Why profit maximization is not the most important objective?

The losing importance of profit maximization is not baseless and it is not only because it ignores certain important areas such as risk, quality, and the time value of money but also because of the superiority of wealth maximization as an objective of the business or financial management.

What are the conditions for profit maximization?

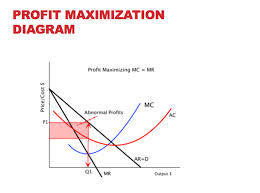

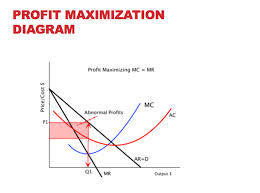

Profit is maximum when the difference between the total revenue and total cost is maximum. For profit maximization, two conditions must be fulfilled, namely, the Under first order condition, Marginal Revenue (MR) should be equal to Marginal Cost (MC).

Why do firms seek profit maximisation through trial and error?

Many firms may have to seek profit maximisation through trial and error. e.g. if they see increasing price leads to a smaller % fall in demand they will try to increase price as much as they can before demand becomes elastic It is difficult to isolate the effect of changing the price on demand.

Which decision would be solely based on profit maximization model?

A decision solely based on profit maximization model would take a decision in favor of profits. In the pursuit of profits, the risk involved is ignored which may prove unaffordable at times simply because higher risks directly questions the survival of a business.

How does profit maximization ignore time value of money?

Profit maximization objective ignores the time value of money and does not consider the magnitude and timing of earnings. It treats all earnings as equal when they occur in different periods. It does not differentiate between the profits of the current year with the profits to be earned in later years.

What are the limitations of profit maximization?

Limitations of Profit MaximizationLong-Term Sustainable Goals. Profit maximization might be one of the top goals of financial management but this type of practice doesn't imply that short-term profit increases will help produce long-term sustainable goals for the company. ... Product Quality. ... Employee Training.

Does profit maximization ignore timing returns?

The profit maximization objective ignores the timing of returns. It equates a dollar received today with a dollar received in the future. In fact, $ 100 today is valued more than $ 100 received after one year. It is because the money received in earlier period may be reinvestable to earn more.

What is the criticism of profit maximization?

Profit maximization objective is a little vague in terms of returns achieved by a firm in different time period. The time value of money is often ignored when measuring profit. It leads to uncertainty of returns. Two firms which use same technology and same factors of production may eventually earn different returns.

What is ignored in profit maximization Mcq?

It ignores the time value of money:Profit maximization does not consider the time value of money or the net present value of the cash inflow. It leads certain differences between the actual cash inflow and net present cash flow during a particular period.

What is the profit maximization rule?

In economics, the profit maximization rule is represented as MC = MR, where MC stands for marginal costs, and MR stands for marginal revenue. Companies are best able to maximize their profits when marginal costs -- the change in costs caused by making a new item -- are equal to marginal revenues.

What maximization objective ignores the time value of money?

What is Profit Maximization? The process of increasing the profit earning capability of the company is referred to as Profit Maximization. It is mainly a short-term goal and is primarily restricted to the accounting analysis of the financial year. It ignores the risk and avoids the time value of money.

Will profit maximization always result in stock price maximization?

Profit maximization does not always result in stock price maximization, because profit maximization can only ensure higher earnings per share not the increased value of a stock. Profit can be manipulated by the managerial actions, like reducing operating costs through hampering the normal flow of actions.

Can a firm Maximise value if it ignores the interests of stakeholders?

Since a firm cannot maximize value if it ignores the interest of it's stakeholders enlightened value maximization can utilize much of the structure of stakeholder theory by accepting long run maximization of the value of the firm as the criterion for making the requisite tradeoffs among its stakeholders.

Why is profit maximization not the appropriate goal?

Profit maximization is an inappropriate goal because it's short term in nature and focus more on what earnings are generated rather than value maximization which comply to shareholders wealth maximization. Wealth maximization overcomes all the limitations that profit maximization possesses.

