What is financial management cycle?

This is a continuous process of planning, implementation, evaluation, audit and improvement based on the outcomes – in other words, as a financial management cycle in which: Earlier steps lead logically to later steps during the financial year.

What are the steps in financial management cycle?

The Financial Management Cycle includes four phases that are essential for the overall evaluation of the financial management of any firm. The four phases are Planning, Budgeting, Managing Operations, and Annual Reporting.

What is the meaning of public financial management system?

The Public Financial Management System (PFMS) is a web-based application for payment, accounting and reconciliation of Government transactions and integrates various existing standalone systems. The primary objective of PFMS is to establish an efficient fund flow system and expenditure network.

What is the importance of public financial management?

Effective public financial management (PFM) ensures that scarce resources have maximum impact and are deployed where they are needed most. This can help achieve government health policy and development objectives and set the stage for robust service delivery.

What are the components of public financial management?

1.1 Public Interest and Expectations. • ... 1.2 Economic and Social Drivers. • ... 1.3 Donor Interest and Expectations. • ... 1.4 Political Will. • ... 1.5 Change Management Capabilities. • ... 2.1 Parliament and Legislation. • ... 2.2 Institutional Framework. • ... 2.3 Regulations. • To what extent are the appropriate accountability.More items...

What are the 4 types of financial management?

Types of Financial Decisions – 4 Types: Financing Decision, Investment Decision, Dividend Decision and Working Capital Decisions.

What is the main objective of public finance?

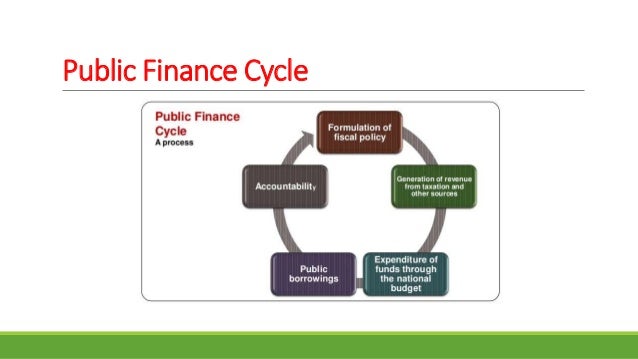

The broad objectives of public financial management are to achieve overall fiscal discipline, allocation of resources to priority needs, and efficient and effective allocation of public services.

When did PFMS started?

2008-09Public Financial Management System (PFMS) initially started as a Plan scheme named CPSMS of the Planning Commission in 2008-09 as a pilot in four States of Madhya Pradesh, Bihar, Punjab and Mizoram for four Flagship schemes e.g. MGNREGS, NRHM, SSA and PMGSY.

What is public finance in simple words?

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones.

What are the challenges of public financial management?

The major challenges of the public finance sustainability consist of creating independent fiscal institutions, fiscal responsibility laws, fiscal rules and the management of fiscal risks.

What are the 4 steps in financial planning?

You can begin to put together a realistic look of your personal financial situation by following a simple 4-step Financial Planning process.Take Inventory. ... Clearly Identify Your Financial Goals. ... Create and Execute a Plan of Action. ... Monitor and Adjust.

What is the stage 3 in financial life cycle?

In fact, there are actually three distinct stages of your financial life. These three stages are wealth accumulation, wealth preservation, and wealth distribution.

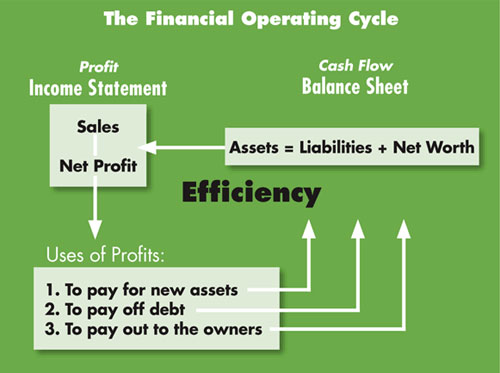

What are the three key elements in the process of financial management?

