The FIFO and LIFO accounting

FIFO and LIFO accounting

FIFO and LIFO accounting are methods used in managing inventory and financial matters involving the amount of money a company has tied up within inventory of produced goods, raw materials, parts, components, or feed stocks. They are used to manage assumptions of cost flows related to inventory, stock repurchases (if purchased at different prices), and various other accounting purposes.

Why would a company use LIFO instead of FIFO?

Key Takeaway

- Last in, first out (LIFO) is a method used to account for how inventory has been sold that records the most recently produced items as sold first.

- The U.S. ...

- Virtually any industry that faces rising costs can benefit from using LIFO cost accounting.

How to calculate cost of goods sold using FIFO method?

Inputs:

- First of all, you just have to enter the quantity of each unit purchases

- Then, you have to add the quantity of the price/unit you purchased

- Also, the lifo fifo method calculator provides you with options of adding more purchases “one by one” or multiple

- Then, you have to enter the total units sold from your number of purchases

Which is a better method LIFO or FIFO?

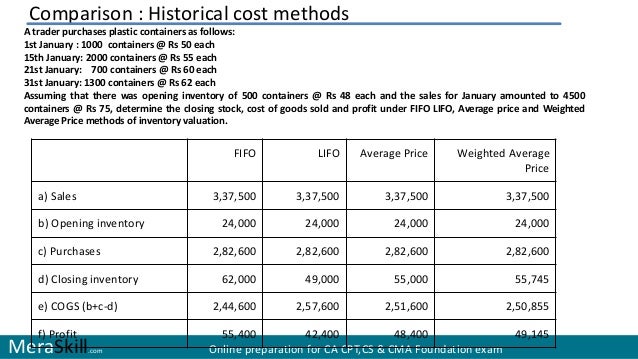

LIFO and FIFO: Impact of Inflation

- LIFO. When sales are recorded using the LIFO method, the most recent items of inventory are used to value COGS and are sold first.

- FIFO. When sales are recorded using the FIFO method, the oldest inventory–that was acquired first–is used up first.

- Average Cost. The average cost method produces results that fall somewhere between FIFO and LIFO. ...

What is the difference between FIFO and average method?

Difference between FIFO and average costing method: 1. Primary distinction: The primary difference between the two methods is the cost ascertained to the inventory that is dispatched or sold by a business. In FIFO method, the basic assumption followed is that inventory which is acquired first or enters the business first will be the first to exit.

Is LIFO the same as average cost?

"Average cost" and "last in, first out," or LIFO, are two of the most common methods for valuing inventory. Both rely on the purchase price of individual items to determine the inventory's value. However, these methods use those amounts differently to arrive at different balances.

What is the difference between FIFO LIFO and average cost accounting?

FIFO (“First-In, First-Out”) assumes that the oldest products in a company's inventory have been sold first and goes by those production costs. The LIFO (“Last-In, First-Out”) method assumes that the most recent products in a company's inventory have been sold first and uses those costs instead.

What is average cost FIFO?

This 'average' cost is then posted when the item is sold. It doesn't change until a new purchase, at a different cost, is made. First-In, First-Out (FIFO) is one of the most commonly used methods used to calculate the value of inventory and cost of goods sold (COGS) during an accounting period.

What is LIFO and FIFO method?

Key Takeaways. The Last-In, First-Out (LIFO) method assumes that the last unit to arrive in inventory or more recent is sold first. The First-In, First-Out (FIFO) method assumes that the oldest unit of inventory is the sold first.

What are the 3 methods to value inventory?

What are the different inventory valuation methods? There are three methods for inventory valuation: FIFO (First In, First Out), LIFO (Last In, First Out), and WAC (Weighted Average Cost).

What is LIFO example?

Example of LIFO that buys coffee mugs from wholesalers and sells them on the internet. One Cup's cost of goods sold (COGS) differs when it uses LIFO versus when it uses FIFO.

What is average cost example?

Average cost includes fixed costs, like those necessary for production, that remain the same no matter the output. An example of a fixed cost is the building space and equipment used to assemble a product. Average cost also includes variable costs.

What is the difference between FIFO and average cost?

The difference between the two depends on the way the inventory is issued; one method sells the goods purchased first (FIFO) and the other calculates the average price for the total inventory (weighted average).

Should I use average cost or FIFO?

Choosing the best cost basis method depends on your specific financial situation and needs. If you have modest holdings and don't want to keep close track of when you bought and sold shares, using the average cost method with mutual fund sales and the FIFO method for your other investments is probably fine.

