The risk management

Risk management

Risk management is the identification, assessment, and prioritization of risks (defined in ISO 31000 as the effect of uncertainty on objectives) followed by coordinated and economical application of resources to minimize, monitor, and control the probability and/or impac…

Full Answer

What are the 5 steps of the risk management process?

What is risk management and why is it important?

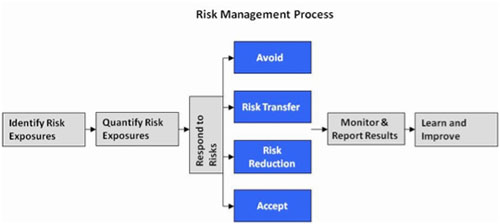

- Identify the risks.

- Analyze the likelihood and impact of each.

- Prioritize risk based on enterprise objectives.

- Treat (or respond to) the risk conditions.

- Monitor results and use those to adjust, as necessary.

What are the five activities of the risk management process?

- To identify the risks.

- To avoid the risks.

- To prevent the risks.

- To control the possible risks.

- To reduce the possible risks.

- To mitigate the possible risks.

What are the objectives of the risk management process?

- Reduce and Eliminate Harmful Threats. Harmful risks and threat are part of every business organisation. ...

- Supports Efficient use of Resources. Risk management aims at efficient utilisation of all resources. ...

- Better Communication of Risk within Organisation. ...

- Reassures Stakeholders. ...

- Support Continuity of Organisation. ...

What are the steps of risk management?

NIST Risk Management Framework Overview • About the NIST Risk Management Framework (RMF) • Supporting Publications • The RMF Steps . Step 1: Categorize. Step 2: Select. Step 3: Implement. Step 4: Assess. Step 5: Authorize. Step 6: Monitor • Additional Resources and Contact Information NIST Risk Management Framework 2|

What is process management risk?

In business, risk management is defined as the process of identifying, monitoring and managing potential risks in order to minimize the negative impact they may have on an organization.

What is meant by process risk?

Definition. Process risk is a loss in revenue as a result of ineffective and/or inefficient processes. Ineffective processes hamper the achievement of the organization's objectives, whereas the processes that are inefficient, may be successful in achieving objectives, yet fail to consider high costs incurred.

What are the five steps of risk management process?

Steps of the Risk Management ProcessIdentify the risk.Analyze the risk.Prioritize the risk.Treat the risk.Monitor the risk.

Why is risk management a process?

Risk management is an important process because it empowers a business with the necessary tools so that it can adequately identify and deal with potential risks. Once a risk has been identified, it is then easy to mitigate it.

How do you identify process risks?

There are several basic methods for risk identification; documentation review, information gathering, checklist and risk catalogs, assumption analysis and diagram techniques. Information gathering is the most common method of identifying risk sources.

What are the 3 types of risk management?

Widely, risks can be classified into three types: Business Risk, Non-Business Risk, and Financial Risk. Business Risk: These types of risks are taken by business enterprises themselves in order to maximize shareholder value and profits.

What are the 5 types of risk management?

Avoidance.Retention.Sharing.Transferring.Loss Prevention and Reduction.

What are the 4 ways to manage risk?

There are four primary ways to handle risk in the professional world, no matter the industry, which include:Avoid risk.Reduce or mitigate risk.Transfer risk.Accept risk.

What is the first step in risk management process?

Risk identification forms the basis for the development of risk management and control.

What are the 6 risk management processes?

Step 1: Hazard identification. This is the process of examining each work area and work task for the purpose of identifying all the hazards which are “inherent in the job”. ... Step 2: Risk identification.Step 3: Risk assessment.Step 4: Risk control. ... Step 5: Documenting the process. ... Step 6: Monitoring and reviewing.

What is the most important step in the risk management process?

Risk Analysis: The Most Important Risk Management Stage.

What are the 4 types of risk?

The main four types of risk are:strategic risk - eg a competitor coming on to the market.compliance and regulatory risk - eg introduction of new rules or legislation.financial risk - eg interest rate rise on your business loan or a non-paying customer.operational risk - eg the breakdown or theft of key equipment.

