How to create a cash book?

Apr 04, 2020 · A Cash receipts journal is a specialized accounting journal and it is referred to as the main entry book used in an accounting system to keep track of the sales of items when cash is received, by crediting sales and debiting cash and …

What are some examples of cash receipts?

Oct 22, 2021 · The cash book is used to record receipts and payments of cash. It works as a book of original entry as well as a ledger account. The entries related to receipt and payment of cash are first recorded in the cash book and then posted to the relevant ledger accounts. Moreover, a cash book is a substitute for cash account in the ledger.

How do you create a receipt?

Jan 03, 2022 · The cash receipts journal manages all cash inflows of a business organization. In other words, this journal is used to record all cash coming into the business. For recording all cash outflows, another journal known as cash disbursements journal or …

How do you download a receipt?

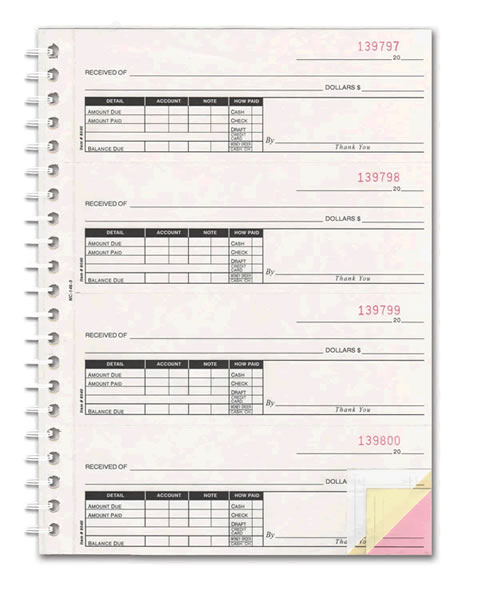

Mar 09, 2022 · A cash receipt is a printed statement of the amount of cash received in a cash sale transaction. A copy of this receipt is given to the customer, while another copy is retained for accounting purposes. A cash receipt contains the following information: The date of the transaction. A unique number that identifies the document. The name of the payer. The amount …

How do you use a cash receipt book?

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer's accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.Oct 10, 2019

What do cash receipts include?

Cash receipts are proof that your business has made a sale. Cash receipts include receipts for cash sales, sales paid for by check, and purchases on store credit. Cash receipts from cash sales impact the cash account on the balance sheet and the sales account on the profit and loss statement.

What is a cash receipts journal with example?

Examples include the receipt of cash for interest, rent and the sale of old assets etc. Cost of goods sold/inventory: In cash receipt journal, this column is used to record the cost of merchandise sold for cash. This column is also found in sales journal where it is used to enter the cost of goods sold on credit.Jan 3, 2022

What is recorded in CRJ?

CRJ means cash receipt journal. In CRJ, we record only cash receipts. There are lots of sources of receiving cash, so, we can make different columns in this journal. In higher classes, this journal is not made, it is included in the debit side of cash book.

How do you write a cash receipts journal?

0:293:08The Cash Receipts Journal - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe first step in the journal is to put the date. Next. We put which account is being credited inMoreThe first step in the journal is to put the date. Next. We put which account is being credited in this case it is an individual accounts receivable account for John Henry.

Why are cash receipts important?

The important benefit of a cash receipt is the completeness of the accounting records that support the existence of recording transactions. A cash receipt also becomes important because one of the major reason for an audit is the lack of documents (such as cash receipts ) to support the existence of the transaction.Jan 14, 2020

What is the difference between sales and cash receipts journal?

It differs from the cash receipts journal in that the latter will serve to book sales when cash is received. The sales journal is used to record all of the company sales on credit. Most often these sales are made up of inventory sales or other merchandise sales.

How do you calculate cash receipts?

Add the amount of last quarter's sales you will collect this quarter and the amount of the current quarter's sales you will collect this quarter to calculate your budgeted cash receipts for the current quarter. In this example, add $400 and $720 to get $1,120 in budgeted cash receipts for the current quarter.

What is a cash journal in accounting?

The cash journal is a subledger of Bank Accounting. It is used to manage a company's cash transactions. The system automatically calculates and displays the opening and closing balances, and the receipts and payments totals. You can run several cash journals for each company code.

What are the 4 journals in accounting?

The four main special journals are the sales journal, purchases journal, cash disbursements journal, and cash receipts journal. These special journals were designed because some journal entries occur repeatedly.

What are the 7 types of journal?

Types of Journal in AccountingPurchase journal.Sales journal.Cash receipts journal.Cash payment/disbursement journal.Purchase return journal.Sales return journal.Journal proper/General journal.

What is a cash receipt journal?

The cash receipts journal is that type of accounting journal which is only used to record all receipts of cash during an accounting period and works on the golden rule of accounting – debit what comes in and credits what goes out. Credit Sales Credit Sales is a transaction type in which the customers/buyers are allowed to pay up for ...

What are the disadvantages of cash receipts journal?

