The modified basis has the following features:

- Records short-term items when cash levels change (the cash basis). This means that nearly all elements of the income statement are recorded using the cash basis, and that accounts receivable and inventory are not recorded on the balance sheet.

- Records longer-term balance sheet items with accruals (the accrual basis). ...

What are the advantages and disadvantages of cash basis accounting?

Cash accounting does a good job of tracking cashflow but does a poor job of matching revenues earned with money laid out for expenses. Simple cash accounts will not give a true picture of the business performance. In order to offer credit and loans, banks might require accounts to be prepared under GAAP.

What type of organization uses cash basis of accounting?

Cash basis accounting can be adequate and preferred by some small businesses, government agencies, non-profit organizations, community association and small service businesses that do not deal with inventory. Businesses that do not sell or buy on credit can use the cash basis of accounting for evaluating their financial performance.

When to use cash vs accrual accounting?

Key Differences

- Size of business: It matters a lot what size of business you own. ...

- Simplicity: Accrual basis of accounting has the capacity to deal with complex types of transactions. ...

- Tax advantage: If you own a micro-business, it’s better to go for the cash accounting method; because by using the cash accounting method, you would be able to get the ...

What are the different types of accounting methods?

- Profit & Loss statement

- General Ledger

- Chart of accounts

- Sales tax summary

- Invoice summary

- Payment summary

- Expense reports

What is included in cash basis?

Cash basis refers to a major accounting method that recognizes revenues and expenses at the time cash is received or paid out. This contrasts accrual accounting, which recognizes income at the time the revenue is earned and records expenses when liabilities are incurred regardless of when cash is received or paid.

What is an example of cash basis accounting?

For an example of how cash basis accounting would work with revenues, consider a small business that sells to other businesses. Its customers pay its invoices in 30 days. The business would record revenues from sales when the payment actually arrives, 30 days or so after the invoice is sent.

What accounts are not used in cash basis accounting?

The cash basis of accounting recognizes revenues when cash is received, and expenses when they are paid. This method does not recognize accounts receivable or accounts payable.

What appears on cash basis financial statement?

What is a Cash Basis Income Statement? A cash basis income statement is an income statement that only contains revenues for which cash has been received from customers, and expenses for which cash expenditures have been made.

Does cash basis have inventory?

One rule that eliminated the ability of most manufacturing entities to utilize the cash basis method of accounting was the inventory rule. This rule essentially stated that entities who maintained inventory records were required to use the accrual basis method of accounting for income tax purposes.

When should cash basis accounting be used?

Cash-basis accounting is a simple accounting method geared toward small business owners. If you run a small company, you may want to use the cash-basis method for your books. To use the cash-basis method, you record each transaction as money changes hands.

How do you record cash basis accounting?

A cash basis accountant would debit the expense and credit cash in the period when the bill is paid. An accrual basis accountant would debit a prepaid expense asset account in the current period and credit cash.

Does cash basis have fixed assets?

Cash basis accounting only deals with cash accounts. It can be used when items such as cash, income, cost of goods sold, equity, and expenses need to be recorded. It cannot be used to record accrual accounts, such as inventory, loans, or fixed assets.

Does cash basis have accounts receivable?

Under the cash basis of accounting, transactions are only recorded when there is a related change in cash. This means that there are no accounts receivable or accounts payable to record on the balance sheet, since they are not noticed until such time as they are paid by customers or paid by the company, respectively.

Does cash basis accounting record all transactions?

Cash basis accounting records revenue and expenses when actual payments are received or disbursed. It doesn't account for either when the transactions that create them occur. On the other hand, accrual accounting records revenue and expenses when those transactions occur and before any money is received or paid out.

Which transaction would be recorded in a cash basis system of accounting?

