Understanding Gross Pay and Net Pay

- Gross Pay. The exempt or salaried employee is paid gross pay based on the amount of her annual salary divided by the number of pay periods in a year, usually ...

- Net Pay. Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. ...

- Understanding Employee Deductions. ...

Is net pay always more than gross pay?

Your gross income is the total amount of money you receive annually. It is the sum of your monthly gross pay. Your gross annual income will always be larger than your net income because it does not include any deductions. Some deductions are mandatory and others are voluntary choices you have made about savings or benefits.

How do you calculate net pay?

To do so, consider the steps below:

- Determine your gross pay In order to figure out how much net pay you'll be receiving, you'll need to know your gross pay. ...

- Determine the sum of your deductions You'll then need to find out what deductions will be taken out of your gross pay. ...

- Calculate for net pay

How to calculate gross pay to net pay?

- Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage.

- Subtracting the value of allowances allowed (for 2017, this is $4,050 multiplied by withholding allowances claimed).

- Determining your annual tax by using the tables below (single and married rates, respectively).

What does gross pay and net pay mean?

Gross pay is the amount that you are actually paid by a company. We will use an annual Retail Sales Worker salary for our examples. Gross pay is almost exclusively higher than Net Pay, Net Pay is the amount you receive after all deductions have been made.

What is net pay example?

Net pay is the amount an employee receives after all deductions and taxes are taken out. In other words, net pay is the amount that an employee finally receives in-hand. It's a take-home salary. For example, Dave's gross pay is $240,000 a year, but what he finally gets in his bank account will be lower than this.

What is net pay and gross pay?

Subscribe now. Gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. The amount remaining after all withholdings are accounted for is net pay or take-home pay.

Is net pay your paycheck?

Net pay is pay after deductions. It's what's left over after union dues, wage garnishments, pension contributions, FICA taxes, income taxes, 401K contributions, and similar deductions have been accounted for.

How do u calculate net pay?

The formula to calculate net salary is quite simple. Net Salary = Gross Salary - Deductions.

Is net income before or after taxes?

For an individual, net income is the “take-home” money after deductions for taxes, health insurance and retirement contributions.

