What is the current sales tax rate in New Jersey?

New Jersey imposes a sales tax on the transfer of tangible goods within the state, and a use tax for goods purchased elsewhere but consumed or stored in the state. The rate of sales tax in New Jersey is 6.625 percent, ranking eighth in the country, according to the Tax Foundation.

Are occasional sales taxable in New Jersey?

While New Jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. This page describes the taxability of occasional sales in New Jersey, including motor vehicles. To learn more, see a full list of taxable and tax-exempt items in New Jersey .

What is the state tax rate for New Jersey?

The state of New Jersey requires you to pay taxes if you are a resident or nonresident that receives income from a New Jersey source. The state income tax rates range from 1.4% to 10.7%, and the sales tax rate is 6.625%.

What is the NJ business tax rate?

New Jersey has a flat corporate income tax rate of 9.000% of gross income. The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax.New Jersey's maximum marginal corporate income tax rate is the 6th highest in the United States, ranking directly below Alaska's 9.400%.

What is the difference between Sales Tax and Use Tax in NJ?

Use tax is imposed on items that are purchased for use in New Jersey for which you did not pay sales tax or you pay less sales tax than what is imposed by New Jersey. Examples of purchases where sales tax may not be collected are those made via the internet, mail order catalog or out-of-state.

What is sales and Use Tax?

Sales tax applies to retail sales of certain tangible personal property and services. Use tax applies if you buy tangible personal property and services outside the state and use it within New York State.

What is subject to NJ Use Tax?

The New Jersey Sales and Use Tax Act imposes a tax on the receipts from every retail sale of tangible personal property, specified digital products, and the sale of certain services, except as otherwise provided in the Act. Tangible personal property can include prewritten computer software delivered electronically.

Do I have to pay NJ Use Tax?

New Jersey Use Tax is due. Example: On a trip to Delaware, you purchase a couch and do not pay sales tax on the purchase. New Jersey Use Tax is due....Estimated Use Tax ChartIf your New Jersey Gross Income is:Use Tax Due is:$200,001 and over0852% (.00852) of income, or $494, whichever is less.7 more rows

What is an example of a use tax?

Examples: A person buys a vehicle from a dealer in a neighboring state and the dealer does not charge sales tax on the vehicle. The buyer must pay use tax on the purchase price of the vehicle when he/she returns to his/her state and/or city.

Is use tax the same as sales tax?

The difference lies in how they're calculated and who pays them. While a sales tax is applied at the time a purchase is made and is collected and remitted to the government by the seller, a use tax is calculated and paid by the consumer or end user. The rate, however, is generally the same as the local/state sales tax.

What is exempt from NJ Sales Tax?

The current Sales Tax rate is 6.625% and the specially designated Urban Enterprise Zones rate is one half the Sales Tax rate. Certain items are exempt from sales tax, such as food, clothing, drugs, and manufacturing/processing machinery and equipment. A resale exemption also exists.

Who has to collect Sales Tax in NJ?

You'll need to collect sales tax in New Jersey if you have nexus there. There are two ways that sellers can be tied to a state when it comes to nexus: physical or economic. Physical nexus means having enough tangible presence or activity in a state to merit paying sales tax in that state.

What is the New Jersey Sales Tax for 2022?

6.625%Local Sales Tax RatesStateState Tax RateMax Local Tax RateNebraska5.50%2.50%Nevada6.85%1.53%New Hampshire0.00%0.00%New Jersey (e)6.625%3.313%48 more rows•Feb 3, 2022

Is NJ sales tax 7 %?

