Full Answer

How do creditors find bank accounts?

Creditors will obtain information from a CHEX report. All retail banks report to CHEX; this does, however, exclude credit unions. Don't be surprised if with in a few days that other account at a different bank gets "hit" also. Most of the time when they find one they will the other.

Can creditors take money from bank account?

Most debt collectors need to sue you and get a court order to take money from your bank account. Some creditors like the IRS, however, can levy your bank account without a court order. Your own bank can take money from your account if you also have a loan with it and are in default.

What banks have no credit check?

OpenSky® Secured Visa® Credit Card

- No credit check to apply and find out instantly if you are approved.

- OpenSky gives everyone an opportunity to improve their credit with an 85% average approval rate for the past 5 years

- Get considered for a credit line increase after 6 months, with no additional deposit required

What is the amount owed to creditors called?

Collection efforts include:

- In-house efforts. You or someone in your firm should contact the non-payer.

- Sue in small claims court.

- Attorneys.

- Collection agencies.

What is the meaning of creditor account?

A term used in accounting, 'creditor' refers to the party that has delivered a product, service or loan, and is owed money by one or more debtors. A debtor is the opposite of a creditor – it refers to the person or entity who owes money.

What type of account is creditors?

current liabilitiesCreditors are an account payable. It is categorized as current liabilities on the balance sheet and must be satisfied within an accounting period.

What is an example of creditor?

Here are some common creditors you may encounter: Friend or family member you owe money to. Financial institution, like a bank or credit union, that extends you a personal loan, installment loan, or student loan. Credit card issuer.

What is debtor and creditor account?

A creditor is an entity or person that lends money or extends credit to another party. A debtor is an entity or person that owes money to another party. Thus, there is a creditor and a debtor in every lending arrangement.

Who are called creditors?

A creditor is an entity (person or institution) that extends credit by giving another entity permission to borrow money intended to be repaid in the future.

Is creditor an asset?

Being a creditor for another business can be considered an asset, demonstrating financial strength to your business, whilst excessive debt counts as a liability.

What is a debtor account?

Accounting of Debtor Account Therefore, in accounting, the client who owes money to a business for purchasing its goods or services on credit is recorded as a debtor account. A debtor account is an asset as it denotes a pending revenue from a credit sale.

Is a bank a creditor?

A creditor is a person, bank, or other enterprise that has lent money or extended credit to another party. The party to whom the credit has been granted is the debtor.

Is creditors Debit or credit?

credit balanceDebtors have a debit balance, while creditors have a credit balance to the firm. Payments or the owed money are received from debtors while loans are made to creditors.

Is creditor a personal account?

A Personal account is a General ledger account connected to all persons like individuals, firms and associations. An example of a Personal Account is a Creditor Account.

Why are creditors liabilities?

Creditors are the liability of the business entity. Liability for such creditors reduces with the payment made to them. Advances from customers: Some customers make the payment in advance for goods. It is the obligation of a business until it supplies the goods.

Are creditors accounts payable?

Accounts payable refers to money owed by a business to its vendors (creditors). Any vendor with an outstanding account balance is considered a creditor. These are vendors whom you expect to pay money to, and are treated as a current liability.

Why creditor is a personal account?

A Personal account is a General ledger account connected to all persons like individuals, firms and associations. An example of a Personal Account is a Creditor Account. A Nominal account is a General ledger account pertaining to all income, expenses, losses and gains.

Are creditors expense?

The same applies to your expenses, all expenses (creditors) for a particular month or year are recorded on your income statement and those accounts that you have not yet paid are recorded on the balance sheet as a liability.

Why are creditors liabilities?

Creditors are the liability of the business entity. Liability for such creditors reduces with the payment made to them. Advances from customers: Some customers make the payment in advance for goods. It is the obligation of a business until it supplies the goods.

What Is a Creditor?

