Should a cross-default provision be in the ISDA schedule?

A cross-default provision (under which all outstanding trades covered by the ISDA can be terminated if the counterparty defaults on third-party debt) can be elected in the ISDA schedule, but firms should consider whether to have it.

What is a cross default?

Updated Jun 30, 2019. Cross default is a provision in a bond indenture or loan agreement that puts a borrower in default if the borrower defaults on another obligation.

What should you look out for when choosing an ISDA?

Watch out for cross default thresholds: The ISDA’s cross-default provision allows the bank to terminate all the outstanding swaps covered by the ISDA if the borrower defaults on third-party debt.

What is the purpose of the cross-default provision?

The cross-default provision exists to protect the interest of lenders, who desire to have equal rights to a borrower's assets in case of default on one of the loan contracts.

What is the meaning of cross-default?

A clause which operates by automatically defaulting a borrower under Agreement A when it defaults under Agreement B. A cross-default provision effectively gives the lender under Agreement A the benefit of the default provisions in Agreement B. Cross-default provisions therefore have a domino effect.

What is cross acceleration vs cross-default?

In contrast to a cross-acceleration, a cross-default clause in Agreement A causes an automatic event of default under that agreement when the borrower defaults under Agreement B, even if the lender under Agreement B does not accelerate repayment.

What is a cross-default covenant?

Definition for : Cross default covenant Cross default Covenants specify that if the company defaults on another loan, the loan which has a cross default clause will become payable even if there is no breach of covenant or default of payment on this loan.

What happens in event of default in ISDA?

Broadly speaking, events of default may occur where one party is at fault. The party at fault is known as the 'defaulting party', and the other party is referred to as the 'non-defaulting party'. Upon the occurrence of an event of default, a party may elect to terminate all transactions under the ISDA Master Agreement.

What is cross acceleration in ISDA?

With cross acceleration, the third party lender defaulted against actually has to take action against the defaulting counterparty before you can trigger your transaction termination rights under your Agreement with that same defaulting counterparty.

What does cross acceleration mean?

A clause which operates by defaulting a borrower under Agreement A when it defaulted under Agreement B and the lender under Agreement B accelerates repayment. A cross-acceleration provision effectively gives the lender under Agreement A the benefit of the default provisions in Agreement B.

How do you negotiate cross-default clauses?

The Borrower may negotiate to include a clause wherein grace period is given to him before activating the cross- default clause. Including grace period will give Borrower a time to take necessary actions if he can without hampering his rights under other loan agreements.

What is a cross collateral cross-default agreement?

What is a cross collateral cross default agreement? In a cross collateral cross default agreement, collateral for one loan can secure another loan when a cross default occurs.

How does cross-default covenant affects the entire debts of a company?

In other words, if the borrower defaults on one loan, he/she will be deemed to be in default on his/her other loans and the debts arising from other loans will become immediately due and payable even if there is no breach of other loans.