A single disadvantage of cash receipts journal is that it only takes into account the cash basis of accounting#N#Cash Basis Of Accounting Cash Basis Accounting is an accounting method in which all the company's revenues are accounted for only when there is an actual cash receipt, and all the expenses are recognized when they are paid. Small companies and individuals generally follow this accounting method. read more#N#. It doesn’t take into account the accrual basis of accounting which is the principal basis of doing double-entry bookkeeping and prudent accounting.

What is the book of original entry?

read more. are not at all recorded in this accounting journal. Accounting Journal Accounting journal, often known as the book of original entry, is first used to record the company's accounting record whenever a financial transaction occurs.

What is rental income?

Financial Institution Financial institutions refer to those organizations which provide business services and products related to financial or monetary transactions to their clients.

How does a cash book work?

It works as a book of original entry as well as a ledger account. The entries related to receipt and payment of cash are first recorded in the cash book and then posted to the relevant ledger accounts. Moreover, a cash book is a substitute for cash account in the ledger. A company that properly maintains a cash book does not need ...

What is cash in finance?

Cash is a current asset which consists of items used in day to day financial transactions as medium of exchange. In accounting and finance, cash includes, currency notes made of paper, coins, demand deposits, money orders, checks and bank overdrafts etc. The following items cannot be treated as cash:

Is cash available to meet current obligations?

It is readily available to meet current obligations of any business organization. It is universally accepted as a mode of payment by creditors. The economic activities of any business involve a regular inflow and outflow of cash and cash equivalents.

What is a cash receipt journal?

The cash receipts journal manages all cash inflows of a business organization. In other words, this journal is used to record all cash coming into the business. For recording all cash outflows, another journal known as cash disbursements journal or cash payments journal is used.

What is account credited?

Account credited: The account credited column is used to enter the title or name of the account that is credited in ledger as a result of cash inflow. For every inflow of cash, one or more accounts are essentially credited in accounts receivable subsidiary ledger or in general ledger or in both.

What Is a Cash Receipt?

A cash receipt is an accounting entry that documents the collection of cash from a customer. Cash receipts typically increase (debits) the company’s cash balance on its balance sheet. Simultaneously, they decrease (credits) either accounts receivable or another asset account.

Where Do Cash Receipts Appear on a Financial Summary?

Cash receipts appear on a financial summary as an increase to the cash account or another asset account. This depends upon the nature of the sale.

What Are the Benefits of Recording Cash Receipts?

The benefits of recording sales in the form of cash receipts are several. These include enabling a business to accurately track its income and expenses. This reduces the time it takes for a business to determine how much income was collected from customers.

How Do You Record Cash Receipts on Your Financial Statements?

Cash receipts on your financial statements can be recorded by following these three steps:

Why Are Cash Receipts Important?

Cash receipts are important to all businesses, no matter the industry. Recording cash deposits accurately helps a business track its income and expenses. It also reduces the time it takes for a business to determine how much income was collected from customers.

Who Should Sign a Cash Receipt?

You should receive two copies of your cash receipts, one for you and one for the customer. The original copy will be filed in the company’s files (the business). The duplicate copy is given to the customer as proof of payment.

Key Takeaways

Cash Receipts are an important part of accounting and business management. There are three main types: Cash, Accounts Payable, and Credit Sales. One of the biggest benefits of recording cash receipts is to help accurately track income and expenses.

Types of Cash Book Formats

Cash Book Format

- Mr. X started the business in the month of June-2019. He invested the capital of $200,000, in which the cash contribution is $100,000, and the rest $100,000 he deposited in the business bank account a business. During June 19, the following transactions took place in the business. Prepare the necessary double-column Cashbook using the data as given below: Solution:

Advantages

- It helps in saving time and labor as in case of recording cash transactions in the journal, tremendous time and labor are required, whereas, in the case of cashbook, cash transactions are recorded...

- Management can know the balances of cash and bank at any time. It helps in effective cash managementCash ManagementCash Management refers to the appropriate collection, handl…

- It helps in saving time and labor as in case of recording cash transactions in the journal, tremendous time and labor are required, whereas, in the case of cashbook, cash transactions are recorded...

- Management can know the balances of cash and bank at any time. It helps in effective cash managementCash ManagementCash Management refers to the appropriate collection, handling, & disbursement of...

- Cashbook is balanced regularly, which helps in avoiding fraud. Also, discrepancies, if any, arises can be found and rectified.

Important Points

- Cash-book plays a dual role as it is the book of the original entry of the company as well as book the final entry.

- It has two of the identical sides, i.e., left-hand side (debit side) and the right-hand side (credit side)

- The difference between the total of the two sides gives cash in hand or bank account balance.

- Cash-book plays a dual role as it is the book of the original entry of the company as well as book the final entry.

- It has two of the identical sides, i.e., left-hand side (debit side) and the right-hand side (credit side)

- The difference between the total of the two sides gives cash in hand or bank account balance.

- The transactions which are done on credit are not recorded in this book.

Conclusion

- Cash-book is a separate book of accounts in which all the cash transactions of the company are entered concerning the corresponding date, and it is different from the cash account where posting is done from the journal. There is no requirement to transfer the balances to the general ledger, which is required in the case of the cash account. Entries...