What are the assumptions of profit maximization?

The profit maximization theory assumes that a company's goal is to maximize profits. It assumes that the decision-making process in a company is rational and efficient, and in order to maximize profits, the firm will take advantage of market opportunities and use its resources efficiently.

Why profit maximization is ambiguous?

(1) Ambiguity – The term profit is a vague and ambiguous concept. It has no precise connotation. It is amenable to different interpretation by different people. To illustrate, profit may be short term or long term, it may be total profit or rate of profit and it may be before tax or after tax and so on.

What are the advantages and disadvantages of profit Maximisation?

Profit maximization is a short term objective of the firm while the long-term objective is Wealth Maximization. Profit Maximization ignores risk and uncertainty. Unlike Wealth Maximization, which considers both. Profit Maximization avoids time value of money, but Wealth Maximization recognises it.

What are the assumptions of profit maximization?

The profit maximization theory assumes that a company's goal is to maximize profits. It assumes that the decision-making process in a company is rational and efficient, and in order to maximize profits, the firm will take advantage of market opportunities and use its resources efficiently.

What are the disadvantages of sales maximisation?

Sales maximization leaves the company at risk. There is no guarantee that the higher sales level will generate income. In fact, many firms will sell a product at or below cost to establish a new customer base. There is no guarantee those customers will remain at a higher price level.

What are the features of profit maximization?

Profit Maximization consists of the following features: Profit Maximization is also known as cash per share maximization. It helps in achieving the objects to maximize the business operation for profit maximization. The ultimate objective of any business is to earn a huge amount of return in terms of profit.

How to achieve Profit Maximization?

Increase sales volume by implementing better marketing strategies, improve quality, do a thorough market study to assess which segments are bringing in more money to the business and focus on driving more sales from those products or services. You can also borrow the best marketing strategy from your competitors, or similar businesses.

What are the advantages of Profit Maximization?

Economic Existence: – The foundation of profit maximization theory is profit and profit is essential for the economic survival of any company or business.

What is Wealth Maximization?

Meaning of Wealth Maximization: – Wealth maximization is the ability of a company to increase the market value of its common stock over time. The market value of the firm is based on many factors like their goodwill, sales, services, quality of products, etc. It is the versatile goal of the company and highly recommended criterion for evaluating the performance of a business organisation. This will help the firm to increase their share in the market, attain leadership, maintain consumer satisfaction and many other benefits are also there.

What is the difference between profit maximization and wealth maximization?

Profit maximization is a short term objective of the firm while the long-term objective is Wealth Maximization.

Why is profit maximization important?

Profit Maximization is necessary for the survival and growth of the enterprise. Conversely, Wealth Maximization accelerates the growth rate of the enterprise and aims at attaining the maximum market share of the economy.

What is the most influential factor in the dealings of a business?

Knowledge of Business Firms: – The profit motive is most influential in the dealings of business firms. For small firms with strong competition, they must act as profit maximization to increase their sales and reduce costs to avoid competition.

How to tell if a company is wealth maximized?

The most direct evidence of wealth maximization is changes in the price of a company’s shares. For example, if a company spends funds to develop valuable new intellectual property, the investment community is likely to recognize the future positive cash flows associated with this new property by bidding up the price of the company’s shares. Similar reactions may occur if a business reports continuing increases in cash flow or profits.

What are the disadvantages of profit maximization?

What Are Some Disadvantages of Profit Maximization? Some of the disadvantages that can result from a company becoming overly focused on profit maximization are the ignoring of risk factors, a lessening or loss of transparency and the compromising of ethics and good business practices.

What does it mean to lower a company's budget?

Lowering or eliminating a company's employee training or research and development budget will lessen operating expenses and also maximize short-term profits. However, the competition may not follow suit and instead produce a much better product or service. The long-term result could be a significant loss of market share for the company that decided to lower its budget to pursue a short-term profit gain.