A creditor is an entity (person or institution) that extends credit by giving another entity permission to borrow money intended to be repaid in the future. A business that provides supplies or services to a company or individual and does not demand payment immediately is also considered a creditor, based on the fact that the client owes the business money for services already rendered.

What is a creditor in business?

A creditor is an entity that extends credit, giving another entity permission to borrow money to be repaid in the future. A business that provides supplies or services and does not demand immediate payment is also a creditor, as the client owes the business money for services already rendered.

How do creditors make money?

Simply, creditors make money by charging interest on the loans they offer their clients. For example, if a creditor lends a borrower $5,000 with a 5% interest rate, the lender makes money due to the interest on the loan. In turn, the creditor accepts a degree of risk that the borrower may not repay the loan.

What happens when a debtor declares bankruptcy?

If a debtor decides to declare bankruptcy, the court notifies the creditor of the proceedings. In some bankruptcy cases, all of the debtor's non-essential assets are sold to repay debts, and the bankruptcy trustee repays the debts in order of their priority.

Why do creditors index interest rates?

To mitigate risk, most creditors index their interest rates or fees to the borrower's creditworthiness and past credit history. Thus, being a responsible borrower could save you a substantial sum, particularly if you are taking out a large loan, like a mortgage.

What happens if a creditor doesn't receive repayment?

Personal creditors who cannot recoup a debt may be able to claim it as a short-term capital gains loss on their income tax return, but to do so, they must make a significant effort to reclaim the debt.

Which debts are prioritized the most?

Tax debts and child support typically get the highest priority along with criminal fines, overpayments of federal benefits, and a handful of other debts. Unsecured loans such as credit cards are prioritized last, giving those creditors the smallest chance of recouping funds from debtors during bankruptcy proceedings.

What is a creditor?

A creditor could be a bank, supplier or person that has provided money, goods, or services to a company and expects to be paid at a later date.

Why are some creditors referred to as secured creditors?

Some creditors are referred to as secured creditors because they have a registered lien on some of the company's assets. A creditor without a lien (or other legal claim) on the company's assets is an unsecured creditor.

What happens if a creditor does not sign a promissory note?

If the creditor is a vendor or supplier that did not require the company to sign a promissory note, the amount owed is likely to to be reported as Accounts Payable or Accrued Liabilities.

Who needs to sign a promissory note?

Some creditors, such as banks and other lenders, have lent money to the company and will require the company to sign a written promissory note for the amount owed. When a promissory note is required, the company borrowing the money will record and report the amount owed as Notes Payable. If the creditor is a vendor or supplier ...

What is a creditor in accounting?

Creditors in accounting are those who sell goods or services to the customer without receiving any single amount (credit sales), it counts as an asset.

Who Is The Creditor?

Creditors are financial providers who have the authority to provide their service to the needed people and organization (debtors) so that they can get paid by the debtors after finishing the repaid period with interest along with repayment of borrowed capital.

What Are The Types Of Creditors?

Creditors can be anyone but they need to provide money to the needed people (individual, organization). At the time of offering the money, they check the details of the borrowers and take out assets as collateral security. They want to know more information regarding such as:

Why do creditors charge interest?

On the other hand, some creditors charge interest according to their own rules so that they can earn a good income by offering money as a loan to the debtors (individual, organization, banks).

What is a creditor in 2021?

What Is a Creditor? By: Sophia. On: June 7, 2021. Under accounting terms, Creditors are a source of getting a loan in many ways such as in the form of money, credit card, goods or services, bonds, or shares. They act as a financial service provider who can be as an individual (family or friends), organization (other corporate or Public company), ...

What is a preferred creditor?

A Preferred Creditor is the one who receives a dividend in bankruptcy in the form of claims such as employee wages, travel expenses, court order support agreements. Read more.. What is a financial ratio analysis. Accounting tools. Accounting software for small business. What is the Balance Sheet.

Can a creditor be anyone?

