What is and isn't covered by homeowners insurance?

Some examples of large-scale events not covered by homeowners insurance include:

- Earthquakes

- Floods

- Acts of war

- Nuclear accidents The following incidents are not covered by your homeowners insurance because they are considered to be the result of normal wear and tear:

- Mold

- Infestations (including termites)

- Water damage

- Sewer backup

How do you calculate homeowners insurance?

and key cover is included in some home insurance policies. Carefully consider what you do and don’t need and check the policies you already have before settling on any add-ons. Black box insurance policies, also known as telematics, calculate premiums ...

What is additional interest on homeowners policy?

- Car insurance

- Homeowners insurance

- Renters insurance

What is loss of use coverage for home insurance?

- Loss of use coverage helps pay for you to live elsewhere while your home is being repaired after a disaster.

- Sometimes called additional living expenses or Coverage D, it’s a standard part of most homeowners and renters policies.

- Loss of use can cover expenses such as hotel stays, home rentals and meals.

What percent is coverage D?

COVERAGE D - LOSS OF USE A, reducing Cov A (FRV only, no ALE) DP-3: 10% of Cov.

What are the 3 basic levels of coverage that exist for homeowners insurance?

Key Takeaways. Homeowners insurance policies generally cover destruction and damage to a residence's interior and exterior, the loss or theft of possessions, and personal liability for harm to others. Three basic levels of coverage exist: actual cash value, replacement cost, and extended replacement cost/value.

What are the 4 main coverages in a homeowners insurance policy?

