Examples of items that may be classified in other comprehensive income are as follows:

- Unrealized holding gains or holding losses on investments that are classified as available for sale

- Foreign currency translation gains or losses

- Pension plan gains or losses

- Pension prior service costs or credits

Full Answer

What is the formula for accumulated other comprehensive income?

There is a formula to calculate comprehensive income. Comprehensive Income = Gross Profit Margin – Operating Expenses (+/-) Other Income items (+/-) Discontinued Operations (add if savings, subtract if loss)

What are elements of comprehensive income?

Elements of Comprehensive Income Statement are: i. Revenue: It is the benefit earned during the year as a result of business operations or an increase in the value of assets or a decrease in the value of liabilities. It increases the value of shareholders’ equity.

What does comprehensive income consist of?

Comprehensive income, also known as all-inclusive concept of income, is the change in equity (net assets) of an entity during a period from transactions and other events and circumstances from non-owner sources. It includes all changes in equity during a period except those resulting from investments by owners and distribution to owners.

How is accumulated other comprehensive income reported?

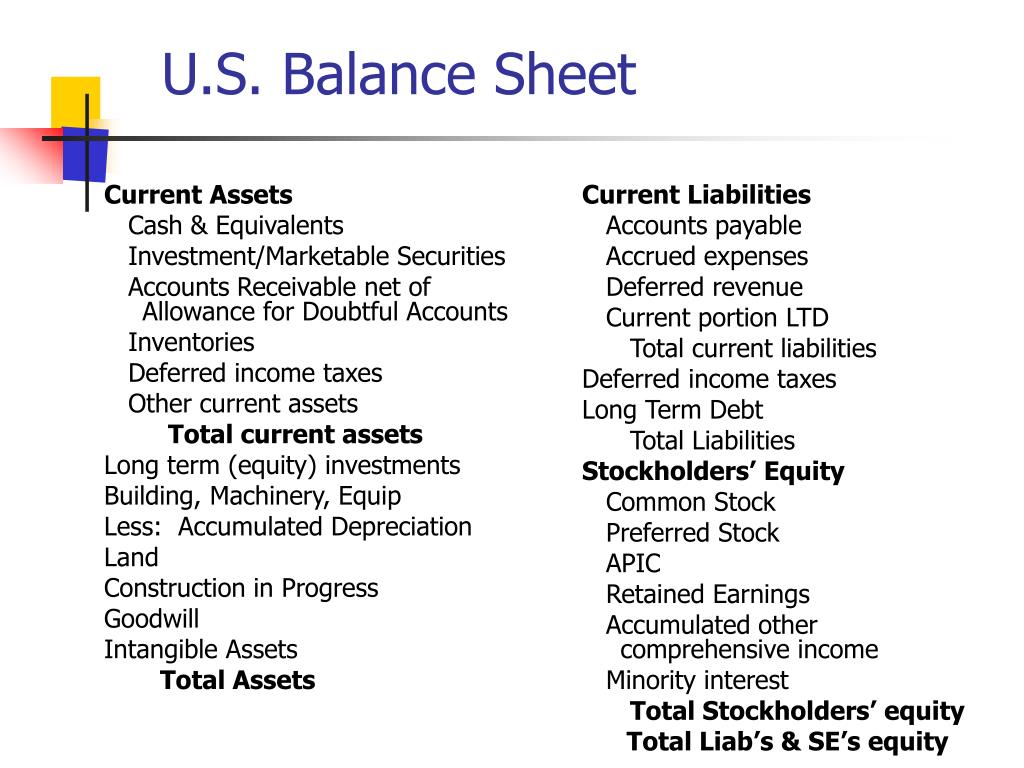

a. Accumulated other comprehensive income is reported in the equity section of the balance sheet. Total other comprehensive income is transferred to a component of equity separate from retained earnings and additional paid-in capital. Other comprehensive income (OCI) includes

What is included in other comprehensive income?

What Is Other Comprehensive Income? In business accounting, other comprehensive income (OCI) includes revenues, expenses, gains, and losses that have yet to be realized and are excluded from net income on an income statement. OCI represents the balance between net income and comprehensive income.

What is not included in other comprehensive income?