Creditors can be anyone but they need to provide money to the needed people (individual, organization). At the time of offering the money, they check the details of the borrowers and take out assets as collateral security. They want to know more information regarding such as: Why they should need money as a loan.

What is a creditor in accounting?

In accounting, creditors are people or organizations like banks and credit unions that offer products and services to the other party without asking them to pay back for it instantly. The term is also found synonymous with the word “supplier” or “vendor”.

What does "creditor" mean?

A creditor refers to a party involving an individual, institution, or the government that extends credit or lends goods, property, services, or money to another party known as a debtor. The credit made through a legal contract guarantees repayment within a specified period as mutually agreed upon by both parties.

How Do Creditors Make Money?

There are a few things that secured lenders are very particular about, such as interest rate. They levy it on borrowers and keep making money from it till the loan repayment Loan Repayment A loan repayment calculator helps in determining the amount of each installment payable by the borrower on taking a certain amount as a loan at a specific interest rate to be repaid in periodic installments for a particular tenure. read more. However, it can vary depending on the amount lent and the lender.

What is the difference between a creditor and a debtor?

Creditors lend money to people or organizations immediately with the guarantee of getting it back at a specified time. Debtors receive the money instantly with the obligation of paying it back in the given time frame.

What is a credit made through a legal contract?

The credit made through a legal contract guarantees repayment within a specified period as mutually agreed upon by both parties. Debtors running out of funds can receive credit immediately without the obligation of paying it back instantly.

How do financial institutions use credit scores?

Credit Scores: Financial institutions use credit scores to know if a particular loan seeker is a low-risk debtor or high-risk debtor. For the loan applicants who appear high-risk to lenders, the interest rate charged is considerably more than their low-risk counterparts.

What is secured creditor?

Secured Creditor always makes sure they get their borrowed amount, such as a mortgage, back at the specified time. They secure the amount against an asset termed collateral, which they seize to cover the los ses from the unpaid loan.

What is a creditor in business?

Creditors are amounts which are owed by you to your suppliers, they are sometimes referred to as accounts payable or trade creditors.

What is a creditor reconciliation?

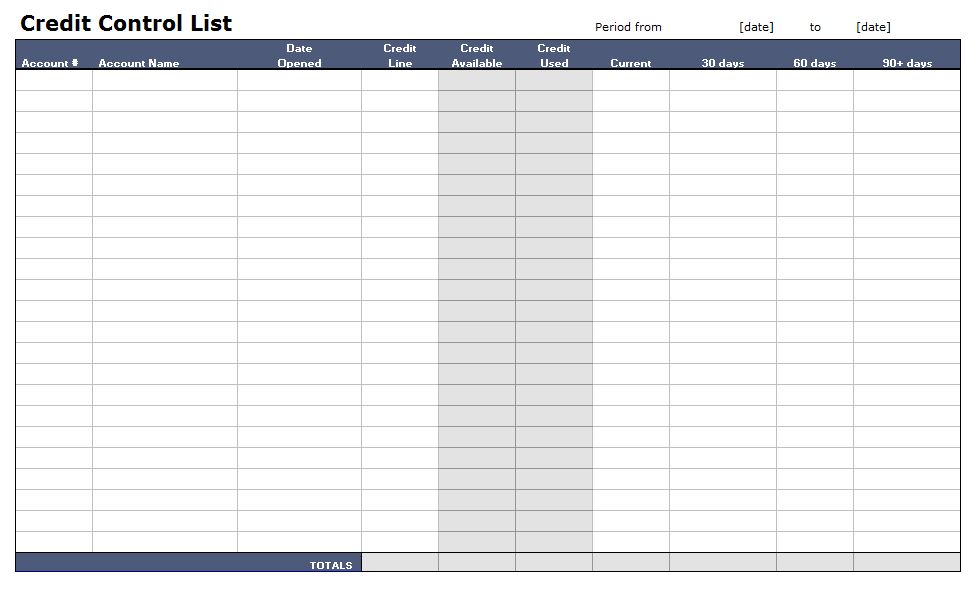

Creditor Reconciliation. The normal balance for a creditor account is a credit balance. Additional invoices added to the creditor control account will increase the credit balance, and payments to suppliers will reduce the balance.