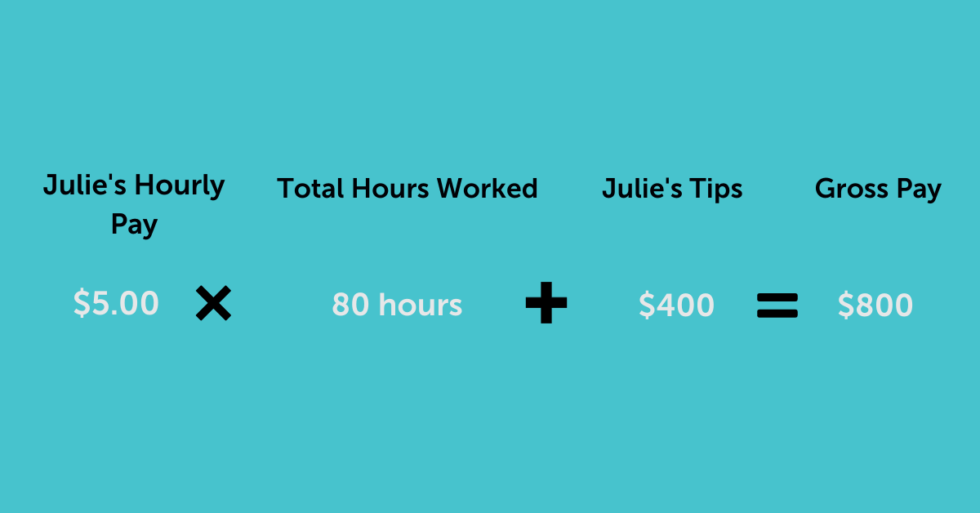

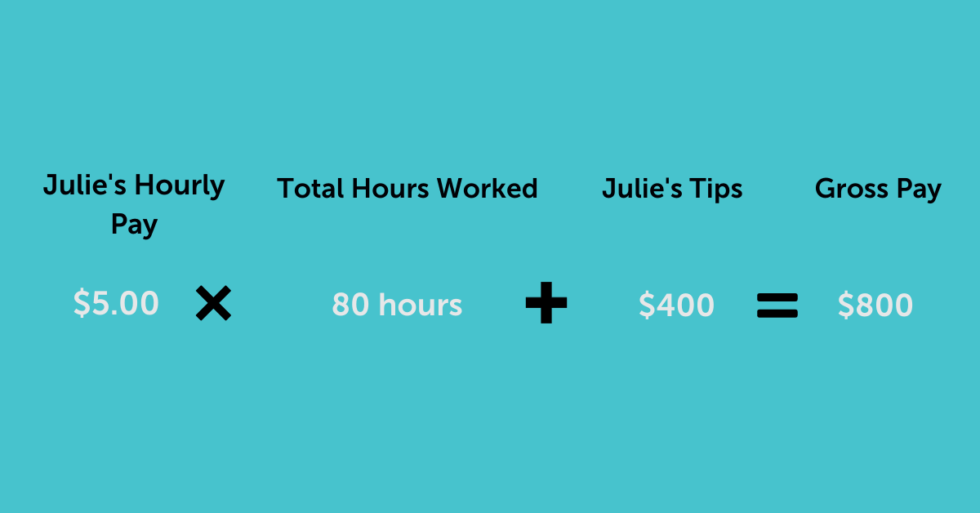

What is an example of gross pay?

For hourly employees, gross wages can be calculated by multiplying the number of hours worked by the employee's hourly wage. For example, an employee that works part-time at 25 hours per week and receives a wage of $12 per hour would have a gross weekly pay of $300 (25x12=300).

Why is my net pay more than my gross pay?

Gross pay is the income you get before any taxes and deductions have been taken out. Your annual gross pay is what's often referred to as your annual salary. Net pay is what's left after deductions like Income tax and National Insurance have been taken off. It's what's often referred to as your take home pay.

What is net pay per month?

Net pay is the money left once taxes and deductions have been taken out of your gross pay. This is the amount that is paid into your bank account and constitutes your income. If you're a salaried employee, you will typically receive a breakdown of your salary each month on your payslip.

Why is my net pay so low?

Your federal income tax withholdings vary depending on factors like your tax bracket, your filing status (married, single, head of household, etc.) and your number of withholding allowances. The fewer allowances you claim, the more money will be withheld from your paycheck and the smaller your take-home pay will be.

What is difference between gross and net amount?

Gross means the total or whole amount of something, whereas net means what remains from the whole after certain deductions are made.

How much is my gross pay?

For hourly employees, gross pay equals the hourly rate times the number of hours worked in a pay period, plus additional sources of income like tips, overtime, or commissions.

What is the meaning of a gross salary?

Gross pay is an individual's total earnings throughout a given period before any deductions are made. Deductions such as mandated taxes and Medicare contributions, as well as deductions made for company health insurance or retirement funds, are not accounted for when gross pay is calculated.

What is a payroll ledger?

A payroll ledger is standard practice for recordkeeping and a tool used the world over by businesses of all sizes. It keeps track of payment inform...

What are payroll ledgers used for?

The primary function of a payroll ledger is to organize and determine the total cost of payroll during a specific period. It may include the follow...

How do you make a payroll ledger?

Many employers rely on payroll software, which have built-in payroll ledgers and automated recordkeeping. Those who prefer manual approaches, like...

What is the purpose of a payroll journal?

A payroll journal or ledger’s primary purpose is to record all payroll-related transactions so that employers can continually assess the financial...

What is meant by payroll journal?

Payroll journals are records of all accounting transactions that result from running payroll. For years, the entries were tracked on paper, but tod...

