Accounting for Finished Goods: Definition, Journal Entries and More

- Definition. Finished Goods are goods that have undergone the manufacturing process, or goods that have been procured for purposes of reselling, and are in the possession of the company, but ...

- Accounting Treatment and Journal Entry. ...

- Conclusion. ...

Are finished goods a current asset?

Is Finished goods inventory a current asset? Inventory is regarded as a current asset as the business as it includes raw materials and finished goods that can be converted into cash within one year or less. How does inventory affect cost of goods sold? An overall decrease in inventory cost results in a lower cost of goods sold.

What was necessary to distribute finished goods?

Finished goods are received similarly from HP Plants across countries. Normal Supply Network consists of 3PL Owned Country Depot in each country and further regional distribution centers and stocking points which ship out goods to distributors who maintain their logistical network to reach to the customer point of delivery.

How to calculate finished good?

Finished goods at the beginning of year + Finished goods produced − Finished goods sold = Finished goods at the end of a year. For example, Diamond Manufacturers are into manufacturing swimming products like swimsuits. Now, to calculate how much worth of Finished Goods is lying in your warehouse or manufacturing unit, you need to refer to the ...

Which is necessary to distribute finished goods?

These are some specific outbound logistics challenges:

- Coordinating Operations: Outbound logistics teams must monitor production, storage and distribution—coordinating the optimal movement of goods is no small task. ...

- Achieving the Seven Rs: Coined by John J. ...

- Inventory Costs: Keeping enough inventory to meet fluctuating customer demand without creating unnecessary holding costs requires careful planning. ...

What finished goods means?

Unfinished Goods means all Inventory excluding finished goods inventory.

What finished goods example?

Finished goods are goods that have completed required manufacturing process and are ready to be fitted/mixed/processed with final product. The final product itself could also be called finished goods. Examples: cars, clothing, food, furniture etc.

What finished goods answer?

Finished Goods are materials or products which have received the final increments of value through manufacturing or processing operations, and which are being held in inventory for delivery, sale, or use.

What is a finished goods inventory?

Finished goods inventory is the total stock available for customers to purchase that can be fulfilled. Using the finished goods inventory formula, sellers can calculate the value of their goods for sale. 'Finished goods' is a relative term, as a seller's finished goods may become a buyer's raw materials.

What is the difference between finished and unfinished goods?

A finished good is a good that has moved through the production process and is considered complete. An unfinished good is the opposite, as it is not made available to be sold since it is deemed to be incomplete. It may be used in the production process but is not sold to consumers.

What are raw and finished products?

A manufacturing company handles two different types of inventory -- raw materials and finished goods. The primary difference is that raw materials inventory is used in the production of goods and finished goods inventory is what the company produces and eventually sells to a product reseller.

Are finished goods an asset?

Finished goods are considered a short-term or current asset on a company's balance sheet because they are usually sold within a year.

How do you find finished goods?

