Can I refinance my home with negative equity?

With negative equity, the process to refinance into a new loan will be more complicated. Most of the time, a lender cannot loan you more than the home is worth, so it may fall on you to pay the difference out of pocket. Negative equity happens when you owe more on your mortgage than what your home is worth.

What does it mean to have a negative equity?

Negative equity occurs when the value of a borrowed asset falls below the amount of the loan/mortgage taken in lieu of the asset. Negative shareholder equity is a similar concept, whereby the company incurs losses that are greater than the combined value of payments made to shareholders and accumulated earnings from prior periods.

Is it possible to refinance with negative equity?

Refinancing with negative equity is possible, but it will cost so much it is not typically advisable. Negative equity simply means you owe more on an outstanding balance on a loan than the asset is worth. For example, a negative equity mortgage means your home is not worth enough money to cover the mortgage balance. This hinders the change of a successful refinance for a number of reasons.

What can I do about negative equity?

What can I do if I have negative equity in my home?

- Make home improvements that add real value.

- Rent your home instead.

- Speak to your existing lender to see if they are happy to port your existing mortgage to a new property.

What happens when you go into negative equity?

Negative equity is when your property becomes worth less than the remaining value of your mortgage. To be in negative equity, the value of your house must fall below the amount you still owe on your mortgage. Equity is the value of your property that you own outright.

How do you pay off negative equity?

If paying off the car's negative equity in one fell swoop isn't on the table, pay a little more each month toward the principal. For example, if your monthly car payment is $351, round up to $400 each month, with $49 going toward the principal. The more you can pay, the faster you'll get rid of the negative equity.

Should I be worried about negative equity?

Don't worry too much, say experts While it is sensible to take precautions, Scott Clay of specialist mortgage lender Together says first-time buyers should not be unduly concerned about negative equity - provided they plan to stay in their home long enough to ride out any potential house price ups and downs.

How much negative equity is too much?

125%The best way to determine if the negative equity is too much is to calculate the Loan-to-Value ratio (LTV). Ideally, the loan amount should not exceed 125% of the resale value.

What happens if you are upside down on your mortgage?

An underwater mortgage, sometimes called an upside-down mortgage, is a home loan with a higher principal than the home is worth. This happens when property values fall but you still need to repay the original balance of your loan.

What happens if you sell a house in negative equity?

You will need your mortgage lender's permission before selling a house in negative equity, and you know you won't get enough from the sale to pay back what you owe. The lender will send you a bill for the shortfall; if you don't make an arrangement to make repayments, you could be taken to court.

What happens if your house is worth more than your mortgage?

If you owe $150,000 on your mortgage loan and your home is worth $200,000, you have $50,000 of equity in your home. Your equity can increase in two ways. As you pay down your mortgage, the amount of equity in your home will rise. Your equity will also increase if the value of your home jumps.

What happens if your house is worth less than you bought it for?

If the appraisal comes in lower than the purchase price, your lender will likely decrease the amount you can borrow. So you'll either have to pay more out of pocket or get the seller to lower their asking price.

Can I trade my car in if I have negative equity?

When trading in a car with negative equity, you'll have to pay the difference between the loan balance and the trade-in value. You can pay it with cash, another loan or — and this isn't recommended — rolling what you owe into a new car loan.

Can you refinance negative equity?

There are a few special programs that you may be able to use to refinance a loan with negative equity. You may be able to use Fannie Mae's High Loan-To-Value Refinance program if you have a conventional mortgage. A High LTV Refinance can allow you to refinance a loan when you owe more money than your home is worth.

Is it smart to use equity to pay off debt?

Using a home equity loan for debt consolidation will generally lower your monthly payments since you'll likely have a lower interest rate and a longer loan term. If you have a tight monthly budget, the money you save each month could be exactly what you need to get out of debt.

Can you release equity to pay off debt?

Equity release can be helpful if you want to repay an existing mortgage, increase your income or pay for care needs. You may also choose to use equity release to help you pay debts that you owe. Equity release can help you in different ways, but always contact us for advice before choosing this option.

What is home equity?

Home equity is how much of your home’s value you actually own versus the amount that is financed. Your equity changes all the time as your home’s value fluctuates, and as you pay down your loan. If your home’s value drops below your outstanding loan balance, you have negative equity.

How to calculate equity?

Calculate Your Equity. To calculate positive or negative equity, you first determine your home’s value, then calculate your loan balance. The difference between home value and loan balance is your positive or negative equity.

Can Zillow give you a home value?

