Key Takeaways

- Financial statement analysis is used by internal and external stakeholders to evaluate business performance and value.

- Financial accounting calls for all companies to create a balance sheet, income statement, and cash flow statement which form the basis for financial statement analysis.

- Horizontal, vertical, and ratio analysis are three techniques analysts use when analyzing financial statements.

What are the five types of financial statements?

What are the 5 types of financial statements

- Income Statement. An income statement contains three main pieces of financial details of the business for a specific accounting period.

- Balance sheet. ...

- Statement of Change in Equity. ...

- Cash Flow Statement. ...

- Notes to Financial Statements. ...

What are the three main ways to analyze financial statements?

- relies on creditors to pay its bills. ...

- Liquidity ratios show how well the company is able to turn assets into cash. ...

- liquidity ratio, an analyst looks at the working capital, current ratio and quick ratio.

- Working capital is a measure of cash flow. ...

- Current ratio is a popular measure of financial strength. ...

- current assets by total current liabilities. ...

What are the different types of financial analysis techniques?

What is Financial Analysis?

- Types of Financial Analysis

- Vertical Analysis. Income Statement The Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time.

- Horizontal Analysis. ...

- Leverage Analysis. ...

- Growth Rates. ...

- Profitability Analysis. ...

- Liquidity Analysis. ...

- Efficiency Analysis. ...

- Cash Flow. ...

- Rates of Return. ...

What are the basics of financial analysis?

What is Financial Analysis

- Revenues. Revenues are probably your business's main source of cash. ...

- Profits. If you can't produce quality profits consistently, your business may not survive in the long run. ...

- Operational Efficiency. Operational efficiency measures how well you're using the company’s resources. ...

- Capital Efficiency and Solvency. ...

- Liquidity. ...

What is financial analysis and its types?

The most common types of financial analysis are vertical analysis, horizontal analysis, leverage analysis, growth rates, profitability analysis, liquidity analysis, efficiency analysis, cash flow, rates of return, valuation analysis, scenario and sensitivity analysis, and variance analysis.

What are the 3 types of financial statement analysis?

The three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement. These three financial statements are intricately linked to one another. Analyzing these three financial statements is one of the key steps when creating a financial model.

What are the 5 methods of financial statement analysis?

Five Financial Statement Analysis TechniquesTrend analysis:Common-size financial analysis:Financial ratio analysis:Cost volume profit analysis:Benchmarking (industry) analysis:

What are the 4 types of financial statements?

4 Types of Financial Statements That Every Business NeedsBalance Sheet. Also known as a statement of financial position, or a statement of net worth, the balance sheet is one of the four important financial statements every business needs. ... Income Statement. ... Cash Flow Statement. ... Statement of Owner's Equity.

How many types of financial analysis are?

There are two types of financial analysis: fundamental analysis and technical analysis.

How many types of financial statement analysis are there?

The three main types financial statements are the balance sheet, the income statement, and the cash flow statement. These three statements together show the assets and liabilities of a business, its revenues and costs, as well as its cash flows from operating, investing, and financing activities.

What is a financial analysis example?

An example of Financial analysis is analyzing a company's performance and trend by calculating financial ratios like profitability ratios, including net profit ratio, which is calculated by net profit divided by sales.

What are the tools of financial analysis?

The three major tools for financial statement analyses are horizontal analysis, vertical analysis, and ratios analysis.

What are the steps in financial statement analysis?

There are generally six steps to developing an effective analysis of financial statements.Identify the industry economic characteristics. ... Identify company strategies. ... Assess the quality of the firm's financial statements. ... Analyze current profitability and risk. ... Prepare forecasted financial statements. ... Value the firm.

What are the six 6 basic financial statements?

These include the working capital ratio, the quick ratio, earnings per share (EPS), price-earnings (P/E), debt-to-equity, and return on equity (ROE). Most ratios are best used in combination with others, rather than singly, for a comprehensive picture of company financial health.

What are the 4 types of accounting?

Discovering the 4 Types of AccountingCorporate Accounting. ... Public Accounting. ... Government Accounting. ... Forensic Accounting. ... Learn More at Ohio University.

Why are the four financial statements important?

Financial statements provide a snapshot of a corporation's financial health, giving insight into its performance, operations, and cash flow. Financial statements are essential since they provide information about a company's revenue, expenses, profitability, and debt.

