Definition: An overhead cost variance is the difference between the amount of overhead applied during the production process and the actual amount of overhead costs incurred during the period. The overhead cost variance can be calculated by subtracting the standard overhead applied from the actual overhead incurred during the period.

How to cut overhead costs?

How to lower overhead costs

- Review everything thoroughly. The first time that you pull your overhead costs, you’ll determine which expenses you can consider indirect.

- Don’t look for a magic bullet. There likely isn’t one single solution to your high overhead percentage. ...

- Brainstorm with your employees. ...

- Reevaluate your third-party contracts. ...

- Clear out your storeroom. ...

How to apportion overhead costs?

How to Apportion Overhead Costs •To Classify the Cost Centers •Cost Centers should be classified into production department and service department. 1st Step •To Divide Total Overhead on Different Basis of Apportionment •One of best step to apportion overhead costs is to know the basis of apportionment of overhead expenses and then to ...

What is variable manufacturing overhead spending variance?

Variable overheads, on the other hand, are tied to production levels. Variable overhead spending variance is the difference between actual variable overhead cost, which is based on the costs of indirect materials involved in manufacturing, and the budgeted costs called the standard variable overhead costs.

What is overhead spending variance?

Overhead spending variance is the difference between actual expenses incurred and the budgeted allowance based on actual hours worked. If actual expenses incurred are more than budgeted allowance based on actual hours worked, an unfavorable spending variance occurs .

How do you calculate overhead variance?

The formulas that are useful for calculating different overhead variances are as follows:Standard rate per unit = Budgeted overheads / Budgeted output.Standard rate per hour = Budgeted overheads / Budgeted hours.Standard hours for actual output = (Budgeted output / Budgeted hours) x Actual output.More items...•

What is overhead cost in simple words?

What are Overhead Costs? Overhead costs, often referred to as overhead or operating expenses, refer to those expenses associated with running a business that can't be linked to creating or producing a product or service. They are the expenses the business incurs to stay in business, regardless of its success level.

What is an overhead variance How is it accounted for typically?

Variable Overhead Spending Variance is the difference between what the variable production overheads actually cost and what they should have cost given the level of activity during a period. The standard variable overhead rate is typically expressed in terms of machine hours or labor hours.

What are the types of overhead variances?

Types of Overhead VariancesFixed Overhead Volume Variance. ... Variable Overhead Efficiency Variance. ... Variable Overhead Spending Variance.

What are examples of overhead costs?

Examples of Overhead CostsRent. Rent is the cost that a business pays for using its business premises. ... Administrative costs. ... Utilities. ... Insurance. ... Sales and marketing. ... Repair and maintenance of motor vehicles and machinery.

What is overhead cost give examples?

Overhead costs are those that are not related directly to the production activity and are therefore considered indirect costs that have to be paid even if there is no production; examples include rent payable, utilities payable, insurance payable, and salaries payable to office staff, office supplies, etc.

Who is responsible for overhead variances?

Reporting Overhead Variance At the end of the fiscal period, the company must account for the amount of overhead variance. There are two ways to do this. First, transfer the overhead variance to the Cost of Goods sold account.

What are the three types of overhead variances and what are the formulas?

Variable Overhead Variance Formula = Standard Variable Overhead – Actual Variable Overhead = (SR – AR) * AO. Fixed Overhead Variance Formula = (AO * SR) – Actual Fixed Overhead. Sales Variance Formula = (BQ * BP) – (AQ * AP)

What are the three types of overhead?

There are three types of overhead: fixed costs, variable costs, or semi-variable costs.

What are the three types of variance?

The three main types of variance analysis are material variance, labor variance and fixed overhead variance....Businesses may use this type of analysis to calculate variance in the following categories:Purchase variance.Sales variance.Overhead variance.Material variance.Labor variance.Efficiency variance.

What is the formula for cost variance?

The cost variance is defined as the 'difference between earned value and actual costs. (CV = EV – AC)' (PMI, 2004, p. 357) Sometimes this formula is expressed as the difference between budgeted cost of work performed and actual cost work performed. If the variance is equal to 0, the project is on budget.

