How to calculate IRR calculator?

Using a financial calculator, enter the following:

- Press the CF (Cash Flow) button to start the Cash Flow register.

- Enter the initial investment (negative number).

- Hit enter.

- Hit the down arrow to move to CF1 or your first year’s cash flow.

- Enter the amount for year 1.

- Hit the down arrow twice to enter year 2’s cash flow.

- Repeat the process until you’ve entered each year of projected cash flow.

How do you calculate IRR manually?

Where:

- FV is future value

- r is the interest rate expressed as a decimal (0.10, not 10 percent)

- n is the number of years

How to determine the IRR?

The internal rate of return (IRR) is the annual rate of growth that an investment is expected to generate. IRR is calculated using the same concept as net present value (NPV), except it sets the ...

How to calculate IRR in Excel?

Steps Download Article

- Launch Microsoft Excel.

- Create a new workbook and save it with a descriptive name.

- Determine the projects or investments you will be analyzing and the future period to use. ...

- Prepare your spreadsheet by creating the column labels. ...

How do you calculate IRR manually?

For each amount (either coming in, or going out) work out its Present Value, then:Add the Present Values you receive.Subtract the Present Values you pay.

What is the formula of IRR with example?

IRR is the rate of interest that makes the sum of all cash flows zero, and is useful to compare one investment to another. In the above example, if we replace 8% with 13.92%, NPV will become zero, and that's your IRR. Therefore, IRR is defined as the discount rate at which the NPV of a project becomes zero.

Why IRR is calculated?

The internal rate of return (IRR) is a core component of capital budgeting and corporate finance. Businesses use it to determine which discount rate makes the present value of future after-tax cash flows equal to the initial cost of the capital investment.

What is IRR simple explanation?

The simple definition for internal rate of return is simply the rate of return at which the net present value of a project is equal to zero. Another way of thinking about it is you want the net present value to be equal to the cost of your investment, or better.

How do you calculate IRR quickly?

So the rule of thumb is that, for “double your money” scenarios, you take 100%, divide by the # of years, and then estimate the IRR as about 75-80% of that value. For example, if you double your money in 3 years, 100% / 3 = 33%. 75% of 33% is about 25%, which is the approximate IRR in this case.

How is IRR calculated in Excel?

Excel's IRR function. Excel's IRR function calculates the internal rate of return for a series of cash flows, assuming equal-size payment periods. Using the example data shown above, the IRR formula would be =IRR(D2:D14,. 1)*12, which yields an internal rate of return of 12.22%.

Is IRR same as ROI?

ROI is the percent difference between the current value of an investment and the original value. IRR is the rate of return that equates the present value of an investment's expected gains with the present value of its costs. It's the discount rate for which the net present value of an investment is zero.

What is a good IRR rate?

This study showed an overall IRR of approximately 22% across multiple funds and investments. This indicates that a projected IRR of an angel investment that is at or above 22% would be considered a good IRR.

What is IRR and NPV?

What Are NPV and IRR? Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. By contrast, the internal rate of return (IRR) is a calculation used to estimate the profitability of potential investments.

What does a 20% IRR mean?

What Does IRR Tell You? Typically speaking, a higher IRR means a higher return on investment. In the world of commercial real estate, for example, an IRR of 20% would be considered good, but it's important to remember that it's always related to the cost of capital.

Is higher IRR better?

Generally, the higher the IRR, the better. However, a company may prefer a project with a lower IRR, as long as it still exceeds the cost of capital, because it has other intangible benefits, such as contributing to a bigger strategic plan or impeding competition.

What happens if IRR is greater than or equal to cost of capital?

If the IRR is greater than or equal to the cost of capital, the company would accept the project as a good investment. (That is, of course, assuming this is the sole basis for the decision. In reality, there are many other quantitative and qualitative factors that are considered in an investment decision.)

What is the hurdle rate?

Hurdle Rate Definition A hurdle rate, which is also known as minimum acceptable rate of return (MARR), is the minimum required rate of return or target rate that investors are expecting to receive on an investment.

Does internal rate of return give you return on investment?

Unlike net present value, the internal rate of return doesn’t give you the return on the initial investment in terms of real dollars. For example, knowing an IRR of 30% alone doesn’t tell you if it’s 30% of $10,000 or 30% of $1,000,000.

What is the IRR rate?

Internal rate of return (IRR) is the discount rate that sets the net present value of all future cash flow from a project to zero. It is commonly used to compare and select the best project, wherein, a project with an IRR over an above the minimum acceptable return (hurdle rate) is selected.

Why use Internal Rate of Return in conjunction with NPV?

Even though the Internal Rate of Return is considered a standalone metric with great importance, it should always be used in conjunction with NPV for getting a clearer picture of a project’s potential in earning the organization a better profit.

Why is internal rate of return important?