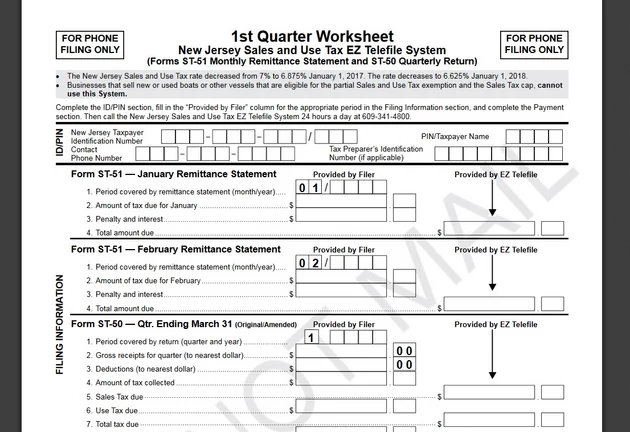

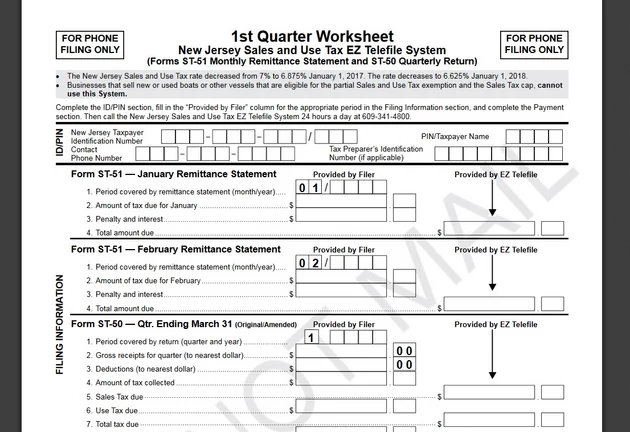

Effective January 1, 2018, the New Jersey Sales and Use Tax Rate is 6.625%. Before January 1, 2017, the Sales Tax rate was 7%. Per P.L. 2016, c.

How do you calculate NJ sales tax?

New Jersey has a 6.625% statewide sales tax rate, but also has 308 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 0.003% on top of the state tax.

Does New Jersey have online sales tax?

Remote sellers are not required to collect and remit Sales Tax on the sale of tangible personal property, specified digital products, or taxable services delivered into New Jersey when sold through a marketplace, because the new law requires the marketplace facilitator to collect and remit Sales Tax on all marketplace ...

What does sales and use mean?

California's sales tax generally applies to the sale of merchandise, including vehicles, in the state. California's use tax applies to the use, storage, or other consumption of those same kinds of items in the state.

What is sellers use tax in Alabama?

eight percentLegislative Act 2015-448, entitled the “Simplified Seller Use Tax Remittance Act,” allows eligible sellers to participate in a program to collect, report and remit a flat eight percent (8%) sellers use tax on all sales made into Alabama.

What is use tax in Nevada?

Sales & Use Tax Return (7/1/11 to Current) Effective January 1, 2020 the Clark County sales and use tax rate increased to 8.375%. This is an increase of 1/8 of 1 percent on the sale of all tangible personal property that is taxable. In the 2011 Legislative Session reduced the interest rate to 0.75% (or .

What is use tax in Virginia?

Sales Tax Rates The sales tax rate for most locations in Virginia is 5.3%. Several areas have an additional regional or local tax as outlined below. In all of Virginia, food for home consumption (e.g. grocery items) and certain essential personal hygiene items are taxed at a reduced rate of 2.5%.

What is a CA-1 in New Jersey?

Once registered, you must display your Certificate of Authority for Sales Tax (Form CA-1) at your business location. This is your permit to collect Sales Tax and to use Sales Tax exemption certificates.

What are some examples of taxable items?

The law exempts some sales and services from Sales Tax. Some examples of taxable items are: Automobiles, furniture, carpeting, and meals bought in restaurants. Some examples of taxable services are: Lawn maintenance , auto repair, snow removal, and telecommunications. Some examples of nontaxable goods and services are: ...

Do you pay sales tax on a service in New Jersey?

When you buy items or services in New Jersey, you generally pay Sales Tax on each purchase. The seller (a store, service provider, restaurant, etc.) collects tax at the time of the sale and sends it to the State. The law exempts some sales and services from Sales Tax.

Do you have to have a tax exemption certificate for a sale?

Some sales are exempt from Sales Tax. When a purchaser claims a tax exemption on a sale, she or he must provide each seller with a tax exemption certificate. Different certificates are required for different types of sales. These forms are available at exemption certificates.