What is horizontal analysis and vertical analysis?

Horizontal analysis represents changes over years or periods, while vertical analysis represents amounts as percentages of a base figure. Horizontal analysis usually examines many reporting periods, while vertical analysis typically focuses on one reporting period.

What are the six basic financial statement?

The basic financial statements of an enterprise include the 1) balance sheet (or statement of financial position), 2) income statement, 3) cash flow statement, and 4) statement of changes in owners' equity or stockholders' equity. The balance sheet provides a snapshot of an entity as of a particular date.

What are the tools of financial analysis?

Major 6 Tools and Techniques of Financial Statement Analysis1) Ratio Analysis.2) Common-Size Statements.3) Comparative Statements.4) Trend Analysis.5) Funds Flow Analysis/Statement.6) Cash Flow Analysis/Statement.

What are the components of financial analysis?

Financial analysis components at a glanceIncome statement. An income statement analysis reveals how your business has performed over a set period of time, usually three to 12 months. ... Balance sheet. ... Cash flow statements. ... Revenue and revenue growth. ... Profit. ... Operational efficiency. ... Capital efficiency. ... Solvency & Liquidity.

What is financial statement analysis?

Financial Statement Analysis refers to the process of reviewing and analyzing a company’s financial statements.

Who are the users of financial statement analysis?

The management, government, employees, customers, and investors are the users of financial statement analysis.

What are the tools of financial analysis?

The most commonly used tools of financial analysis are comparative statement (comparison of financial statements), common size statement (vertical...

What are the types of financial statement analysis?

These include horizontal analysis, vertical analysis, liquidity analysis, profitability analysis, variance, and valuation analysis.

Why is financial statement analysis done?

It is done to understand the financial position, solvency, and profitability of the business, and to make better financial decisions in future.

What is financial statement analysis?

Financial statement analysis is a function that involves the evaluation of reported financial statements of an entity, to aid stakeholders and users of those statements in their decision making. It seeks to establish relationships between various financial parameters so as to gain a better understanding of the entity’s financial health and performance. Financial statement analysis benefits both internal stakeholders (like management and existing shareholders) as well as external stakeholders (like potential investors, lenders and suppliers).

Why is financial analysis important?

All in all, financial statement analysis is an extremely vital function as it has utility for both internal and external stakeholders. Generally, a large part of this financial analysis is presented in annual reports along with the reported financial statements. This is done so that the information is easily accessible by all stakeholders. However, a leader is only as good as his team; thus for financial statement analysis to be meaningful, the financial statements themselves must be accurate and the interpretations applied must be meaningful.

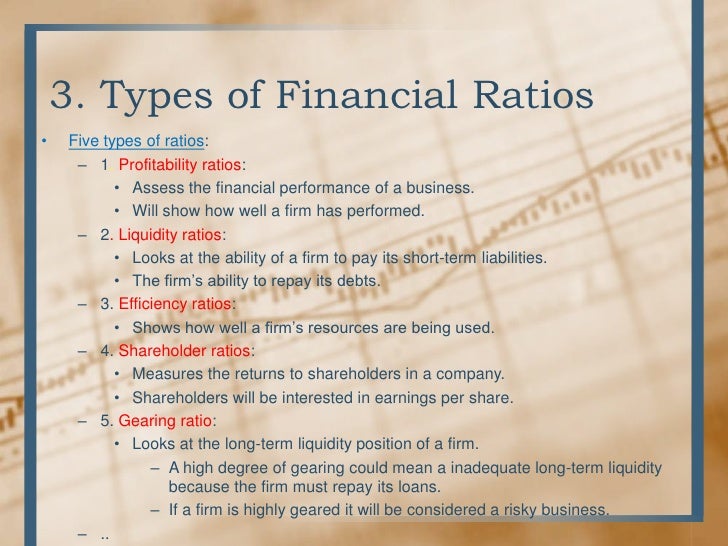

What is ratio analysis?

Ratio analysis involves evaluating relationship between various line items of financial statements like income statement and balance sheet. This is done by calculating various financial ratios and comparing them with some set standards. On the basis of this comparison, management can take corrective steps and other stakeholders can make informed decisions according to their specific situations.

What is profitability ratio?