What is overhead formula?

To calculate the overhead rate, divide the indirect costs by the direct costs and multiply by 100. If your overhead rate is 20%, it means the business spends 20% of its revenue on producing a good or providing services. A lower overhead rate indicates efficiency and more profits.

What is another word for overhead cost?

What is another word for overhead?budgetburdencostdepreciationexpenseexpensesinsuranceoutlayrentupkeep1 more row

Why is it called overhead?

overhead (adv.) mid-15c., over-hed, "above one's head, aloft," from over- + head (n.) or from a survival of Old English oferheafod. The adjective, "situated above or aloft," is attested from 1874.

What is overhead cost in a project?

Project Overhead costs may include expenses such as office space, utilities, director and executive level employees, benefits, insurance, taxes, etc. These costs are generally treated as fixed costs and apply universally to all projects across the company.

What is overhead cost and how do you calculate it?

The overhead rate or the overhead percentage is the amount your business spends on making a product or providing services to its customers. To calculate the overhead rate, divide the indirect costs by the direct costs and multiply by 100.

Why is controlling overhead costs more difficult than controlling direct materials and direct labor costs?

Controlling overhead costs is more difficult and complex than controlling direct materials and direct labor costs because responsibility for overhead costs is difficult to pin down. The total overhead cost variance can be sub-divided into a budget or spending variance and an efficiency variance.

What is budget variance?

Budget or spending variance is the difference between the budget and the actual cost for the actual hours of operation. This variance can be compared to the price and quantity variance developed for direct materials and direct labor.

Can overhead cost variance be analyzed?

The total overhead cost variance can be analyzed into a budgeted or spending variance and a volume variance. Namely:

Who is True Tamplin?

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

What is overhead variance?