Zillow can give you an initial estimate of your home’s value, then you can find a local real estate agent to do a custom analysis for you. Most local real estate agents are happy to do this kind of analysis for free. Next you can look at your mortgage statement to get your current loan balance.

What is negative equity?

key takeaways. Negative equity occurs when the value of real estate property falls below the outstanding balance on the mortgage used to purchase that property. Negative equity is colloquially referred to as "being underwater.". Negative equity often results with the bursting of a housing bubble, a recession, or a depression—anything ...

How does home equity work?

Home equity can be accumulated by either a down payment made during the initial purchase of the property or with mortgage payments, as a contracted portion of that payment will be assigned to bring down the outstanding principal still owed. Owners can benefit from property value appreciation as it will cause their equity value to increase. ...

What is home equity?

Home equity is the value of a homeowner’s interest in their home. It is the real property’s current market value less any liens or encumbrances that are attached to that property. This value fluctuates over time as payments are made on the mortgage and market forces play on the current value of that property.

What causes real estate values to fall?

depression —anything that causes real estate values to fall. For instance, say a buyer financed the purchase a $400,000 home with a mortgage of $350,000. If the market value of that home the next year tumbles to $275,000, the owner has negative equity in the home because the mortgage attached to the property is $75,000 greater than ...

Is a negative equity home a debt?

The sale of a home with negative equity becomes a debt to the seller, as they would be liable to their lending institution for the difference between the attached mortgage and the sale of the home.

Who is James Chen?

James Chen, CMT is an expert trader, investment adviser, and global market strategist. He has authored books on technical analysis and foreign exchange trading published by John Wiley and Sons and served as a guest expert on CNBC, BloombergTV, Forbes, and Reuters among other financial media.

How Does Negative Equity Occur?

Negative equity occurs when the value of an asset you own is less than the outstanding balance on the loan. You may hear a lender refer to a loan with negative equity as “ underwater ” or “upside-down.” But wait – since most lenders won’t loan you more money than your home is worth, how is negative equity possible?

Why is negative equity bad?

Negative equity occurs when you owe more money on your home than your home is worth. Falling local property values and missed payments can cause negative equity. This is a problem because it can make selling your home or refinancing more difficult. You can avoid negative equity by buying a home when market prices are low, putting more money down and buying a home you can afford. You can also wait until property values improve, you can refinance or you can sell your home and pay your lender the difference.

Why is it so hard to refinance a home?

You may have a tough time getting a refinance because lenders can’t loan out more money than your property is worth.

What is equity in a home?

Please check out our disclosure policy for more details. “Equity” is a term that refers to the amount of your home that you own. In most circumstances, your home equity increases over time as you make payments on your loan. But if property values fall, you may find yourself with no equity or even negative equity.

How long does it take to close a refinance on a streamline loan?

There must be at least 210 days between when you closed on your FHA loan and the date you close on your Streamline refinance.

How does a home loan work?

Every time you make a payment on your home loan, you gain a small amount of equity in your property. Once you fully own your home, you have 100% equity in your property. You can continue to make payments on your loan if you’re comfortable in your home and you can manage your payments. When home values rise again, you can eventually sell or refinance your home once your equity is out of the negative.

What happens when you refinance a mortgage?

A refinance can allow you to lower your monthly payment by taking a lower interest rate or by lengthening your term.

What happens if you wait out a negative equity loan?

If you wait out a negative-equity situation, paying down the loan can rebuild equity as your principal payments reduce the amount you owe on the loan. Also, since real estate markets tend to be cyclical, your home might ultimately regain value if you’re in a position to wait long enough.

What is negative equity?

Negative equity occurs when your home’s value is lower than the balance on your mortgage loan.

What happens if you sell your home for its current value?

In other words, if you were to sell the home for its current market value, you’d actually owe the bank money to close out the mortgage.

What happens if you buy a home with a 20% down payment?

If you buy your home with a reasonable down payment, you may be less likely to develop negative equity. In the example above, if the homeowner purchased their $315,000 home with a 20% down payment of $63,000, their loan amount would be $252,000. Even if the market brought the home’s value down to $270,000, they’d still have $18,000 of positive equity.

When does negative equity resolve itself?

Negative equity can resolve itself when the market improves and/or if you continue to pay down a mortgage loan.

Can you get a home equity loan with negative equity?

Home equity loans are not available: With negative equity, you’re not eligible for home equity loans and home equity lines of credit (HELOCs) to finance home improvements or to use for other purposes.

Is negative equity always bad?

