Key Takeaways

- An indirect tax is a tax that, while legally imposed on one party, is actually ultimately borne by another party.

- Examples of indirect taxes include sales tax, excise tax, value-added tax, and tariffs.

- Governments have tax codes that dictate who and what is subject to the indirect tax as well as how one may pay the indirect tax.

What are the differences between direct tax and indirect tax?

- Direct Tax refers to the tax which is paid directly to the government by the person on whom it is imposed. ...

- The Central Board of Direct Taxes (CBDT) functioning under the Department of Revenue is the authority that administers Direct Taxes in India. ...

- While Direct tax is levied on the assessee, which may include Individual, HUF, Company, AOP, BOI, etc. ...

What are some examples of indirect tax?

What Are the Types of Indirect Taxes?

- Service Tax. A consumer pays service tax to purchase a service from any entity. ...

- Value Added Tax. State governments collect this tax on a good or service at each point of purchase where a value has been added.

- Custom Duty. The Union government collects this indirect tax on an import of a product in India. ...

- Excise Duty. ...

- Sales Tax. ...

- Entertainment Tax. ...

Which tax is an indirect tax?

“Taxpayers may settle debts (regardless of whether they are registered as overdue federal tax liabilities, including suspended liabilities) that are pending in administrative adjudication or judicial litigation as of 3 May 2022,” EY said.

What are the features of indirect tax?

What Are the Features of Indirect Tax?

- Initially, its nature was regressive. ...

- The liability of tax payment can be transferable. ...

- The taxpayer is always the end consumer, and the taxable product is a finished good and service.

- Indirect tax encourages an individual to save and invest and boost growth.

- It is impossible to escape this tax as it comes under the market price of a product.

What do you mean by indirect tax?

Indirect tax is the tax levied on the consumption of goods and services. It is not directly levied on the income of a person. Instead, he/she has to pay the tax along with the price of goods or services bought by the seller.

What is direct and indirect tax in economics?

Direct taxes are non-transferable taxes paid by the tax payer to the government and indirect taxes are transferable taxes where the liability to pay can be shifted to others. Income Tax is a direct tax while Value Added Tax (VAT) is an indirect tax.

What is indirect tax and its types?

Indirect tax is a tax that can be passed on to another individual or entity. Indirect tax is generally imposed on suppliers or manufacturers who pass it on to the final consumer. Excise duty, customs duty, and Value-Added Tax (VAT) are examples of Indirect taxes.

What is direct tax with example?

A direct tax is a tax that a person or organization pays directly to the entity that imposed it. Examples include income tax, real property tax, personal property tax, and taxes on assets, all of which are paid by an individual taxpayer directly to the government.

What is the difference between direct and indirect?

Direct Speech is from the speaker's standpoint, whereas indirect speech is from the listener's standpoint. Direct speech is when we use the exact rendition of the words of the speaker. Conversely, in an indirect speech own words are used to report the speaker's statement.

Why is indirect tax important?

The importance of taxes for the government when it comes to indirect taxation is that they are an automatic function that accompany the buying and selling of goods and services across the country. They are therefore easy to collect and convenient for both taxpayers and the tax collection authorities.

What are four types of indirect taxes?

Types of Indirect TaxesSales tax. Whenever people go to the malls or department stores to shop, they are already about to pay indirect taxes. ... Excise tax. Excise tax is also very common. ... Customs tax. ... Gas tax. ... The poor can do their share. ... They aren't very obvious. ... Collection is easy. ... Discourages consumption of harmful products.

What are the characteristics of indirect tax?

Features of Indirect TaxesPayment and Tax Load - The service provider makes payment of indirect taxes and this is transferred to a final consumer.Liability of Tax – Here the seller or service provider makes payment on indirect taxes which are transferred to final consumer.More items...

What are the types of direct taxes?

Direct taxes are one type of taxes an individual pays that are paid straight or directly to the government, such as income tax, poll tax, land tax, and personal property tax....Types of Direct TaxesIncome tax. It is based on one's income. ... Transfer taxes. ... Entitlement tax. ... Property tax. ... Capital gains tax.

Which are indirect taxes in India?

This tax is often levied on goods and services which results in their higher prices. A few examples of indirect taxes in India include service tax, central excise and customs duty, and value added tax (VAT).

What are the types of tax?

In a broader term, there are two types of taxes namely, direct taxes and indirect taxes. The implementation of both taxes differs. You pay some of them directly, like the cringed income tax, corporate tax, wealth tax, etc., while you pay some of the taxes indirectly, like sales tax, service tax, value added tax, etc.

What is indirect tax?