Other comprehensive income consists of revenues, expenses, gains, and losses that, according to the GAAP and IFRS standards, are excluded from net income on the income statement. Revenues, expenses, gains, and losses that are reported as other comprehensive income are amounts that have not been realized yet.

How do I calculate other comprehensive income?

That said, the statement of comprehensive income is computed by adding the net income – which is found by summing up the recognized revenues minus the recognized expenses – to other comprehensive income, which captures any unrealized balance sheet gains or losses that are excluded from the income statement.

What is included in other comprehensive income quizlet?

What are other comprehensive income items? Unrealized gains and losses on securities available for sale, unrecognized pension gains and losses, foreign currency translation adjustments, certain derivative gains and losses.

What is included in OCI under IFRS?

Other comprehensive income (OCI) is an accounting item for firms that includes revenues, expenses, gains, and losses that have yet to be realized.

What is the difference between P&L and OCI?

amortised cost information in P&L reflects the return made through collection of contractual cash flows, and OCI reflects changes in fair value attributable to changes in market prices.

Is OCI on the income statement?

No, other comprehensive income (OCI) is not part of the income statement. OCI represents all gains and losses in the current year that were not recorded to the income statement. OCI is part of total comprehensive income, which is net income/loss + other comprehensive income/loss.

Is OCI part of equity?

Other comprehensive income (“OCI”) is part of stockholders equity on the balance sheet and is not part of the income statement. OCI represents the current year activity that is used to calculated accumulated other comprehensive income (“AOCI”) at the end of the year. Either gains or losses are recorded to OCI.

Is OCI part of retained earnings?

Answer and Explanation: Retained earnings do not include OCI comprehensive income. Other comprehensive income (OCI) consists of gains or losses that affect only the balance sheet but are not reported in the income statement.

What is comprehensive income quizlet?

Comprehensive income includes all changes in equity during a period except those resulting from - owner investments and distributions to owners.

Which of the following items should be reported in other comprehensive income OCI )?

Which of the following items should be reported in other comprehensive income (OCI)? Unrealized loss on an investment in debt securities classified as an available-for-sale security. Accumulated other comprehensive income is reported in which of the following financial statements? The statement of financial position.

Is investments by owners included in comprehensive income?

In a companies' financial reporting, comprehensive Income (or comprehensive earnings) "includes all changes in equity during a period except those resulting from investments by owners and distributions to owners".

Which of the following is not included in the calculation of net income?

Trial balance. Journal. Which of the following accounts is not included in the calculation of net income? Rent revenue.

What is an example of comprehensive income?

Comprehensive income examples There are many different types of profits or losses which aren't covered in the usual net income. For example, lottery winnings are considered part of comprehensive income for tax purposes, but they wouldn't constitute regular earned income.

Which of the following is least likely to be included when calculating comprehensive income?

Which of the following is least likely to be included when calculating comprehensive income? Feedback: Comprehensive income includes all changes in equity except transactions with shareholders. Therefore, dividends paid to common shareholders are not included incomprehensive income.

Which of the following changes during a period is not a component of other comprehensive income?

Comprehensive income is defined as the change in equity of a business during a period from transactions of nonowner sources. Stockholders are owners of the corporation or entity, therefore, transactions between the entity and shareholder are not a component of comprehensive income.

Why is income statement important?

While the income statement remains a primary indicator of the company’s profitability, other comprehensive income improves the reliability and transparency of financial reporting. The other income information cannot uncover the company’s day-to-day operations, but it can provide insight on other essential items.

Is comprehensive income included in income statement?

According to accounting standards, other comprehensive income cannot be reported as part of a company’s net income and cannot be included in its income statement. Income Statement The Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or.

Is unrealized income considered comprehensive income?

Only unrealized items are recorded as other comprehensive income. Once the transaction has been realized (e.g., the company’s investments have been sold), it must be removed from the company’s balance sheet and recognized as a realized gain/loss on the income statement.

What are some examples of comprehensive income?

Examples of Other Comprehensive income are: Unrealized gain or loss on bonds. Unrealized gain or loss on investments that are available for sale. Foreign currency translation gains or loss. Pension plans gain or losses.

How is Other Comprehensive income recognized?

For the purpose of accounting for its investments a company must recognize the investment, determine its carrying amount* and depreciation and impairment loss if any. When the cost incurred for acquiring a property, plant or equipment is determined as an asset cost then the company must determine the carrying amount.

