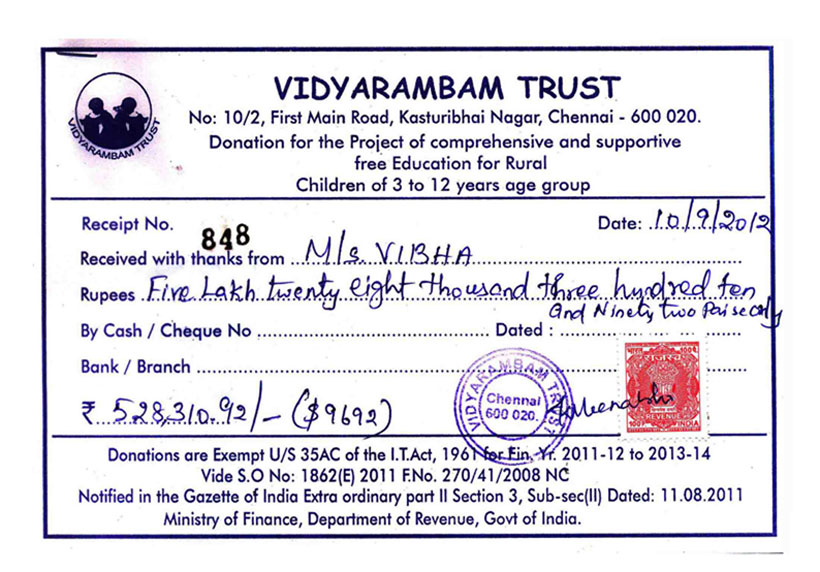

A cash receipt is a printed acknowledgement of the amount of cash received during a transaction involving the transfer of cash or cash equivalent. The original copy of the cash receipt is given to the customer, while the other copy is kept by the seller for accounting purposes.

What is cash receipt with example?

This is a simple operation, selling a simple product, for a simple price. Timmy sells a glass of lemonade for $1, and without say it's expected that you have to immediately pay Timmy $1 to receive a glass of lemonade. In this example, each sale generated by Timmy's lemonade stand generates a $1 cash receipt.

What is recorded in CRJ?

Meaning of CRJ CRJ means cash receipt journal. In CRJ, we record only cash receipts. There are lots of sources of receiving cash, so, we can make different columns in this journal. In higher classes, this journal is not made, it is included in the debit side of cash book.

What is a receipt book used for?

Definition of receipt, receipt book paper given to a payer to evidence payment of an invoice. It generally includes the payer's name, amount, date, and purpose and should be retained by anyone who pays in cash to prove payment.

What is CRJ in accounting?

This stands for Journal. These journals represent the different types of activity for your company. For example, CRJ stands for Cash Receipts Journal. Money that you have received from your customers will post to this journal. Another example is the CDJ, which stands for Cash Disbursements Journal.

How do you record cash receipts?

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer's accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

What are the 7 types of journal?

ADVERTISEMENTS: Here we detail about the seven important types of journal entries used in accounting, i.e., (i) Simple Entry, (ii) Compound Entry, (iii) Opening Entry, (iv) Transfer Entries, (v) Closing Entries, (vi) Adjustment Entries, and (vii) Rectifying Entries.

What are the 7 journals in accounting?

Types of Journal in AccountingPurchase journal.Sales journal.Cash receipts journal.Cash payment/disbursement journal.Purchase return journal.Sales return journal.Journal proper/General journal.

What are the 5 journals in accounting?

Remember, we have 5 special journals:a sales journal to record ALL CREDIT SALES.a purchases journal to record ALL CREDIT PURCHASES.a cash receipts journal to record ALL CASH RECEIPTS.a cash disbursements journal to record ALL CASH PAYMENTS; and.More items...

How do you write a cash receipt book?

What information must I put on a receipt?your company's details including name, address, phone number and/or email address.the date of transaction showing date, month and year.a list of products or services showing a brief description of the product and quantity sold.More items...

What are the types of receipts?

However, receipts are classified into two types. They are: Revenue receipts. Capital receipts.

What is difference between receipt and invoice?

While an invoice is a request for payment, a receipt is the proof of payment. It is a document confirming that a customer received the goods or services they paid a business for — or, conversely, that the business was appropriately compensated for the goods or services they sold to a customer.

What is cash receipts in cash flow?

Cash receipts from sales of goods and services including receipts from collection of accounts receivable and both short/long-term notes receivable from customers and students arising from those sales. Cash receipts from quasi-external operating transactions with other funds.

What is cash receipts in cash budget?

The cash receipts section of a cash budget summarizes all cash expected to flow into the business during the budget period. Now, because many companies generally extend credit to their customers, a lot of their sales are originally recorded as accounts receivable.