Internal Rate of Return is much more useful when it is used to carry out a comparative analysis rather than in isolation as one single value. The higher a project’s Internal Rate of the Return value, the more desirable it is to undertake that project as the best available investment option.

Can IRR be calculated analytically?

Due to the character of the formula, however, IRR can’t be calculated analytically, and should instead be calculated either through trial-and-error or by the use of some software system programmed to calculate the IRR. Also, have a look at the differences between NPV and IRR. Differences Between NPV And IRR The Net Present Value (NPV) ...

Is NPV a drawback of IRR?

Disadvantages. The need for the use of NPV in conjunction is considered to be a big drawback of IRR. Although considered an important metric, it can’t be useful when used alone. The problem arises in situations where the initial investment gives a small IRR value but a greater NPV value.

Can internal rate of return be compared to prevailing rates of return?

It can even be compared to the prevailing rates of return within the securities market. If a firm cannot notice any investment options with Internal Rate of Return values more than the returns which will be generated within the monetary markets, it may merely opt to invest its retained earnings.

Is $60 yearly or yearly?

By default, all the payments are taken as yearly, either at the start or the end of the year. It can even be compared to the prevailing rates of return within the securities market.

What is the IRR?

The IRR is the discount rate at which the net present value (NPV) of future cash flows from an investment is equal to zero. Functionally, the IRR is used by investors and businesses to find out if an investment is a good use of their money. An economist might say that it helps identify investment opportunity costs. A financial statistician would say that it links the present value of money and the future value of money for a given investment.

What is IRR used for?

Functionally, the IRR is used by investors and businesses to find out if an investment is a good use of their money. An economist might say that it helps identify investment opportunity costs. A financial statistician would say that it links the present value of money and the future value of money for a given investment.

Does IRR take capital?

IRR models do not take the cost of capital into consideration. They also assume that all cash inflows earned during the project life are reinvested at the same rate as IRR. These two issues are accounted for in the modified internal rate of return (MIRR) . Take the Next Step to Invest. Advertiser Disclosure.

What is IRR?

IRR is the discount rate in which the net present value of all future cash flows from an investment or project is equal to zero. In other words, it is a means of measuring how profitable an investment or project will be.

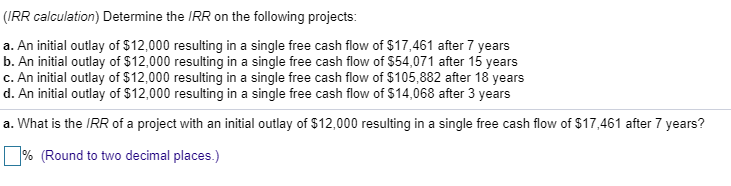

How to calculate IRR

In order to calculate the IRR by hand, you'll need to estimate the rate of return that will set the net present value to zero. As you perform this calculation, you'll need to adjust this estimation until you get as close to zero as you can. Here are the steps to take in calculating IRR by hand:

Why is IRR important?

In addition to measuring whether or not you've made a worthy investment or project, calculating IRR can help you determine whether or not you should focus your attention on a different venture. For example, if you've made an investment that isn't worthwhile, you might consider other investment opportunities that could achieve better results.

IRR vs. ROI

Return on investment, or ROI, is the measurement of financial benefit that you gain from an investment. In contrast, IRR allows businesses to determine the discount rate at which an investment would bring about a worthy return. While both can help you determine whether or not your investment is worthwhile, IRR and ROI have many differences.

IRR vs. modified internal rate of return

Modified internal rate of return (MIRR) is a modification of the IRR that is used to solve any issues when it comes to an IRR calculation. Unlike IRR, MIRR calculates an investment's return based on the assumption that cash inflows should be reinvested at the rate of the cost of capital. This tends to result in MIRR being lower than IRR.

What is the IRR decision rule?

The general IRR decision rule is, if IRR of a project is greater than the company's minimum acceptable rate of return then the project should be taken. But if the IRR falls below the minimum acceptable rate of return then the project should be dropped. When comparing different projects, IRR can help us determine the project's likelihood ...

What is the formula for IRR?

So, the formula for calculating IRR is same as NPV. Where NPV value is equal to zero.

Why should IRR not be used?

IRR should not be used to decide the mutually exclusive projects but to decide if a single project is worth pursuing. Other limitation of IRR is that all cash flows are assumed to be re-invested at same rate but in real world this may change over long term. IRR shouldn't be used to compare projects of different durations.

Is higher IRR good?

Assuming all project require same up-front investment then the one with higher IRR is considered as desirable. IRR plays good role in stock buyback programs inside big corporations. It shows if the investment in company's own stock is better than any other outside investment or use of the capital.

How to interpret the Internal Rate of Return

Intuitively, there are 2 interpretations of the Internal Rate of Return.

