What is Ledger in Accounting?

- Ledger in Accounting Explained. A ledger is a date-wise record of all the transactions related to a particular account. ...

- Format. Ledgers have a T format where the debit is depicted on the left side, and credit is shown on the right side.

- Example. Machinery purchased for $17000 through cheque—January 1, 2021. Goods sold for $1950—March 18, 2021. ...

What are different types of ledgers?

Various types of Distributed Ledger Technology

- Introduction. ...

- Distributed Ledger Technology (DLT) DLT is a digital system that records, shares and synchronises transactions across multiple independent computers in different locations at the same time.

- Blockchain. ...

- Other types of DLT. ...

What are the different types of ledger accounts?

What is a General Ledger (GL)?

- General ledger account. A general ledger account (GL account) is a primary component of a general ledger. ...

- Controlling Accounts vs. Subsidiary ledger. ...

- General Ledgers and Double-Entry Bookkeeping. ...

- Link to Balance Sheet and Income Statement. ...

- Decentralized Ledger – Blockchain Technology. ...

- Additional Resources. ...

What is an example of general ledger?

Simple General Ledger Example Definition. General ledger is the book that stores and updates all the accounts in the company when the transactions are recorded in the general journal. It is the set of accounts that contain all transactions in each account in the company. In short, it is the master of all accounts in the company.

Is chart of accounts the same as a general ledger?

The chart of accounts is not the same as the general ledger. Instead, it’s just a listing of the various ledger accounts that the company or organization uses. But it does not have the financial information, like how much is in each account. All it has is the account’s name and number.

What are the types of format of ledger?

There are 3 types of Ledgers –Sales Ledger.Purchase Ledger.General Ledger.

What is ledger explain?

A ledger is a book or collection of accounts in which account transactions are recorded. Each account has an opening or carry-forward balance, and would record each transaction as either a debit or credit in separate columns, and the ending or closing balance.

What is the format of ledger posting?

Every ledger contains two sides: the left side shows debit entries while the right one depicts credit entries. Abbreviations of “Dr.” and “Cr.” on the top of the left and right sides respectively helps us identify them easily. Secondly, every ledger relates to a particular person, asset, income or expense.

What are the 3 types of ledgers?

What are the types of ledgers? There are three main types of ledgers: sales, purchase, and general. Sales ledgers are used to keep track of all the money being collected from customers.

What are the 4 ledgers?

Various Ledger Accounts prepared from the above journal entries.Cash Account Ledger.Capital Account Ledger.Purchases Account Ledger.Sales Account Ledger.

Why are ledgers important?

Ledgers are used to separate financial data from the journal into specific accounts on their own sheets for increased readability of the documented transactions.

What are the 5 types of general ledger accounts?

General ledger accounts are divided into five types of categories. The types include assets, liabilities, income, expense and capital.

What is balance sheet format?

It consists of transactions recorded under two sides namely, assets and liabilities. Assets are placed in the left hand side, while the liabilities are placed on the right hand side. The total of both side should always be equal. The balance sheet discloses financial position of the business.

How do you prepare a ledger?

When creating a general ledger, divide each account (e.g., asset account) into two columns. The left column should contain your debits while the right side contains your credits. Put your assets and expenses on the left side of the ledger. Your liabilities, equity, and revenue go on the right side.

What is ledger entry?

A ledger entry is a record made of a business transaction. The entry may be made under either the single entry or double entry bookkeeping system, but is usually made using the double entry format, where the debit and credit sides of each entry always balance.

What is general ledger example?

There are many examples of a general ledger as they record every financial transaction of a firm. Furniture account, salary account, debtor account, owner's equity, etc., are some examples.

What is ledger How is it to be created explain with example?

A ledger is the actual account head to identify your transactions and are used in all accounting vouchers. For example, purchase, payments, sales, receipts, and others accounts heads are ledger accounts. Without a ledger, you cannot record any transaction.

What is general ledger example?

There are many examples of a general ledger as they record every financial transaction of a firm. Furniture account, salary account, debtor account, owner's equity, etc., are some examples.

What is ledger in accounting class 11?

Ledger Account A ledger in accounting refers to a book that contains different accounts where records of transactions pertaining to a specific account is stored. It is also known as the book of final entry or principal book of accounts. It is a book where all transactions either debited or credited are stored.

In a ledger if the debit side is greater than the credit side then what does it represents?

If Debit side is greateer than the credit side then it represents Cash at the bank.

What is Ledger Posting?

Whenever a transaction takes place it is denoted and recorded in the journal in the form of the journal entry. Furthermore, this entry is posted ag...

What are the different categories of Ledger Accounts?

Assets, Liabilities, Stocks, Operating Revenue and Expense are some categories of Ledger Account

What are the different types of ledgers?