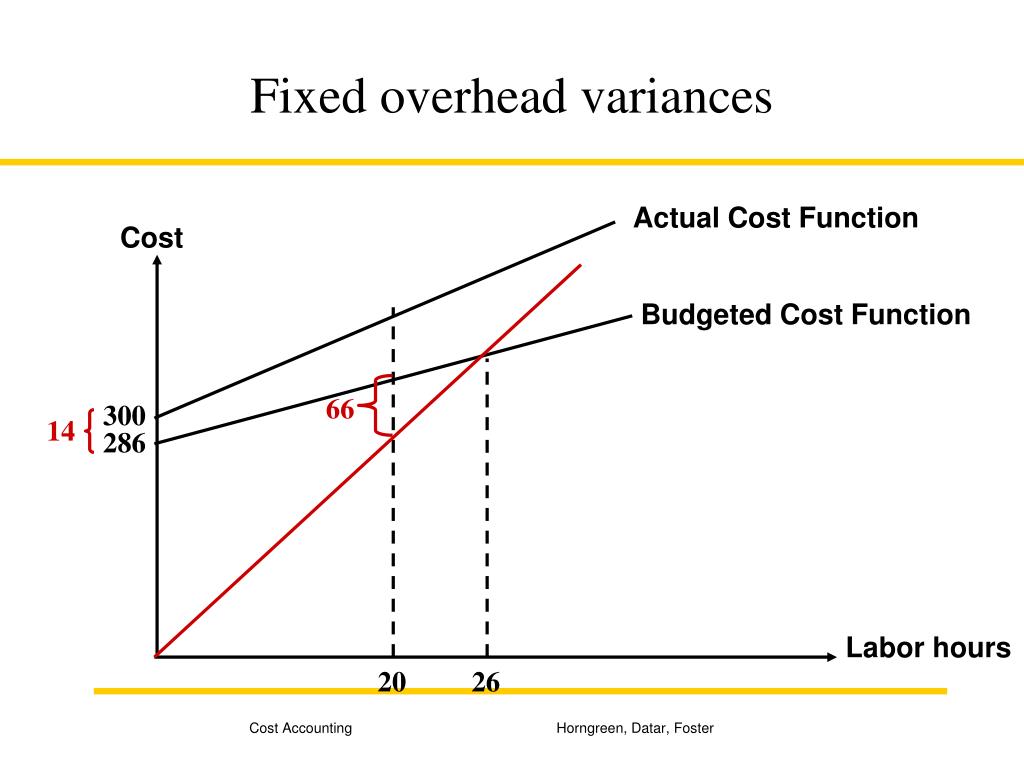

Overhead cost variances can be: 1. fixed overhead and 2. variable overhead variances. 1. Fixed overhead variances: It is that cost which is not directly related to output, it is in general time-related cost. It is that cost which is a difference between standard cost and fixed overhead allowed for actual output achieved and the actual.

What is variance in overhead?

Variable overhead variances rise or fall in proportion to output. Therefore, these variances reflect the difference between the standard cost of overheads allowed for the actual output achieved and the actual overhead cost incurred.

What is over-recovery of fixed overheads?

This shows the over/under absorption of fixed overheads during a particular period. When the actual output exceeds the standard output, it is known as over-recovery of fixed overheads.

Who is True Tamplin?

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

What is variance in accounting?

Variance as we know is the difference between what has been planned/budgeted or standard one and the actual one. Therefore, Variable Overhead Cost Variance (VOCV) is also represents the difference between the budgeted or standard variable overhead cost and the actual overheads that a company incurs on actual production. We denote this variance as VOCV. This variance basically represents the under or over cost of variable overhead.

How to calculate standard variable overhead?

We can calculate the Standard Variable Overhead for Actual Production using the following formula = Actual Output Units * Standard Rate per Unit

What is VOCV in math?

VOCV = VO Expenditure Variance plus VO Efficiency variance. As it is a total of these two variances.

What is VOCV in statistics?

VOCV is one of the parts of total variable overhead, with the other two being VOExV (variable overhead expenditure variance) and VOEfV (variable overhead efficiency variance).

What is a favorable variance?

Like other variances, VOCV can also be favorable or adverse (unfavorable). A favorable variance is when the standard is less than the actual. It means the company spends less than the standard cost. An adverse variance is when the actual spending is more than the standard. This means a company spends more than the estimates.

Can VOCV be calculated on time?

We usually calculate the VOCV in total. This is because the variable overheads can only vary on the basis of units and not time. However, some are of the opinion that variable overhead do vary on the basis of time too. And because of that the other two variances, namely variable overhead efficiency and expenditure variance arise. Hence, they believe that they can use actual time information to calculate such variance. In this article, however, we will talk of VOCV on the basis of units only.

Who is Sanjay Borad?

Sanjay Borad is the founder & CEO of eFinanceManagement. He is passionate about keeping and making things simple and easy. Running this blog since 2009 and trying to explain "Financial Management Concepts in Layman's Terms".

What is cost variance?

Cost variance is the difference between the amount you budget for a project and the actual amount you spend completing the project. The technical definition is the difference between the Budgeted Cost of Work Performed (BCWP) and the Actual Cost of Work Performed (ACWP). It's a way to show how an expense line item, project or any budget is performing financially. Many industries use cost variance in a variety of ways, from reports to forecasts, depending on what they're trying to achieve. Here are some example of cost variance in relation to specific costs:

What is a negative cost variance?

Cost variances are negative, positive or zero. A negative cost variance happens when you overspend and go above your budget. A positive cost variance happens when you underspend and stay below your budget. A zero cost variance is when the amount you spend matches your budget exactly. Negative cost variances can indicate a business is overspending and whether the business has enough excess funds to cover its overspending. Positive cost variance can indicate both effective and unsuccessful activities, and zero cost variances are ideal.

Why is cost variance important?

Cost variance is important because it allows you to track the financial progression of your project. It is an indicator of how well you monitor and mitigate potential risks and how well you analyze data related to the project. You can also evaluate your cost variance to make comparisons between the budget and actual cost throughout a project your team completes, giving you the opportunity to make improvements to your budget approaches that align with your goals. Another helpful aspect is that you can use historical data from similar projects to create a more accurate projection for the budget.

