What is NETnet PP&E?

Net PP&E is short for Net Property Plant and Equipment. Property Plant and Equipment is the value of all buildings, land, furniture, and other physical capital that a business has purchased to run its business. The term "Net" means that it is "Net" of accumulated depreciation expenses.

What is the figure for net property plant and equipment?

Depending on the industry of the company, the figure for Net Property, Plant, and Equipment can vary widely. For example, service companies with low amounts of equipment and buildings would be expected to have a relatively low figure.

What type of asset is property plant and equipment?

Property, plant, and equipment are also called fixed assets, meaning they are physical assets that a company cannot easily liquidate or sell. PP&E fall under the category of noncurrent assets,...

What is property plant and equipment (PP&E)?

What Is Property, Plant, and Equipment (PP&E)? Property, plant, and equipment (PP&E) are long-term assets vital to business operations and not easily converted into cash. Property, plant, and equipment are tangible assets, meaning they are physical in nature or can be touched.

Is Net plant and equipment a current asset?

You'll find PP&E on your company's balance sheet as non-current assets. This asset category includes land, buildings, machinery, office equipment, vehicles, furniture and fixtures. It's also called fixed assets. Net PP&E is what's left after you apply depreciation on the various assets.

How do you find the net plant and equipment?

How to Calculate Property, Plant, and Equipment (PP&E) Property, plant, and equipment are recorded in a company's balance sheet, it is, therefore, essential that these assets are calculated appropriately. The formula for calculating PP&E is; Net PPE = Gross PPE + Capital Expenditures - AD.

How do you find net property plant and equipment on a balance sheet?

0:313:55Property Plant and Equipment on the Balance Sheet - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe value of property plant equipment is typically depreciated over the estimated life of the assetMoreThe value of property plant equipment is typically depreciated over the estimated life of the asset because even the longest term assets become obsolete or useless. After a period of time now let's

What is plant and equipment on a balance sheet?

Definition of Property, Plant and Equipment Property, plant and equipment is the long-term asset or noncurrent asset section of the balance sheet that reports the tangible, long-lived assets that are used in the company's operations. These assets are commonly referred to as the company's fixed assets or plant assets.

What is plant and equipment?

Key Takeaways Property, plant, and equipment (PP&E) are a company's physical or tangible long-term assets that typically have a life of more than one year. Examples of PP&E include buildings, machinery, land, office equipment, furniture, and vehicles. Companies list their net PP&E on their financial statements.

What comes under property, plant, and equipment?

Thus, property, plant and equipment would include assets used for selling and distribution, finance and accounting, personnel and other functions of an enterprise. Items of property, plant and equipment may also be acquired for safety or environmental reasons.

Why is property, plant, and equipment important?

Property, plant and equipment represent important asset values of an organization and the actual physical presence of the asset should be compared periodically with the perpetual records. Therefore, it is imperative that the accounting and management of these assets be uniform, consistent, and accurate.

How do you calculate equipment?

How to Calculate Equipment CostFind the book value of the equipment on the company's balance sheet. The book value is the amount the equipment is currently worth. ... Find the accumulated depreciation for the equipment. ... Add the book value of the asset to the accumulated depreciation.

Where is equipment on a balance sheet?

Is Equipment on the Balance Sheet? Yes, equipment is on the balance sheet. It is listed under “Noncurrent assets”. Noncurrent assets are added to current assets, resulting in a “Total Assets” figure.

What is plant and equipment examples?

Plant includes machinery, equipment, appliances, containers, implements and tools and components or anything fitted or connected to those things. Some examples of plant include lifts, cranes, computers, machinery, scaffolding components, conveyors, forklifts, augers, vehicles, power tools and amusement devices.

Why is property, plant, and equipment a non current asset?

Non-current assets are assets whose benefits will be realized over more than one year and cannot easily be converted into cash. The assets are recorded on the balance sheet at acquisition cost, and they include property, plant and equipment, intellectual property, intangible assets, and other long-term assets.

How do you calculate equipment?

How to Calculate Equipment CostFind the book value of the equipment on the company's balance sheet. The book value is the amount the equipment is currently worth. ... Find the accumulated depreciation for the equipment. ... Add the book value of the asset to the accumulated depreciation.

What is net income formula?

Net income is calculated by subtracting all expenses from total revenue/sales: Net income = Total revenue - total expenses.

What does equipment net of depreciation mean?

Net of depreciation refers to the reported amount of a tangible fixed asset, including all accumulated depreciation charged against it.

How do u find net income?

The formula for calculating net income is:Revenue – Cost of Goods Sold – Expenses = Net Income. ... Gross Income – Expenses = Net Income. ... Total Revenues – Total Expenses = Net Income. ... Gross income = $60,000 - $20,000 = $40,000. ... Expenses = $6,000 + $2,000 + $10,000 + $1,000 + $1,000 = $20,000.More items...•