What are 4 types of operational risk?

Operational risk can occur at every level in an organisation. The type of risks associated with business and operation risk relate to: • business interruption • errors or omissions by employees • product failure • health and safety • failure of IT systems • fraud • loss of key people • litigation • loss of suppliers.

What is a process risk point audit?

During the risk assessment process, Internal Auditing identifies and assesses both the likelihood and potential impact of various risks to the organization. Internal controls are then identified and evaluated to determine how adequate they are in reducing risk to ensure that residual risk is at manageable levels.

What is meant by liquidity risk?

Liquidity risk is defined as the risk of incurring losses resulting from the inability to meet payment obligations in a timely manner when they become due or from being unable to do so at a sustainable cost.

What is business process risk assessment?

Business Process Risk Assessment. This service is typically used to evaluate one or two processes within a Line of Business (LOB). The focus is operational risk, inclusive of cybersecurity, insider threat and fraud.

What Are the Benefits of a Risk Management Process?

A reliable risk management process and a detailed risk management plan can help you understand and control risk. That, in turn, empowers management to make better decisions and assure the company achieves its objectives.

The 5-Step Risk Management Process

The best risk management programs follow a five-step risk management process. These steps will prepare your firm to identify, treat, and manage possible risks. They will also help you manage and monitor risks, which is essential to protect the company from adverse circumstances.

Simplify the Risk Management Process with Reciprocity ROAR

In today’s digital economy, IT and cyber risks are among the biggest risks to your organization. See, understand, and act on these risks to protect your enterprise with Reciprocity’s Risk Observation, Assessment and Remediation ( ROAR) platform.

What is risk management?

Risk management is a process that seeks to reduce the uncertainties of an action taken through planning, organizing and controlling of both human and financial capital.

How to implement risk management?

If you plan to implement the risk management process in your company, be aware that you must separate it into certain steps so that everything happens as expected. The risk management process is divided as follows: Risk management planning: establishing scope, detailing management activities for the project. Identify the risks: define the main ...

What is process governance in BPM?

While process governance seeks to outline rules and guidelines for managing and executing processes to optimize workflows and determine risks, compliance has a duty to keep the organization within the rules and the law, and in this way, avoid institutional risks. If you work with BPM (Business Project Management), ...

What is qualitative risk analysis?

Qualitative risk analysis: analyze the exposure to risk to prioritize those that will be the subject of analysis, an additional action or contingency plan

When we talk about risks that a company is subject to dealing with, they don’t necessarily have to be bad?

When we talk about risks that a company is subject to dealing with, they don’t necessarily have to be bad, they can be positive. Risks offer threats but also opportunities, it’s up to the risk management process to define which target to achieve.

Is there a risk in hedge operations?

A totally possible risk (in my case, an exchange rate increase) that could have been mitigated with a simple currency hedge operation, ended up with every possibility of occurring in this project.

Can organizations be harmed by uncertainty?

However, many organizations have not yet realized this and end up being harmed by the uncertainties they let pass in their projects (such as in a case we commented on recently …).

What is risk management?from marquette.edu

Risk management is the continuing process to identify, analyze, evaluate, and treat loss exposures and monitor risk control and financial resources to mitigate the adverse effects of loss. Loss may result from the following: financial risks such as cost of claims and liability judgments. operational risks such as labor strikes.

What is effective risk management?from corporatefinanceinstitute.com

Effective risk management means attempting to control, as much as possible, future outcomes by acting proactively rather than reactively. Therefore, effective risk management offers the potential to reduce both the possibility of a risk occurring and its potential impact.

Why is it important to understand the basic principles of risk management?from corporatefinanceinstitute.com

As a result, it is important to understand the basic principles of risk management and how they can be used to help mitigate the effects of risks on business entities.