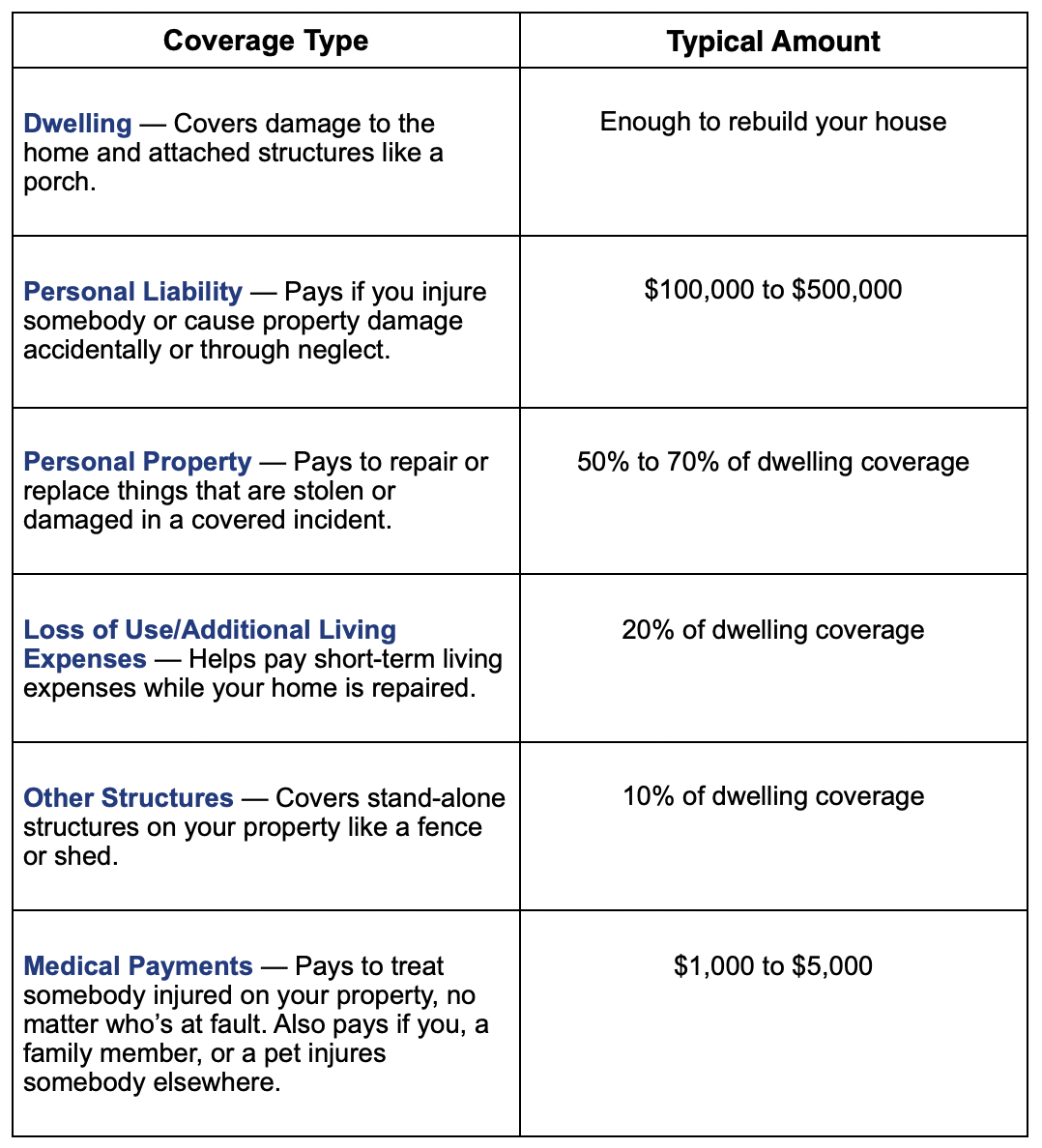

A standard policy includes four key types of coverage: dwelling, other structures, personal property and liability. If your home is damaged by a covered event, like strong winds, dwelling coverage can help pay to repair it.

Which of the following would not be covered as a loss under Coverage D of a homeowners policy?

Coverage D of a Homeowners Policy includes loss of income from an incidental business -- Coverage D does not cover loss of income from an incidental business.

What are the 6 categories covered by homeowners insurance?

Generally, a homeowners insurance policy includes at least six different coverage parts. The names of the parts may vary by insurance company, but they typically are referred to as Dwelling, Other Structures, Personal Property, Loss of Use, Personal Liability and Medical Payments coverages.

What is Coverage C on a homeowners policy?

This coverage provides protection for the contents of your home and other personal belongings owned by you and other family members who live with you. Coverage C is normally 50% of coverage A or is subject to an established amount agreed upon by you and the insurance company.

What is Coverage A and B?

In general, Coverage A covers damage to the dwelling or house. Coverage B covers damage to other structures such as a detached garage, work sheds, etc.

What does Coverage B mean?

other structures insurance coverageCoverage B, also known as other structures insurance coverage, is the part of your homeowners policy that protects structures on your property not physically connected to your home, such as a detached garage, storage shed, or gazebo.

What does coverage f mean?

Medical Payments to OthersCoverage F, or “Medical Payments to Others” coverage is the component of your homeowners insurance policy which will help pay towards injuries sustained by someone who is not the insured, or a regular resident of the property.

Does my homeowners insurance cover damage to neighbor's property?

Your home insurance should cover the damage caused to your own property, but for it to pay out for your neighbour's repairs it needs to be established that you are legally liable for causing the damage.

How do I maximize my homeowners insurance claim?

Prepare for Disaster in Advance Preparation is key when it comes to maximizing your home insurance claim. The two main ways homeowners can ensure they're adequately prepared to deal with a disaster are to maintain a home inventory and keep updated pictures on hand.

Is there a deductible for loss of use?

Do you pay a deductible on loss of use insurance? A home insurance deductible generally applies when filing a claim, but you do not have a separate deductible for loss of use coverage. The cost of your living expenses will be reimbursed up to your policy's limit and insurer's approval of your expenses.

What is HO3 vs HO6 insurance?

HO-3 and HO-6 insurance cater to different home owners. HO-3 insurance is designed for standalone homes, and HO-6 insurance is used to cover condos. There are some similarities—they both cover personal property, liability, medical payments and loss of use coverage.

What perils are covered by the HO 2 and HO-3?

