What are the tax advantages of deferring income?

Tax Advantages. Many times, the contributions you make to your deferred compensation plan will not be taxed. Your dividends and interest are also less likely to get taxed as well. The amount that you withdraw is the only taxable amount. Once you withdraw the money from a deferred compensation plan, you will be taxed at your income tax rate.

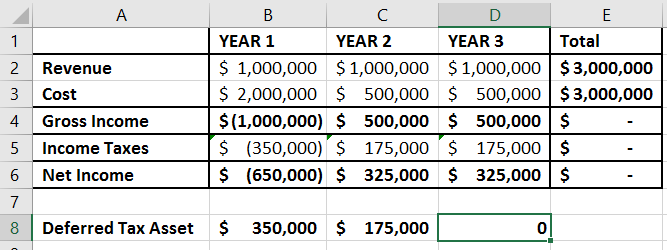

What do you mean by deferred taxes?

Deferred tax is the tax that is levied on a company, that has either been deducted in advance or is eligible to be carried over to the succeeding financial years. Know more about its types, calculation, and scenarios in which it is recorded.

Are deferred income taxes debit or credit?

When the amount paid is greater than, company needs to debit deferred tax assets and credit additional income tax payable. Deferred tax assets are the difference between income expense and income tax payable. Most of the time, we may combine both transactions as the following:

Is deferred tax an asset or liability?

Deferred tax could be deferred tax asset or deferred tax liability, in which it will be deductible or taxable in the future. Deferred tax is the tax effect that occurs due to the temporary differences, either taxable temporary difference or deductible temporary difference.

What is deferred tax in simple terms?

IAS 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable temporary differences. So, in simple terms, deferred tax is tax that is payable in the future.

What is deferred income tax example?

A common example of tax-deferred liabilities for individuals is a 401(k). A 401(k)s is a deferred tax retirement plan. You pay no taxes on contributions to the 401(k) until years or decades later when you make a withdrawal.

How is deferred income tax calculated?

How Deferred Tax Liability Works. It is calculated as the company's anticipated tax rate times the difference between its taxable income and accounting earnings before taxes.

Why is deferred income tax an asset?

A deferred tax asset is an asset to the Company that usually arises when the Company has overpaid taxes or paid advance tax. Such taxes are recorded as an asset on the balance sheet and are eventually paid back to the Company or deducted from future taxes.

Is deferred income a liability?

Deferred income is a current liability and would sit on the balance sheet under trade payables.

Is deferred income included in taxable income?

Deferred income taxes are taxes that a company will eventually pay on its taxable income, but which are not yet due for payment. The difference in the amount of tax reported and paid is caused by differences in the calculation of taxes in the local tax regulations and in the accounting framework that a company uses.

Is deferred tax an asset?

A deferred tax asset represents a financial benefit, while a deferred tax liability indicates a future tax obligation or payment due. For instance, retirement savers with traditional 401(k) plans make contributions to their accounts using pre-tax income.

Is deferred tax a current asset?

Deferred taxes are a non-current asset for accounting purposes. A current asset is any asset that will provide an economic benefit for or within one year. Deferred taxes are items on the balance sheet that arise from overpayment or advance payment of taxes, resulting in a refund later.

Is Deferred income considered earned income?

Deferred compensation is typically not considered earned, taxable income until you receive the deferred payment in a future tax year.

What is the difference between current tax and deferred tax?

Current tax is the amount of income taxes payable (recoverable) in respect of the taxable profit (tax loss) for a period. Deferred tax liabilities are the amounts of income taxes payable in future periods in respect of taxable temporary differences.

How does deferred tax increase?

An increase in deferred tax liability or a decrease in deferred tax assets is a source of cash. Likewise, a decrease in liability or an increase in deferred asset is a use of cash. Analyzing the change in deferred tax balances should also help to understand the future trend these balances are moving towards.

What is negative deferred income tax?