There are 3 types of Ledgers –. Sales Ledger. Purchase Ledger. General Ledger. 1. Sales Ledger – Sales Ledger is a ledger in which the company maintains the transaction of selling the products, services or cost of goods sold to customers. This ledger gives the idea of sales revenue and income statement. 2.

What is a general ledger account?

Ledger Account is a journal in which a company maintains the data of all the transactions and financial statement. Company’s general ledger account is organized under the general ledger with the balance sheet classified in multiple accounts like assets, Accounts receivable, account payable, stockholders, liabilities, equities, revenues, taxes, ...

What is the book of accounts?

Ledger is a book that contains the accounts. Any financial statement related to the financial position of the company emerges only from the accounts. Thus, this ledger is known as the principal book. So, the result of all this is that it is necessary to relate all the information for any account available is from the ledger. This book of accounts is the most important book for any business and that is why it is known as the king of all books. Also, the ledger book is also known as the book of the final entry. The Ledger account is thought of the book that has all the accounting information of the company.

When a person is liable to do something for a firm, the fact is mentioned using that person's?

Thus, when a person is liable to do something for a firm, the fact is mentioned using that person’s account. This is moreover related to the personal account. For other accounts like expenses or losses, a certain expense has been incurred by the firm or has lost money. This can be related to the nominal account.

What is general ledger?

General Ledger: In General ledger, all the other account’s entries are recorded other than sales and purchase account. It can also be termed as summarise ledger of all the nominal and real accounts such as a/c receivable, inventory account, cash account, investment account, machinery account, etc.

What is a purchase ledger?

Bought Ledger/Creditors Ledger: This ledger is prepared for recording the credit purchase transactions, i.e., the transactions of the parties from whom the goods have been acquired in credit. It can also be termed as purchase ledger. 2.

What is the difference between a permanent ledger and a temporary ledger?

Permanent Ledger: These are the ledgers having opening and closing balances which get forwarded to the next year. Temporary Ledger: They don’t have any opening and closing balance, and the account gets closed by transferring the amount to the profit and loss account at the end of the year.

What is the master account in a general ledger?

Various subsidiary ledgers are prepared for providing details to the general ledger, and at last, all are sum-up in one ledger called the general ledger. Thus, this account is also termed as “ master account ” or “ main account “.

What is the book of final entry?

Ledgers are the books of final entry. On the basis of method/ process of recording. Process of recording entries is known as journalization. The method of recording in the ledger is known as posting. On the basis of use. Journal is used on a daily basis to record transactions in a chronological manner.

How does a temporary ledger account get closed?

Temporary Ledger: They don’t have any opening and closing balance, and the account gets closed by transferring the amount to the profit and loss account at the end of the year.

What is separate ledger account?

Separate ledger accounts are prepared to identify the dues and payments of the parties individually at the end of the year which is impossible to trace only with the journal entries, as thousands of transaction took place during the year with different parties.