With HO2 coverage, your dwelling coverage is written as named perils which means that your home structure is only covered by perils included in your policy. On the flipside, with HO3 coverage, your dwelling coverage is written as open perils which means that unless a peril is specifically excluded, it is covered.

What is the difference between HO3 and ho5?

An HO-3 policy only covers personal property for named perils, while an HO-5 policy covers personal property for open perils. In simple terms, this means an HO-5 insurance policy is more comprehensive and covers damage to your personal property in all cases, except damage specifically excluded from your policy.

Which of these is the best description of the special HO-3 homeowners insurance policy?

A homeowners insurance (HO-3) policy is a coverage plan that covers your home's structure, your personal belongings and liability in the event of damage or injury. Typically, an HO-3 policy will also cover additional living expenses and protection for other structures on your property.

How long does loss of use coverage last?

Coverage D in your home insurance policy can pay for additional living expenses, such as the cost of: Loss of use coverage is usually available for 12 months or how long it takes to make your dwelling inhabitable – whichever comes first.

What happens if your home is uninhabitable?

It also won’t pay for additional living expenses when your home is made uninhabitable by an event your home insurance policy doesn’t cover, like earthquakes.

Can you draw on loss of use?

To draw on your loss of use coverage, your home must be made uninhabitable by a peril your home insurance policy covers, such as: Typically, if your home is undamaged but you still can’t access it because of a government mandate or a civil authority, this coverage won’t kick in . An exception may happen if a civil authority prohibits the use ...

Does loss of use insurance cover living expenses?

Loss of use insurance can help pay for the additional living expenses you take on when a covered home insurance claim makes your home uninhabitable. Think about the last time you stayed away from home. Chances are you had to line up a place to stay and pay to eat at restaurants or order takeout.

What does personal property cover?

What It Covers: Personal property coverage protects the belongings found within the home that don’t fall outside the stipulations in the policy, such as items in certain categories or that are too valuable and need their own policies.

What is coverage A?

Coverage A, or dwelling coverage, is the central coverage included in a homeowners policy and will generally have the highest limit of types of coverage on your policy. What It Covers: Dwelling coverage protects the structural components of your home from damage and covers in the event of damage to the home ...

What type of coverage is required for fire, theft, and lightning?

When It Applies: This type of coverage will usually apply in the event of damage from theft, vandalism, fire, explosions, windstorms, and lightning. Standard Coverage: Coverage A can have any limit and it is generally recommended that homeowners carry Coverage A that protects the full replacement cost of their home.

How many types of home insurance are there?

Standard home insurance has six types of coverage on each policy. Though some of these types of coverage have names more commonly used in the industry, companies described these six types alphabetically, as coverages A through F. Each type of coverage plays its own role in providing comprehensive financial protection for you and your home.

What is the standard coverage for a home?

Standard Coverage: Standard policies will usually limit Coverage B to 10% of the replacement cost of the home , which is also the general industry’s minimum recommendation for homeowners. Add-On Coverage You Might Need: Depending on your home’s circumstances, including location, you might want to request a higher limit for Coverage B.

What is loss of use insurance?

Loss of use refers to when the insured home is damaged to the point that it cannot be lived in. Loss of use coverage is also known as additional living expenses coverage.

When does coverage E apply?

When It Applies: Coverage E applies in cases where the homeowner is at fault (or liable, when negligence has caused a loss due to property damage or injury. Liability coverage does not apply for things that the homeowners or household members did not cause or did deliberately.

Blog

Helpful tips, advice, information and fun facts on topics including safety, maintenance and homeowners insurance.

Homeowners Insurance: Coverage D Explained

As we are in the midst of the peak of Hurricane Season, it is important to understand what your homeowners insurance policy covers. You do not want to wait until the unexpected occurs to learn you may not have adequate coverage. As such, we would like to provide you with some information on Coverage D.

What is included in a standard home insurance policy?

Other home insurance coverages in a standard policy: A standard home insurance policy generally includes the following six main forms of coverage. Because Loss of Use isn’t used as often as other types of protection such as dwelling or personal property, it is sometimes forgotten. Make it a point to familiarize yourself with all major forms ...