What is FIFO example?

Example of FIFO Imagine if a company purchased 100 items for $10 each, then later purchased 100 more items for $15 each. Then, the company sold 60 items. Under the FIFO method, the cost of goods sold for each of the 60 items is $10/unit because the first goods purchased are the first goods sold.

How do you explain LIFO?

LIFO stands for “Last-In, First-Out”. It is a method used for cost flow assumption purposes in the cost of goods sold calculation. The LIFO method assumes that the most recent products added to a company's inventory have been sold first. The costs paid for those recent products are the ones used in the calculation.

How is LIFO calculated?

To calculate FIFO (First-In, First Out) determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold, whereas to calculate LIFO (Last-in, First-Out) determine the cost of your most recent inventory and multiply it by the amount of inventory sold.

What is the difference between FIFO first in, first out and LIFO last in, first out accounting quizlet?

* FIFO (first-in-first-out) assumes merchandise is sold in the order it was acquired by a firm. * LIFO (last-in-first-out) assumes merchandise is sold in the reverse of the order it was acquired by a firm. - to report a higher profit?

What is LIFO FIFO and HIFO?

FIFO (first-in first-out), LIFO (last-in first-out), and HIFO (highest-in first-out) are simply different methods used to calculate cryptocurrency gains and losses.

What is the difference between FIFO method and weighted average method in process costing?

The first-in first-out inventory valuation method assumes that the first items into inventory are the first items used in production. The weighted average cost is equal to the total cost of all inventory items divided by the number of units.

How does a FIFO cost method of inventory valuation differ from a weighted average cost method?

The key difference between FIFO and weighted average is that FIFO is an inventory valuation method where the first purchased goods are sold first whereas weighted average method uses the average inventory levels to calculate inventory value.

B1. Perpetual FIFO

Under the perpetual system the Inventory account is constantly (or perpetually) changing. When a retailer purchases merchandise, the retailer debit...

B2. Perpetual LIFO

Under the perpetual system the Inventory account is constantly (or perpetually) changing. When a retailer purchases merchandise, the retailer debit...

B3. Perpetual Average

Under the perpetual system the Inventory account is constantly (or perpetually) changing. When a retailer purchases merchandise, the costs are debi...