What is net pay?

Net pay, or take-home pay, is an employee’s earnings total after all deductions are subtracted from their gross pay. Examples of deductions include mandatory withholdings, such as Federal Insurance Contribution Act (FICA) taxes and income taxes, as well as voluntary contributions to benefits, like health insurance and retirement savings plans. These transactions, if done incorrectly, pose substantial risks to employers, which is why many choose to work with a payroll service provider.

What is the difference between gross and net pay?

Gross pay is how much employees earn before taxes and other withholdings, whereas net pay is the amount of money employees actually take home after all payroll deductions. For example, if an employee makes $8,000 gross per month and has $1,700 deducted for taxes and benefits, that individual’s net pay would be $6,300. This difference between gross and net pay is a result of any of the following types of withholdings:

What is the basic salary?

A basic salary is the minimum amount an employee earns prior to taxes and other deductions, which makes it a form of gross pay. It does not include other forms of compensation, such as commission, bonuses or the monetary worth of benefits packages.

Is net pay based on hourly pay?

Net pay is usually based on either an hourly wage or a salary. Hourly employees are largely non-exempt from the Fair Labor Standards Act (FLSA), which means they must be paid at least the federal minimum wage and are entitled to overtime if they work more than 40 hours in a workweek. Note that some states have their own minimum wage and overtime laws.

Is net pay a bank account?

Yes, net pay is the value of an employee’s paycheck or the amount transferred electronically to a bank account or paycard.

Can you calculate net pay manually?

While it’s possible for employers to calculate net pay manually, many choose to use payroll software, which automates the process, thereby saving time and improving accuracy. Another option is to outsource payroll to a full-service provider, who in addition to running payroll, will deposit and file taxes on the employer’s behalf and support regulatory compliance.

Why is net pay important?

Although their gross pay may be higher, the amount of net pay will always be lower. Thus, employees are much more concerned with the net amount since it is the amount that they are going to get as their paychecks.

How to calculate net pay?

Net Pay = Gross Pay – Deductions. Thus, to calculate, you need to reduce the value of deductions from the gross pay. The companies usually mention the amounts of deductions that it makes from the salary and bifurcation of the amounts.

What is gross pay?

Gross pay refers to the total salary that an employee earns for his employment services without reducing any deductions. Net pay refers to the portion of gross pay employees receive as paychecks after accounting for all deductions. Calculation.

How is the CTC calculated?

It is calculated by adding all components of salary such as basic pay, allowances, bonus. It can also be calcula ted by reducing the employer’s contribution to employee benefit plans from the CTC (Cost to Company).

What is cash flow?

Cash Flows Cash Flow is the amount of cash or cash equivalent generated & consumed by a Company over a given period.

Does an employee have to pay gross pay?

However, the employee doesn’t have the entire amount of gross pay. Certain deductions are made from the gross pay, and the resultant amount paid to the employee is known as net pay. These deductions can be on account of tax withheld and employee’s contributions to various employee benefit plans such as retirement plans, pension plans, etc.

What is net pay?

Net pay refers to the amount an employee takes home, not the amount it costs to employ them. Retirement plan contributions, employee benefits, and employer FICA taxes are deducted before an employee receives their net pay.

What does net pay mean for employers?

For employers, what does net pay mean? A broader net pay definition includes implications for the employer, such as the obligation to match an employee’s retirement or savings fund. Only a portion of an employee’s costs are directly paid to the employee.

What is gross pay?

● Gross pay is an accurate indicator of how well an employee is being compensated, but an inaccurate indicator of spending power.

What deductions are included in net pay?

Deductions can include court-ordered withholdings and other withholdings, such as union dues, charitable contributions, insurance premiums, and retirement account contributions. All of these items should be considered when calculating net pay.

How to calculate gross pay?

The formula to use is: gross pay - taxes withheld - minus deductions withheld = net pay. And just because taxes were withheld does not mean individuals do not have to file their taxes. They may still owe taxes or could possibly be entitled to a refund. Net Pay Overview.