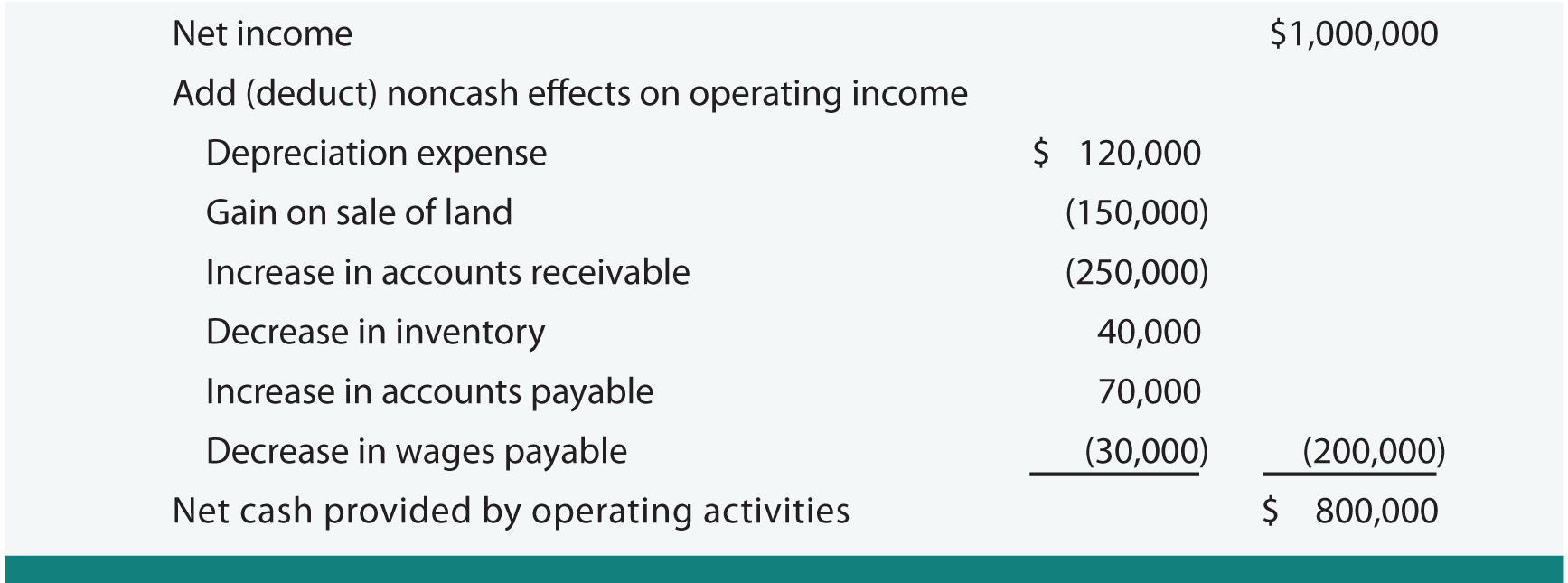

Under the cash basis of accounting, a business records only transactions involving increases or decreases of its cash. To arrive at cash flows from operations, it is necessary to convert the income statement from an accrual basis to the cash basis of accounting.

Which transaction would not be recorded under cash basis accounting quizlet?

Cash-basis accounting does NOT record: depreciation expense. Under cash-basis accounting, no journal entry is recorded when a sale is made on account. Generally Accepted Accounting Principles (GAAP) require the use of accrual accounting.

How do you record cash basis accounting?

A cash basis accountant would debit the expense and credit cash in the period when the bill is paid. An accrual basis accountant would debit a prepaid expense asset account in the current period and credit cash.

What is the main characteristic of cash basis accounting?

Cash Basis Accounting is an accounting method in which all the company's revenues are recognized when there is actual receipt of the cash, and all the expenses are recognized when they are paid. Individuals and small companies generally follow the method.

What is difference between cash basis and accrual basis?

Cash basis accounting records revenue and expenses when actual payments are received or disbursed. It doesn't account for either when the transactions that create them occur. On the other hand, accrual accounting records revenue and expenses when those transactions occur and before any money is received or paid out.

What is not included in cash basis financial statements?

The cash basis balance sheet includes three parts: assets, liabilities, and equity. The balance sheet does not track or record accounts payable, accounts receivable, or inventory with this method. So, your balance sheet does not include any unpaid invoices or expenses.

How does cash basis accounting work?

Using cash-basis accounting, the company is only able to recognize the revenue upon project completion, which is when cash is received. However, during the project, it records the project's expenses as they are being paid. If the project's time span is greater than one year, the company's income statements will appear misleading as they show the company incurring large losses one year followed by great gains the next.

What Does Cash Basis Mean?

Cash basis refers to a major accounting method that recognizes revenues and expenses at the time cash is received or paid out. This contrasts accrual accounting, which recognizes income at the time the revenue is earned and records expenses when liabilities are incurred regardless of when cash is received or paid.

Why is cash basis accounting beneficial?