What is the sales tax rate in New Jersey?

The New Jersey state sales tax rate is 7%, and the average NJ sales tax after local surtaxes is 6.97% . Groceries, clothing and prescription drugs are exempt from the New Jersey sales tax. Counties and cities are not allowed to collect local sales taxes.

Does New Jersey have sales tax?

New Jersey doesn't collect sales tax on purchases of most prescription drugs, groceries and clothing. In most states, necessities such as groceries, clothes, and drugs are exempted from the sales tax or charged at a lower sales tax rate.

Is gas tax exempt in New Jersey?

Gasoline purchases are not subject to the New Jersey Sales Tax, but a Gasoline Excise Tax does apply.

What is the sales tax rate in New Jersey?from tax-rates.org

The New Jersey state sales tax rate is 7%, and the average NJ sales tax after local surtaxes is 6.97% . Groceries, clothing and prescription drugs are exempt from the New Jersey sales tax. Counties and cities are not allowed to collect local sales taxes.

When are quarterly sales tax returns due?from nj.gov

Quarterly Sales and Use Tax Returns are due before 11:59 p.m. of the 20th day of the month after the end of the filing period. If the due date falls on a weekend or legal holiday, the return and payment are due on the following business day.

Is gas tax exempt in New Jersey?from tax-rates.org

Gasoline purchases are not subject to the New Jersey Sales Tax, but a Gasoline Excise Tax does apply.

What is the sales tax rate in New Jersey?

The base state sales tax rate in New Jersey is 6.625%. Local tax rates in New Jersey range from 0.00%, making the sales tax range in New Jersey 6.63%.

What items are exempt from sales tax in New Jersey?

Some goods are exempt from sales tax in New Jersey for example groceries, most medical supplies and some items of clothing. You'll also find New Jersey sales tax exemptions which can be applied because the seller or purchaser meets certain criteria.

Do you have to charge sales tax in New Jersey?

You need to charge sales tax in New Jersey if you have a sales tax nexus in the state. A sales tax nexus means different things in different states. It can mean having a physical location (e.g. a brick and mortar store), or someone in the state working for you.

Who collects sales tax in New Jersey?from state.nj.us

All businesses that sell taxable goods and services in New Jersey must register with the New Jersey Division of Revenue and Enterprise Services to collect Sales Tax. This includes any person who makes seasonal or occasional sales at events such as a flea market or craft show.

What is NJ online tax filing?from state.nj.us

The NJ Online Filing Service is for resident income tax return filers, including first time filers. The service is free and most all taxpayers may use it. It allows filers to upload scanned copies of required financial documents and schedules, and provides e-check and credit card payment options for filers with balances due.

How to correct errors on monthly sales tax?from state.nj.us

Correct any errors on a monthly Sales Tax payment by adjusting the amounts when you file the quarterly return.

What is the discount for sales tax?from comptroller.texas.gov

Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

When are sales tax payments due?from state.nj.us

When Do You File? You must file your monthly payments and quarterly Sales Tax returns on or before 11:59 p.m. of the 20th day of the month after the end of the filing period. (See chart below.) If the due date falls on a weekend or a legal holiday, the return and payment are due on the following business day.

Where to mail New Jersey program?from state.nj.us

Correspondence regarding New Jersey's program can be addressed to: State of New Jersey, Division of Revenue and Enterprise Services, e-Gov Services Unit, PO Box 191, Trenton, NJ 08646-0191.

Who downloads your tax return?from state.nj.us

The Division of Revenue and Enterprise Services then downloads your return and sends a second notice to the company confirming receipt and indicating whether or not the State has accepted it for final processing.

What is the tax rate for repairing property in New Jersey?