Deferred tax refers to either a positive (asset) or negative (liability) entry on a company's balance sheet regarding tax owed or overpaid due to temporary differences.

Which of the following is an example of a deferral?

Here are some examples of deferrals: Insurance premiums. Subscription based services (newspapers, magazines, television programming, etc.) Prepaid rent.

Where does deferred income payment go on tax return?

This appears to be "Other reportable income" since it is not reported to the IRS on any tax form.

What are deferred tax assets?

Deferred tax assets are items that may be used for tax relief purposes in the future. Usually, it means that your business has overpaid tax or has paid tax in advance, so it can expect to recoup that money later. This sometimes happens because of changes in tax rules that occur in the middle of the tax year.

Are deferred income taxes the same as deferred tax assets?

A deferred tax asset is an item on the balance sheet that results from the overpayment or the advance payment of taxes. It is the opposite of a deferred tax liability, which represents income taxes owed.

What is deferred liability?

Deferred tax liability is created when the Company underpays the tax, which it will have to pay in the near future. The liability is created not due to Company defaulting on its tax liabilities but due to timing mismatch or accounting provisions, which causes less tax outgo than required by the Company.

How does deferred tax affect cash flows?

Deferred tax impacts the future cash flows for the Company Cash Flows For The Company Cash Flow is the amount of cash or cash equivalent generated & consumed by a Company over a given period . It proves to be a prerequisite for analyzing the business’s strength, profitability, & scope for betterment. read more – while deferred tax assets lower the cash outflow, deferred tax liability increases the cash outflow for the Company in the future

How does deferred income affect tax?

Deferred Income tax affects the tax outgo to the authorities for the financial year. If there is a deferred tax asset, the Company will have to pay less tax in the particular year, whereas, if there is a deferred tax liability, it will have to pay more tax. How to Provide Attribution?

What is deferred income tax?

Deferred income tax is a balance sheet item which can either be a liability or an asset as it is a difference resulting from recognition of income between the accounting records of the company and the tax law because of which the income tax payable by the company is not equal to the total expense of tax reported.

What is deferred tax asset?

Deferred tax asset is created when the Company has already paid the tax. The benefit of deferred tax assets is that the Company will have less tax outgo in the future subsequent years.

What is LIFO accounting?

LIFO accounting means inventory acquired at last would be used up or sold first. read more. . It created a temporary difference of $ 50,000, and if the tax rate is 30% would create a tax liability of $ 15,000.

How to look for changes in deferred taxes?

Analysts should look for changes in deferred taxes by reading the footnotes to the financial statements Financial Statements Financial statements are written reports prepared by a company's management to present the company's financial affairs over a given period (quarter, six monthly or yearly). These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels. read more, which could include information about the warranty, bad debts, write-downs, policy on capitalizing or depreciating assets, policy on amortizing financial assets, revenue recognition policy, etc.

Why is deferred income tax an asset?

Having said that, it is an asset. When income tax is deferred, it saves the taxpayer from paying a tax they may not be able to afford at this time in their life. 1031 exchanges are a prime example of this scenario. A rental house may make more money in the long-run than simply selling off the asset during a slow market. So, it may be in the taxpayer’s interest to roll the proceeds of an old rental into a new rental.

What is deferred tax?

Deferred tax is the most simple terms is a liability (tax) which exists from the moment the income is earned but is delayed until the income accessed. In addition to 401 (k) plans, the deferred tax is often used in 1031 exchanges. Not familiar with the term? Plenty of people know what they are even if they don’t know their name. Ever hear on the news if a house is sold and the proceeds of the house are rolled into another house before the end of the year, no tax is due? It’s a bit more complex than that but the principle is the same.

How much tax liability is 401(k) distribution?

When it comes to 401 (k) plans, deferred taxes come down to tax brackets. 401 (k) distributions are treated like income. Therefore, the tax liability must be calculated as such. Receive over $100,000 in 401 (k) normal distributions? 24% tax liability. However, most taxpayers hold out 30% if they have any other income sources or investments.