Profitability ratios: measure the ability of a commercial entity to generate profits for its stockholders or owners. These ratios can include gross and net profit ratio, P/E ratio, EPS ratio, and return on capital employed ratio etc.

What is liquidity ratio?

Liquidity ratios: measure an entity’s ability to service its near-term debts as well as to meet its near-term fund requirements. A typical set of liquidity ratios includes current ratio, quick or liquid ratio, absolute liquid ratio, and current cash debt coverage ratio etc.

What is horizontal analysis?

Horizontal analysis involves evaluation of financial statements on a historical basis. Under this technique, financial data is compared across time periods. For example, the progression of sales is evaluated over the years to evaluate the sales growth rate of the entity.

What is the purpose of a performance analysis?

This analysis provides a basis for estimating the entity’s future performance as well as assists in setting benchmarks or standards for forthcoming years.

What is Financial Statement Analysis?

The term ‘Financial Statement Analysis’ refers to the systematic numerical representation of the relationship of one financial aspect with the other. The activity of financial statement analysis is undertaken to analyse the company on the basis of its profitability, solvency, operational efficiency, and growth prospects.

What are the two main types of profitability analysis?

Margin Ratios and return Ratios are the two main types of profitability analysis.

What is dynamic analysis?

It refers to the analysis of financial statement figures that are dynamic in nature.

What is the common size balance sheet?

The common-size balance sheet shows the total of assets or liabilities to be assumed as 100 and the figures are expressed as a percentage of the total.

What is cash equivalent analysis?

Such an analysis helps find out the causes of changes in the cash position between the two balance sheets at two different dates.

What is the purpose of ratios in accounting?

It uses ratios to determine whether or not a company will be able to pay back any debts or other expenses.

What is internal analysis?

1. Internal Analysis. Internal analysis is made by the top management executives with the help of Management Accountant. The finance and accounting department of the business concern have direct approach to all the relevant financial records.

What is short term analysis?

Short Term Analysis. The short term analysis of financial statement is primarily concerned with the working capital analysis so that a forecast may be made of the prospects for future earnings, ability to pay interest, debt maturities – both current and long term and probability of a sound dividend policy.

Why is long term analysis important?

There must be a minimum rate of return on investment. It is necessary for the growth and development of the company and to meet the cost of capital. Financial planning is also necessary for the continued success of a company.

Parties Involved in Financial Statement Analysis

The different parties involved in carrying out financial statement analysis are depicted below:

Guidelines for Financial Statement Analysis

Choice of tools should be appropriate at the time of selection. Use ratios for better interpretations.

Importance of Financial Statement Analysis

Management: For analyzing market trends, preparation of managerial reports, forecasting and decision making.

Limitations of Financial Statement Analysis

The difference in Accounting policies, methods, standards between both local and global firms.

Conclusion

Internal and external beneficiaries carry out financial statement analysis for multiple purposes using different tools like comparative statements, common-size statements, ratio analysis, trend analysis, cash flow statements and fund flow statements using the horizontal and vertical approach.

What is Financial Statement Analysis?

Financial Statement Analysis is largely a study of the relationship among the various financial factors in a business as disclosed by a single set of statements and a study of the trends of these factors as shown in series of statement

What is horizontal analysis?

When financial statements for a certain number of years are examined and analysed, the analysis is called horizontal analysis. It is also called “Dynamic Analysis.” This is based on the data or information spread over a period of years rather than on one date or period of time as a whole.

What is financial analysis?

Financial analysis refers to the process of analyzing a business' various finances to evaluate its financial stability and future. Financial analysis helps business owners determine any necessary courses of action they'll need to take to stay afloat, make a profit or avoid bankruptcy.

How do companies use financial analysis?

Companies use financial analysis both internally and externally. Internally, they analyze their financial status to improve future decisions that could be beneficial or adjust their budgets accordingly. Externally, a company uses various types of financial analyses for investment. In other words, analysts evaluate a company's finances to determine whether they'd make a worthwhile investment. Investors can even analyze a company's past performance to predict future performance. This is considered a bottom-up approach.

What is the purpose of liquidity analysis?

3. Liquidity. Liquidity analysis uses ratios to determine whether or not a company will be able to pay back any debts or other expenses. This type of analysis is helpful because if a business isn't able to pay off any liabilities, they're bound to face financial troubles in the near future.