Though negative equity may not always be the worst situation, it does have significant drawbacks:

What does negative equity mean?

What is negative equity? When a homeowner has negative equity, that’s also known as being underwater. It means she owes more money on her mortgage than she could make on the sale of her home. As we learned in the last recession, the implications of negative equity for individuals and for the economy can be enormous.

Is negative equity a part of the housing market?

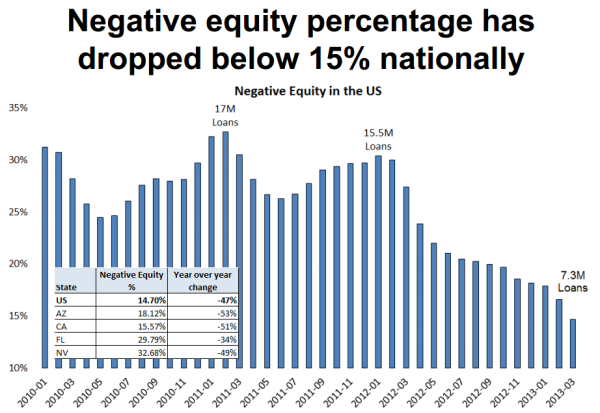

We should be prepared for negative equity to remain a part of the U.S. housing market for a long time to come. It is likely to continue to fall as home values increase, freeing those already relatively close to positive equity. But even as home values close in on peak levels reached during the housing boom, those deeply underwater homeowners still face a long wait before returning to a positive balance on their home loans. We’re likely in store for a kind of new environment in housing, one in which the longer-term level of negative equity is substantially higher than the roughly 3ish percent we’d expect to see in a historically “normal” market. Negative equity cut the housing market very deeply, and its scars are likely to be long-lasting.

What happens when the value of the asset remains constant but the amount of the loan balance goes up?

It can be due to the borrower not making sufficient repayments to the lender. 2. Negative shareholder equity. For listed companies, at times, a negative balance can appear for the equity line-item of the balance sheet.

Why is there negative equity?

For assets, negative equity can appear due to a reduction in the asset value or for companies if there is a large dividend paid, or there are significant accumulated losses.

What is negative amortization?

Another related concept is negative amortization. It happens when the value of the asset remains constant, but the amount of the loan balance goes up. It can be due to the borrower not making sufficient repayments to the lender.

What are tangible assets?

Tangible Assets Tangible assets are assets with a physical form and that hold value. Examples include property, plant, and equipment. Tangible assets are. . It normally occurs when the value of the asset depreciates rapidly over the period of use, resulting in negative equity for the borrower.

What does a negative balance mean on a balance sheet?

It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s incurred losses that are greater than the combined value of payments made to shareholders and accumulated earnings from previous periods.

What is negative shareholder equity?

Negative shareholder equity is a similar concept, whereby the company incurs losses that are greater than the combined value of payments made to shareholders and accumulated earnings from prior periods.

What is negative net worth?

Negative net worth. Net worth is used in the context of individuals. A person who has negative equity is said to have a negative net worth, which essentially means that the person’s liabilities exceed the assets he owns. A common example of people who have a negative net worth are students with an education line of credit.

What are the disadvantages of a home equity line of credit?

This means that if you fail to comply with the terms of your loan, your loan could default, which could lead to foreclosure. You should also be prepared for the required payment of your loan to increase from interest-only payments to interest-plus-principal payments after your draw period ends. Many HELOCs may also include a balloon payment to pay off the loan.

What is a home equity line of credit?

A home equity line of credit (HELOC) can be a convenient way to borrow money. It can be much be less expensive than a credit card installment plan or personal loan. Also, with a HELOC, you pay interest only the amount of the line you use. Nevertheless, a HELOC also has some drawbacks you need to be aware of.

How long does a home equity line of credit last?

A home equity line of credit usually requires the repayment of interest during the draw period, which can last up to 10 years, before monthly payments of principal and interest are required until the loan is repaid.

What happens if you fall behind on your mortgage payments?

If you fall behind on your monthly mortgage payments, per your loan agreement, you could lose your home. An unsecured loan requires no collateral. If you default, the lender can’t automatically take your property. Generally, lenders charge a higher rate of interest for unsecured loans.

How long does a HELOC interest only payment last?

HELOC interest-only payments could come back to bite you. During your draw period, which can last up to 10 years, you may be allowed to make interest-only payments on the amount you borrow. However, when this period expires, you will be responsible for paying principal and interest, in addition to a possible balloon payment at the end ...

How old do you have to be to get a reverse mortgage?