What is the problem with deferred income tax?

The problem with deferred income tax is the amount of misinformation out there. Deferred income tax applies to numerous tax situations. However, this article will focus on four common deferred income tax scenarios: installment sales, section 1031 exchanges, qualified retirement plans, and depreciation. While installment sales, section 1031 exchanges, and depreciation are technically deferred capital gains tax, they have become incredibly more popular since the pandemic. It’s become a priority for individuals and companies to defer tax liabilities until a time the wallets are little more flush.

When depreciating an asset to reduce tax liability, is it critical to remember the deferred tax will catch?

When depreciating any asset to reduce tax liability, it is critical to remember the deferred tax will catch up when the asset is sold. For example, first year bonus depreciation was 50% until the enactment of Tax Cuts and Jobs Act of 2017 (TCJA) in the end of 2018 which changed the bonus depreciation to 100%. For example, if a taxpayer depreciates out a semi-truck which is used for work until the depreciation reaches zero ($0), when they sale the truck, the deferred tax will be recaptured. If the semi-truck is sold for $40,000 and it is three years old, the taxpayer will owe the deferred tax. In other words, taking the bonus depreciation on earlier tax returns allowed the taxpayer to not pay the tax. But once the asset is sold off, the IRS wants their share of the tax.

What is a 1031 exchange?

To prevent owing tax on the sale, as the individual intends to continue as a landlord, the individual hires a professional 1031 exchange firm to act as their qualified intermediary. While the individual works on closing on the house, the firm holds onto the money until the closing period when they pay the money directly to the seller of the property thus allowing the money never touch the individual’s hands.

When deferring the proceeds of a 1031 exchange, is it critical to remember the taxes are not due on?

When deferring the proceeds of a sale through a 1031 exchange, it is critical to remember the taxes are not due on the proceeds of the sale but rather the profit. For example, if a rental house was purchased for $120,000 and later sold for $160,000. The initial profit will appear to be $40,000 (but depreciation of the house will have to be calculated which will reduce the taxpayer’s basis in the house).

What is MACRS in tax?

MACRS – The IRS’s Depreciation System. Some of the methods used for depreciation by the IRS are discussed below. The modified accelerated cost recovery system (MACRS) is the primary tax depreciation system used by the IRS.

What is the difference between GAAP and IRS?

For example, the most common difference between the IRS and GAAP is the methods used to calculate depreciation. Deferred income tax is mainly caused by differences in income recognition between tax laws (IRS) and accounting methods (GAAP).

What is GAAP accounting?

GAAP GAAP, Generally Accepted Accounting Principles, is a recognized set of rules and procedures that govern corporate accounting and financial. ). In financial reporting, a company’s income tax payable. Income Tax Payable Income tax payable is a term given to a business organization’s tax liability to the government where it operates.

Why is GAAP reporting discrepancies?

It can cause reporting discrepancies when accountants choose to use alternate depreciation policies that are different from the tax agency. GAAP: Unlike the IRS, GAAP gives accountants the freedom to select from multiple methods of depreciation.

What is deferred income tax?

What is a Deferred Income Tax? Deferred income tax is a liability that can be found on a balance sheet. It results from differences in income tax recognition between tax laws (IRS) and accounting methods ( GAAP. ). Income Tax Payable Income tax payable is a term given to a business organization’s tax liability to the government where it operates.

Why is income tax payable not equal to total tax expense?

However, income tax payable may not equal total tax expense due to the difference in income recognition between tax laws and accounting methods. To simplify, accounting rule differences between a company and the IRS may cause a deferment in income tax payment.

What is income tax payable?

Income Tax Payable Income tax payable is a term given to a business organization’s tax liability to the government where it operates. The amount of liability will be based on its profitability during a given period and the applicable tax rates. Tax payable is not considered a long-term liability, but rather a current liability,

What Is Deferred Income Tax?