Where is a trade creditor recorded?

A trade creditor is normally first recorded in the purchase ledger which contains a personal account for each supplier. In this way a listing of the purchase ledger accounts will give you a listing of outstanding debts or creditors.

What happens at the end of each accounting period?

At the end of each accounting period, the ending balance on each supplier account can be reconciled to the independent statement received from the supplier. This statement shows the balance the supplier thinks is outstanding and, if the ending balance on the supplier creditors account does not agrees to the statement, then the purchases, payments, and adjustments each need to be checked to understand why, and appropriate correcting entries made.

What is control account?

Control accounts are a type of accounting control which is used mainly in manual accounting systems. Control accounts are similar to trial ledger to check for arithmetical accuracy of the accounts, just that control accounts are more detailed in nature and only governs one activities at a time, such as the creditors and debtors amounts.

What does a debit entry in a debtor account mean?

A normal debtor account will have a debit entry, representing an increase in the debtor account. An a credit entry represents a decrease in the debtor account. A short summary is represented below.

What is a Contra entry?

Contra entry occurs when you have a creditor that is a debtor at the same time. So, a supplier or (a creditor) will supply you with goods on credit and at the same time purchasing goods (now acting as a debtor) from you on credit. Contra amount is given most of the time. (Optional): Useful for A-Level Students.

What happens if a business owes more than it owes us?

If our business owes Business A more than Business A owe us, then Business A becomes our creditors. In this context, we owe Business A $20,000 and Business A owes us $1,000.

What are not included in control accounts?

It should be noted that the following are not included in control accounts, 1) Bad debts recovered. 2) Cash sales. 3) Cash purchases. 4) Increase in provision for doubtful debts. These four items do not affect debtors and creditors account.

Do creditor accounts have to be debited?

So the same thing goes with understanding this format, anything that will increase the creditors account will have to be credited, and anything that will decrease the creditors account will have to be debited.

Is a sales ledger control account the same as a creditor control account?

Please take note that “ sales ledger control account ‘ is also known as “ debtors control account ‘ and “ purchases ledger control account ” is the same as “ creditors control account .” Both names should be familiarized because all the names are often used during examination. It is not hard to understand the meaning behind each name, you sale your products/services to a debtors and hence the name sales ledger control account and debtors control account. Likewise, you purchase your products from creditors and hence the name purchase ledger control account and creditors control account.

What does "closed account" mean on credit report?

On closed accounts, your credit report may include a comment that indicates who closed the account and may say "account closed by creditor" if the credit card issuer closed your account.

Why do credit card companies close accounts?

For example, your card issuer may close your account if you become too delinquent on your payments, allow the account to be inactive for a long period , or if the creditor is no longer issuing that card. 1 .

What to do if your credit card is closed?

If you have an account reported as closed and it's still open, contact your credit card issuer to find out why. If the accounts say the creditor closed it even though you were the one who closed it, you can use the credit report dispute process to have your credit report updated to show that. Remember, it doesn't hurt your credit score ...

Why is it important to pay off credit cards after closing?

It's important that you keep making at least the minimum payment on time each month, even after the account is closed, to protect your credit score. Late payments will hurt your credit score just as if the credit card was still open.

Does closing a credit card affect your credit score?

However, the act of having a credit card closed, whether by you or by the creditor, can hurt your credit score by raising your credit utilization. For example, your credit score could be impacted by a closed credit card if you have a balance on the credit card or if you have high balances on all your other credit cards and this was the only card with significant available credit.

Will "Account Closed by Creditor" Hurt Your Credit Score?

The remark "account closed by creditor" or a comment that a creditor closed your account doesn’t hurt your credit score. Fortunately, this type of comment isn't picked up by the credit scoring calculation. 2