How to use the IRR? (IRR Rules for Acceptance of Projects)

Notice the graph above… As long as the firm’s / project’s cost of capital (discount rate (“r”)) is lower than the Internal Rate of Return, it’s earning a positive NPV.

How to Calculate IRR?

The IRR calculation is typically done with some algebraic manipulations by hand, or by using something like Excel® or Google Sheets.

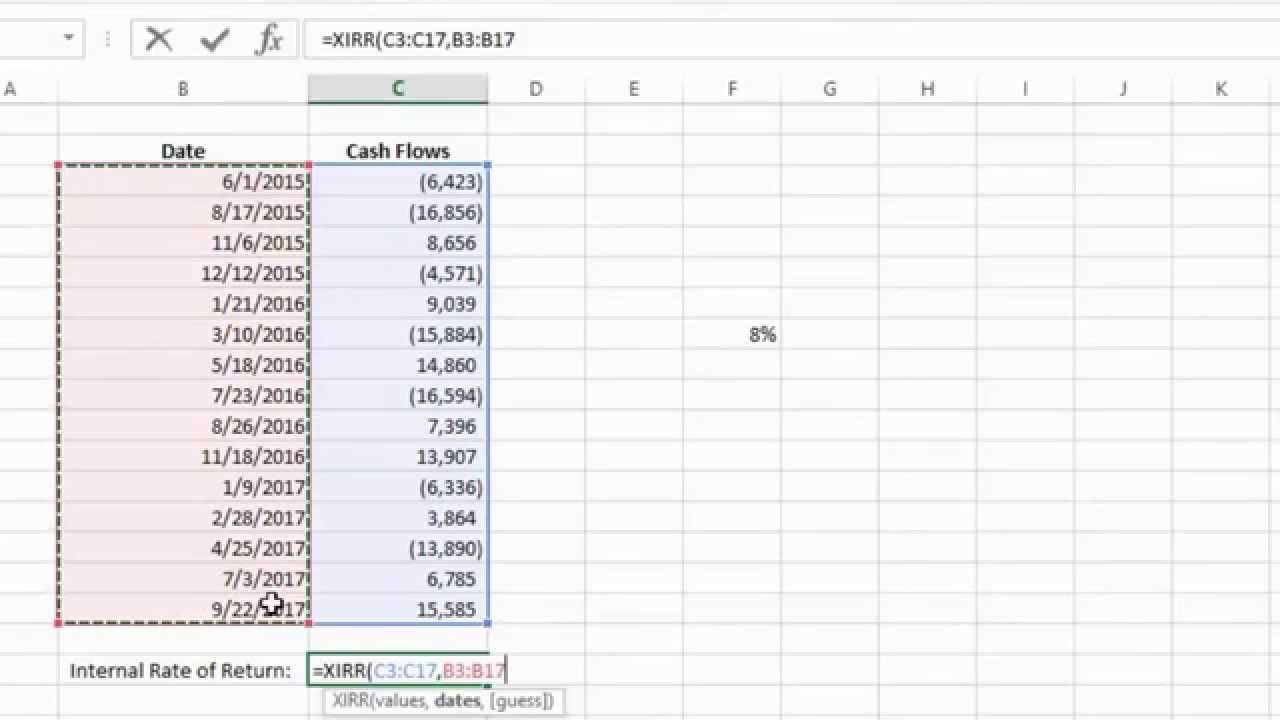

How to calculate IRR on Excel

Excel® makes life a lot easier. There are two functions you can use to calculate IRR on Excel®, creating your very own IRR calculator:

Other uses of the Internal Rate of Return

Apart from investment appraisal, the Internal Rate of Return is also useful for valuing bonds!

What is IRR in finance?

What is IRR? IRR stands for the internal rate of return. The IRR is an interest rate which represents how much money you stand to make from an investment, helping you estimate its future growth potential. In technical terms, IRR can be defined as the interest rate that makes the Net Present Value ...

What is NPV in accounting?

NPV is a measure of cash flow. So if a net present value is a minus number, you’re losing money on that project. If it’s a positive number, you’re making money on the project. To work out the net present value, add together the present values of all money coming in, and subtract all present values of money going out.

Is ROI a fixed value?

However, the ROI uses fixed values and doesn’t consider how money changes over time. A investment of $100 in 1976 which returns $200 in 2020 is obviously not such a successful investment as an investment of $100 in 1976 which returns $200 in 1977.

What is the Internal Rate of Return or IRR?

IRR, or the Internal Rate of Return, is the interest rate (or sometimes, discount rate), making the net present value of all cash flows in an investment equal to zero. Thus, the IRR is the steady-state interest rate in a perfectly behaved investment that matches the real-life experience of cash flows.

The Difference Between Money Now and the Future

Whether it's time or money, we've only got some much – and when you are planning on spending either, you should be modeling potential outcomes. An IRR calculation can't help you much with time, but it can help you model out a few different scenarios for the future growth of your money.