To obtain a reverse mortgage line of credit, you must be at least 62. Unlike a home equity line of credit, a reverse mortgage line of credit can never be frozen or reduced, even if your credit or home value drops.

What happens if your credit score declines?

If your credit score or the value of your home declines, your lender could reduce the amount of your credit line or freeze your HELOC. Having the rug pulled from under you could upset your financial plans.

What is retained earnings?

Within the shareholders' equity section of the balance sheet, retained earnings are the balance left over from profits, or net income, that is set aside to be used to pay dividends, reduce debt, or reinvest in the company. In the event of a net loss, the loss is carried over into retained earnings as a negative number and is deducted ...

Why is negative shareholder equity a red flag?

Negative shareholders' equity is a red flag for investors because it means a company's liabilities exceed its assets.

Why does a company's balance sheet show negative equity?

A company's management that borrows money to cover accumulated losses instead of issuing more shares through equity funding could cause the company's balance sheet to show negative shareholders' equity. Typically, the funds received from issuing stock would create a positive balance in shareholders' equity.

What is a negative balance in shareholders' equity?

A negative balance in shareholders' equity is a red flag that investors should investigate the company further before purchasing its stock.

What does negative stockholders equity mean?

As a result, a negative stockholders' equity could mean a company has incurred losses for multiple periods, so much so, that the existing retained earnings, and any funds received from issuing stock were exceeded.

What is shareholders equity?

Shareholders' equity represents a company's net worth (also called book value) and measures the company's financial health. If total liabilities are greater than total assets, the company will have a negative shareholders' equity.

Where is amortization recorded?

The amortization of intangible assets, such as patents or trademarks, is recorded in the shareholders' equity section of the balance sheet and might exceed the existing balance of stockholders' equity. The amortization of intangibles is the process of expensing the cost of an intangible asset over the projected life of the asset.

What is negative equity?

Perhaps one of the most distressing periods in UK property history happened back in 2008, when house prices fell sharply. Prices dropped around 20% in about 18 months. This created a large number of Negative Equity cases.

Trying to sell a house in negative equity

The housing market can be a tricky place, and there are hundreds of stories of negative equity.

How negative equity can affect you

Perhaps you won’t be surprised to hear that negative equity has a direct impact on you being able to sell your home. Basically it will make it very difficult. It could affect you in a few ways:

If you're in negative equity and want to move house

This is the main issue that faces someone in negative equity. If moving home wasn’t an issue, then it’s always possible to stay put until things change. As long as you make your mortgage payments you're fine.

What Is Negative Equity?

Calculate Your Equity

- To calculate positive or negative equity, you first determine your home’s value, then calculate your loan balance. The difference between home value and loan balance is your positive or negative equity. Zillow can give you an initial estimate of your home’s value, then you can find a local real estate agent to do a custom analysis for you. Most local real estate agents are happy to do this …

A Look at Two Scenarios

- Let’s look at two scenarios to clearly illustrate the math behind positive equity and negative equity. At the time of a purchase, your positive equity is the amount of your down payment. If you bought a home for $300,000 using a 20-percent down payment of $60,000 and a 30-year fixed rate mortgageat 4 percent, you’d have 20-percent equity in your new home. If your home’s value rose …

Read More About Negative Equity

- The Zillow Research blog regularly covers the latest negative equity trends. Read their negative equity articles here.

What Is Negative Equity?

- Negative equity occurs when the value of real estate property falls below the outstanding balance on the mortgage used to purchase that property. Negative equityis calculated simply by taking the current market value of the property and subtracting the amount remaining on the mortgage.

How Negative Equity Works

- To understand negative equity, we must first understand "positive equity" or rather as it is commonly referred to, home equity. Home equity is the value of a homeowner’s interest in their home. It is the real property’s current market valueless any liens or encumbrances that are attached to that property. This value fluctuates over time as payments are made on the mortgag…

Negative Equity's Economic Implications

- Negative equity can occur when a homeowner purchases a house using a mortgage before either a collapse of a housing bubble, a recession, or a depression—anything that causes real estate values to fall. For instance, say a buyer financed the purchase a $400,000 home with a mortgage of $350,000. If the market value of that home the next year tumbles to $275,000, the owner has …

Special Considerations

- Negative equity is not to be confused with mortgage equity withdrawal (MEW) is the removal of equity from the value of a home through the use of a loan against the market valueof the property. A mortgage equity withdrawal reduces the real value of a property by the number of new liabilities against it—but it doesn't mean the owner has gone into the red, equity-wise.