Unless a sale is exempted/excluded by the Sales and Use Tax Act, New Jersey imposes a tax of 6.625% upon the receipts from every retail sale of tangible personal property. Generally, the maintaining, servicing, or repairing of real property is taxable unless the service results in an exempt capital improvement. A repair service is a service which maintains the existing value of property. A maintenance service is a service which preserves the existing condition of property. A capital improvement is an installation of tangible personal property which results in an increase of the capital value of real property or a significant increase in the useful life of property. If a service results in an exempt capital improvement, the property owner must provide the contractor with a fully completed Certificate of Exempt Capital Improvement (Form ST-8) to claim the exemption.#N#After Super Storm Sandy, the Division of Taxation received many inquiries regarding the taxability of sales of tangible personal property and services sold in connection with disaster recovery efforts. The Division compiled this list of frequently asked questions posed by property owners and contractors to address some of the Sales and Use tax concerns regarding the purchase of tangible personal property and services associated with disaster recovery.#N#Frequently Asked Questions from Property Owners:

How long does a hotel have to collect sales tax?

However, unless an upfront agreement exists between the hotel and the occupant, the hotel must collect the tax until the occupancy reaches 90 consecutive days.

How long does it take for a hotel to refund sales tax?

After 90 consecutive days , the hotel is no longer required to collect the tax and the occupant is entitled to a refund of the Sales Tax already collected. If the hotel does not refund the Sales Tax, you may apply for a refund directly to the Division using Form A-3730 .

Is cleaning of furniture subject to tax?

Answer: Yes. The cleaning of household goods such as furniture, decorative items, and personal items is maintaining or servicing tangible personal property and, as such, the charges are subject to tax. For additional information see Technical Advisory Memorandum TAM-2012-3 Charges for Water Damage Restoration Services .

Do you pay tax on floor coverings in New Jersey?

Answer: Yes. Charges for the installation of floor covering are subject to tax. For additional information on the installation of floor covering see publication ANJ-5 Floor Covering Dealers & New Jersey Sales Tax . I hired a contractor to remove water and sand from the first floor of my home.

Is the purchase of materials and supplies subject to tax?

Is the purchase of these materials and supplies subject to tax? Answer: Yes. The purchase of materials and supplies is subject to tax. This is true regardless of whether the property owner or contractor purchases or makes use of the materials and/or supplies.

Do you have to pay tax on shingles?

Answer: Yes. Installation of replacement shingles is repairing real property and as such the charges are subject to tax. My roof was severely damaged and now requires the installation of a new roof.

Who collects sales tax in New Jersey?

All businesses that sell taxable goods and services in New Jersey must register with the New Jersey Division of Revenue and Enterprise Services to collect Sales Tax. This includes any person who makes seasonal or occasional sales at events such as a flea market or craft show.

When are sales tax payments due?

When Do You File? You must file your monthly payments and quarterly Sales Tax returns on or before 11:59 p.m. of the 20th day of the month after the end of the filing period. (See chart below.) If the due date falls on a weekend or a legal holiday, the return and payment are due on the following business day.

How to pay taxes electronically?

You must send payments electronically. Make these payments when you file your returns. There are three ways you can do this: 1 Electronic check (e-check), 2 Electronic funds transfer (EFT), or 3 Credit card (Fees Apply*). *The fee is added to your actual payment.

What is the average sales tax in New Jersey?

Average Sales Tax (With Local): 6.625%. New Jersey has state sales tax of 6.625% , and allows local governments to collect a local option sales tax of up to N/A.

How many counties are there in New Jersey?

In the map of New Jersey above, the 21 counties in New Jersey are colorized based on the maximum sales tax rate that occurs within that county. Counties marked with a in the list below have a county-level sales tax. You can also download a New Jersey sales tax rate database .

Does a city have a sales tax?

Cities or towns marked with an have a local city-level sales tax, potentially in addition to additional local government sales taxes. Click on any city name for the applicable local sales tax rates.

When will NJ send out middle class tax rebates?from state.nj.us

We began mailing Middle Class Tax Rebates to eligible New Jersey residents on July 2. Checks are mailed to residents filing a 2020 Income Tax return (NJ-1040) claiming at least one dependent child with a tax balance of $1 or more.

When are quarterly sales tax returns due?from nj.gov

Quarterly Sales and Use Tax Returns are due before 11:59 p.m. of the 20th day of the month after the end of the filing period. If the due date falls on a weekend or legal holiday, the return and payment are due on the following business day.