What is Total Comprehensive Income?

Total comprehensive income is the combination of profit or loss and other comprehensive income.

When do expenses appear in other comprehensive income?

Revenues, expenses, gains and losses appear in other comprehensive income when they have not yet been realized. Something has been realized when the underlying transaction has been completed, such as when an investment is sold. Thus, if your company has invested in bonds, and the value of those bonds changes, you recognize the difference as a gain or loss in other comprehensive income. Once you sell the bonds, you have then realized the gain or loss associated with the bonds, and can then shift the gain or loss out of other comprehensive income and into a line item higher in the income statement, so that it is a part of net income.

Is it acceptable to report components of other comprehensive income net of related tax effects?

It is acceptable to either report components of other comprehensive income net of related tax effects, or before related tax effects with a single aggregate income tax expense or benefit shown that relates to all of the other comprehensive income items.

Is selling bonds a part of net income?

Once you sell the bonds , you have then realized the gain or loss associated with the bonds, and can then shift the gain or loss out of other comprehensive income and into a line item higher in the income statement, so that it is a part of net income.

What is OCI in accounting?

Other comprehensive income, or OCI, consists of items that have an effect on the balance sheet amounts, but the effect is not reported on the company's income statement.

Does OCI affect retained earnings?

Since the OCI items do not affect the net income, they do not cause a change in a corporation's retained earnings. Instead, the current period's OCI items cause a change in accumulated other comprehensive income, which is a different component of stockholders' equity.

What Is Other Comprehensive Income?

Understanding Other Comprehensive Income

- Corporate income can be broken down in a multitude of ways. To compensate for this, the Financial Accounting Standards Board (FASB) requires companies to use universal measurements to help provide investors and analysts with clear, easily accessible information on a company's financial standing.1 The Statement of Financial Accounting Standards No. 220, pub…

Common Examples of Other Comprehensive Income

- Any held investment classified as available for sale, which is a non-derivative asset not intended to be held until maturity and isn't a loan or a receivable, may be recognized as comprehensive income. Other examples of OCI include: 1. The previously mentioned bond portfolio is such an asset, as long as the business does not classify the bonds as held-to-maturity. Any change in th…

What Is Other Comprehensive Income?

- Other Comprehensive Income refers to items of income and expenses that are not recognized as a part of the profit and loss account This Income appears as a line item below the income statement. In simple words it is gain or loss that has not been realized. For example, gain or loss on an investment can be realized when it is sold. Hence for investm...

How Is Other Comprehensive Income recognized?

- Indian Accounting standard 16, prescribes the accounting treatment for Property, Plant and Equipment. For the purpose of accounting for its investments a company must recognize the investment, determine its carrying amount* and depreciation and impairment loss if any. When the cost incurred for acquiring a property, plant or equipment is determined as an asset cost the…

Why Is The Disclosure of Other Comprehensive Income Important?

- A company’s performance can be viewed by its Profit and Loss statement. While the items reported in profit and loss accounts throw light on the company’s operations, looking at the unrealized profit or loss can prepare investors for the future and also help them to take decisions accordingly.

Illustrations

- Let us simplify the above-mentioned treatment for movement in asset value through these illustrations: Micro Ltd purchases a machinery for Rs.25,85,000 on 25th April 2020 . It opts for the revaluation method. On 30th June 2020 it revalues the asset at Rs.30,50,000. The difference of Rs.4,65,000 will be shown under Other Comprehensive income and on the liabilities side under E…

What Is Other Comprehensive Income?

- Other comprehensive income is those revenues, expenses, gains, and losses under both Generally Accepted Accounting Principles and International Financial Reporting Standards that are excluded from net income on the income statement. This means that they are instead listed afternet income on the income statement. Revenues, expenses, gains and losses...

Examples of Other Comprehensive Income

- Examples of items that may be classified in other comprehensive income are as follows: 1. Unrealized holding gains or holding losses on investments that are classified as available for sale 2. Foreign currency translation gains or losses 3. Pension plan gains or losses 4. Pension prior service costs or credits

Presentation of Other Comprehensive Income

- It is acceptable to either report components of other comprehensive income net of related tax effects, or before related tax effects with a single aggregate income tax expense or benefit shown that relates to all of the other comprehensive income items.