Why do project managers use variance?

Project managers often use cost variance to track where their actual costs stand compared to their budget. They use cost variance to make financial adjustments throughout the duration of the project. Cost accountants also use cost variance to track, investigate and report the reasons for a variance. They often give these reports to management along with suggestions for future changes to reduce or increase the size of the variance in the future.

Why do direct product costs change?

Direct product costs: Direct product costs can change unexpectedly due to product damage, delays in handling, an industry shortage of an item or an increase in shipping fees.

What is cost variance?

What is a Cost Variance? A cost variance is the difference between the cost actually incurred and the budgeted or planned amount of cost that should have been incurred.

When is a variance unfavorable?

There is an unfavorable variance when the actual cost incurred is greater than the budgeted amount. There is a favorable variance when the actual cost incurred is lower than the budgeted amount. Whether a variance ends up being positive or negative is partially due to the care with which the original budget was assembled.

Is a cost variance report bad?

Thus, a cost variance report should only include a few items each month, preferably with recommended actions to be taken. Not all unfavorable variances are bad. Spending more money in one area may create a favorable variance somewhere else.

Should a cost variance report include a few items each month?

Thus, a cost variance report should only include a few items each month, preferably with recommended actions to be taken.

Who reports cost variances?

Cost variances are usually tracked, investigated, and reported on by a cost accountant . This person determines the reason why a variance occurred and reports the results to management, possibly along with a recommendation for changing operations to reduce the size of the variance (if unfavorable) in the future.

What is FOH variance?

In simple terms, FOH cost variance measures the difference between the standard fixed overheads for actual output and actual fixed overheads incurred.

What would happen if a mistake in the estimate of fixed overheads was made?

Since Fixed overheads are made of components costs like depreciation, provisions, etc, a mistake in the estimate of such costs would result in the wrong variance analysis.

What is fixed overhead cost?

Fixed overhead cost refers to costs that are incurred even when the production level is zero. It includes insurance, rent, utility, office administrative expenses, and other expenses of the same nature.

Why is FOH volume variance favorable?

Interpretation: The FOH volume variance is favorable because the company achieved a higher output than anticipated in the budget.

Who is Adio PLC?

The management of Adio PLC, a fast-growing company in the consumer goods industry, charged its chief accountant to prepare a budget on the fixed overheads to be incurred next year.

Is it unnecessary to monitor overhead variances?

It may be unnecess ary and wasteful to monitor fixed overhead variances since its cost does not change regularly.

Fixed Overhead Variance

Variable Overhead Variance

- Variable overhead variances rise or fall in proportion to output. Therefore, these variances reflect the difference between the standard cost of overheadsallowed for the actual output achieved and the actual overhead cost incurred. This type of variance is calculated separately for direct variable expenses and overhead variable expenses. The per-unit cost does not change due to the chang…

Example

- This example covers fixed overhead variances. Using the information given below, compute the fixed overhead cost, expenditure, and volume variances. 1. Normal capacity = 5,000 hours 2. Budgeted fixed overhead rate = $10 per standard hour 3. Actual level of capacity utilized = 4,400 standard hours 4. Actual fixed overhead = $52,000

Problem 1

- In department A of a plant, the following data are submitted for the week ending 31 March 2019: 1. Standard output for 40 hours per week = 1,400 units 2. Budgeted fixed overhead = $1,400 3. Actual output = 1,200 units 4. Actual hours worked = 32 hours 5. Actual fixed overhead = $1,500 Required: Prepare a statement of variances.

Problem 2

- The following information was obtained from the record of a manufacturing unit using the standard costingsystem: Required You are required to calculate the following overhead variances: (a) Variable overhead variance (b)Fixed overhead 1. Expenditure variance 2. Volume variance 3. Efficiency variance 4. Calendar variance (c)In addition, prepare a reconciliation statement for th…