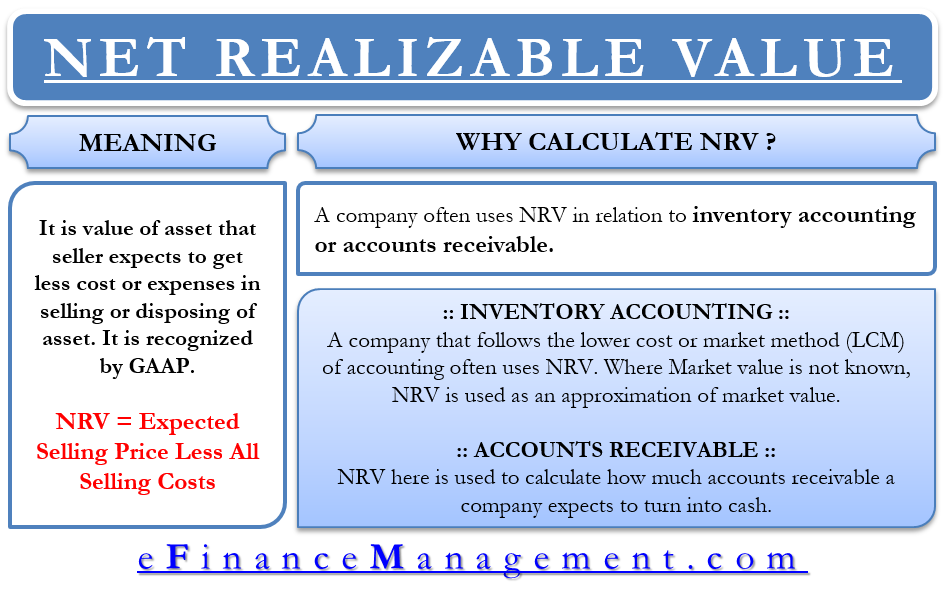

The lower of cost or net realizable value concept means that inventory should be reported at the lower of its cost or the amount at which it can be sold. Net realizable value is the expected selling price of something in the ordinary course of business, less the costs of completion, selling, and transportation.

What is lower of cost or net realizable value rule?

Lower of cost or net realizable value rule means that inventory must be valued and reported at lower of the following: For example, an item of inventory costs $100. The estimated amount that will be recovered from sale of that inventory item (NRV) is $120. In this case, you don’t need to do anything.

Is cost of inventory less than net realizable value?

Under normal circumstances, cost of inventory is always lesser than the net amount business can earn by selling the inventory, called net realizable value (NRV). Common sense dictates that cost has to be lesser than NRV to make profit.

What is NETnet realizable value (NRE)?

Net realizable value is an important metric that is used in the lower cost or market method of accounting reporting. Under the market method reporting approach, the company’s inventory must be reported on the balance sheet at a lower value than either the historical cost or the market value.

Why do electronics have lower cost and net realizable value?

This often occurs in the electronics industry as new and more popular products are introduced. The lower of cost and net realizable value can be applied to individual inventory items or groups of similar items. Assume two types of inventory for a paper supply company, as shown in Figure 6.15 below.

What if NRV is higher than cost?

Common sense dictates that cost has to be lesser than NRV to make profit. But following a concept of conservatism, even if NRV is higher than cost, value of inventory is kept at cost and gain is not recognized until the inventory actually sells.

Why are inventories measured at lower of cost and net realizable value?

Obsolescence, over supply, defects, major price declines, and similar problems can contribute to uncertainty about the “realization” (conversion to cash) for inventory items. Therefore, accountants evaluate inventory and employ lower of cost or net realizable value considerations.

How do you calculate NRV and lower cost?

It is found by determining the expected selling price of an asset and all the costs associated with the eventual sale of the asset, and then calculating the difference between these two. To put it in formulaic terms, NRV = Expected selling price - Total production and selling costs.

What is lower of cost value?

The lower of cost or market (LCM) method states that when valuing a company's inventory, it is recorded on the balance sheet at either the historical cost or the market value. Historical cost refers to the cost at which the inventory was purchased. The value of a good can shift over time.

When Should inventory be valued at its net realizable value?

Under the market method reporting approach, the company's inventory must be reported on the balance sheet at a lower value than either the historical cost or the market value. If the market value of the inventory is unknown, the net realizable value can be used as an approximation of the market value.

What happens when the value of inventory is lower than its cost?

If market value remains greater than cost, no change is made in the reported balance until a sale occurs. In contrast, if the value drops so that inventory is worth less than cost, a loss is recognized immediately. Accountants often say that losses are anticipated but gains are not.

How do you calculate net realizable value?

Net realizable value, or NRV, is the amount of cash a company expects to receive based on the eventual sale or disposal of an item after deducting any associated costs. In other words: NRV= Sales value - Costs.

What is net Realisable value in accounting?

Net Realisable Value (NRV) is the amount by which the estimated selling price of an asset exceeds the sum of any additional costs expected to incur during the sale of the asset. NRV has significant importance in the valuation of inventory.

When applying the lower of cost or net realizable value NRV means quizlet?

a. Net realizable value (NRV) is the selling price less estimated costs to complete and estimated costs to make a sale.

Why is closing stock valued at lower of cost?

Closing stock is valued at lower of cost or net realisable value (market value) because of the Prudence Concept of accounting, whereby anticipated losses are accounted while anticipated profits are not.

Is lower of cost or market conservative?

Lower of cost or market (LCM or LOCOM) is a conservative approach to valuing and reporting inventory. Normally, ending inventory is stated at historical cost.

Which of the following is true of lower of cost or market?

Which of the following is true about lower-of-cost-or-market? It is inconsistent because losses are recognized but not gains, It usually understates assets, and It can increase future income if the expected reductions do not materialize.

Why are inventories measured at lower of cost and net realizable value quizlet?

drop of future utility below its original cost. Why are inventories stated at lower-of-cost and net realizable value? a. To report a loss when there is a decrease in the future utility.

Why is inventory measured at the lower of cost?

commodity brokers and dealers who measure their inventories at fair value less costs to sell. When such inventories are measured at fair value less costs to sell, changes in fair value less costs to sell are recognised in profit or loss in the period of the change.

Why are inventories stated at lower of cost and net realizable value quizlet?

Terms in this set (20) Why are inventories stated at lower-of-cost and net realizable Value? To permit future profits to be recognized. To report a loss when there is a decrease in the future utility below the original cost.

Why inventories are valued at a lower cost?

If an inventory is valued at cost, whereas its NRV is lower, this means that the inventory is impaired. It is overvalued such that upon sale of the inventory, the full amount recorded would not be received. This is why inventory is stated at lower of cost and NRV.