What does hyhy mean on a depreciation schedule?

HY = Half-Year: Depreciation is halved for the first and last year once it is in service. MY = Modified Half-Year: If put into service before the midpoint of the year, the fixed asset receives a full year of depreciation for the first year, but none on the last.

What is the half-year convention for depreciation?

Using the half-year convention, a taxpayer claims a half of a year’s depreciation for the first taxable year, regardless of when the property was actually put into service. It is assumed that the property being depreciated was placed into service at the midpoint of the year.

What is depreciation in accounting?

Accounting is full of conventions to match sales and expenses in the year they are incurred. One convention is referred to as depreciation. Depreciation allows a company to expense a portion of the cost of an asset in the year it is purchased only if the asset will give value to the company in more than one year.

What is sum-of-the-years-digits depreciation method?

The sum-of-the-years-digits method is one of the accelerated depreciation methods. A higher expense is incurred in the early years and a lower expense in the latter years of the asset’s useful life. In the sum-of-the-years digits depreciation method

What is depreciation method 200db hy?

The double declining balance method of depreciation, also known as the 200% declining balance method of depreciation, is a form of accelerated depreciation. This means that compared to the straight-line method, the depreciation expense will be faster in the early years of the asset's life but slower in the later years.

What are the 3 methods of depreciation?

What Are the Different Ways to Calculate Depreciation?Depreciation accounts for decreases in the value of a company's assets over time. ... The four depreciation methods include straight-line, declining balance, sum-of-the-years' digits, and units of production.More items...

How do you calculate 150 DB Hy depreciation?

Depreciation rate for 150 percent declining balance method = 20% * 150% = 20% * 1.5 = 30% per year. Depreciation = $140,000 * 30% * 9/12 = $31,500.

What are the 5 methods of depreciation?

Companies depreciate assets using these five methods: straight-line, declining balance, double-declining balance, units of production, and sum-of-years digits.

Which depreciation method should I use?

The straight-line method is the simplest and most commonly used way to calculate depreciation under generally accepted accounting principles. Subtract the salvage value from the asset's purchase price, then divide that figure by the projected useful life of the asset.

How do we calculate depreciation?

To calculate depreciation using the straight-line method, subtract the asset's salvage value (what you expect it to be worth at the end of its useful life) from its cost. The result is the depreciable basis or the amount that can be depreciated. Divide this amount by the number of years in the asset's useful lifespan.

How is 200 db Hy depreciation calculated?

You calculate 200% of the straight-line depreciation, or a factor of 2, and multiply that value by the book value at the beginning of the period to find the depreciation expense for that period.

Which depreciation method is least used?

Straight line depreciation is often chosen by default because it is the simplest depreciation method to apply.

What is Syd method?

Sum of Years Depreciation (SYD) is a method of accelerated depreciation. Similar to the double declining balance method, sum of years depreciation aims to depreciate a company's assets at an accelerated rate.

What are the 10 methods of depreciation?

Various Depreciation MethodsStraight Line Depreciation Method.Diminishing Balance Method.Sum of Years' Digits Method.Double Declining Balance Method.Sinking Fund Method.Annuity Method.Insurance Policy Method.Discounted Cash Flow Method.More items...•

What are the two types of depreciation?

The four main depreciation methods mentioned above are explained in detail below.Straight-Line Depreciation Method. ... Double Declining Balance Depreciation Method. ... Units of Production Depreciation Method. ... Sum-of-the-Years-Digits Depreciation Method.

What is depreciation example?

An example of Depreciation – If a delivery truck is purchased by a company with a cost of Rs. 100,000 and the expected usage of the truck are 5 years, the business might depreciate the asset under depreciation expense as Rs. 20,000 every year for a period of 5 years.

What is depreciation & its types examples?

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery etc.

What is 3 year property?

(3) Classification of certain property (A) 3-year property The term “3-year property” includes— (i) any race horse— (I) which is placed in service before January 1, 2022 , and (II) which is placed in service after December 31, 2021 , and which is more than 2 years old at the time such horse is placed in service by such ...

What are the other names of depreciation?

depreciationbelittlement,denigration,deprecation,derogation,detraction,diminishment,disparagement,put-down.

How to calculate depreciation expense?

The straight-line method of depreciation expense is calculated by dividing the difference between the cost of the truck and the salvage value by the expected life of the truck. In this example, the calculation is $105,000 minus $5,000 divided by 10 years, or $10,000 per year. Ordinarily, the firm would expense $10,000 in years one through year 10.

What is the Half-Year Convention For Depreciation?