Does profit maximization increase long term?

Profit maximization is an obvious goal of management, but it does not necessarily imply that short-term profit increases will produce long-term sustainable gains. For example, a reduction in product quality that lowers production costs will produce a quick increase in profit, but lowered quality standards can also tarnish a company's reputation and provide the competition with an advantage.

How to maximise profit?

But, to maximise profit, it involves setting a higher price and lower quantity than a competitive market.

How does a monopoly maximize profit?

Note, the firm could produce more and still make normal profit. But, to maximise profit, it involves setting a higher price and lower quantity than a competitive market.

What is profit satisficing?

This occurs when there is a separation of ownership and control and where managers do enough to keep owners happy but then maximise other objectives such as enjoying work.

What is an assumption in classical economics?

An assumption in classical economics is that firms seek to maximise profits.

What happens if a firm produces less than output of 5?

Therefore, for this extra output, the firm is gaining more revenue than it is paying in costs, and total profit will increase.

What happens to the marginal cost of output after 5?

However, after the output of 5, the marginal cost of the output is greater than the marginal revenue. This means the firm will see a fall in its profit level because the cost of these extra units is greater than revenue.

Can you know the marginal revenue?

In the real world, it is not so easy to know exactly your marginal revenue and the marginal cost of last goods sold. For example, it is difficult for firms to know the price elasticity of demand for their good – which determines the MR.

What is profit maximization?

According to conventional economists, profit maximization is the only objective of organisations, making it as the base of conventional theories. It is also regarded as the most reasonable and productive business objective of an organisation.

How does an organisation maximise its profit?

Therefore, an organisation maximises its profit by equalising its marginal revenue and marginal costs. Figure 5 shows the profit maximisation of an organisation under imperfect competition:

What is the equilibrium point at which the organisation maximises its profit in perfect competition?

Thus, the equilibrium point at which the organisation maximises its profit in perfect competition is at the output rate Q.

How is profit maximising output determined?

Thus, the profit-maximising output is determined at the point where extra revenue obtained by selling the last unit becomes equal to the marginal cost incurred in the production of that unit. Figure 2 shows the profit maximisation under perfect competition:

What is marginal revenue?

Marginal revenue can be defined as the revenue generated from sale of the last unit of output, on the other hand, marginal cost can be described as the cost incurred in the production of one additional unit of output. Both TR and TC functions involve a common variable, which is output level (Q).

How to calculate total profit?

The total profit (Π) of a business organisation is calculated by taking the difference between Total Revenue (TR) and Total Cost (TC). Thus,

Why is short run important?

short run to identify the most efficient manner to increase profits. It is mainly concerned with the determination of price and output. level that returns the maximum profit. It is an important assumption. that helped economists in the formulation of various economic theories, such as price and production theories.

What is profit maximization?

Profit maximization is the maximum that the bottom line or net income can be achieved. Wealth maximization is how the capital structure can be optimized to give higher return on equity. For example in the former if you raise price and feel the bottom line is directly related, then it may be an illusion.

What is the goal of maximization of profit?

However, “Maximization of profit” as Corporate goal is criticised by scholars on given grounds: 1- It ignores timing of return. 2- It ignores risk factor.

What is shareholder wealth maximization?

The objective of shareholder’s wealth maximization is an long-term perspective, considers all future cash flows, dividends, risks associated with a decision, time value of money etc. Profit maximization can be a part of wealth maximization strategy, but should never be permitted to overshadow the latter..

What is the goal of management without profit?

I suspect your question relates to the morality of profit before people. The goal of management is to extract as much value as possible from the resources under their control.

Is profit good or bad?

Since the purpose of a business is to provide a product or service at a profit, then profit is obviously not only good, but necessary. Or, said differently, the company isn’t fulfilling it’s purpose if it operates at a loss over the long term. So, profit is good and necessary for multiple reasons.