Indirect taxes. An indirect tax is charged on producers of goods and services and is paid by the consumer indirectly. Examples of indirect taxes include VAT, excise duties (cigarette, alcohol tax) and import levies.

Why are indirect taxes used?

Indirect taxes can be used to overcome market failure and make people pay the full social cost. For example, excise duties like cigarette and tobacco tax can internalise the external cost of smoking and drinking alcohol.

What is VAT rate?

VAT rates may be set at 20%. This percentage tax is known as an ad Valorem tax – it means the producer is charged a percentage of the price. For example, If the good is priced at £100, the firm has to pay £20 to the government, and this will be partly absorbed by the consumer through higher prices.

What is the effect of indirect taxes on the price of a good?

The burden of indirect taxes. If the government imposes an indirect tax on a good, the effect on the final price depends on the elasticity of demand. If demand is price inelastic, then the firm will be able to pass on the majority of the tax to the consumer (consumer burden). If the demand is price elastic, then the producer will absorb most ...

What is import duty?

Import duties as indirect tax. If the government imposed import duties on goods such as whiskey imports. The supermarket importing the whisky is responsible for paying the import duty on arrival in the country. This import levy will influence the price that the supermarket charges to the consumer.

Is it easier for firms to pay indirect taxes than consumers?

It is easier for firms to pay indirect taxes than consumers

Taxes Explained in Less Than 5 Minutes

Logan Allec is a licensed Certified Public Accountant (CPA) and a personal finance expert. He has more than a decade of experience consulting and writing about taxes, tax planning, credit cards, budgeting, and more. Logan also has a master's in taxation from the University of Southern California (USC).

Definition and Example of Indirect Tax

An indirect tax is a tax whose payment can be shifted to another party from the party legally responsible for remitting the tax to the government.

How Indirect Taxes Work

In general, the jurisdiction imposing an indirect tax has a tax code governing the collection and remittance of the tax.

Do I Need To Pay Indirect Taxes?

Whether you need to pay indirect taxes depends on whether the jurisdiction where you live imposes indirect taxes on the activities you pursue, the goods and services you purchase, or the property you own.

How Much Are Indirect Taxes?

The amount of an indirect tax depends on the kind of tax and the jurisdiction imposing it.

Types of Indirect Taxes

There are a variety of indirect taxes that can be imposed. In the chart below, we describe some of the common types of indirect taxes. 5 6 7 8

Indirect Tax vs. Direct Tax

While an indirect tax is ultimately paid and remitted by different taxpayers, a direct tax is remitted to the government by the same taxpayer who is responsible for paying it to the government. A direct tax cannot be shifted to others.

What is indirect tax?

What are Indirect Taxes? Indirect taxes are basically taxes that can be passed on to another entity or individual. They are usually imposed on a manufacturer or supplier who then passes on the tax to the consumer. The most common example of an indirect tax is the excise tax on cigarettes and alcohol.

How are indirect taxes different from direct taxes?

Indirect vs. Direct Taxes. Indirect taxes and direct taxes differ in many ways, but the most common is how they are paid. From the name itself, direct tax is paid directly to the government while the indirect tax is paid indirectly. It means that though it is imposed on a particular company or supplier that can pass the tax on to consumers, ...

What is ad valorem tax?

Ad Valorem Tax The term “ad valorem” is Latin for “according to value,” which means that it is flexible and depends on the assessed value of an asset, product or service. are also an example of an indirect tax.

What does direct tax mean?

It means that though it is imposed on a particular company or supplier that can pass the tax on to consumers, ultimately transferring the burden to the latter. Direct taxes, on the one hand, are taken from an individual’s earnings.

What is the IRS website?

How to Use the IRS.gov Website IRS.gov is the official website of the Internal Revenue Service (IRS), the United States’ tax collection agency. The website is used by businesses and

Why don't people feel taxed?

People don’t feel they are being taxed simply because the tax comes in small values. Plus, add the fact that they are not indicated in the price tag, but can only be seen on the purchase receipt. Source Documents The paper trail of a company's financial transactions are referred to in accounting as source documents.

When are indirect taxes paid?

Unlike direct taxes where documents need to be accomplished and filing is required, indirect taxes are paid the moment a consumer buys a product. The tax is collected by the supplier and paid to the government.

What are some examples of direct tax?

These are largely taxes on income or wealth. Income tax, corporation tax, property tax, inheritance tax and gift tax are examples of direct tax. Also See: Indirect Tax, Corporation Tax, Securities Tran.

What is non tax revenue?

Non-Tax Revenue is the recurring income earned by the government from sources other than taxes. Description: The most important receipts under this head are interest receipts (received on loans given by the government to states, railways and others) and dividends and profits received from public sector companies.