Benefits of Cash Basis Accounting. Cash basis accounting is advantageous because it is simpler and less expensive than accrual accounting. For some small business owners and independent contractors who carry no inventory, it is a suitable accounting practice.

Which tax reform act prohibits cash basis accounting?

The Tax Reform Act of 1986 prohibits the cash basis accounting method from being used for C corporations, tax shelters, certain types of trusts, and partnerships that have C Corporation partners.

What is the IRS's accounting method?

The Internal Revenue Service (IRS) allows most small businesses to choose between the cash and accrual method of accounting , but the IRS requires businesses with over $25 million in average annual gross receipts from sales for the 3 preceding tax years to use the accrual method . 1 Businesses must use the same method for tax reporting as they do for their own accounting records. (For related reading, see " How Does Accrual Accounting Differ from Cash Basis Accounting? ")

What is cash basis accounting?

The cash basis of accounting is a way of recording the accounting transactions. Accounting Transactions Accounting Transactions are business activities which have a direct monetary effect on the finances of a Company. For example, Apple representing nearly $200 billion in cash & cash equivalents in its balance sheet is an accounting transaction.

What are the different types of accounting?

Some of them include financial accounting, forensic accounting, accounting information system, managerial accounting, taxation, auditing, cost accounting, etc. read more

What is a particular accounting period?

Particular Accounting Period Accounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared.

What does "gives a clear picture of the amount of cash in hand and the bank account" mean?

Gives a clear picture of the amount of cash in hand and the bank account; Gives a clear picture of the correct financial position of a business; It doesn’t reflect the money that is owed to you or money you owe to others. It records money owed to you and the money you owe to others.

Does cash basis accounting generate accurate financial statements?

This method does not generate accurate financial statements; hence the lenders refuse to lend money to business having cash basis accounting.

Does cash basis require accounting software?

It does not require complex accounting software. Hence a business can easily maintain a cash basis single-entry system in a notebook or on a simple spreadsheet. Since it tracks cash inflow and outflow, a firm knows how much actual cash it has at a given period.

Who uses cash basis accounting?

Individuals and small, service-based businesses who only handle cash prefer a cash basis accounting system. Businesses who don't sell or buy on credit can also use this system to assess their financial performance. Apart from small businesses and individuals, government agencies and non-profit organizations may also use a cash basis accounting system.

Why is cash basis accounting important?

Ease of use: Cash basis accounting offers a simple and straightforward approach to recording financial transactions. Since it only accounts for paid or received cash, it makes tracking a company's cash flow much simpler. It's also easy to learn and may be more cost-efficient, too.

Why is accrual method important?

Since an accrual method includes both accounts receivables and payables, it gives you a more accurate idea of your company's profitability —especially in the long term.

Why do businesses record cash exchanges?

Potential tax advantage: Only recording your transactions during a cash exchange lets you control the timing of your transactions. This lets you increase the speed of your expenses and slow down your revenue. Therefore, some businesses may lower their tax liability by legally increasing their expenses and decreasing their income.

What do you use to make a sale?

When they make a sale, the customer uses cash, a wire transfer, a check or with a debit or credit card.

Can you recognize revenue on cash basis?

Therefore, using cash basis accounting, you can't recognize the revenue until your company completes the project since that's when you'll receive payment.

Do small businesses use cash basis or accrual?

While most small businesses can choose between the cash basis and accrual accounting methods, the IRS does have some stipulations. For example, if a company has over $25 million in average annual gross receipts from sales for the last three tax years, they need to follow the accrual method.

What is a cash basis balance sheet?

Cash-basis accounting balance sheet example. In accounting, you use financial statements to compile and review financial information. One important statement is the balance sheet. The balance sheet is a record of your business’s progress, giving you a snapshot of your financial condition. When creating a balance sheet with cash-basis accounting, ...

Why use cash-basis accounting?

Many small businesses benefit from using cash-basis accounting. Here are some advantages of the cash-basis method.

How does accrual accounting differ from cash basis accounting?

Accrual accounting differs from cash-basis because you record income and expenses at different times. With accrual accounting, you record income when you incur it, not when you receive it. For example, you record income on the day you send an invoice to a customer. You might not receive the payment for 30 days, ...

What is accrual accounting?