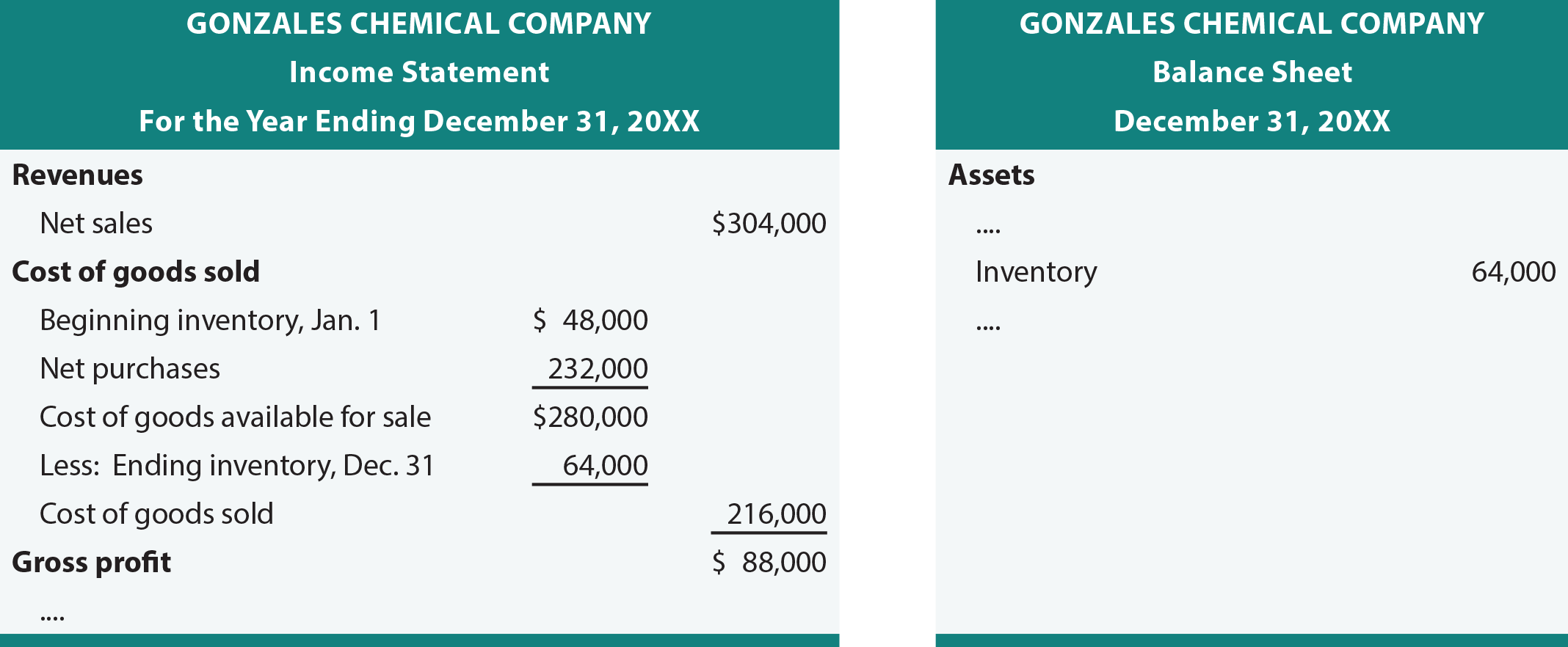

Comparison of Cost Flow Assumptions

Below is a recap of the varying amounts for the cost of goods sold, gross profit, and ending inventory that were calculated above.The example assum...

How much is ending inventory in LIFO?

Ending Inventory per LIFO: 1,000 units x $8 = $8,000. Remember that the last units in (the newest ones) are sold first; therefore, we leave the oldest units for ending inventory.

Why is LIFO not accurate?

As a result, LIFO doesn't provide an accurate or up-to-date value of inventory because the valuation is much lower than inventory items at today's prices.

Why would COGS be higher under LIFO?

In an inflationary environment, the current COGS would be higher under LIFO because the new inventory would be more expensive. As a result, the company would record lower profits or net income for the period. However, the reduced profit or earnings means the company would benefit from a lower tax liability.

Why is FIFO better than COGS?

FIFO can be a better indicator of the value for ending inventory because the older items have been used up while the most recently acquired items reflect current market prices. For most companies, FIFO is the most logical choice since they typically use their oldest inventory first in the production of their goods, which means the valuation of COGS reflects their production schedule.

What accounting method is used to determine inventory costs?

The accounting method that a company uses to determine its inventory costs can have a direct impact on its key financial statements (financials)—balance sheet, income statement, and statement of cash flows. The U.S. generally accepted accounting principles (GAAP) allow businesses to use one of several inventory accounting methods: first-in, ...

When sales are recorded using the FIFO method, what is the oldest inventory?

When sales are recorded using the FIFO method, the oldest inventory–that was acquired first–is used up first. FIFO leaves the newer, more expensive inventory in a rising-price environment, on the balance sheet.

Can seafood companies leave their inventory idle?

In other words, the seafood company would never leave their oldest inventory sitting idle since the food could spoil, leading to losses. As a result, LIFO isn't practical for many companies that sell perishable goods and doesn't accurately reflect the logical production process of using the oldest inventory first.

What is a perpetual FIFO?

With perpetual FIFO, the first (or oldest) costs are the first removed from the Inventory account and debited to the Cost of Goods Sold account. Therefore, the perpetual FIFO cost flows and the periodic FIFO cost flows will result in the same cost of goods sold and the same cost of the ending inventory.

Why is a perpetual LIFO entry needed?

An entry is needed at the time of the sale in order to reduce the balance in the Inventory account and to increase the balance in the Cost of Goods Sold account. If the costs of the goods purchased rise throughout the entire year, perpetual LIFO will result in a lower cost of goods sold and a higher net income than periodic LIFO.

Inventory Valuation and Tracking

Businesses need to keep track of which items they sell and which items they have on hand, including their exact value.

1. The FIFO Method

The FIFO method is the first option for valuing stock and probably the most common.

2. The LIFO Method

Another method that is used, and the opposite of the FIFO method, is LIFO.

3. The Weighted Average Cost Method

The weighted average method is a final option for valuing our inventory.

FIFO vs LIFO vs Weighted Average Around the World

Generally accepted accounting principles in the United States allow for the use of all three inventory methods.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

FIFO, LIFO, Weighted Average Method Mini Quiz

1. Computerized inventory systems are most commonly associated with which inventory tracking system? *

How to calculate cost of goods sold?