What is Union excise duty?

Union excise duty is a type of indirect tax on goods manufactured in India. Description: Union excise duties are levied in accordance with the rates mentioned in Schedule I and II of the Central Excise Tariff Act, 1985. The taxable event here is the ‘Manufacture’.

What is service tax?

Service Tax. Service tax is a tax levied by the government on service providers on certain service transactions, but is actually borne by the customers. It is categorized under Indirect Tax and came into existence under the Finance Act, 1994.

What is IIP index?

IIP is an index which shows the growth rates in different industry groups of the economy in a stipulated period of time.

What is indirect tax?

Indirect tax, also known as consumption tax, is the type of tax which are not directly borne by the person, whereas the incidence of such taxes is passed on to the end consumer of goods or services by adding such taxes in the value of those goods or services, like Excise duty, Service tax, VAT, etc. In simple words, it is a type of tax that can be ...

Why are indirect taxes important?

There are no deadlines, and no documentation is required. It also has one more significant advantage that indirect taxes prevent tax evasion

What is excise duty?

Excise Duty – Excise duty is a tax on manufacturing; manufacturer have to pay it, but often pass on to the customers. It applies to those goods manufactured within the country. This tax is liable as soon as goods are manufactured. VAT (Value Added Tax) – The VAT.

How much does the government tax on spas?

Consider that the government of the USA taxes 10% of any indoor spa services. So if an individual goes to take this service and is charged $100 for each sitting, then they will have to pay $10 as excise for each sitting they take (100 X 10%). If they charge $300 for each sitting, then the tax that would have to be paid is $30

How do consumers pay taxes?

The consumers pay for the taxes indirectly by paying more for the product. The US charges Indirect taxes at a subnational level. State also has the authority to impose its taxes. Apart from state, local jurisdictions also have the authority to impose sales taxes.

What is entertainment tax?

Entertainment tax – This type of tax applies to every transaction that is related to entertainment. For example – movies, sports, stage shows, exhibitions

What is service tax?

Service Tax – This tax is collected from the individual or entities providing services like consultancy, legal, and other such services. This tax is payable as soon as the service is offered.

What is indirect tax?

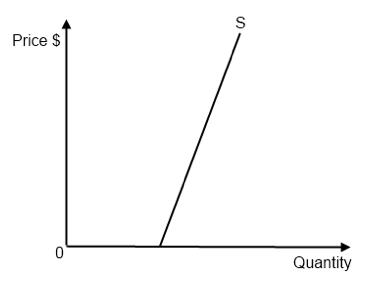

Indirect taxes are a form of government intervention in markets often with the aim of addressing market failure. Producers may be able and choose to pass on some or all an indirect tax to their customers by raising prices.

Is indirect tax regressive?

When measured relative to household incomes, indirect taxes (around 45% of which are VAT) can be judged to be regressive: that is, those with lower incomes pay more relative to their income. However, when measured relative to household expenditure, indirect taxes are more evenly distributed across individuals.

What is indirect tax?

An indirect tax is a tax applied on the manufacture or sale of goods and services. There are two types of indirect taxes – ad valorem tax and specific tax. A specific tax is imposed on each unit, i.e. $0.50 on a pack of cigarettes, while an ad valorem tax (or percentage tax) is a percentage of the price like a sales tax of 10%.

Why are indirect taxes used?

Indirect taxes can be used to make the polluter pay and internalize the external costs of production and consumption.

Why are indirect taxes less easy to avoid?

Indirect taxes are less easy to avoid. This ensures that the entire population pays some form of tax. In the case of direct taxes (like income tax), the poor are not taxed due to their low income.