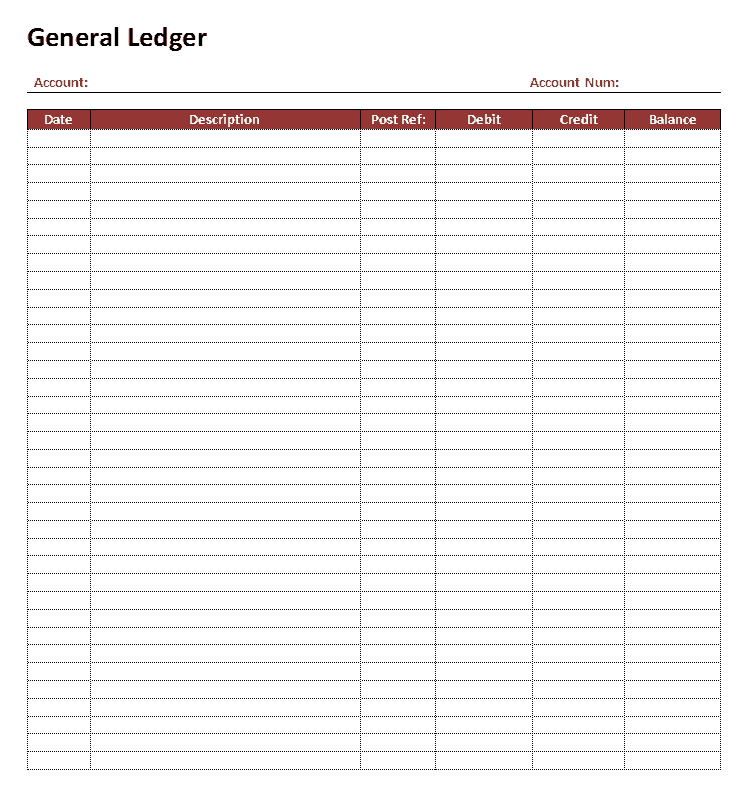

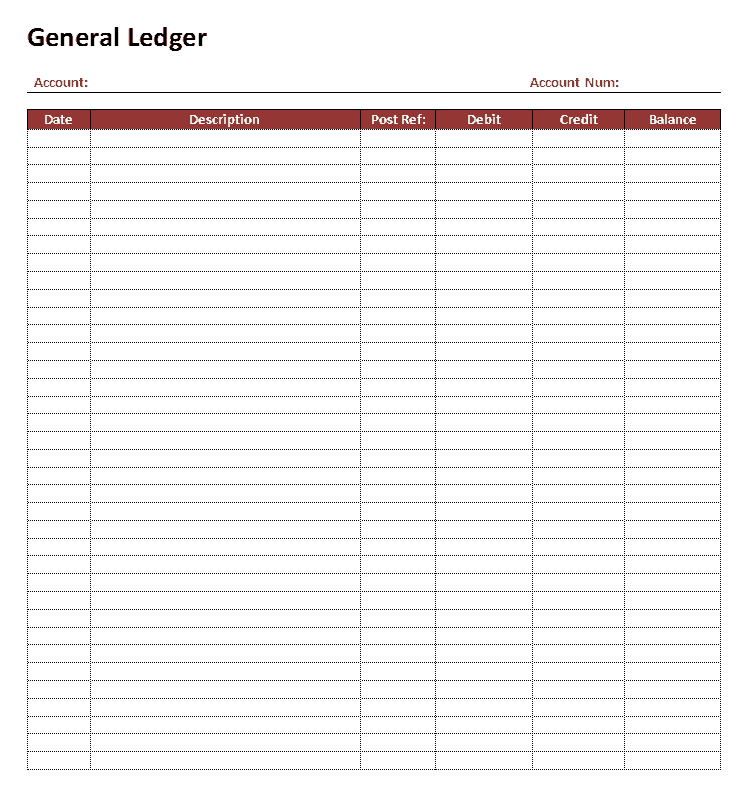

What is the format of a ledger?

The ledger consists of two columns prepared in a T format. The two sides of debit and credit contain date, particulars, folio number and amount columns. The ledger format is as follows.

What is a ledger?

A ledger contains different components which include the various transaction elements such as date, amount, particulars and l .f (ledger folio). Individual transactions are contained within a ledger account and are identified by a transaction number or any other type of notation.

What is ledger in accounting?

A ledger in accounting refers to a book that contains different accounts where records of transactions pertaining to a specific account is stored. It is also known as the book of final entry or principal book of accounts. It is a book where all transactions either debited or credited are stored.

Why is the ledger important?

It is regarded as the most important book in accounting as it helps in creating a trial balance that acts as a precursor to the preparation of financial statements. The information stored in a ledger account contains both starting and ending balances which are adjusted during the course of the accounting period with respective debits and credits.

What is the process of transferring entries from a journal to the respective ledger accounts?

For this process, first, the entries are recorded in journals and then transferred to their respective ledger accounts.

What is a ledger?

Ledgers break up the financial information from the journals into specific accounts such as Cash, Accounts Receivable and Sales, on their own sheets. This allows you to see the details of all your transactions.

What is a general ledger?

A general ledger is used by businesses that employ the double-entry bookkeeping method, which means that each financial transaction affects at least two general ledger accounts and each entry has a debit and a credit transaction. Double-entry transactions are posted in two columns, with debit postings on the left and credit entries on the right, ...

What is double entry accounting?

Businesses that use the double-entry bookkeeping method of recording transactions make the accounting ledger. Each transaction is recorded into at least two ledger accounts. The entries have debit as well as credit transactions and are posted in two columns. The debit

What is the process of recording transactions in a journal called?

The process of recording transactions in a journal is called journalizing while the process of transferring the entries from the journal to the ledger is known as posting.

What are the accounts in the general ledger?

Here are the primary general ledger accounts: 1 Asset accounts include fixed assets, prepaid expenses, accounts receivable and cash 2 Liability accounts which include notes payable, lines of credit, accounts payable and debt 3 Stockholders’ equity accounts 4 Revenue accounts 5 Expense accounts 6 Revenue and loss accounts such as interest, investment, disposal of an asset

Why is a ledger important?

Also, in the end, the ledger amounts should be balanced. Preparing a ledger is important as it serves as a master document for all your financial transactions.

How are transactions recorded throughout the year?

These transactions are recorded throughout the year by debiting and crediting these accounts. The transactions are caused by normal business activities such as billing customers or through adjusting entries.

What is the format of a ledger?

Format of Ledger. A ledger account is T-shaped, having two sides, wherein the left part of the account represents the debit side, whereas the right part of the account, is the credit one. Both the sides consist of four columns, as you can see in the specimen below:

What is a ledger?