Thus, to calculate cost of goods sold (CGS) we simply take the total cost of goods available for sale (the $12,000) [recall this is the total available inventory that could be sold when you add in the beginning inventory and ALL purchases during the time period] and subtract the ending inventory of $5800 and get the CGS of $6200.

Is the newest inventory sold first in FIFO?

In other words, it is the reverse of what you did before, because under LIFO, the last (i.e., the newest) inventory you bought is considered to be sold first, while under FIFO, the oldest inventory/purchases you bought/had is considered sold first.

What are the main objectives of LIFO method?

The major objectives Of the LIFO method to change the cost of goods sold with the most recent cost incurred. Adjust the financial statements for inflation. To obtain a better matching of current revenues with current costs in times of inflation.

What is the FIFO method?

FIFO Method. The FIFO method assumes that the earliest goods purchased are the first to be sold, FIFO often parallels the actual physical.flow of merchandise, it generally is a good business practice as to sell the oldest unit first.

What is the effect of LIFO on deflation?

Using LIFO for a deflationary period results in both accounting profit and the value of unsold inventory is higher.

What is the average inventory method?

The average inventory method assumes that using in the smoothes out cost fluctuation by the cost of goods sold. 2. Measurement of profit. FIFO is good when the price level is high. LIFO is good when the price level is low or high. When the price of inventory fluctuates. 3.

What is the purpose of the LIFO method?

The major objectives of the LIFO method are to change the cost of goods sold with the most recent cost incurred.

How to calculate average cost?

The average cost method will take the total cost of goods that will available for sale and divide it by the total sum of the product from the inventory and purchases.

What is included in inventorial cost?

All expenditures needed to acquire goods and to make them ready for sale are included as the inventorial cost. It appears from the diagram that; the

What is FIFO and average cost?

FIFO and average cost are two methods of valuing inventory. Choosing the right method for your small business could potentially allow you to book thousands of dollars in additional or earlier profits. The main distinction between the FIFO – or first-in, first-out – and average cost method is the way each accounting option calculates inventory and cost of goods sold. Using the right method can help ensure that your small business meets customer needs by having products available when customers want them while maximizing profits.

What is FIFO in warehouse?

FIFO involves selling the oldest items or those that have been in the warehouse the longest first, hence the term, first-in, first-out. The average cost method, which is sometimes called the weighted average cost, is calculated by dividing the total cost of goods in your inventory by the total number of items available for sale.

Why use the average cost method?

Average cost, though, is great if you are operating in a period of relatively low or no inflation. If prices are stable, you might as well use the average cost method because it's much simpler to calculate. However, if prices are fluctuating, either up or down, you do not want to use the average cost method because it could potentially cost you ...

Does FIFO increase profits?

In an inflationary period, FIFO leads to higher profits, because you are selling goods that cost you less when you purchased them compared to more recent items that you purchased at a higher per-unit price. The effect is the opposite in a deflationary period. If prices are dropping, you should not use the FIFO method.

Does FIFO have inventory control?

Note that with FIFO you don't have to use or resell the oldest bags of cement first: FIFO is a cost-accounting method, not an inventory-control method. You're simply taking note that you purchased X number of bags at a lower price. Average cost, by contrast, is just that – the average cost for all of the bags of cement, ...

Inventory valuation and Tracking

- Businesses need to keep track of which items they sell and which items they have on hand, including their exact value. During the year your inventory on hand is valued at how much it cost you to buy it (or if you're a manufacturing business- to make it). Each time you receive inventory you simply record how much it cost and enter it in your accounting system. Now, there are two b…

An Example to Illustrate The Three Inventory Accounting Methods

- The following example will illustrate these three methods: Cindy Sheppard runs a candy shop. She enters into the following transactions during July: July 1 Purchases 1,200 lollypops at $1 each. July 13 Purchases 500 lollypops at $1.20 each. July 14 Sells 700 lollypops at $2 each. First of all, how many lollypops does she have at the end of the month? Answer: 1,200 + 500 – 700 = 1,000 l…

FIFO vs LIFO vs Weighted Average Around The World

- Generally accepted accounting principles in the United States allow for the use of all three inventory methods. However, the LIFO method is disallowedin non-US countries (it is disallowed under International Financial Reporting Standards, which are the accounting standards most of the world uses). The FIFO method and the weighted average cost metho...

Test Yourself!

- Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed. Difficulty Rating: Intermediate Quiz length: 7 questions Time limit: 8 minutes Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before yo…