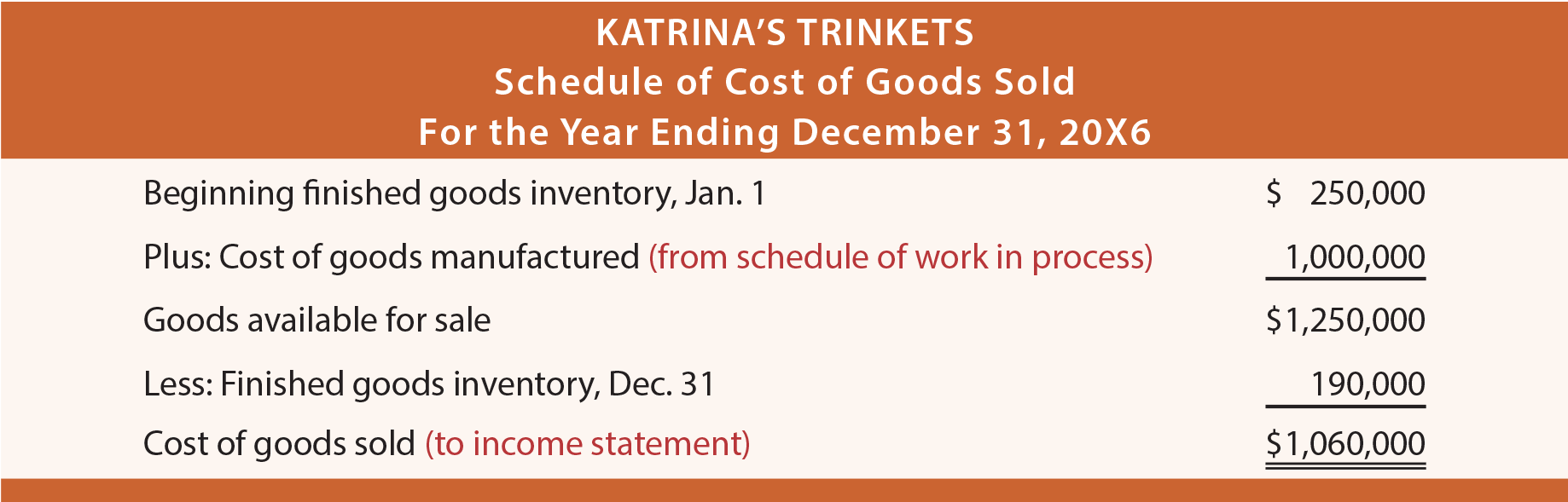

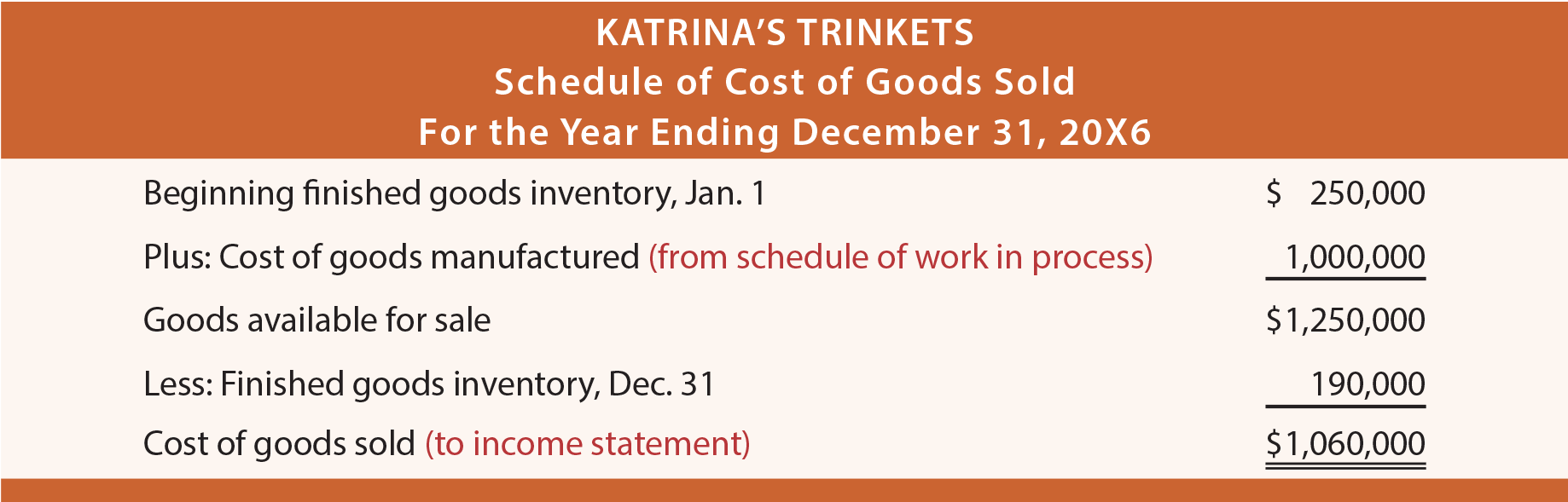

Subtract the cost of goods sold (COGS) from the cost of goods manufactured (COGM). Calculate the new finished goods inventory by adding the previous finished goods inventory value to the previous solution (COGM minus COGS).

What are finished and semi finished goods?

semi-finished goods are goods, such as partly finished goods, used as inputs in the production of other goods including final goods. A firm may make and then use intermediate goods, or make and then sell, or buy then use them.

What do you call the finished goods when sold?

When the good is completed as to manufacturing but not yet sold or distributed to the end-user, it is called a "finished good". This is the last stage for the processing of goods. The goods are ready to be consumed or distributed. There is no processing required in term of the goods after this stage by the seller.

What is finished goods?

Finished Goods are goods that have undergone the manufacturing process, or goods that have been procured for purposes of reselling, and are in the possession of the company, but have not been sold yet.

Is finished goods inventory a unique asset?

These units are also referred to as merchandise, which is mainly owned by the retailer. From a manufacturing perspective, it can be seen that finished goods inventory can be referred to as a unique asset.

What is finished goods inventory?

Definition: Finished goods inventory is the third group of inventory owned by a manufacturer and consist of products that are ready for sale. You can think of this like merchandise owned by a retailer. These goods are completely finished, made it through the production process, and ready for consumers to buy.

What happens after a product is made through the assembly line?

After the goods have made it through the entire assembly line and are completely ready for sale, they are transferred out of the work in process account to the finished goods inventory account. As you can see, this process allows a manufacturer to track how much inventory it has at any stage in the production process.

How long does it take to process raw materials?