With accrual accounting, a sale made on December 31 is income for that year, even if it’s paid the next year. That increases your taxable income for the year, making your tax liability higher. With cash-basis accounting, you report income when you receive funds.

Why is it important to know how much cash you have?

As a small business owner, it’s crucial to know how much cash you have on hand. Since you record money as it enters or leaves your business, you get an accurate picture of your cash levels. This helps you track cash flow, avoid overspending, and plan for large purchases.

When do you record expenses?

You record expenses when you incur them when using the accrual method. For example, you record an expense the day you receive an invoice from a vendor. Though it might be several weeks before the check is cashed, the expense is recorded.

Where are liabilities and equity recorded?

Liabilities and equity are recorded on the right side of the statement. The final balance of the assets should equal the total of the liabilities and equity. If you use the cash-basis method, you will not record accounts payable, accounts receivable, or inventory on the balance sheet.

What is cash basis accounting?

The cash basis of accounting recognizes revenues when cash is received, and expenses when they are paid. This method does not recognize accounts receivable or accounts payable. The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your accounts.

What is cash in banking?

cash definition. A current asset account which includes currency, coins, checking accounts, and undeposited checks received from customers. The amounts must be unrestricted. (Restricted cash should be recorded in a different account.)

What Are the Objectives of Financial Accounting?

At the start and end of every tax year, businesses have to account for inventory .In general, businesses can only deduct expenses that are recognized within the tax year. The choice of revenue/expense recognition method can determine which year a business can deduct its expenses. Likewise, a company that receives payment from a client in 2018 for services rendered in 2017 will only be allowed to include the revenue in its financial statements for 2018. The disadvantage of the cash basis accounting is that it can paint an inaccurate picture of the business’s financial health and growth. This is because the related expenses may be recognized in a different period than the revenues.The cash basis is relatively easy to use, and so is preferred when the accounting staff is small and less well trained. Modified cash-basis accounting is a hybrid between accrual and cash-basis accounting. It has more accounts than the cash-basis method because it uses the accounts used in accrual.

What is accrual basis in LLC?

Under the accrual basis, revenue is recognized when earned and expenses when incurred. Under the cash basis, revenue is recognized when cash is received and expenses when bills are paid. The accrual basis involves more complex accounting, but results in more accurate financial statements.

Why is accrual basis accounting more accurate?

Accrual basis accounting achieves a more accurate measurement of a business’s periodic net income because it attempts to match revenues and expenses related to the same accounting period.

Why is modified cash basis accounting preferred?

The cash basis is relatively easy to use, and so is preferred when the accounting staff is small and less well trained. Modified cash-basis accounting is a hybrid between accrual and cash-basis accounting. It has more accounts than the cash-basis method because it uses the accounts used in accrual.

When is accrual accounting used?

Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned, regardless of when the money is actually received or paid. For example, you would record revenue when a project is complete, rather than when you get paid.

What Is Cash Basis Accounting?

Businesses using cash basis accounting record revenue when it’s actually received—say, when a check is deposited, clears and cash lands in the account—and expenses when a payment is issued.

Why is cash basis accounting incomplete?

However, because cash basis accounting doesn’t show incoming payments or commitments coming due, it can provide an incomplete picture of a company’s health. For instance, it wouldn’t show upcoming lease payments or revenue expected from orders that are booked but haven’t shipped.

Why is accrual accounting important?

It allows for recording revenue and expenses in the periods in which they’re incurred, even if no money changes hands at that point. It also allows for the tracking of inventory, as well as accounts receivable and payable.

What is accounting software?

Accounting software can help any business accurately employ either a cash-based or accrual-based accounting system. The software can streamline accounting processes and help ensure accuracy and compliance with regulations. To learn more about NetSuite accounting solutions, schedule a free consultation today.

Which accounting method is used by public companies?

Public companies in the U.S. must follow generally accepted accounting principles (GAAP), which require the accrual accounting method.

When are accrual expenses recorded?

In accrual accounting, revenue and expenses are recorded when they’re earned or incurred, even if no money changes hands at that point. With double-entry bookkeeping, required by U.S. GAAP, all transactions are recorded twice, both as debits and credits. Debit entries increase expenses but reduce revenue, while credit entries do the opposite, decreasing expenses and increasing revenue. The total of the debit and credit entries offset each other.

Why do self employed use cash basis accounting?

The reason? It’s generally the simplest accounting method. Cash basis accounting also provides a quick look at the amount of money the business actually has on hand. That’s a crucial metric for any company.

