In brief, the key differences between cost and financial accounting are that cost accounting is inwardly focused on management decisions, while financial accounting is focused on issuing financial statements to outside parties. Audience

What is cost formula in accounting?

accounting. The formula for the weighted average cost method is as follows: Costs of goods available for sale is calculated as beginning inventory value + purchases. Units available for sale are the number of units a company can sell or the total number of units in inventory and is calculated as beginning inventory in units + purchases in units.

Is accounting better then Finance?

Many people confuse finance with accounting. But finance is much vast than accounting. To learn the fundamentals of finance, you need to have a basic understanding of accounting, but the scope of finance is much more than accounting. If you’re good at maths and logical reasoning, you would be able to make your mark in the financial field.

What are the advantages of cost accounting?

What are the Advantages of Cost Accounting?

- Cost Object Analysis. ...

- Investigation of Causes. ...

- Trend Analysis. ...

- Cost Modeling. ...

- Acquisition Effects. ...

- Project Billings. ...

- Budget Compliance. ...

- Capacity Management. ...

- Outsourcing Effects. ...

- Inventory Valuation. ...

What are the objectives of cost accounting?

Thus, the following are the main objectives of cost accounting:

- Ascertainment of the cost per unit of the different products that a business concern manufacturers.

- To correctly analyze the cost of both the process and operations.

- Disclosure of sources for wastage of material, time, expenses or in the use of the equipment and the preparation of reports which may be necessary to control such wastage.

What is the difference between accounting and financial accounting?

The main difference between them is that those who work in finance typically focus on planning and directing the financial transactions for an organization, while those who work in accounting focus on recording and reporting on those transactions.

Is cost accounting part of financial accounting?

Conclusion. Cost accounting is an indirect part of financial accounting and a direct part of management accounting. Both cost accounting vs financial accounting can be used together to reduce costs and increase the profitability of a firm.

What is the similarities between cost accounting and financial accounting?

(iv) Both cost accounts and financial accounts involve the process of matching the costs and revenues of the related activity for the current period. (v) Both accounting systems keep records of direct costs and indirect costs. (vi) Both accounting systems enable the business to compare and reconcile trading results.

What are the causes of difference between cost and financial accounts?

Financial accounting reveals profits and losses of the business as a whole during a particular period, while cost accounting shows, by analysis and localisation, the unit costs and profits and losses of different product lines.

What are the 4 types of cost accounting?

Types of cost accounting include standard costing, activity-based costing, lean accounting, and marginal costing.

Why is cost accounting better than financial accounting?

In cost accounting, minute reporting of cost is done per-unit wise. Fixation of selling price is not an objective of financial accounting. Cost accounting provides sufficient information, which is helpful in determining selling price. Relative efficiency of workers, plant, and machinery cannot be determined under it.

What is cost accounting with example?

Cost accounting involves determining fixed and variable costs. Fixed costs are expenses that recur each month regardless of the level of production. Examples include rent, depreciation, interest on loans and lease expenses.

What is cost accounting in simple words?

Cost accounting is a process of assigning costs to cost objects that typically include a company's products, services, and any other activities that involve the company. Cost accounting is helpful because it can identify where a company is spending its money, how much it earns, and where money is being lost.

What is the relationship between cost management and financial accounting?

Cost-related data as obtained from financial accounting is the base of cost accounting. Management accounting is based on the data as received from financial accounting and cost accounting. Provides future cost-related decisions based on the historical cost information.

What are the main 3 types of cost?

These expenses include:Variable costs: This type of expense is one that varies depending on the company's needs and usage during the production process. ... Fixed costs: Fixed costs are expenses that don't change despite the level of production. ... Direct costs: These costs are directly related to manufacturing a product.More items...

What are the 6 types of costs?

A supply professional knows that Price = Cost + Profit. He or she also must understand variable, fixed, semi-variable, total, direct, and indirect costs and how those costs influence prices.