What is loss of use coverage?

What is ‘Loss of Use’ coverage? Loss of Use (or Coverage D) is the portion of a standard home insurance policy that protects you in the event that your home is destroyed or damaged by a covered peril and you must seek other living arrangements while repairs are made.

What is the loss of use limit on home insurance?

Most standard home insurance policies will provide Loss of Use protection up to 20% of your dwelling coverage limit.

Is loss of use coverage good?

Though your Loss of Use coverage can help you get back on your feet after your home becomes damaged, it’s better if you don’t suffer damage from a covered peril in the first place.

What is a D on renters insurance?

What Is Coverage D On Renters Insurance? Coverage D on your renters insurance is called “additional living expenses” or “loss of use.”. While the terminology varies, the intention of the coverage does not. When you suffer a loss, it’s a given that you’ll incur additional costs to live if you can’t use the insured premises.

What is Coverage D?

Coverage D is designed to protect you against the significant additional living expenses that occur following a loss. You’ll need somewhere else to stay, and you’ll also have other costs.

Why is coverage D important?

Since insurance is, broadly speaking, designed to return you to the financial condition you were in before you suffered the loss, Coverage D is one way that the additional costs of a loss are mitigated so as not to make your financial position worse. That’s the reason that the coverage exists, and really the reason that insurance exists ...

Why does food cost more?

In so doing, your food will cost more because you can’t cook meals at home. There will likely be additional transportation costs to get you to work and your kids to where they need to go. The type of things that can be covered under Coverage D are quite broad, up to the policy limit.

What happens if water pipe breaks?

If the main water service pipe breaks two floors below you, you probably have no direct damages from the loss. But if the entire building is without water while repairs are made, the city might well order you not to live there.

Does Coverage D stand on its own?

Coverage D does not, and cannot, stand on its own. Loss of use coverage on renters insurance has to be triggered by something else. What is that something else? A covered loss to the insured location – your resident premises. In our article on Coverage C, you saw the long list of perils that are covered.

Does food cost more in a hotel?

Food will cost more, since you’ll likely be in a hotel and unable to cook for yourself . In other words, the policy covers, up to the policy limit, necessary living expenses that you incur in order to continue your life in a way that is as near as possible to your normal standard of living. Since you’re probably still paying rent on ...

What Is Loss of Use Coverage?

What Does Loss of Use Coverage Cover?

- This portion of your home insurance policy can usually pay for: 1. Temporary accommodation, for example a hotel, apartment or motel 2. Transportation costs 3. Pet boarding 4. Grocery or restaurant bills spent in addition to your regular level of expenditure 5. Relocation costs of your personal belongings 6. Laundry expenses 7. Parking fees Again, t...

What Doesn’T Loss of Use Insurance Cover?

- Loss of use coverage typically won’t pay for: 1. Your mortgage 2. Loss of rental income beyond the period it takes to repair or rebuild your home It also won’t pay for additional living expenses when your home is made uninhabitable by an event your home insurance policy doesn’t cover, like earthquakes.

When Does Loss of Use Coverage Kick in?

- To draw on your loss of use coverage, your home must be made uninhabitable by a perilyour home insurance policy covers, such as: 1. Fire 2. Windstorm 3. Vandalism Typically, if your home is undamaged but you still can’t access it because of a government mandate or a civil authority, this coverage won’t kick in. An exception may happen if a civil authority prohibits the use of your …

Coverage A – Dwelling Coverage

Coverage B – Other Structures Coverage

Coverage C – Personal Property Coverage

Coverage D – Loss of Use Coverage

- Loss of use refers to when the insured home is damaged to the point that it cannot be lived in. Loss of use coverage is also known as additional living expenses coverage. 1. What It Covers: Loss of use covers additional living expenses, including housing expenses and in-excess of normal food costs when the insured property cannot be used. It can al...

Coverage E – Personal Liability Coverage

Coverage F – Medical Coverage

Conclusion