What is profitability analysis?

In a profitability analysis, a company's rate of return is evaluated. Every business wants to be profitable, therefore, using the profitability analysis to measure its cost and revenue in a given period can be highly beneficial for them. If a company's revenue outweighs its costs, it's considered profitable.

Why is horizontal analysis important?

Horizontal analysis is also known as dynamic analysis or trend analysis, the latter being because this form of analysis can be useful in spotting trends over time. 3. Liquidity.

How many different types of financial analysis are there?

Watch this short video to quickly understand the twelve different types of financial analysis covered in this guide.

What is profitability analysis?

Profitability is a type of income statement. Income Statement The Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or. analysis where an analyst assesses how attractive the economics of a business are.

What is leverage analysis?

Leverage Analysis. Leverage ratios are one of the most common methods analysts use to evaluate company performance. A single financial metric, like total debt, may not be that insightful on its own, so it’s helpful to compare it to a company’s total equity to get a full picture of the capital structure.

What are the different types of budgets?

Types of Budgets There are four common types of budgeting methods that companies use: (1) incremental, (2) activity-based, (3) value proposition, and (4) or forecast . Financial Forecasting Financial forecasting is the process of estimating or predicting how a business will perform in the future.

What is horizontal analysis?

Horizontal analysis involves taking several years of financial data and comparing them to each other to determine a growth rate. This will help an analyst determine if a company is growing or declining, and identify important trends.

What Are Financial Statements?

Financial statements are written records that convey the business activities and the financial performance of a company. Financial statements are often audited by government agencies, accountants, firms, etc. to ensure accuracy and for tax, financing, or investing purposes. Financial statements include:

What are the three major financial statements?

The three major financial statement reports are the balance sheet, income statement, and statement of cash flows.

What is CFS in accounting?

The CFS allows investors to understand how a company's operations are running, where its money is coming from, and how money is being spent. The CFS also provides insight as to whether a company is on a solid financial footing. There is no formula, per se, for calculating a cash flow statement.

What is the difference between assets and liabilities?

Assets are listed on the balance sheet in order of liquidity. Liabilities are listed in the order in which they will be paid. Short-term or current liabilities are expected to be paid within the year, while long-term or non-current liabilities are debts expected to be paid in over one year.

What is a CFS statement?

The cash flow statement (CFS) measures how well a company generates cash to pay its debt obligations, fund its operating expenses, and fund investments. The cash flow statement complements the balance sheet and income statement .

What is the purpose of income statement?

The main purpose of the income statement is to convey details of profitability and the financial results of business activities. However, it can be very effective in showing whether sales or revenue is increasing when compared over multiple periods. Investors can also see how well a company's management is controlling expenses to determine whether a company's efforts in reducing the cost of sales might boost profits over time.

What is account receivable?

Accounts receivables are the amount of money owed to the company by its customers for the sale of its product and service.

What are the different types of financial analysis?

Types of financial analysis is analyzing and interpreting data by various types according to their suitability and the most common types of Financial Analysis are vertical analysis, horizontal analysis, leverage analysis, growth rates, profitability analysis, liquidity analysis, efficiency analysis, cash flow, rates of return, valuation analysis, scenario and sensitivity analysis, and variance analysis.

What is financial analysis?

Financial analysis means the analysis of the financial statement to reach up to the productive conclusion, which will help the investors and other stakeholders to maintain their relationship with the company , and there are various types that experts and analysts use to do a post-mortem of financial statements.

Why is profitability analysis important?

Profitability financial analysis helps us understand how the company generates

What is the purpose of a long term analysis?

The focus under this analysis is to ensure the proper solvency of the company in the near future and to check whether the company is able to pay all the long-term liabilities. and obligations.

What is short term analysis?

It analyses the short-term capability of the company with respect to day-to-day payments of trade creditors, short-term borrowings, statutory payments, salaries, etc. Its main intent is to verify the appropriate liquidity being maintained thoroughly for the given period, and all the liabilities are being met without any default.

Why is profitability important in financial analysis?

The main aim of all the investment decisions is to ensure the maximum profit out of the investment made in the project.

What is valuation analysis?

Valuation analysis means deriving the company’s fair valuation. You may use one of the following valuation financial analysis tools –