What is included in financial accounting?

Financial accounting is the process of recording, summarizing and reporting a company's business transactions through financial statements. These statements are: the income statement, the balance sheet, the cash flow statement and the statement of retained earnings.

What all is included in financial accounting?

Financial accounting includes the bookkeeping of financial transactions like purchases, sales, receivables, and payables. Accountants follow the Generally Accepted Accounting Principles (GAAP) for creating income statements, cash flow statements, balance sheets, and shareholder's equity statements.

What is the relationship between cost accounting management accounting and financial accounting?

Cost-related data as obtained from financial accounting is the base of cost accounting. Management accounting is based on the data as received from financial accounting and cost accounting. Provides future cost-related decisions based on the historical cost information.

Which costing system is used for financial accounting?

Lean costing, or lean accounting, helps to better the financial management practices used by an organization. Lean costing assigns value-based pricing to the costs of production rather than using standard or historical costing methods.

1. What is Cost Accounting?

Cost Accounting is a branch of accounting that deals with responsibilities like tracking different costs involved in a business venture at its vari...

2. What is Financial Accounting?

This branch of accounting is responsible for recording accurate information about all financial transactions of a firm. It helps to evaluate a firm...

3. What is the difference between Finance and Accounting?

Accounting is mostly responsible for keeping track of the flow of money to and from a firm. On the other hand, finance is a broader concept that is...

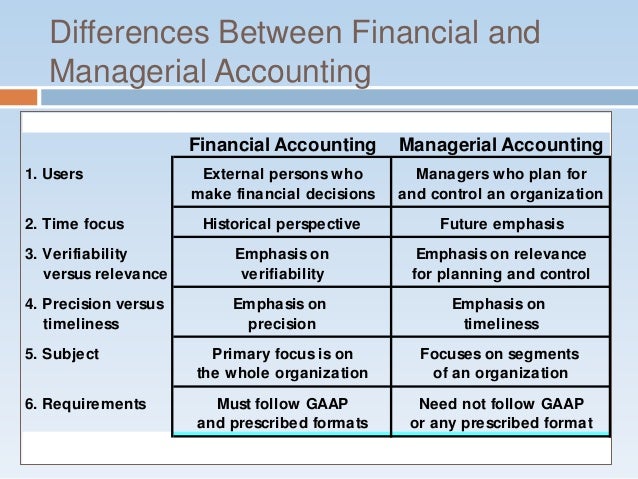

4. Differentiate between Financial Accounting and Management Accounting.

The primary point of difference between financial accounting and management accounting is that the former deals with the accurate collection and re...

5. How does Cost Accounting differ from financial accounting?

Cost Accounting refers to a system of accounting that keeps a track of various costs that occur during the production activities of a business wher...

What is the difference between finance and accounting?

Ans. Accounting is mostly responsible for keeping track of the flow of money to and from a firm. On the other hand, finance is a broader concept that is responsible for managing assets and liabilities and adopting suitable plans for growth prospects.

What is Cost Accounting?

Cost Accounting is a branch of accounting that deals explicitly with the costs which have been incurred through the course of a production. The information generated through cost accounting is used to keep track and adjust the operations effectively to maximise both profit and their efficiency.

What are the objectives of cost accounting?

Objectives of Cost Accounting 1 Determination of the cost per unit of goods that have been produced by the firm. 2 Accurate reporting of both operational and processing cost. 3 Formulating a report on cost-utility and recommendations to maximise profit on production. 4 Formulating data and guidelines to determine the accurate cost of manufacturing goods and rendering services.

Why is cost accounting important?

Therefore, it can be said that cost accounting enables business owners to analyse and classify expenditure of a specific production unit. It also helps to determine the input cost required to appoint labour and purchase raw materials at each level. In turn, it allows firm owners to control and lower unwarranted expenses significantly.

What is the branch of accounting responsible for recording accurate information about all financial transactions of a firm?