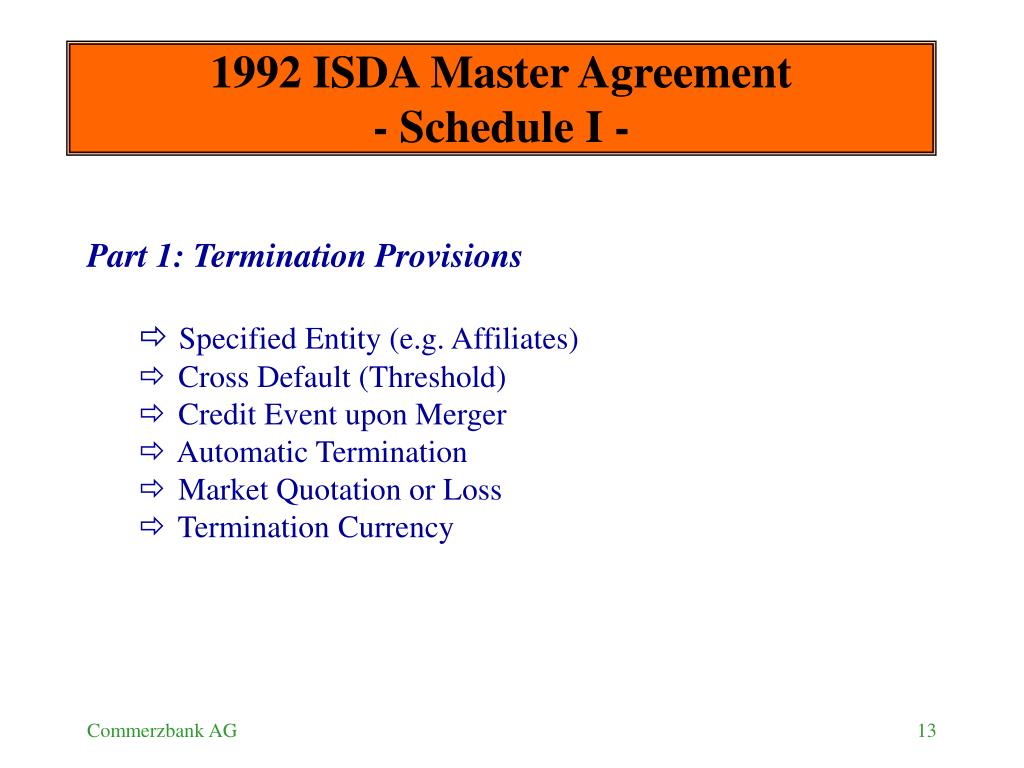

What are the 4 parts of ISDA?

The framework consists of a master agreement, a schedule, confirmations, definition booklets, and credit support documentation. The master agreement is a document agreed to between two parties that sets out standard terms that apply to all the transactions entered into between those parties.

What is the difference between default and event of default?

A default is a breach of a contract or agreement. It occurs when one party fails to uphold their contractual duties. An event of default is a specific event or occurrence that allows the non-defaulting party the ability to terminate the contract or accelerate the debt owed by the defaulting party.

What comes first default or event of default?

An event of default occurs when a borrower breaches a credit agreement and is considered to have defaulted on their debt. Default generally occurs when you fail to repay loans according to the terms in the promissory note with your lender.

What is a cross collateral cross-default agreement?

What is a cross collateral cross default agreement? In a cross collateral cross default agreement, collateral for one loan can secure another loan when a cross default occurs.

What is an event of default clause?

Events of default are common in loan agreements or debt instruments. An event of default entitles the lender to cancel the facility and/or declare all amounts owing by the borrower to be immediately due and payable.

What is a default clause?

A default clause is a provision in a legal contract that states what will happen if either party in a contract defaults or fails to hold up their end of the agreement.

How does cross collateralization work?

Cross collateralization is the act of using an asset that's collateral for an initial loan as collateral for a second loan. If the debtor is unable to make either loan's scheduled repayments on time, the affected lenders can eventually force the liquidation of the asset and use the proceeds for repayment.

Article Overview

In finance, deals require dependable behavior by all parties. But all too often, one or more parties default on their obligations and jeopardize the transaction. Therefore, borrowers and lenders have–with the help of attorneys–developed cross default provisions to protect themselves. Accordingly, this article addresses:

What is Cross Default?

A CD provision or cross default clause can appear in a loan agreement. It states that a loan is in default if the borrower defaults on another of its loans. A default occurs when a borrower fails to make timely payments of principal and/or interest. It also occurs when a borrower violates a loan covenant.

Example of Cross Default

We’ve already given you a couple of examples of CD. Here is another example.A Borrower receives a loan from Lender A to build a steel factory. Furthermore, the Borrower contracts with a contractor under a construction service agreement.

Frequently Asked Questions

A cross default threshold is the minimum loan amount that can be subject to CD. With this clause, loan amounts below the cross default threshold will not trigger a loan’s cross default provisions.

How then can a risk manager use the ISDA Master Agreement to enhance credit protection and pre-empt potential hazards?

Taking the advice of Fraulein Maria in The Sound of Music “Let’s start at the very beginning” (a very good place to start) by asking the simple question - Who is my counterparty?

Examples of credit provisions which may be negotiated include

Specified Entities: You may have requested all Affiliates but your counterparty may only want to include certain named entities (or none at all!).