The half-year convention for depreciation is the depreciation schedule that treats all property acquired during the year as being acquired exactly in the middle of the year. This means that only half of the full-year depreciation is allowed in the first year, while the remaining balance is deducted in the final year of the depreciation schedule, or the year that the property is sold. The half-year convention for depreciation applies to both modified accelerated cost recovery systems and straight-line depreciation schedules.

What is the purpose of the half year convention?

The purpose of the half-year convention is to better align expenses with revenues generated by the asset in the same accounting period, per the matching principle. The half-year convention applies to all forms of depreciation, including straight-line, double declining balance, and sum-of-the-years' digits.

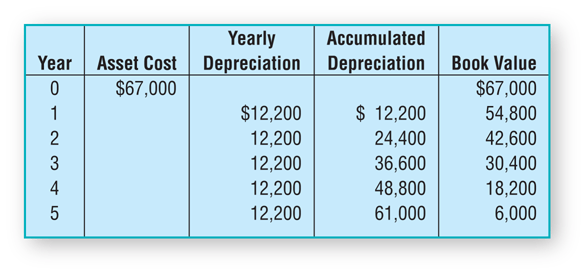

Why is depreciation recorded on a company's books?

An item is recorded on a company's books as a fixed asset at the time of purchase if it will bring value to the company over a number of years. Depreciation allows a company to expense a portion of the cost of an asset in each of the years of the asset's useful life. The company will then keep track of the book value of the asset by subtracting the accumulated depreciation from the asset's historical cost.

When can a mid quarter convention be used instead of a half year convention?

There is also a mid-quarter convention that can be used instead of the half-year convention, if at least 40% of the cost basis of all fixed assets acquired in a year were put in service sometime during the last three months of the year.

What is the matching principle in accounting?

As one of many U.S. generally accepted accounting principles, the matching principle seeks to match expenses to the period in which the related revenues were earned. Depreciation is an accounting convention that helps match related expenses and revenues.

Which depreciation method is the most common?

While the straight-line method is the most common, there are also many cases where accelerated methods. Accelerated Depreciation Accelerated depreciation is a depreciation method in which a capital asset reduces its book value at a faster (accelerated) rate than it would.

What is depreciation expense?

Depreciation expense is used in accounting to allocate the cost of a tangible asset. Tangible Assets Tangible assets are assets with a physical form and that hold value. Examples include property, plant, and equipment. Tangible assets are. over its useful life.

What is double declining balance depreciation?

Compared to other depreciation methods, double-declining-balance depreciation#N#Double Declining Balance Depreciation The double declining balance depreciation method is a form of accelerated depreciation that doubles the regular depreciation approach. It is#N#results in a larger amount expensed in the earlier years as opposed to the later years of an asset’s useful life. The method reflects the fact that assets are typically more productive in their early years than in their later years – also, the practical fact that any asset (think of buying a car) loses more of its value in the first few years of its use. With the double-declining-balance method, the depreciation factor is 2x that of the straight-line expense method.

What is straight line depreciation?

In straight-line depreciation, the expense amount is the same every year over the useful life of the asset.

What is units of production depreciation?

The units-of-production depreciation method depreciates assets based on the total number of hours used or the total number of units to be produced by using the asset, over its useful life.

Is depreciation expense capitalized?

There are several types of depreciation expense. Depreciation Expense When a long-term asset is purchased, it should be capitalized instead of being expensed in the accounting period it is purchased in. and different formulas for determining the book value.

How much depreciation expense is there in year 4?

At the beginning of Year 4, the asset's book value will be $51,200. Therefore, the book value of $51,200 multiplied by 20% will result in $10,240 of depreciation expense for Year 4.

What is double declining balance?

This means that compared to the straight-line method, the depreciation expense will be faster in the early years of the asset's life but slower in the later years. However, the total amount of depreciation expense during the life of the assets will be the same.

Does book value decrease with depreciation?

Since book value is an asset's cost minus its accumulated depreciation, the asset's book value will be decreasing when the contra asset account Accumulated Depreciation is credited with the depreciation expense of the accounting period.

What is depreciation method?

The depreciation method can take the form of straight-line or accelerated (double-declining-balance or sum-of-year), and when accumulated depreciation matches the original cost, the asset is now fully depreciated on the company’s books. When an asset is officially placed in service, it can have a material impact on reported pretax earnings and therefore the amount of tax that a company must pay.

What is the Mid Quarter Convention Method for Depreciation?

Home » Bookkeeping » What is the Mid Quarter Convention Method for Depreciation?

What is fully depreciated asset?

A fully depreciated asset is a property, plant or piece of equipment (PP&E) which, for accounting purposes, is worth only its salvage value. Whenever an asset is capitalized, its cost is depreciated over several years according to a depreciation schedule. Theoretically, this provides a more accurate estimate of the true expenses ...

How much depreciation is required for fixtures?