Ans. This branch of accounting is responsible for recording accurate information about all financial transactions of a firm. It helps to evaluate a firm’s financial standing at a given point of time.

What is financial accounting?

Typically, financial accounting is that branch of accounting, which is responsible for recording the aggregate financial data of a firm. It helps to measure the financial outcomes of a given accounting period and further helps to evaluate the position of assets and liabilities held with an organisation accordingly.

What is financial record?

Recording all financial transactions within a given period in a systematic manner.

What is the difference between financial accounting and cost accounting?

The following are the major differences between cost accounting and financial accounting: 1 Cost Accounting aims at maintaining cost records of an organisation. Financial Accounting aims at maintaining all the financial data of an organisation. 2 Cost Accounting Records both historical and per-determined costs. Conversely, Financial Accounting records only historical costs. 3 Users of Cost Accounting is limited to internal management of the entity, whereas users of Financial Accounting are internal as well as external parties. 4 In cost, accounting stock is valued at cost while in financial accounting, the stock is valued at the lower of the two i.e. cost or net realisable value. 5 Cost Accounting is mandatory only for the organisation which is engaged in manufacturing and production activities. On the other hand, Financial Accounting is mandatory for all the organisations, as well as compliance with the provisions of Companies Act and Income Tax Act is also a must. 6 Cost Accounting information is reported periodically at frequent intervals, but financial accounting information is reported after the completion of the financial year i.e. generally one year. 7 Cost Accounting information determines profit related to a particular product, job or process. As opposed to Financial Accounting, which determines the profit for the whole organisation made during a particular period. 8 The purpose of Cost Accounting is to control costs, but the purpose of financial accounting is to keep complete records of the financial information, on the basis of which reporting can be done at the end of the accounting period.

What is cost accounting?

Cost Accounting refers to that branch of accounting which deals with costs incurred in the production of units of an organization. On the other hand, financial accounting refers to the accounting concerned with recording financial data of an organization, in order to exhibit exact position of the business. Cost accounting generates information so ...

How does cost accounting add to the effectiveness of financial accounting?

Cost Accounting adds to the effectiveness of the financial accounting by providing relevant information which ultimately results in the good decision-making process of the organisation. It traces the cost incurred at each level of production, i.e. right from the input of the material till the output produced, each and every cost is recorded. There are two types of Cost Accounting systems, they are:

Why is financial accounting important?

The information provided by the financial accounting is useful in making comparisons between different organisations and analysing the results thereof, on various parameters. In addition to this, performance and profitability of various financial periods can also be compared easily.

What are the two types of cost accounting systems?

There are two types of Cost Accounting systems, they are: Non – Integrated Accounting System: The accounting system in which separate set of books is maintained for cost information. Integrated Accounting System: The accounting system in which cost and financial data are maintained in a single set of books.

What is financial accounting?

Financial Accounting is an accounting system that captures the records of financial information about the business to show the correct financial position of the company at a particular date. Information type. Records the information related to material, labor and overhead, which are used in the production process.

When is cost accounting reported?

Cost Accounting information is reported periodically at frequent intervals, but financial accounting information is reported after the completion of the financial year i.e. generally one year.

What is Cost Accounting?

Cost accounting is referred to as a form of managerial accounting that is used by businesses to classify, summarize and analyse the different costs with the purpose of cost control and cost reduction and thereby helping management in making better decisions.

What is Financial Accounting?

Financial accounting is a branch of accounting that is concerned with the summarizing, recording and reporting of financial transactions that take place in a business concern over a time period.

What is the primary function of cost accounting?

The primary function of cost accounting is said to be arranging, recording and identifying suitable investment allocation for investment to determine the costs of goods and services. It also helps in presenting relevant data to the management related to service, contract or finding shipment cost.

What is cost object analysis?

Cost object analysis- Expenses and revenues can be gathered by cost object, like product line, distribution channel, and by-product to understand which is effective or require additional support.

What is the purpose of financial statements?