The stock is classified as raw materials inventory. These raw materials are machined and put through the assembly process. This process could take days or weeks. In the meantime, these goods are transferred from the raw materials account into the work in process inventory account. After the goods have made it through the entire assembly line ...

What is raw material inventory?

When a manufacturer decides to make a product, it must order the basis stock needed to build the product. This stock could be bars of steel, sheets of metal, or blanks of plastic—anything in its raw form. The stock is classified as raw materials inventory.

Is finished goods worth more than raw materials?

In other words, finished goods are usually worth much more than raw materials.

What is finished goods?

As we learned, finished goods are goods or products that do not require any further processing and are ready to be sold, with unprocessed foods being foods done growing and have been prepped for sale, and processed foods being food that's been changed from its natural state.

What are some examples of finished goods?

Examples of finished goods include: Fruits and vegetables. Meats.

What is processed food?

Processed Foods. When a food is processed you end up with other types of finished goods such as cereals, canned tuna ready to be eaten, chips, salsa, soda, and many other items that you find in the aisles of your grocery store.

How long do durable goods last?

Durable goods are products that last a while. Typically these items are expected to last at least three years . These include things such as heavy machinery, furniture, cars, and jewelry.

Is a finished good considered merchandise?

This means that once you have decided to purchase a finished good at the store and you have checked out with it , it's no longer called a finished good. You've bought it, and now it is merchandise. The reason for this technicality is for accounting purposes.

Is food a non-durable product?

Actually, your finished food products are all considered non-durable goods. The medicine you use is a non-durable good. Your clothes and shoes are also finished non-durable goods. The gasoline that powers your car is another example of a non-durable good that, when ready to be sold, is a finished good. The next time you are out shopping look ...

Do eggs have to be gathered and packaged?

The same goes with your meats. Your meat has been cut and packaged so it's ready to be used. Your eggs have been gathered, cleaned, and packaged in cartons. You know that when you purchase these food items, the seller or farmer has done all the processing needed to make it ready to be sold.

What are finished goods?

Finished goods are products that have completed the manufacturing process but have yet to be sold to retailers or customers. These products are one form of inventory. In manufacturing, inventory can be categorized into three main types:

Why understanding finished goods is important

Accurately calculating your finished goods inventory is a necessary step toward understanding your inventory ratios. Simply put, it helps you understand the total value of the raw materials, works in process and finished goods in your warehouse.

How to include finished goods in accounting

Including finished goods in accounting can ensure an accurate income statement for a company. Follow these steps to manage finished goods accounting:

Examples

To help you understand more and apply this formula, we take an example of a textile company X producing silk. At the end of 2020, factory X had 1000 finished pieces of silk in stock that needed to be sold. 1 piece of silk cost $5 each to fabricate. In 2020, factory X manufactured 1600 pieces and sold 900 pieces.

What are 4 types of inventory?

Raw materials: all the initial products used in the production or manufacture of finished or manufactured products. These are materials produced by nature that require processing for use. The definition of raw materials includes both the materials used to manufacture these finished products and the energy commodities required for their production.

How to calculate ending inventory?

Ending inventory is the value of the “leftover” inventory that still can be sold at the end of the accounting period. To calculate the ending inventory, we take the total of beginning inventory and net purchases and finish by subtracting the cost of goods sold.

When finished goods are shipped to customers, the cost of finished goods are transferred from finished goods account to cost of goods sold

When finished goods are shipped to customers, the cost of finished goods are transferred from finished goods account to cost of goods sold account. If a job is completed according to specification of a particular customer, the complete job is shipped to the customer immediately and the manufacturing cost associated with the job (as shown by the job cost sheet) is charged to the cost of goods sold. But in some cases, the complete job is not shipped but only a portion of the job is sold to customers. In such circumstances, the manufacturing cost per unit is computed and the cost of the units that have been shipped to customers is charged to cost of goods sold account.

What is job order costing?

In a job order costing system, all manufacturing costs (i.e., direct materials, direct labor, and applied manufacturing overhead) of the job are debited to work in process account. When a job is completed, its cost (as shown by job cost sheet) is transferred from the work in process account to the finished goods account.

Is a complete job shipped?

But in some cases, the complete job is not shipped but only a portion of the job is sold to customers. In such circumstances, the manufacturing cost per unit is computed and the cost of the units that have been shipped to customers is charged to cost of goods sold account.

Introduction

In the job order costing, the manufacturing company can move the work in process to the finished goods when it completes a job during the period. Likewise, the journal entry for finished goods is required to transfer the cost of work in process to the finished goods inventory account.

Finished goods journal entry

In job order costing, when a job is completed and products are ready for sale, the company can make the journal entry for finished goods by debiting the finished goods inventory and crediting work in process inventory.

Example

For example, with the job order costing, the manufacturing company ABC has completed a job with the goods that cost $30,000 during the month. The goods are later sold on credit for $50,000.