Ledger. Definition: Ledger implies the principal books of accounts, wherein all accounts, i.e. personal, real and nominal are maintained. After recording the transactions in the journal, the transactions are classified and grouped as per their title, and so all the transactions of similar type into are put in a particular account.

What is the difference between a personal ledger and a debtor ledger?

Personal Ledger: Personal Ledger, implies the ledger that records details of every transaction about the persons, concerned with the accounting unit. Debtors Ledger: Debtors are the persons to whom goods are sold. So, it includes the accounts of individual trade debtors of the entity are covered in this category.

Why is the ledger important?

Ledger is the King of all Books and that is why it is also known as the book of final entry wherein account-wise balance of each account is ascertained. It helps in the preparation of trial balance and financial statement, i.e. profit & loss account, balance sheet, and cash flow statement. Reader Interactions.

When it comes to posting the entries, the accounts debited in the journal are to be debited in the?

When it comes to posting the entries, the accounts debited in the journal are to be debited in the ledger , however, reference is given to the concerned credit account.

When the debit and credit items are transferred from journal to the specific ledger accounts, the process is called?

When the debit and credit items are transferred from journal to the specific ledger accounts, the process is called as Posting . The rules with respect to the ledger posting are discussed as under:

What is a creditor ledger?

Creditors Ledger: Creditors are the persons or firm from whom we purchase the goods. So, it encompasses the accounts of individual trade creditors of the business enterprise.

How many forms of ledger accounts are there?

There are two forms of ledger accounts. These are:

What is the process of transferring information from journal to ledger account?

The process of transferring information from journal to ledger accounts is known as posting . The goal of all transactions is ledger. Ledger is known as the destination of entries in journal but it must be remembered that transactions cannot be recorded directly in the ledger - they must be routed through journal.

What is journal accounting?

The journal provides a complete listing of the daily transactions of a business. But it does not provide information about a specific account in one place. For example, to know how much cash balance we have, the accounting clerk would have to check all the journal entries in which cash is involved, and this is very laborious job; because there are hundreds or even thousands of cash transactions recorded on different pages of journal. To avoid this difficulty, the debit and credit of journalized transactions are transferred to ledger accounts. Thus all the changes for a single account are located in one place - in a ledger account. This makes it easy to determine the current balance of any account.

What is the left side of a ledger called?

It appears that each account in the ledger has two similar sides - left hand side is called debit side (briefly Dr.) and right hand side (briefly Cr.) side. Now a days these two words are not used, because it is obvious that the left hand side is debit side and right hand side is credit side.

What is the process of equalizing the two sides of an account?

The balance is written on the lesser side to make the two sides equal. The process of equalizing the two sides of an account is known as balancing. The rules for balancing an account are stated as below: Add up the amount columns of both the sides of an account and write the totals in a separate slip of paper.

What is the book in which all the transactions of a business concern are finally recorded in the concerned accounts in a?

So, the books in which all the transactions of a business concern are finally recorded in the concerned accounts in a summarized form is called ledger.

What is the book in which accounts are maintained called?

The book in which accounts are maintained is called ledger. Generally, one account is opened on each page of this book, but if transactions relating to a particular account are numerous, it may extend to more than one page. All transactions relating to that account are recorded chronologically.

Why is the ledger important in accounting?

It is the most important book of accounting as it helps in the creation of trial balance which then acts as a base for the preparation of financial statements.

What is the process of transferring a transaction from a journal to a ledger account?

The process of transferring a transaction from a journal to a ledger account is called Posting . It is an essential task as it summarizes all transactions related to that account at one place. Posting is made to accounts from journal entries and various subsidiary books.

What are some examples of accounts?

Few examples of each are Furniture, Cash, Creditors, Bank Loan, Capital, Drawings, Sales, Rent, etc.

What is the book of final entry?

It is a book in which all ledger accounts and related monetary transactions are maintained in a summarized and classified form. All accounts combined together make a ledger and form a permanent record of all transactions.

What is general ledger?

General Ledger is a process of summarizing all the financial transaction of an account for a given period in a prescribed format with the objective to ascertain the closing balance at the end of the given period.

What is a ledger account?

What is ledger account? Ledger account and general ledger account are interchangeably used to denote the account report that contains a record of all business transactions related to an account. For every account, you deal with, a separate ledger account is prepared that summarizes the closing balance for a given period.

What is the method of transferring debit and credit items from journal to classified accounts in the ledger?

The methodology of transferring the debit and credit items from journal to classified accounts in the ledger is known as posting. The posting of the ledger should be followed in accordance with the rules.

How many columns are there in a general ledger?

Each of the general ledgers debit and credit side has four columns.

What is the first step in the process of preparing general ledger?

As discussed above, the first step in the process of preparing general ledger is posting. The following are ledger posting of ABC and Co.

What is the principal book of accounts?

It is also known as principal books of account in which the account-wise balance of each account is determined.