Recommended Articles

- This article has been a guide to what is Cash Book and its definition. Here we discuss three types of cash book formats in accounting along with examples, advantages & limitations. You can learn more about accounting from the following articles – 1. Petty Cash Book 2. Examples of Bookkeeping 3. QuickBooks Training Course 4. Cash Receipt Format

Types of Cash Receipts

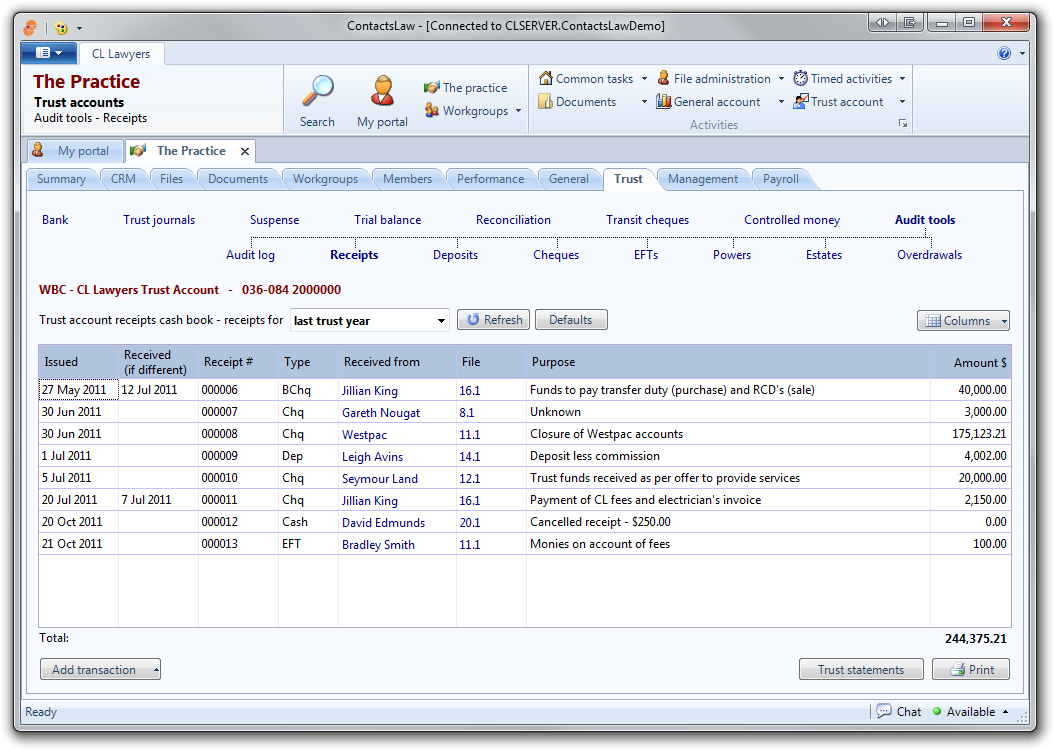

Example of Cash Receipt Journal

- When a retailer/wholesaler sells goods to a customer and it collects cash, this transaction is recorded in the cash receipts journal. Investment of capital by the owner of a business is recorded in cash receipts, sale of an asset for cash is recorded in cash receipts, all kinds of collections from credit customers are recorded in cash receipts, collection of bank interest, dividendDividen…

Practical Example

- The following example shows how cash receipt journal accounting works and recorded in accounting ledgersAccounting LedgersLedger in Accounting, also called the Second Book of Entry, is a book that summarizes all the journal entries in the form of debits & credits to use for future reference & create financial statements. read more:

Advantages

- Helps in keeping track of all cash received during the period.

- Helps in preparation of cash account ledger and cash flow statement for the period.

- Helps in keeping track of trade receivablesTrade ReceivablesTrade receivable is the amount owed to the business or company by its customers. It is also known as account receivables and is represent...

- Helps in keeping track of all cash received during the period.

- Helps in preparation of cash account ledger and cash flow statement for the period.

- Helps in keeping track of trade receivablesTrade ReceivablesTrade receivable is the amount owed to the business or company by its customers. It is also known as account receivables and is represent...

- Helps in keeping track of all outstanding and aged supplier payments by matching the cash received with cash paid during the period.

Disadvantages

- A single disadvantage of cash receipts journal is that it only takes into account the cash basis of accountingCash Basis Of AccountingCash Basis Accounting is an accounting method in which all the company's revenues are accounted for only when there is an actual cash receipt, and all the expenses are recognized when they are paid. Small companies and individuals generally follow t…

Post Posting Checks

- There are two post posting checks which can be made following the posting of the cash receipts journal at the end of an accounting period to ensure that the transactions during the period have been correctly entered and presented in ledgers and the financial statements of an organization: 1. The total of all the customer sub-ledger balances which are appearing under the account hea…

Recommended Articles

- This has been a guide to what is cash receipts journal and its definition. Here we discuss its types, example, format, advantages, and disadvantages. You can learn more about economics from the following articles – 1. Cash Receipt Template 2. Cash Book 3. Rules for Journal Entries 4. Special Journal