Under the straight-line method, the 10-year life means the asset’s annual depreciation will be 10% of the asset’s cost. Under thedouble declining balance method the 10% straight line rate is doubled to 20%. However, the 20% is multiplied times the fixture’s book value at the beginning of the year instead of the fixture’s original cost. The double declining balance method of depreciation, also known as the 200% declining balance method of depreciation, is a form of accelerated depreciation.

When did the depreciation system change?

In 1981 , Congress again changed the depreciation system, providing generally for shorter lives for recovery of costs. Under the Accelerated Cost Recovery System (ACRS), broad groups of assets were assigned based on the old ADR lives (which the IRS has updated since).

What is a half year convention?

In tax accounting the half-year convention is the default applicable convention used for federal income tax purposes. Like other conventions, the half-year convention affects the depreciation deduction computation in the year in which the property is placed into service.

When is depreciable property placed in service?

Depreciable property is assumed to be placed into service on July 1 of the year in which it is placed into service.

Half-Year Convention For Depreciation Example

- The allocation of depreciation for the half-year convention can be difficult to grasp. To get a better understanding, an example of a half-year convention with a depreciation schedule is shown below. Example: Company A purchases a manufacturing machine for $25,000 on March 1, 2020…

Types of Depreciation Conventions

- As for the types of depreciation conventions, nine conventions govern when and how depreciation is calculated. The conventions are listed and discussed below: 1. FM = Full Month: The fixed asset receives a full month of depreciation during the month when it is placed in service. It does not receive depreciation for the month of disposal. 2. HM = Modified Half Month: If the fixed asset i…

Tax Implications

- How and when depreciation is calculated directly affects an organization’s tax status. A half-year convention does not require taxpayers to prove when the fixed asset was placed into service. Instead, the U.S. Internal Revenue Service (IRS) created a rule that assumes fixed assets are placed into service on July 1stof the year it was actually placed in service. The IRS created the r…

Related Readings

- CFI is the official provider of the global Commercial Banking & Credit Analyst (CBCA)™certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful: 1. Day-Count Convention 2. Depreciated Cost 3. Double Declining Balance Depreciation 4. Depreciation Metho…

What Is The Half-Year Convention For Depreciation?

Understanding The Half-Year Convention For Depreciation

- As one of many U.S. generally accepted accounting principles, the matching principle seeks to match expenses to the period in which the related revenues were earned. Depreciation is an accounting convention that helps match related expenses and revenues. An item is recorded on a company's books as a fixed asset at the time of purchase if it will br...

Example of The Half-Year Convention

- As an example, assume a company purchases a $105,000 delivery truck with a salvage value of $5,000 and an expected life of 10 years. The straight-line method of depreciation expense is calculated by dividing the difference between the cost of the truck and the salvage value by the expected life of the truck. In this example, the calculation is $105,000 minus $5,000 divided by 1…

Straight-Line Depreciation Method

Double Declining Balance Depreciation Method

- Compared to other depreciation methods, double-declining-balance depreciationresults in a larger amount expensed in the earlier years as opposed to the later years of an asset’s useful life. The method reflects the fact that assets are typically more productive in their early years than in their later years – also, the practical fact that any asset (think of buying a car) loses more of its value …

Units of Production Depreciation Method

- The units-of-production depreciation method depreciates assets based on the total number of hours used or the total number of units to be produced by using the asset, over its useful life. The formula for the units-of-production method: Depreciation Expense = (Number of units produced / Life in number of units) x (Cost – Salvage value) Consider a m...

Sum-Of-The-Years-Digits Depreciation Method

- The sum-of-the-years-digits method is one of the accelerated depreciation methods. A higher expense is incurred in the early years and a lower expense in the latter years of the asset’s useful life. In thesum-of-the-years digits depreciation method, the remaining life of an asset is divided by the sum of the years and then multiplied by the depreciating base to determine the depreciation …

Summary of Depreciation Methods

- Below is the summary of all four depreciation methods from the examples above. Here is a graph showing the book value of an asset over time with each different method. Here is a summary of the depreciation expense over time for each of the 4 types of expense.

Video Explanation of Depreciation Methods

- Below is a short video tutorial that goes through the four types of depreciation outlined in this guide. While the straight-line method is the most common, there are also many cases where accelerated methodsare preferable, or where the method should be tied to usage, such as units of production. Video: CFI’s Financial Analysis Courses.

More Resources

- Thank you for reading this CFI guide to the four main types of depreciation. To help you become a world-class financial analyst, these additional CFI resources will be helpful: 1. Depreciation Schedule 2. Depreciation Expense 3. Projecting Balance Sheet Items 4. Property, Plant & Equipment (PP&E)