Elements of Financial ManagementFinancial Planning. Financial planning, as an important element of financial management, ensures that adequate finances are available at the requisite time to meet the needs of a business. ... Financial Control. ... Financial Decision-making.

How many basic process does financial management consist of?

Most financial management plans will break them down into four elements commonly recognised in financial management. These four elements are planning, controlling, organising & directing, and decision making.

Real challenges in making this work effectively

Finance departments often use jargon which service departments don’t understand and service departments have difficulties keeping to agreed budgets. So the budget process is often an annual budget battle, frequently made more challenging by the necessary process of multi-annual budgeting.

Can auditors help?

In my view they can. But a change in the timing of their interventions is needed, increasingly looking forward as well as backward. Audit should not be limited to the audit of outcomes. To add value auditors must also audit decision-making processes.

What is PFM in finance?

A public financial management (PFM) system is a set of rules and institutions, policies, and processes that govern the use of public funds across all sectors, from revenue collection to monitoring of public expenditures.

What are the steps of the budget cycle?

There are three main steps in the budget cycle, a central component of every PFM system: budget formulation, budget execution, and budget monitoring. The budget planning process usually involves collecting estimates from all ministries and departments on the financial resources required to carry out their objectives, prioritizing those needs, and then allocating funds across different areas based on prioritized needs and the budget ceiling, which is usually set by the ministry of finance. Once a level of funding is confirmed, ministries and departments receive funding in the following fiscal year to pay public or private providers for goods and services. Budget monitoring ensures that ministries and other entities comply with laws and regulations, including filing financial reports and audits and ensuring that correct financial controls are in place.

What is PFM in family planning?

PFM is an integral component of securing sufficient and efficient funding for family planning. Stakeholders should consider how family planning budgets are formulated, executed, and monitored, and how family planning ties into the greater PFM system.

Why is PFM important?

A well-functioning PFM system is critical to ensuring accountability and efficiency in the use of public financial resources , while a weak PFM system can result in significant wastage of scarce resources (Figure 1). PFM is particularly relevant to health financing, as most resources for health tend to come from public budgets.

What is PFM in health?

PFM is particularly relevant to health financing, as most resources for health tend to come from public budgets. In particular, PFM systems influence how much funding is available and allocated to health, the effectiveness of spending on health, and the level of flexibility in use of health funds. Figure 1.

What is public financial management?

Public financial management is the administration of funds used to deliver public services. Depending on the level of government and the specific nation, these can range from water and sewage service in a city to a national health plan. This is a special field within the larger discipline of financial management, ...

What are the sources of revenue for public finance?

Sources of revenues for public finance activities can include taxes, fees, and fines. In public financial management, analysts prepare revenue projections and discuss ways to increase or manage revenues more effectively.

How do political parties participate in policy making?

They may participate directly in policy making at the polls, through petitions, and in lobbying measures targeted at specific agencies or legislators. Another issue is the need to balance the public good, and what will benefit most people most of the time, in public financial management.

What is public finance?

Public finance is the management of a country’s revenue, expenditures. Expenditure An expenditure represents a payment with either cash or credit to purchase goods or services. An expenditure is recorded at a single point in. , and debt load through various government and quasi-government institutions. This guide provides an overview of how public ...

What are the components of public finance?

The main components of public finance include activities related to collecting revenue#N#Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. In accounting, the terms "sales" and#N#, making expenditures to support society, and implementing a financing strategy (such as issuing government debt). The main components include:

What is the budget?

Budget. The budget is a plan of what the government intends to have as expenditures in a fiscal year. In the U.S., for example, the president submits to Congress a budget request, the House and Senate create bills for specific aspects of the budget, and then the President signs them into law.

What is the government spending?

Much of the government’s spending is a form of income or wealth redistribution, which is aimed at benefiting society as a whole.

What are the three financial statements?

Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows. These three core statements are. . Components of Public Finance.

What happens if the government spends more than it collects in revenue?

If the government spends more then it collects in revenue there is a deficit in that year. If the government has less expenditures than it collects in taxes, there is a surplus.