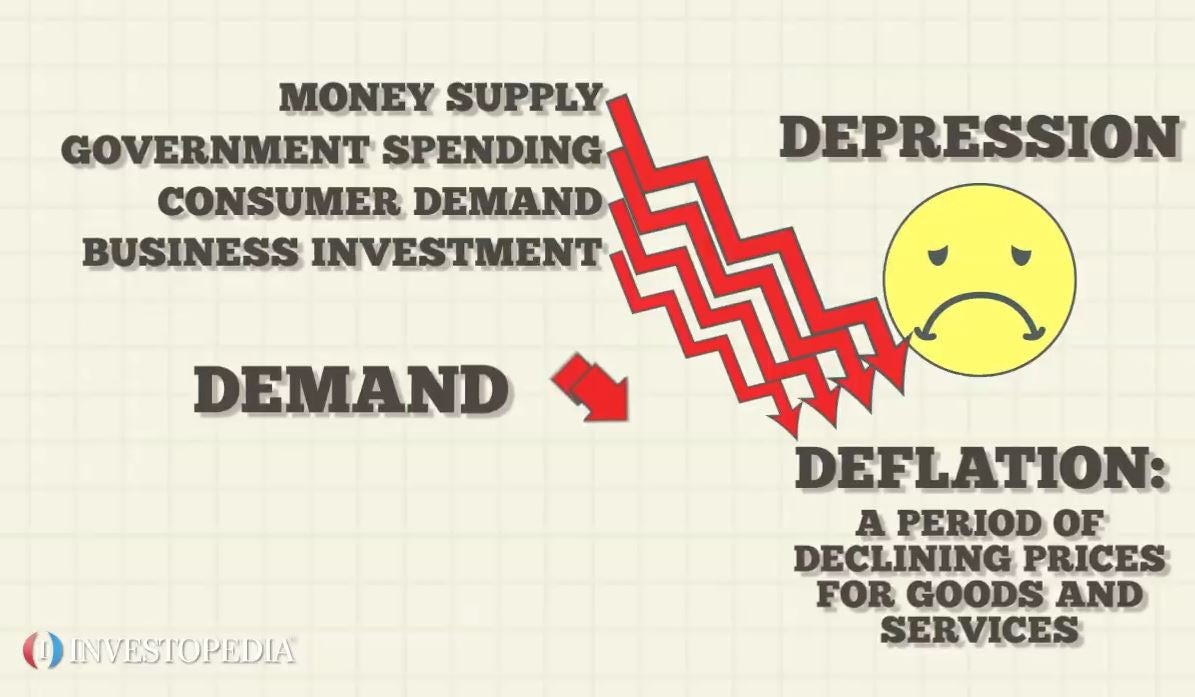

Can higher indirect taxes cause inflation?

Higher indirect taxes can cause cost-push inflation which can lead to a rise in inflation expectations.

Example of VAT as An Indirect Tax

The Burden of Indirect Taxes

- If the government imposes an indirect tax on a good, the effect on the final price depends on the elasticity of demand. If demand is price inelastic, then the firm will be able to pass on the majority of the tax to the consumer (consumer burden). If the demand is price elastic, then the producer will absorb most of the tax in reduced profit margin (known as producer burden)

Comparison with Direct Taxes

- A direct tax is paid for by the individual the government is aiming to tax. For example, with income tax, workers pay the tax directly to the government. Direct taxes can have a higher political cost because the impact is more pressing to the individual.

Advantages of Indirect Taxes

- It is easier for firms to pay indirect taxes than consumers

- In the US, some sales taxes are direct. This means when a good is bought. The shop adds the indirect tax onto the good. This means consumers see incorrect prices and the final price can be an awkwa...

- Indirect taxes can be used to overcome market failure and make people pay the full social co…

- It is easier for firms to pay indirect taxes than consumers

- In the US, some sales taxes are direct. This means when a good is bought. The shop adds the indirect tax onto the good. This means consumers see incorrect prices and the final price can be an awkwa...

- Indirect taxes can be used to overcome market failure and make people pay the full social cost. For example, excise duties like cigarette and tobacco tax can internalise the external cost of smokin...

Potential Disadvantages of Indirect Taxes

- Regressive nature of indirect taxes. Indirect taxes tend to take a higher percentage of income from those on low income. For example, a smoker who pays £1,000 a year in smoking duties. For a smoker...

- Can encourage tax evasion. Cigarette taxes can encourage a black market in bootleg cigarettes.

Types of Indirect Taxes

Example of Indirect Taxes

- Let us use the example of VAT to illustrate how an indirect tax is imposed. Say, for example, John goes to the outlet store to buy a refrigerator that’s priced at $500. When he asks the sales representative, he or she will declare the sale price, which is $500, and that is the right answer. The refrigerator’s real value is actually less than that, but because a VAT has been added (usuall…

Advantages

- Taxes may sound like an added burden for consumers, but indirect taxes are not always just a negative thing. Here are some of their advantages:

Indirect vs. Direct Taxes

- Indirect taxes and direct taxes differ in many ways, but the most common is how they are paid. 1. From the name itself, direct tax is paid directly to the government while the indirect tax is paid indirectly. It means that though it is imposed on a particular company or supplier that can pass the tax on to consumers, ultimately transferring the bur...

Additional Resources

- Thank you for reading CFI’s guide to Indirect Taxes. To keep learning and advancing your career, the additional CFI resources below will be useful: 1. Accounting for Income Taxes 2. How to Use the IRS.gov Website 3. Regressive Tax 4. Sin Tax