Deferred income tax is when a company defers paying tax on income for a period of time. There are numerous reasons why this may occur. For example, a company may recognize revenue at a time where tax laws were changing, and needed to defer this liability as they were unprepared for this change. The way a company depreciates assets may also be a culprit.

Why Are Tax Deferrals Important?

Tax deferrals are important because it allows an individual or company to increase their purchasing power at a faster rate. Following the example we went over above, where the individual invested $100,000 and earned a 10% return in year one, imagine if the individual had to pay a 25% tax on that $10,000 profit. Instead of being able to invest $110,000 in year 2, they would only be able to invest $107,500. That would reduce how much profit one could potentially earn in year two.

What Is the Difference Between Tax Free and Tax Deferral?

No tax is paid at retirement, because the tax is paid upfront when deposited. A tax deferral is when the tax liability is postponed to a later date.

What are some examples of tax deferrals?

There are numerous examples of tax deferrals you may be familiar with. These include, 401 (k) plans, 403 (b) plans, and various IRA accounts.

How long do you have to withdraw an annuity to get tax deferred?

These annuities also allow your money, and interest, to grow tax deferred until withdrawing it at 59 ½. If withdrawn earlier, you’ll need to pay full tax on your profit.

What is a fixed deferred annuity?

A fixed deferred annuity is an annuity product issued by an insurance agency or investment firm. Unlike a variable rate annuity, a fixed annuity will provide a fixed rate of return for a given period of time, which is arguably both the greatest advantage and disadvantage of this investment vehicle.

Why do companies benefit from tax deferrals?

A company also benefits from tax deferrals as it gives more liquidity to the company in the present day. The company can use that liquidity, or cash, to generate a greater return, or make larger investments.

What is deferred tax liability?

When a company opts to accumulate its tax for a particular fiscal year and settle it in the subsequent year, then it is known as "deferred tax liability". It indicates a future financial obligation. Let's take an example to understand why and when such a situation may arise.

Why is it important to recognize deferred tax liabilities?

It is important to recognize deferred tax liabilities because it helps the company be prepared for future expenses and plan its business operations accordingly. Similarly, it is prudent to recognize deferred tax assets because it can help reduce tax liabilities in the future.

What is deferred tax?

The term "deferred tax" refers to a tax which shall either be paid in future or has already been settled in advance. In this article, we will see why a company may differ its tax to a subsequent fiscal year or why a company may choose to pay the tax in advance.

Why do companies prepare income statements?

Most companies normally prepare an "income statement" and a "tax statement" every fiscal year because the guidelines that govern the recording of income and taxation are slightly different. It is this slight disparity between the guidelines that creates the scope for deferred tax.

What happens if a company makes a gross loss?

In case of a gross loss - If a company makes a gross loss in a particular fiscal, then it can carry it forward to offset the profits that may be generated in the next year. In that way, it will reduce the taxable income of the company in the future.

Is a future financial obligation a deferred tax liability?

Hence, it is a future financial obligation that is recorded as deferred tax liability.

What is deferred tax?

Deferred Tax is the effect which arises in the company because of the timing differences between the date when taxes are paid to tax authorities actually by the company and the accrual of such tax i.e., differences of taxes arising as taxes due in one of the accounting period are either not paid or overpaid in that period.

What is a deferred tax expense?

The term “Deferred Tax Expense” refers to the income tax effect on a balance sheet arising out of difference taxable income calculated based on the company’s accounting method and the accounting income calculated based on tax laws. Further, it can also be termed as the income tax effect due to timing differences – temporary or permanent, ...

Why is deferred tax expense important?

The deferred tax expense can be very important information for both existing investors and prospective investors as they intend to crosscheck the balance sheet of a company with its income statement to verify if there is any tax payable for the company during the given period.

Why is a deferred tax asset carried on the balance sheet?

It is carried on the balance sheet of a company so that it can be used in the future to reduce the taxable income.