What are the types of receipts?

However, receipts are classified into two types. They are: Revenue receipts. Capital receipts.

What is the difference between cash receipts and cash payments?

Cash transactions are ones that are settled immediately in cash. Cash transactions also include transactions made through cheques. Cash transactions may be classified into cash receipts and cash payments....Cash Receipts.Cash receipt from receivable:DebitCashCreditReceivables

What is a cash receipt?

A cash receipt is a printed acknowledgment of the amount of cash received during a transaction involving the transfer of cash or cash equivalent. The original copy of this receipt is given to the customer, while the other copy is kept by the seller for accounting purposes. In other words, it is generated when a vendor accepts cash ...

Why are cash receipts important?

Another importance of cash receipts is that at certain times, it can also be useful for tax purposes. It can be used to legally minimize or decrease tax payable. Since it can be used as expenses that are deducted to sales, it will reduce the payment due to lower net income.

What is debit in accounting?

Debit Debit is an entry in the books of accounts, which either increases the assets or decreases the liabilities. According to the double-entry system, the total debits should always be equal to the total credits. read more. the cash account, credit the receivable account).

What is a credit term for a distributor?

Credit Terms Credit Terms are the payment terms and conditions established by the lending party in exchange for the credit benefit.

What is cash equivalent?

Cash Or Cash Equivalent Cash and Cash Equivalents are assets that are short-term and highly liquid investments that can be readily converted into cash and have a low risk of price fluctuation. Cash and paper money, US Treasury bills, undeposited receipts, and Money Market funds are its examples. They are normally found as a line item on the top of the balance sheet asset. read more

When is cash acknowledged?

Usually, the cash is acknowledged when money is taken from a customer to adjust the outstanding accounts receivable balance

Can receipts be used to claim expenses?

Also, a receipt asked during purchases or payments can be validly used to claim as an expense and then utilized as a deduction to sales in case the purchaser is a sales tax registered.

Which side of the cashbook is the receipt?

Cash-book has two sides, i.e., the left-hand side and the right-hand side, where all the receipts in cash are recorded on the left side, whereas all the payments in cash are recorded on the right side. Cashbook helps in effective cash management as management can know the balances of cash and bank at any time and take the necessary decisions ...

What is a cash book?

Cash Book is the one in which all the cash receipts and cash payments including the funds that are deposited in the bank and funds which are withdrawn from the bank are recorded according to the date of the transaction. All the transaction which is recorded in the cash book has the two sides i.e., debit and credit.

What is a single column cash book?

Single column cash-book contains only the cash transactions done by the business. Single column cash-book has only a single money column on debit and credits both sides. It does not record the transaction-related, which involves banks or discounts. The transactions which are done on credit are not recorded while preparing the single column cash –book.

Why is cashbook important?

It helps in saving time and labor as in case of recording cash transactions in the journal, tremendous time and labor are required, whereas, in the case of cashbook, cash transactions are recorded straight away that is in the form of the ledger. Management can know the balances of cash and bank at any time. It helps in effective cash management.

What is cash management?

Cash Management Cash Management refers to the appropriate collection, handling, & disbursement of cash for ensuring financial stability & avoiding insolvency risk. read more. .

What is the difference between cash book and credit book?

It has two of the identical sides, i.e., left-hand side (debit side) and the right-hand side (credit side) The difference between the total of the two sides gives cash in hand or bank account balance.

What is the difference between the sum of balances of the debit side and the credit side?

The difference between the sum of balances of the debit side and credit side shows the balance of the cash on hand or bank account. Cashbook plays a dual role as it is the book of the original entry of the company as well as book the final entry

What is a cash receipt journal?

The cash receipts journal manages all cash inflows of a business organization. In other words, this journal is used to record all cash coming into the business. For recording all cash outflows, another journal known as cash disbursements journal or cash payments journal is used.

What is the cost of goods sold in cash receipt journal?

Cost of goods sold/inventory: In cash receipt journal, this column is used to record the cost of merchandise sold for cash. This column is also found in sales journal where it is used to enter the cost of goods sold on credit. The total of this column is debited to cost of goods sold account and credited to inventory account in general ledger.

What is account credited?

Account credited: The account credited column is used to enter the title or name of the account that is credited in ledger as a result of cash inflow. For every inflow of cash, one or more accounts are essentially credited in accounts receivable subsidiary ledger or in general ledger or in both.

What is the column used to record cash sales?

Sales: This column is used to record cash sales. Every time a cash sale is made, the amount received is entered in this sales column

What is the cash column in a general ledger?

Cash: In cash column the amount of cash received is entered. The cash account in general ledger is debited by the total of this column.

Where Do Cash Receipts Appear on a Financial Summary?