What is withheld from paycheck?

To summarize, items that may be withheld from a paycheck include: Employee portion of Social Security tax. Employee portion of Medicare tax.

What is net pay?

Net pay or wages, however, are considered a person’s wages after withholding deductions, sometimes referred to as their take-home pay. This is the money an employee actually has to spend every month. It does not include income tax, Medicare, or Social Security payments. When comparing two employees’ gross and net pay, ...

Why do lenders want to know your net pay?

So they want to know your net pay (instead of the gross pay) when determining if the applicant can actually afford the desired loan amount.

What is gross income?

For businesses, the gross income is all of the money you brought in that year. It’s your total revenue ( not total profit). Just as with individuals, many lenders and other organizations are much more interested in a business’s net income. However, a business’s net income is computed a little differently — the business owner must subtract out costs ...

What is gross pay?

Gross pay, wage, or income can basically be defined as the total income a person makes. For a monthly gross wage, that’s the hourly wage multiplied by the number of hours the person worked that month, or it is the person’s set monthly salary. Per the IRS, if the person received tips during the month, they would be added in and included in ...

What if someone simply wants to know your amount of income?

What if someone simply wants to know your amount of income? That usually means they want to know your gross rather than your net pay.

Is pension a part of gross income?

The additional money that an employer contributes towards an employee’s retirement or pension is not considered a part of the gross income because the employee is not receiving that money at the time. Thus, you can follow this very general formula for how to calculate net pay from gross pay:

Is gross pay considered net pay?

Gross Pay – Payroll Deductions = Net Pay. There are some other items that are excluded by the IRS, but they are very specific, and other organizations may consider these items a part of the gross pay. Net pay or wages, however, are considered a person’s wages after withholding deductions, sometimes referred to as their take-home pay.

What is net pay?

Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. 2 To determine net pay, gross pay is computed based on how an employee is classified by the organization. An hourly or nonexempt employee is paid by the hours worked times the agreed-upon hourly rate ...

How to calculate net pay?

In all cases, to calculate the employee's net pay, the amount to subtract from gross pay is determined by using the number of deductions declared by the employee on the W-4 form. These are used in conjunction with the tax charts provided by the Internal Revenue Service (IRS). The employee's total number of deductions are determined by the number of immediate family members.

What deductions are included in gross pay?

Voluntary deductions from gross pay include items such as charitable contributions (for example, United Way), disability insurance, extra life insurance, and the employee's required contribution to healthcare insurance coverage. Any court-ordered garnishment is also subtracted from an employee's gross pay.

How is gross pay calculated?

Gross pay is computed based on how an employee is classified by the organization. An hourly or nonexempt employee is paid by multiplying the total number of hours worked by an hourly rate of pay. The non-exempt employee's paycheck may also include payments for overtime time, bonuses, reimbursements, and so forth.

What is an hourly pay?

An hourly or nonexempt employee is paid by the hours worked times the agreed-upon hourly rate of pay. The non-exempt employee's paycheck may also include payment for overtime, bonuses, reimbursements, and so forth. The salaried or exempt employee is paid an annual, agreed-upon salary, usually in bi-weekly payments.

How is an exempt employee paid?

The exempt or salaried employee is paid gross pay based on the amount of her annual salary divided by the number of pay periods in a year, usually 26. For example, a salaried employee who makes $40,000 per year is paid by dividing that $40,000 by the number of pay periods in a year. In the example, the employee would receive 26 paychecks that each total $1,538.46. Any reimbursements, bonuses, or other payments would also be added to gross pay.

What is gross pay?

Updated August 08, 2020. Gross pay is the total amount of money that the employer pays in wages to an employee. According to the Internal Revenue Service, "This includes all income you receive in the form of money, goods, property, and services that is not exempt from tax. It also includes income from sources outside the United States (even ...