What does it mean to be risk averse?from corporatefinanceinstitute.com

Risk Averse Definition Someone who is risk averse has the characteristic or trait of preferring avoiding loss over making a gain. This characteristic is usually attached to investors or market participants who prefer investments with lower returns and relatively known risks over investments with potentially higher returns but also with higher uncertainty and more risk.

What is the risk unit?from marquette.edu

The Risk Unit is responsible for evaluating loss exposures, assessing liability, handling claims, promoting internal controls and developing effective safety and health programs. The corporate and student insurance plans are managed by this unit.

What are the types of loss exposures within the province of risk management?from marquette.edu

Types of Loss Exposures within the province of risk management include: Property - Real & Personnel, Tangible & Intangible.

Why is risk management important?from corporatefinanceinstitute.com

Risk management is an important process because it empowers a business with the necessary tools so that it can adequately identify and deal with potential risks. Once a risk has been identified, it is then easy to mitigate it.

What is progressive risk management?

In addition, progressive risk management ensure s risks of a high priority are dealt with as aggressively as possible. Moreover, the management will have the necessary information that they can use to make informed decisions and ensure that the business remains profitable.

Why is it important to understand the basic principles of risk management?

As a result, it is important to understand the basic principles of risk management and how they can be used to help mitigate the effects of risks on business entities.

What does it mean to be risk averse?

Risk Averse Definition Someone who is risk averse has the characteristic or trait of preferring avoiding loss over making a gain. This characteristic is usually attached to investors or market participants who prefer investments with lower returns and relatively known risks over investments with potentially higher returns but also with higher uncertainty and more risk.

What is risk analysis?

Risk analysis is a qualitative problem-solving approach that uses various tools of assessment to work out and rank risks for the purpose of assessing and resolving them. Here is the risk analysis process: 1. Identify existing risks. Risk identification mainly involves brainstorming. A business gathers its employees together ...

Why is assessment and management of risks important?

For a business, assessment and management of risks is the best way to prepare for eventualities that may come in the way of progress and growth. When a business evaluates its plan for handling potential threats and then develops structures to address them, it improves its odds of becoming a successful entity.

What is risk management structure?

Risk management structures are tailored to do more than just point out existing risks. A good risk management structure should also calculate the uncertainties and predict their influence on a business. Consequently, the result is a choice between accepting risks or rejecting them.

What is acceptance of risk?

Acceptance or rejection of risks is dependent on the tolerance levels that a business has already defined for itself. If a business sets up risk management as a disciplined and continuous process for the purpose of identifying and resolving risks, then the risk management structures can be used to support other risk mitigation systems.

What are the steps of risk management?

As per ISO 31000 (Risk Management - Principles and Guidelines on Implementation), risk management process consists of the following steps and sub-steps: 1 Establishing the Context 2 Identification 3 Assessment

What is a common risk check?

Common Risk Check: There are certain risks that are common to an industry. Each risk is listed and checked on time.

What is taxonomy based risk identification?

Taxonomy based Risk Identification: The possible risk sources are broke down, hence taxonomy. A questionnaire is made best on existent knowledge; the answers to the questions are the risk.

Is ISO a risk management process?

This accounts for certain changes in the entire risk management process. However the ISO has laid down certain steps for the process and it is almost universally applicable to all kinds of risk. The guidelines can be applied throughout the life of any organization and a wide range of activities, including strategies and decisions, operations, processes, functions, projects, products, services and assets.

What is risk management?

Risk management is the process of identifying, evaluating, and prioritizing risks followed by integrated and economical application of resources to reduce, observe, and control the probability or impact of unfortunate events or to maximize the realization of opportunities.

Why is risk management important?

The purpose of risk management is not to wipe out all risks. It is to decrease the negative consequence of risks. By working with risk managers, employees can make smart decisions to prevent risks and improve the chance of being rewarded.

Why is it important to have a risk manager?

Risk managers help employees from all departments succeed with their projects. Just they have to evaluate risks and implement strategies to maximize organizational success. It can also apply to individual projects. If something goes wrong, there will already be a strategy in place to handle it. This encourages employees to prepare for unexpected risks and maximize project output.