Cash receipts appear on a financial summary as an increase to the cash account or another asset account. This depends upon the nature of the sale.

What are some examples of cash receipts?

Examples of cash receipts could include fees collected by a lawyer, deposits made toward the purchase of a home and refundable airline tickets bought by a customer and returned after their flights are cancelled. Cash receipts can come from the sale of goods instead of services as well.

Who Should Sign a Cash Receipt?

You should receive two copies of your cash receipts, one for you and one for the customer. The original copy will be filed in the company’s files (the business). The duplicate copy is given to the customer as proof of payment.

What Are the Benefits of Recording Cash Receipts?

These include enabling a business to accurately track its income and expenses. This reduces the time it takes for a business to determine how much income was collected from customers.

How Do You Record Cash Receipts on Your Financial Statements?

Cash receipts on your financial statements can be recorded by following these three steps:

Why Are Cash Receipts Important?

Cash receipts are important to all businesses, no matter the industry. Recording cash deposits accurately helps a business track its income and expenses. It also reduces the time it takes for a business to determine how much income was collected from customers.

What is a debit in accounting?

If the payment you received is for goods that you have produced and not yet sold, then record it as an increase in inventory (debit) instead of as an increase to accounts payable (credit). The debit would be for inventory and the credit would be for either cash or accounts receivable, depending upon what type of sale was made. After the sale is recorded, the increase in inventory due to production is counted as a decrease to inventory. This is opposed to being counted as an increase to cash.

How do you show the Cash Receipt?

The cash receipts transaction is shown in the accounting records with the following bookkeeping entries:

What is the entry to accounts receivable?

In practice the entry to the accounts receivable would be a two stage process. The amount would be posted to the sales ledger, to the individual account of the customer, and then the control totals in the sales ledger would be posted to the accounts receivable control account.

What is receipt book template?

The receipt book template is an array of 3 receipts laid out horizontally that is commonly used in a booklet for multiple uses. If the receipt book will be placed in a binder, it must be ‘hole punched’ with a standard hole puncher (3 or 5 rings).

How to keep receipts after payment?

If the receipt will be given to a client after payment, a portion of the receipt should be kept for record-keeping. This can be accomplished by making a note of the receipt in a transaction booklet or by using carbon copy receipts.

How to report a payment received?

After documenting the payment, tend to the “For Payment Of” by submitting a brief description of the merchandise or services that were purchased Now, the person who has accepted the payment on behalf of the entity receiving it should report his or her full name on the line labeled “Received By.’ Next, you will need to document the complete name of the entity or person who has submitted the payment on the line attached to the “Received From” line.

Types of Cash Book Formats

Cash Book Format

- Mr. X started the business in the month of June-2019. He invested the capital of $200,000, in which the cash contribution is $100,000, and the rest $100,000 he deposited in the business bank account a business. During June 19, the following transactions took place in the business. Prepare the necessary double-column Cashbook using the data as given below: Solution:

Advantages

- It helps in saving time and labor as in case of recording cash transactions in the journal, tremendous time and labor are required, whereas, in the case of cashbook, cash transactions are recorded...

- Management can know the balances of cash and bank at any time. It helps in effective cash managementCash ManagementCash Management refers to the appropriate collection, handl…

- It helps in saving time and labor as in case of recording cash transactions in the journal, tremendous time and labor are required, whereas, in the case of cashbook, cash transactions are recorded...

- Management can know the balances of cash and bank at any time. It helps in effective cash managementCash ManagementCash Management refers to the appropriate collection, handling, & disbursement of...

- Cashbook is balanced regularly, which helps in avoiding fraud. Also, discrepancies, if any, arises can be found and rectified.

Important Points

- Cash-book plays a dual role as it is the book of the original entry of the company as well as book the final entry.

- It has two of the identical sides, i.e., left-hand side (debit side) and the right-hand side (credit side)

- The difference between the total of the two sides gives cash in hand or bank account balance.

- Cash-book plays a dual role as it is the book of the original entry of the company as well as book the final entry.

- It has two of the identical sides, i.e., left-hand side (debit side) and the right-hand side (credit side)

- The difference between the total of the two sides gives cash in hand or bank account balance.

- The transactions which are done on credit are not recorded in this book.

Conclusion

- Cash-book is a separate book of accounts in which all the cash transactions of the company are entered concerning the corresponding date, and it is different from the cash account where posting is done from the journal. There is no requirement to transfer the balances to the general ledger, which is required in the case of the cash account. Entries...

Recommended Articles

- This article has been a guide to what is Cash Book and its definition. Here we discuss three types of cash book formats in accounting along with examples, advantages & limitations. You can learn more about accounting from the following articles – 1. Petty Cash Book 2. Examples of Bookkeeping 3. QuickBooks Training Course 4. Cash Receipt Format