Preparation of Financial Statements- All the records help the accountant to prepare a financial report of the company and check the financial status.

What is the purpose of costing?

To provide important data and guidelines for determining the cost of manufactured goods or services rendered

What are the principal classifications of financial statements?

The financial statements principal classifications are revenues, expenses, equity, assets and liabilities . Few advantages of financial accounting are: Maintenance of Business Record- All the details of the transaction are recorded in the book of account systematically.

What is financial accounting?

Financial accounting primarily focuses on reporting the financial results and financial position of an entire business entity. Cost accounting usually results in reports at a much higher level of detail within the company, such as for individual products, product lines, geographical areas, customers, or subsidiaries. Product costs.

Is there a regulatory framework for cost accounting?

There is no regulatory framework governing cost accounting reports. Report content. A financial report contains an aggregation of the financial information recorded through the accounting system. The information in a cost accounting report can contain both financial information and operational information. The operational information can come ...

What is the difference between financial accounting and cost accounting?

1. Cost accounting focuses on assessing per unit cost incurred to produce and sell the products so that it can be sold at the right price while Financial accounting is focused on all monetary transactions so that it can determine the profitability and financial health of a firm. 2.

Why is cost accounting important?

It is important to keep financial and operational records of a firm, governed and classified under general accounting. Both branches show profitability, cost accounting does on a unit basis and financial accounting shows in totality.

What is financial accounting?

Financial Accounting involves recording and analyzing all the financial transactions of a company for a specific period of time. It is then summarised into financial statements that show the profitability of a company or the outcome of operations.

Why do we use cost accounting?

Cost accounting: Management use it for budgeting, cost control, cost reduction, and inventory management among others so that it can improve margins

Is cost accounting forecasted?

Cost accounting is forecasted using the budgeting technique. It is not possible to forecast financial accounting. Format. No specific format is used, the intention is to record all the important information. There are formalized principles such as GAAP and IFRS, designed and controlled by independent agencies. Reports.

Is cost accounting a direct or indirect accounting?

Conclusion. Cost accounting is an indirect part of financial accounting and a direct part of management accounting. Both cost accounting vs financial accounting can be used together to reduce costs and increase the profitability of a firm.

Explanatory discussion for financial and cost accounting

Accounting is always interconnected with business operations. So, both accounting types coexist, Although cost accounting is a small component of overall financial and business cycles. Yet, its importance can not be neglected. The reason is that the cost accounting approach provides insights into operational inefficiencies.

Fast additional fact about cost accounting

Cost accounting is about tracking various costs associated with production activities in an organization.

Conclusion

Accounting helps business owners and other stakeholders to understand business needs, performance, and corrective actions to be taken. Generally, accounting can be divided into two types that include financial accounting and management accounting.

Frequently asked questions

Which type of accounting is more important financial or cost accounting?

What is cost accounting?

Cost accounting is a tool used by management to improve business process efficiency. Financial accounting presents the business’s performance. Cost accounting focuses on the internal aspects of a company. Financial accounting focuses on its external aspects.

What is the purpose of financial accounting?

Financial accounting classifies, stores, records, and analyzes a company’s financial statements. The goal is to improve the business’s profitability and increase its transparency.

Why is estimation important in accounting?

Additionally, estimation is important in cost accounting. It helps determine the per-unit cost of sales. In contrast, every transaction in financial accounting is reporting based on actual data.

Is cost accounting a must for all organizations?

Yet, the use of financial accounting is a must for all organizations. Cost accounting is not performed as per any particular period. Rather, it’s performed in a short interval of time as in the production of a unit or product. Financial accounting records an organization’s financial activity for a given financial period.

Is cost accounting profit oriented?

While cost accounting helps improve a company’s processes, financial accounting is profit-oriented. The use of cost accounting is not mandatory in all companies. Only those using manufacturing processes or activities must use cost accounting. Yet, the use of financial accounting is a must for all organizations.