What is the cash basis of a balance sheet?

What are the Contents of a Cash Basis Balance Sheet? Under the cash basis of accounting, transactions are only recorded when there is a related change in cash. This means that there are no accounts receivable or accounts payable to record on the balance sheet, since they are not noticed until such time as they are paid by customers or paid by ...

What is modified cash basis accounting?

Modified cash basis accounting. The same as the cash basis, except that long-term assets and long-term liabilities are included in the balance sheet. Accrual basis accounting. Records revenues and expenses as they are earned or incurred, irrespective of changes in cash.

What is prepaid expense?

Prepaid expenses. Not used for the cash basis or modified cash basis, since these items are charged to expense. Used under the accrual basis. Accounts receivable. Not used for the cash basis or modified cash basis, since no transaction is considered to have occurred until the customer pays. Used under the accrual basis.

What is fixed asset?

Fixed assets. Not used for the cash basis, but is used under the modified cash basis. Also used under the accrual basis. Accounts payable. Not used under the cash basis or modified cash basis, since no transaction is considered to have occurred until the company pays its suppliers. Used under the accrual basis.

Can loans be used on cash basis?

Loans. Not used for the cash basis, though some companies prefer to include it. Used under the modified cash basis and accrual basis.

Is inventory used for cash basis?

Used under the accrual basis. Fixed assets. Not used for the cash basis, but is used under the modified cash basis.

Is cash basis included in the balance sheet?

The exact number of inclusions and exclusions used for the balance sheet under the cash basis is really up to the user ; the cash basis is not supported by any accounting standards, so the exact structure of the cash basis balance sheet is decided by common usage. Thus, you will see a variety of alternative formats for the cash basis that may include or exclude additional line items, such as inventory and fixed assets.

What is the Modified Cash Basis of Accounting?

The modified cash basis of accounting uses elements of both the cash basis and accrual basis of accounting. Under the cash basis, you recognize a transaction when there is either incoming cash or outgoing cash; thus, the receipt of cash from a customer triggers the recordation of revenue, while the payment of a supplier triggers the recordation of an asset or expense. Under the accrual basis, you record revenue when it is earned and expenses when they are incurred, irrespective of any changes in cash.

What is accrual basis?

Records longer-term balance sheet items with accruals (the accrual basis). This means that fixed assets and long-term debt are recorded on the balance sheet, while the related fixed asset depreciation and amortization are recorded on the income statement.

What is modified cash basis?

The modified cash basis provides financial information that is more relevant than can be found with cash basis record keeping, and generally does so at less cost than is needed to maintain a set of full-accrual accounting records.

Is modified cash basis allowed?

The modified cash basis is not allowed under Generally Accepted Accounting Principles ( GAAP) or International Financial Reporting Standards ( IFRS ), which means that a business using this basis will need to alter the recordation of those elements of its transactions that were recorded under the cash basis, so that they are now accrual basis transactions. Otherwise, an outside auditor will not sign off on its financial statements. However, these changes are fewer than what would be required if a business were to make a full transition from the cash basis to the accrual basis of accounting.

Is modified cash basis cost effective?

The modified cash basis uses double entry accounting, so the resulting transactions can be used to construct a complete set of financial statements. It is not possible to have a modified cash basis of accounting using only the single entry system.

Can an outside auditor sign off on financial statements?

Otherwise, an outside auditor will not sign off on its financial statements. However, these changes are fewer than what would be required if a business were to make a full transition from the cash basis to the accrual basis of accounting.

Is there a standard for using modified cash basis?

There are no exact specifications for what is allowed under the modified cash basis, since it has developed through common usage. There is no accounting standard that has imposed any rules on its usage. If the modified cash basis is used, transactions should be handled in the same manner on a consistent basis, so the resulting financial statements are comparable over time.

Cash Basis Accounting Example

Features

Where Is The Cash Basis of Accounting used?

Advantages

Disadvantages

Cash Basis Accounting vs. Accrual Basis Accounting

Conclusion

- The cash basis of accounting is a way of recording the accounting transactionsAccounting TransactionsAccounting Transactions are business activities which have a direct monetary effect on the finances of a Company. For example, Apple representing nearly $200 billion in cash & cash equivalents in its balance sheet is an accounting transaction. read ...

Recommended Articles