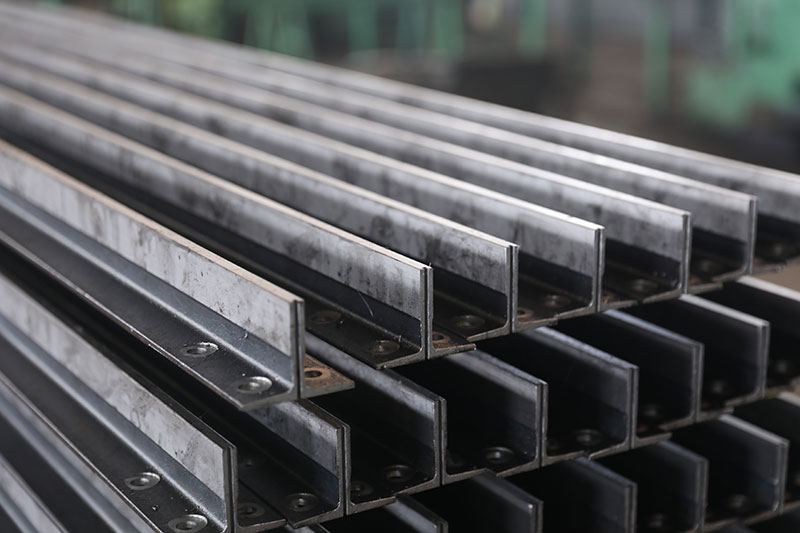

What is Property, Plant and Equipment?

Property, plant and equipment are tangible assets (with physical substance) often abbreviated to PP&E. They are expected to be used by the business for more than one year and, consequently, categorized as non-current assets. They are initially included at cost, which is purchase price plus any incidentals associated with their acquisition. This can be summarized by all costs which bring the asset to its working condition for its intended use. Delivery, inspection, handling and installation costs will all be included in the items initial value.

What happens if PP&E is constructed rather than purchased?

If PP&E is constructed rather than purchased, all costs of construction, including interest, are added to arrive at the PP&E work in process amount. It is presented as one line item but can be made up of the following components:

What is net P&E?

Net PP&E is short for Net Property Plant and Equipment. Property Plant and Equipment is the value of all buildings, land, furniture, and other physical capital that a business has purchased to run its business. The term "Net" means that it is "Net" of accumulated depreciation expenses.#N#For example, assume that a company buys a building worth $1,000,000, along with $50,000 of furniture. Their Net PP&E at the moment of purchase is $1,050,000.#N#Each year, however, the company must depreciate the value of that PP&E to account for the fact that it will wear out an need to be fixed or re-purchased in the future. Assume that in the first year, the company depreciates the building and furniture by $105,000 (or 10% of the original value). Then, at the end of the year, its Net PP&E is:#N#$1,050,000 - $105,000 = $945,000#N#As the company buys more PP&E, the value of its Net PP&E will increase, and as time passes, the value will decrease according to depreciation expenses.

What is net depreciation?

The term "Net" means that it is "Net " of accumulated depreciation expenses. For example, assume that a company buys a building worth $1,000,000, along with $50,000 of furniture.

What Classifies as Property, Plant, and Equipment?

Property, plant, and equipment basically includes any of a company’s long-term, fixed assets. PP&E assets are tangible, identifiable, and expected to generate an economic return for the company for more than one year or one operating cycle (whichever is longer).

Why do PP&E assets need to be fixed?

The nature of PP&E assets is that some of these assets need to be regularly fixed or replaced to prevent equipment failures or to adopt a more sophisticated technology. For example, it is normal for companies to repair or replace old factories or automobiles with new assets when necessary.

Is PP&E a fixed asset?

PP&E is a tangible fixed-asset account item and the assets are generally very illiquid. A company can sell its equipment, but not as easily or quickly as it can sell its inventory. Inventory Inventory is a current asset account found on the balance sheet, consisting of all raw materials, work-in-progress, and finished goods that a.

Our Financial Analysis Success Kit is Ready!

We've combined all our highly popular financial analysis tools into one mega-financial-analysis-kit that will save you hundreds of dollars if purchased separately. The kit contains 9 files packed with the most important financial ratio analysis tools you can find to help rocket your way to mastering financial analysis. The kit includes:

Explanation of Net Property Plant Equipment

Also called Capital, Long-Term, Long-Lived, or Tangible Assets and Listed on the Balance Sheet, these are the fixed assets of the company that do not get used up during the normal operation of the business. This is also why they are called long-lived.

Importance of Net Property Plant Equipment

Depending on the industry of the company, the figure for Net Property, Plant, and Equipment can vary widely. For example, service companies with low amounts of equipment and buildings would be expected to have a relatively low figure.

What are Fixed Assets?

You list fixed assets on the balance sheet, as part of your total assets. They're "fixed" because they can't be sold as easily as inventory. They're non-current because you probably can't convert them to cash within a year.

Ins and Outs of Depreciation

Every fixed asset except land depreciates. This is the loss of value that reflects age, constant use and wear and tear. Depreciation accumulates. If your factory equipment loses $2,000 a year, at the end of four years, the depreciation is $8,000. You keep up depreciation as long as you own an asset, until you've depreciated the value away.

How to Calculate Net PP&E

To calculate net PP&E, you take gross PP&E, add related capital expenses and subtract depreciation.

What is net sales?

In accounting, net usually refers to the combination of positive and negative amounts. For example, the amount of net sales is the combination of the amount of gross sales (a positive amount) and some negative amounts such as sales returns, sales allowances, and sales discounts. Hence, if gross sales are 990 and sales returns are 10, ...

What is net income?

net income. Revenues and gains minus expenses and losses.

What is net realizable value?

net realizable value. The amount to be received in the ordinary course of business minus the costs of completion and disposal.

What is accounts receivable net?

accounts receivable, net. The recorded amount of accounts receivable minus the allowance for doubtful accounts.