What is the first step in risk management?

The first step of risk management is to identify the risks that the business is discovered to in its operating environment. There are many types of risks, including legal risks, environmental risks, market risks, regulatory risks, and much more. It is important to identify as many of these risk factors as possible. In a manual management environment, these risks are written down manually.

What is risk prevention strategy?

While the complete elimination of all risks is hardly possible, a risk prevention strategy is planned to deflect as many threats as possible in order to avoid the costly and disruptive effects of a damaging event.

Why is transparency important in risk management?

Transparent communication among your team and stakeholders is crucial for the ongoing monitoring of potential threats. And while it may seem you’re herding cats sometimes, with your risk management process and its corresponding project risk register in place, putting tabs on those moving targets becomes anything but risky business.

What does it mean to treat and moderate risk?

Effectively treating and moderating the risk also means using your team’s resources properly without hindering the project in the meantime. As time goes on and you develop a larger database of past projects and their risk logs, you can expect potential risks for a more proactive rather than reactive approach for more efficient treatment.

In this expert guide to project risk management, learn how to mitigate risks and ensure project success

We all tend to look for possibilities of failure whenever we start (or think of starting) something new. This scenario also holds true for project managers.

What is project risk?

Project risk is any potential issue that could negatively impact the successful completion of your projects. Risks could be due to internal or external factors. For instance, a key supplier going out of business and a key team member leaving your organization—both qualify as project risks.

What is project risk management?

Project risk management is the process of identifying, assessing, and responding to unexpected risks that might affect your project’s goals and progress.

Why do you need project risk management?

As a project manager, identifying and assessing risks is an essential part of your job. It helps prioritize your project management efforts. If a risk assessment indicates that the impact of a particular threat will be severe, you should take necessary steps to avoid or mitigate that threat in advance.

Common types of project management risks (with examples)

Let’s go through some of the most common types of project risks that you may encounter. We’ve also added examples to explain the risks better.

5 steps to manage project risks

Risks are an inherent part of any project. While it’s impossible to eliminate all risks, it’s indeed possible to limit their impact by managing them. The following steps will help you competently reduce and control all potential project risks.

Tips for successful project risk management

When it comes to ensuring project success, here are a few risk management tips to follow:

Key Highlights

The financial risk process is a series of steps undertaken to effectively manage financial risks.

What is Financial Risk?

Individuals and corporations face various financial risks. In general, financial risks are events or occurrences with undesirable or unpredictable financial outcomes or impacts.

Financial Risk Management Process

As already mentioned, the following steps are a general process for dealing with any kind of risk:

Additional Resources

Thank you for reading CFI’s guide to Financial Risk Management Process. To keep learning and developing your knowledge base, please explore the additional relevant resources below:

Risk Management Structures

Response to Risks

- Response to risks usually takes one of the following forms: 1. Avoidance: A business strives to eliminate a particular risk by getting rid of its cause. 2. Mitigation: Decreasing the projected financial valueassociated with a risk by lowering the possibility of the occurrence of the risk. 3. Acceptance: In some cases, a business may be forced to accept a risk. This option is possible if …

Importance of Risk Management

- Risk management is an important process because it empowers a business with the necessary tools so that it can adequately identify and deal with potential risks. Once a risk has been identified, it is then easy to mitigate it. In addition, risk management provides a business with a basis upon which it can undertake sound decision-making. For a business, assessment and ma…

Risk Analysis Process

- Risk analysis is a qualitative problem-solving approach that uses various tools of assessment to work out and rank risks for the purpose of assessing and resolving them. Here is the risk analysis process:

Summary

- Our business ventures encounter many risks that can affect their survival and growth. As a result, it is important to understand the basic principles of risk management and how they can be used to help mitigate the effects of risks on business entities.

More Resources

- Thank you for reading CFI’s guide to Risk Management. To keep learning and advancing your career, the following CFI resources will be helpful: 1. Idiosyncratic Risk 2. Loss Aversion 3. RAID Log 4. Risk Averse