What factors determine the amount of interest earned on?

Three factors that determine what your interest rate will be

- Credit score Your credit score is a three-digit number that generally carries the most weight when it comes to determining your individual creditworthiness. ...

- Loan-to-value ratio The loan-to-value (LTV) ratio is calculated as the amount of the loan divided by the appraised value of the property and is expressed as a percentage. ...

- Debt-to-income

Does interest earned show on income statement?

The company will earn interest income from that investment. In the income statement, interest income is recorded separately from the operating income if the income statement that the company uses is a multiple-step income statement. But if it uses a single-step income statement, it is recorded in the revenue section.

What is the best way to earn interest on money?

- Bank account interest rates dropped last March when the Fed lowered its rate to near zero.

- You may be able to increase returns by opening a high-yield account at a bank or credit union.

- Other options that may pay more than you're earning now include money market accounts and CDs.

- Read more stories on Personal Finance Insider.

What does interest earned mean?

What is Interest Earned? Interest earned is the amount of interest earned from investments that pay the holder a regular series of mandated payments. For example, interest earned can be generated from funds invested in a certificate of deposit or an interest-bearing bank account. Accounting for Interest Earned

What is the term for earning interest on interest?

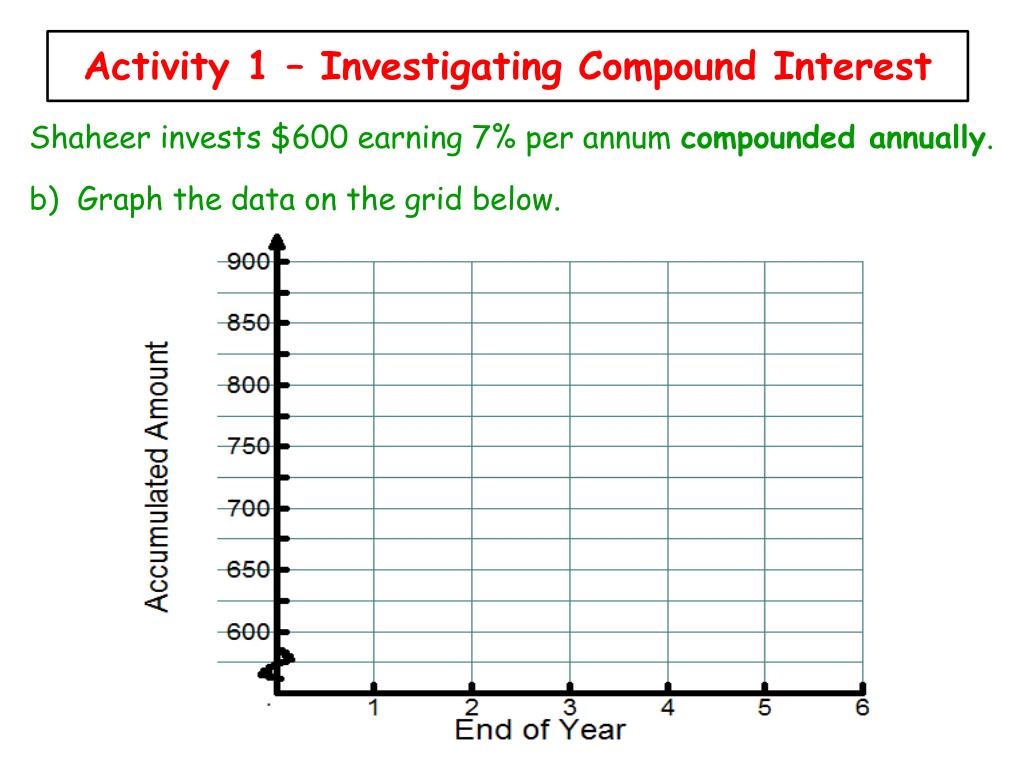

In simple terms, compound interest is interest you earn on interest. With a savings account that earns compound interest, you earn interest on the initial principal plus on the interest that accumulates over time.

What does it mean by earning interest?

Interest is the money you owe when borrowing or receive when lending. Lenders calculate interest as a percentage of the loan amount. Consumers can earn interest by lending money (such as through a bond or certificate of deposit) or depositing funds into an interest-bearing bank account.

How do I calculate interest earned?

Interest earned according to this formula is called simple interest. The formula we use to calculate simple interest is I=Prt I = P r t . To use the simple interest formula we substitute in the values for variables that are given, and then solve for the unknown variable.

What is interest earned example?

For example, we can multiply 0.02 by 3 years and get 0.06. Multiply that figure by the amount in the account to complete the calculation. Let's say the principal amount borrowed is $5,000; multiplying the figure by 0.06 will give us $300. Thus, $300 is the interest earned for the money lent for a period of 3 years.

How do I know if I have interest income?

Your interest income for the year would probably be included on the final bank statement for 2016. Or if you have online access to your bank account, you can probably find a link on the home screen for “tax forms” or something similar that will show you the interest income for the year.

What is the difference between interest earned and interest received?

Earned interest is the rate of interest that an investment earns on the principal amount. Accrued interest is interest that an investment is currently earning, but that you have not collected yet. In nutshell, you accrue interest all quarter/ month and you receive it on the payment date.

How much interest will I earn monthly?

To calculate a monthly interest rate, divide the annual rate by 12 to reflect the 12 months in the year. You'll need to convert from percentage to decimal format to complete these steps. Example: Assume you have an APY or APR of 10%. What is your monthly interest rate, and how much would you pay or earn on $2,000?

How much interest does 10000 earn a year?

Currently, money market funds pay between 0.85% and 1.05% in interest. With that, you can earn between $85 to $105 in interest on $10,000 each year.