Calculating IRR in Microsoft Excel or Another Spreadsheet Program

Your first exposure to an internal rate of return calculation may have been through Excel or another spreadsheet program, but if not – I'll walk through it here. For the same scenario as above, create two columns, Period and Amount. Under those two, paste the following values (note that the first period is "0", no time has passed):

Internal Rate of Return (IRR) Explained

Formula For Internal Rate of Return

- The internal rate of return gauges the break-even rate of any project. Therefore, at this point, the net present value (NPV) becomes zero. Here, The internal rate of return is the discount rate.

Calculation For IRR

- Using excel is the easiest way to determine the internal rate of return. Alternatively, the trial-and-error method can be used. Here multiple discount rates are taken to get zero NPV. Due to the character of the formula, however, IRR can’t be calculated analytically and should instead be calculated either via trial-and-error or by using software sy...

Internal Rate of Return Examples

- Consider the following example to better understand the application of the internal rate of returns (IRR). The DEF Group wants to diversify its business and plan to take up a new project that requires an initial investment of $400000. They will pay it off in 4 years. It will generate $40000 in the first year, $80000 in the second year, $1600000 in the third year, and $259600 in the fourth y…

Internal Rate of Return in Excel

- Given below is a systematic process of calculating the internal rate of returns (IRR) using excel: Step 1 – Cash inflows and outflows in a standard format Below is the cash flow profile of the project. Now, we need to put the cash flow profile in the standardized format: Step 2 – Apply the IRR formula in excel. Step 3 – Compare IRR with the Discount Rate 1. From the above calculatio…

Advantages and Disadvantages

- The best part of the internal rate of return (IRR) is that it considers the time value of moneyTime Value Of MoneyThe Time Value of Money (TVM) principle states that money received in the present is of higher worth than money received in the future because money received now can be invested and used to generate cash flows to the enterprise in the future in the form of interest o…

IRR vs. Roi

- IRR is the percentage return at which the company will reap the returns equivalent to its cash outflow. In addition, it gives an overview of the yearly growth rate. In contrast, return on investmentReturn On InvestmentThe return on investment formula measures the gain or loss made on an investment relative to the amount invested. The net income divided by the original c…

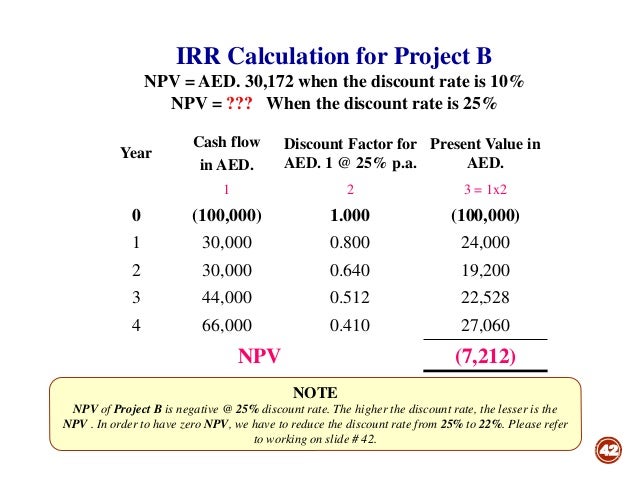

Npv vs. IRR

- The net present value is the final cash flow that a project will generate potentially, i.e., positive or negative returns. Whereas the internal rate of return is the discount rate at which the NPV becomes zero or reaches the break-even pointBreak-even PointIn accounting, the break even point is the point or activity level at which the volume of sales or revenue exactly equals total expense…

Recommended Articles

- This article is a guide to what is Internal Rate of Return (IRR) and its definition. Here we discuss the internal rate of return in excel formula, examples, advantages, disadvantages, and IRR in Excel. You may also have a look at the following articles on Corporate Finance – 1. Formula for Incremental IRR 2. Negative Interest Rate Example 3. Capital Budgeting Techniques

The Purpose of The Internal Rate of Return

- The IRR is the discount rate at which the net present value (NPV) of future cash flows from an investment is equal to zero. Functionally, the IRR is used by investors and businesses to find out if an investment is a good use of their money. An economistmight say that it helps identify investment opportunity costs. A financial statistician would say that it links the present value of …

The Formula For The Internal Rate of Return

- One possible algebraic formula for IRR is: IRR=R1+(NPV1×(R2−R1))(NPV1−NPV2)where:R1,R2=randomly selected discount ratesNPV1=…

Possible Uses and Limitations

- IRR can be calculated and used for purposes that include mortgage analysis, private equity investments, lending decisions, expected return on stocks, or finding yield to maturity on bonds. IRR models do not take the cost of capital into consideration. They also assume that all cash inflows earned during the project life are reinvested at the same rate as IRR. These two issues ar…