When do deferred taxes exist?

For example, deferred taxes exist when expenses are recognized in a company's income statement before they are required to be recognized by the tax authorities or when revenue is subject to taxes before it is taxable in the income statement. 2

What Is a Deferred Tax Asset?

A deferred tax asset is an item on a company's balance sheet that reduces its taxable income in the future.

What Is a Deferred Tax Asset vs. a Deferred Tax Liability?

A deferred tax asset represents a financial benefit, while a deferred tax liability indicates a future tax obligation or payment due.

Why are deferred assets important?

This asset helps in reducing the company’s future tax liability.

When is deferred tax asset recognized?

It is important to note that a deferred tax asset is recognized only when the difference between the loss-value or depreciation of the asset is expected to offset future profit. 1 . A deferred tax asset can conceptually be compared to rent paid in advance or refundable insurance premiums; while the business no longer has cash on hand, ...

Why does my company get refunded?

This may occur simply because of a difference in the time that a company pays its taxes and the time that the tax authority credits it. Or, it may indicate that the company overpaid its taxes. In that case, the money will be refunded.

What happens to the tax rate when the tax rate goes up?

If the tax rate goes up, it works in the company’s favor because the assets’ values also go up , therefore providing a bigger cushion for a larger income. But if the tax rate drops, the tax asset value also declines. This means that the company may not be able to use the whole benefit before the expiration date.

What Is an Example of Deferred Tax Liability?

The depreciation of fixed assets is a common example.

How is the anticipated tax rate calculated?

It is calculated as the company's anticipated tax rate times the difference between its taxable income and accounting earnings before taxes.

What is accelerated depreciation?

But for tax purposes, the company will use an accelerated depreciation approach. Using this method, the asset depreciates at a greater rate in its early years. A company may record a straight-line depreciation of $100 in its financial statements versus an accelerated depreciation of $200 in its tax books. In turn, the deferred tax liability would equal $100 multiplied by the tax rate of the company.

Why is a tax liability deferred?

The liability is deferred due to a difference in timing between when the tax was accrued and when it is due to be paid. For example, it might reflect a taxable transaction such as an installment sale that took place one a certain date but the taxes will not be due until a later date.

Why is deferred tax liability important?

A deferred tax liability records the fact the company will, in the future, pay more income tax because of a transaction that took place during the current period , such as an installment sale receivable.

What is the depreciation method for long-lived assets?

The depreciation expense for long-lived assets for financial statement purposes is typically calculated using a straight-line method, while tax regulations allow companies to use an accelerated depreciation method. Since the straight-line method produces lower depreciation when compared to that of the under accelerated method, a company's accounting income is temporarily higher than its taxable income.

What does it mean when a company says it has underpaid?

By saying it has underpaid doesn't necessarily mean that it hasn't fulfilled its tax obligations, rather it is recognizing that the obligation is paid on a different timetable. For example, a company that earned net income for the year knows it will have to pay corporate income taxes. Because the tax liability applies to the current year, ...

The IRS vs. GAAP

Treatment of Depreciation

- The main cause of deferred income tax is due to the differences between how depreciation is calculated under the IRSand GAAP. 1. IRS: The IRS allows a set list of depreciation methods for the treatment of depreciation on specific assets. It can cause reporting discrepancies when accountants choose to use alternate depreciation policies that are dif...

MACRS – The IRS’s Depreciation System

- Some of the methods used for depreciation by the IRS are discussed below. The modified accelerated cost recovery system (MACRS) is the primary tax depreciation system used by the IRS. It allows the capital cost of an asset to be recovered through annual deductions over a certain period. Also, the IRS has a specific list of assets that are eligible for MACRS depreciatio…

More Resources

- CFI is the official provider of the global Commercial Banking & Credit Analyst (CBCA)™certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful: 1. Depreciation Methods 2. IFRS vs. US GAAP 3. Intangible Assets 4. MACRS Depreciation